DualGrid EA MT5 (Latest version) – GroupBuy

Main Slot Purchase Phase

Main Slot Price: $95.00

0 out of 5 main slots sold

What is DualGrid EA?

DualGrid EA is an automated trading system built on a dual-strategy grid architecture, designed to balance flexibility and stability. It allows traders to adapt to different market conditions through configurable logic, disciplined execution, and structured risk management. With advanced filtering and controlled exposure, DualGrid focuses on long-term consistency, adaptability, and capital protection rather than aggressive overtrading.

About the Author

This product is compiled by Phathutshedzo Tshivhasa. This author has more than +1 years of experience working on MQL5 with many famous products such as DualGrid EA MT5, Gold Throne MT5, Gold Throne MT4, AllPair Engine, GoldTick EA and other advisors. Among them, DualGrid EA is his best performing product.

DualGrid EA MT5 Review

Key Features of DualGrid EA for MT5

🔹 Dual-Strategy Framework: Two independent grid strategies for flexible risk and execution control.

🔹 Configurable Risk Control: Supports auto lot, fixed lot, and balance-based position sizing.

🔹 Advanced Market Filtering: Reduces noise and avoids unnecessary trades during unstable conditions.

🔹 Strategy Independence: Enable or disable Buy/Sell logic separately for each strategy.

What is the DualGrid EA Trading Strategy?

🔹 Delayed Grid Logic: Uses structured grid placement to manage entries over market fluctuations.

🔹 Flexible Martingale Control: One strategy allows martingale to be fully neutralized via settings.

🔹 Adaptive Execution Model: Adjusts behavior based on timeframe and market conditions.

🔹 Controlled Exposure: Designed to limit overtrading and maintain consistent drawdown levels.

DualGrid EA MT5 Review

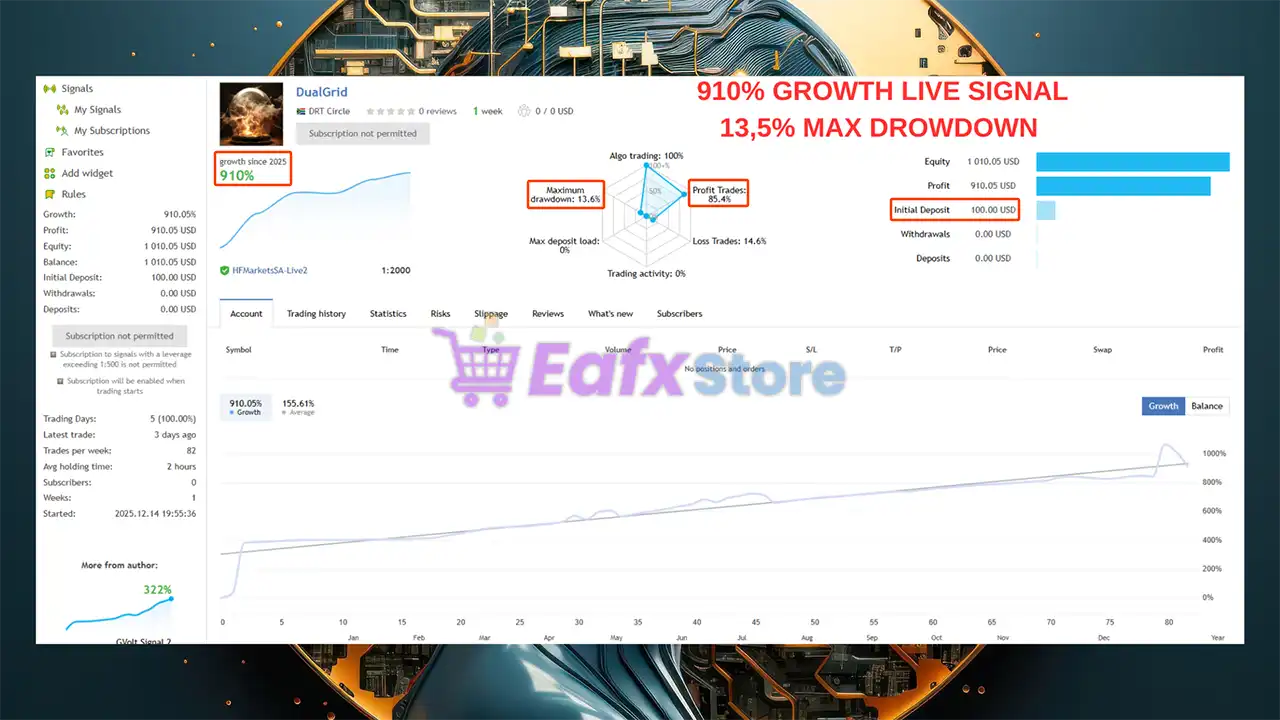

1. DualGrid EA Signal Results:

The DualGrid EA achieved impressive profit performance when trading with GOLD pair. Trading results on real account for 1 consecutive weeks of trading:

