Market Reversal Alerts MT4 v5.10 (Platform build 1455+)

Subscriptions for Special Plan

- 30 EA package is more economical!

- Special package with 99%

- Download 1 EA/Day

Subscriptions for Premium Membership

- Download Unlimited in 1 Year

- Get 100% Discount

- Get free access to all

Subscriptions for Gold Membership

- 1 Year Membership

- Get 100% Discount

- Access EA+Indicator+Course

Frequently bought together 🎁

Add these products to enhance your purchase

Market Reversal Alerts MT4: AI-Powered Market Structure Reversal Detection

Market Reversal Alerts is a dynamic indicator designed to identify when a trend or price move is approaching exhaustion and is ready to reverse. It leverages sophisticated algorithms to alert you to crucial changes in market structure, which are typical precursors to reversals or major pullbacks. The indicator graphically represents potential shifts by drawing and trailing rectangles along the price, providing clear visual cues and integrated alerts when a reversal is likely.

🔶 Vendor website: Click here

About the Author

This product is compiled by LEE SAMSON. This author has more than +5 years of experience working on MQL5 with many famous products such as Market Reversal Alerts MT4, Stock Index Hedge EA, Opening Range Breakout MT4, Position Trader EA and other advisors. Among them, Market Reversal Alerts MT4 is his best performing product.

Key Features of Market Reversal Alerts for MT4

🔹 Market Structure Shift Alerts: Detects potential reversals and major pullbacks as trends approach exhaustion.

🔹 Dynamic Structure Mapping: Draws and trails rectangles to track short-term structure with price action.

🔹 Multi-Timeframe Insight: Displays higher timeframe reversal zones on lower charts for clearer bias.

🔹 Flexible Alert System: Pop-up, push, and email alerts for timely, actionable notifications.

🔹 Directional Control: Filter long, short, or all alerts to align with prevailing trend conditions.

What is the Market Reversal Alerts MT4 Trading Strategy?

🔹 Exhaustion-Based Logic: Identifies weakening momentum after new highs or lows near key levels.

🔹 Structure Confirmation: Signals when price closes beyond the structure rectangle, hinting a reversal.

🔹 Level Confluence Approach: Encourages alignment with support, resistance, or supply-demand zones.

🔹 Retest Validation: Alerts on retests to confirm higher-probability entries.

🔹 Risk-Aware Framework: Designed to pair with logical stop placement and controlled reward targets.

