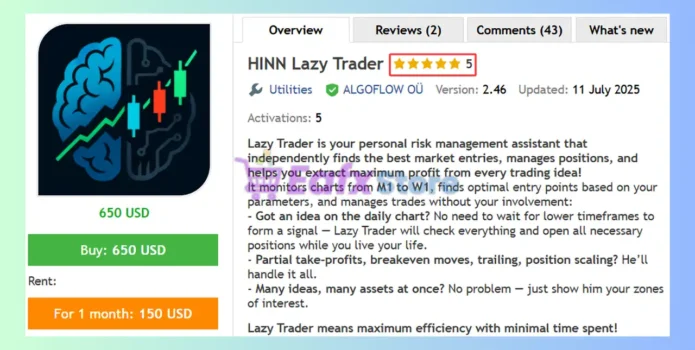

HINN Lazy Trader EA MT5 (Latest version) – GroupBuy

Main Slot Purchase Phase

Main Slot Price: $150.00

0 out of 5 main slots sold

What is HINN Lazy Trader EA?

HINN Lazy Trader EA MT5 is an automated trading assistant that identifies optimal entries, manages positions, and maximizes profit with minimal trader involvement. It scans multi-timeframe charts, executes trades based on structure and liquidity, and handles partials, breakeven, and scaling. Built with multi-model logic and strict risk control, it delivers efficient, rule-based intraday trading.

➡️ Vendor website: View here

➡️ This is GroupBuy ==> How to Join

About the Author

This product is compiled by Georg Vahi. This Germany author has more than +3 years of experience working on MQL5 with many famous products such as HINN Lazy Trader MT5, HINN MagicEntry Extra MT5 and others. Among them, HINN Lazy Trader EA is his best performing product.

Key Features of HINN Lazy Trader for MT5

🔹 Multi-Timeframe Scanning: Monitors M1–W1 to detect optimal entries using structure, liquidity, and volatility zones.

🔹 Session-Based Engine: Trades only high-liquidity windows using automated time detection for any broker.

🔹 Multi-Model Logic: Uses reversal, breakout, sweep, and trend models to adapt to changing market conditions.

🔹 Smart Trade Management: Automates partials, breakeven and scaling to maximize profit efficiency.

Trading Strategy

🔹 Liquidity-Based Entries: Targets sweeps, imbalances, and volatile zones for precise intraday setups.

🔹 Breakout & Reversal Mix: Uses DR, SMR, TRB, and structure models to trade reversals and range breakouts.

🔹 Intraday Timing Focus: Trades around key AM/PM windows to capture volatility expansions.

🔹 RR-Driven Exits: Follows 1R–3R targets with optional partials for controlled, predictable outcomes.

HINN Lazy Trader EA MT5 Review

🔹 Risk-Control Framework: Features daily loss limits, RR-based exits, and prop-firm friendly protection.

🔹 Visual Mapping Tools: Displays highs, lows, quantiles, and structure to align entries with market context.

HINN Lazy Trader EA Review

HINN Lazy Trader MT5 Review

Why Choose & Use HINN Lazy Trader EA?

🔹 Hands-Off Execution: Opens trades for your ideas automatically—no need to monitor lower timeframes.

🔹 Prop-Firm Ready: Built around strict risk parameters and news filters for challenge accounts.

🔹 Highly Customizable: Flexible models, sessions, and risk settings fit any trading style or asset.

🔹 Precision Performance: Designed for clean entries, stable drawdown, and consistent intraday results.

🔹 Multi-Asset Capability: Supports trading multiple ideas and pairs simultaneously without overload.

Recommended settings

Recommended settings and parameters to pay attention to from developers and experts:

| Features | Type |

|---|---|

| Trading platform | MetaTrader 5 (MT5) |

| Time frames | M1 to W1 |

| Currency pairs | Any |

| Minimum / Recommended deposit | $100 |

| Minimum / Recommended leverage | Any |

| Account type | Any |

| Product type | Original version |

| Additional services | Unlock and Decompile |

| Recommended brokers | Exness Broker, Icmarkets Broker |

| Recommended VPS | MyfxVPS.com ( Blue VPS, Golden VPS). Lowest Latency, 2 week Free Trial, 100% Free for 12-18 Months. |

➡️ Reviewed by David Easton

Product Download Package?

The download package of the product suite includes:

✅ Setting (If Any).docx

✅ Installation Guide.docx

Conclusion

In short, HINN Lazy Trader EA combines multi-timeframe scanning, liquidity-based entries, and session-focused execution to deliver precise, high-probability intraday trades. With advanced trade models, automated scaling, and RR-driven exits, it ensures disciplined and consistent performance. Fully customizable and prop-firm friendly, it handles multiple assets effortlessly. A smart, hands-off solution designed for accuracy, stability, and professional-grade trading results.

User Reviews

Only logged in customers who have purchased this product may leave a review.

❓ What is HINN Lazy Trader EA MT5 and how does it work?

HINN Lazy Trader EA MT5 is an automated trading assistant that scans multiple timeframes, identifies high-probability trade setups using liquidity and structure, executes trades, and manages entries, partials, breakeven, and scaling—all with minimal trader involvement. It delivers rule-based and efficient intraday trading.

❓ What trading strategies does HINN Lazy Trader EA use?

It uses a mix of breakout and reversal strategies based on DR, SMR, TRB, and structure models. It focuses on liquidity sweeps, imbalances, volatility zones, and intraday timing to capture precise market opportunities.

❓ Which timeframes does the EA analyze?

The EA scans from M1 to W1 to detect high-probability setups by monitoring structure shifts, liquidity pockets, and volatility across multiple timeframes for confluence. This ensures precise and confident trade execution.

❓ What are the minimum deposit and leverage requirements?

The minimum recommended deposit is $100 with any leverage allowed. The EA is optimized for flexibility and can run on any account type, including ECN, STP, DMA, or even basic retail accounts.

❓ Is HINN Lazy Trader EA suitable for prop firm challenges?

Yes. It includes strict risk control parameters, daily loss limits, RR-based exits, news filters, and prop-firm compliant trading logic, making it ideal for prop-firm challenges and funded accounts.

❓ What makes HINN Lazy Trader EA different from other Expert Advisors?

It combines multi-model logic (reversal, breakout, sweep, trend), session-based trading, multi-timeframe scanning, and intelligent trade management (partials, breakeven, scaling), offering both precision and flexibility.

❓ Does the EA support hands-off trading?

Absolutely. It automates most tasks, including trade entry, stop-loss placement, partials, scaling, and breakeven adjustments. Traders don’t need to constantly monitor lower timeframes or manually manage trades.

❓ Can I trade multiple instruments simultaneously?

Yes. It supports multi-asset trading, allowing you to run multiple strategies or pairs at the same time without overload, making it perfect for diversified portfolio automation.

❓ How does the EA manage risk and protect accounts?

It features RR-driven exits, daily loss limits, exposure control, breakeven and partials management, and emergency stop modules to protect your account—especially useful for prop and challenge accounts.

❓ Is HINN Lazy Trader EA customizable for different trading styles?

Yes. You can customize sessions, model logic (reversal, breakout, sweep), risk settings, scaling behavior, and even partial targets to match your trading preferences, assets, and strategies.

There are no reviews yet.