Market Reversal Alerts MT4 Review

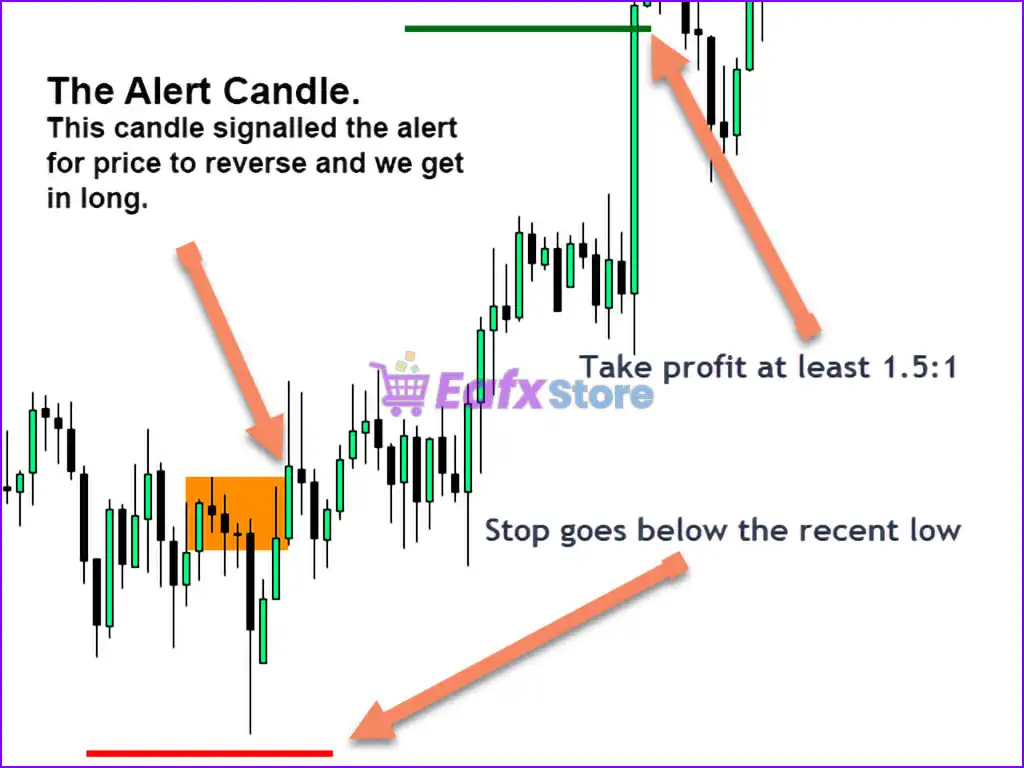

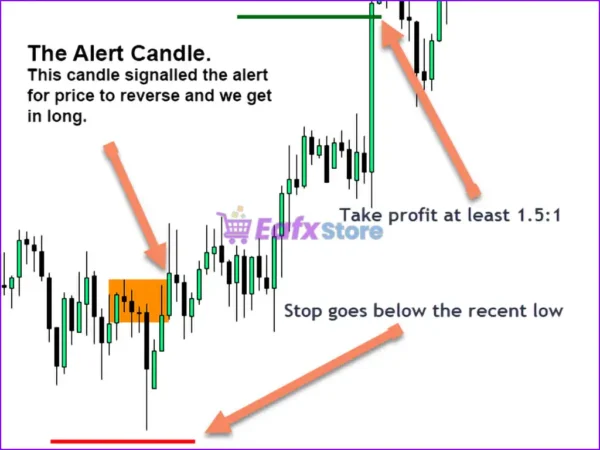

The indicator detects breakouts and price momentum whenever a new high or low is established close to a potential exhaustion point. It marks a rectangle on the last candle of opposite color and tracks it along with price as it follows the current short-term trend.

When price weakens to the extent that it closes above or below the rectangle, it signals a potential change in market structure. Subsequently, the indicator notifies you of a potential shift in direction, marking the beginning of a potential trend reversal or significant pullback.

Market Reversal Alerts MT4 Reviews

Market Reversal Alerts Indicator Review

Market Reversal Alerts Indicator MT4 Review

Why choose Market Reversal Alerts?

🔹 Capital Protection Focused: Helps avoid late entries by signaling early structure changes.

🔹 Consistent Decision Support: Objective alerts reduce emotional and discretionary mistakes.

🔹 Highly Adaptable Tool: Works with any market, timeframe, or existing strategy.

🔹 Time-Saving Automation: Monitors structure continuously without manual chart scanning.

🔹 Professional Reliability: Built for traders seeking stability, clarity, and long-term consistency.

Trading Specifications

Recommended settings and parameters to pay attention to from developers and experts:

| Features | Type |

|---|---|

| Trading platform | MetaTrader 4 (MT4) |

| Time frames | Any |

| Currency pairs | Any |

| Product type | NoDLL / Fix |

| Additional services | Unlock and Decompile |

| Recommended brokers | Exness Broker, Icmarkets Broker |

| Recommended VPS | MyfxVPS.com ( Blue VPS, Golden VPS). Lowest Latency, 2 week Free Trial, 100% Free for 12-18 Months. |

➡️ Reviewed by David Easton

What’s in the Package?

The download package of the product suite includes:

✅ Indicators: Market Reversal Alerts v5.10_fix.ex4

Conclusion

In short, The Market Structure Reversal Alert Indicator is a powerful tool for traders seeking to pinpoint high-probability trend reversals and market exhaustion zones with precision. By intelligently identifying breakout momentum, trailing price action, and highlighting key reversal signals through dynamic rectangles, this indicator helps traders react proactively to structural changes in the market. Its real-time alerts—via pop-up, push, or email—ensure you never miss a potential shift in trend, while advanced features like higher-timeframe bias overlays, directional filters, and re-test confirmations make it suitable for all trading styles and timeframes.

User Reviews

Only logged in customers who have purchased this product may leave a review.

1. What does "market structure reversal" mean?

It refers to a potential shift in price direction, where a trend might be ending and a new one beginning.

2. How does the indicator identify potential reversals?

It analyzes price momentum and breakouts, focusing on areas where a trend might be losing steam. When price action weakens and closes outside a defined zone, it suggests a possible reversal.

3. Does the indicator automatically generate trades?

No, it provides alerts for potential reversals, but you decide whether and how to trade them.

4. What kind of alerts does it offer?

It offers visual alerts (changing color rectangles) and optional pop-up, push, and email notifications.

5. Does it work on all markets and timeframes?

Yes, it functions across all trading symbols and timeframes.

6. How can I confirm a reversal signal?

Look for historical support/resistance levels or recent stop hunts near the reversal zone. Consider higher timeframes for confirmation.

7. Can I use other indicators alongside this one?

Absolutely! This indicator can either validate your existing strategy or be used for additional confirmation of signals from other tools.

8. How do I set stop-loss and take-profit levels?

Place your stop loss just above the last high (for long trades) or below the last low (for short trades). Take profit is flexible, but a 1.5:1 or 2:1 risk-to-reward ratio is a good starting point.

🔥 Get This EA for FREE with Our Membership! 🚀🚀

Unlock access to this EA, premium Indicators, and exclusive trading tools completely FREE with any of our Membership Plans! Thousands of traders already benefit from our VIP library—join them and level up your trading instantly. Choose Your Membership:

- SPECIAL – 1 Month Membership

- GOLD – 1 Year Membership

- PREMIUM – 1 Year Membership

There are no reviews yet.