✅ Initial Deposit: $100

✅ Growth Rate: +910%

✅ Win Rate (% of total): 85.4%

✅ Maximum Drawdown: 13.6%

DualGrid EA Signal

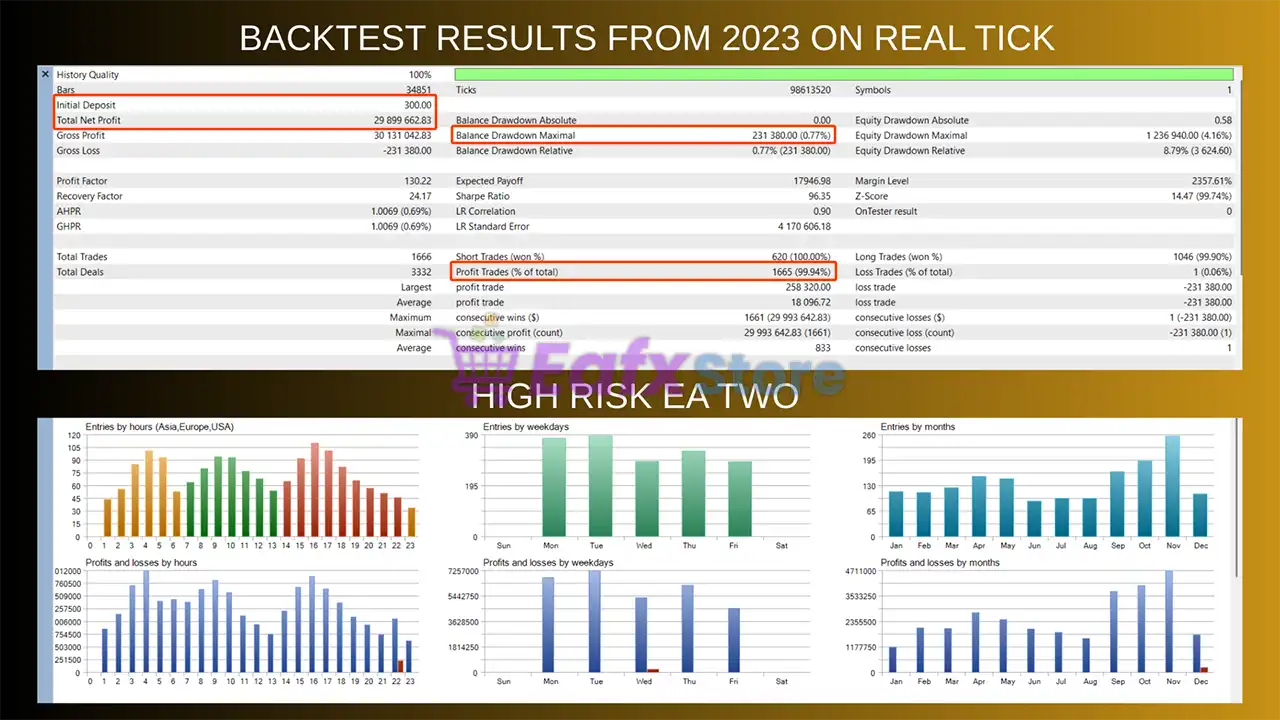

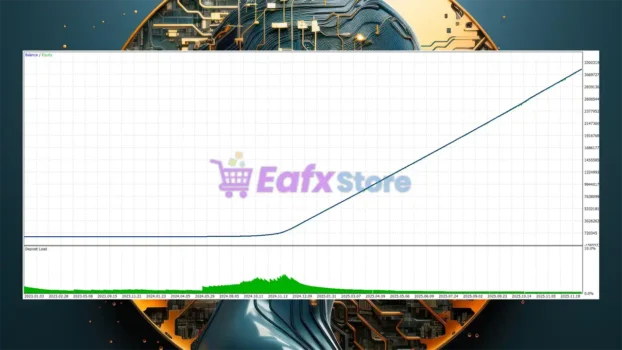

2. DualGrid EA MT5 Backtest:

The DualGrid EA backtest trading results achieved impressive profit performance for 24 months on the XAUUSD (Gold) pair.

DualGrid EA MT5 Backtest

Why Choose & Use DualGrid EA?

🔹 Focus on Stability: Built for disciplined trading with controlled risk rather than fast profits.

🔹 High Adaptability: Suitable for different risk profiles and changing market environments.

🔹 Transparent Control: Traders maintain full authority over strategy activation and lot sizing.

🔹 Marketplace Ready: Ideal for users seeking a structured, customizable grid trading solution.

Recommended settings

Recommended settings and parameters to pay attention to from developers and experts:

| Features | Type |

|---|---|

| Trading platform | MetaTrader 5 (MT5) |

| Time frames | Any |

| Currency pairs | Gold (XAUUSD) |

| Minimum / Recommended deposit | $100 |

| Minimum / Recommended leverage | Any |

| Account type | Any |

| Product type | Original version |

| Additional services | Unlock and Decompile |

| Recommended brokers | Exness Broker, Icmarkets Broker |

| Recommended VPS | MyfxVPS.com (Blue VPS, Golden VPS). Lowest Latency, 2 week Free Trial, 100% Free for 12-18 Months. |

Product Download Package?

The download package of the product suite includes:

Conclusion: Balancing Aggression and Safety with DualGrid

In short, DualGrid for MT5 is a versatile solution for traders who want the high-profit potential of grid trading without being forced into high-risk Martingale cycles. By allowing Strategy One to run as a pure grid while reserving Strategy Two for aggressive recovery, it provides a unique “hybrid” approach to the Gold market.

User Reviews

Only logged in customers who have purchased this product may leave a review.

❓ What is the core trading strategy of DualGrid EA?

DualGrid EA is built on a dual-strategy grid framework. It operates two independent trading systems simultaneously. The first is a Delayed Grid which allows traders to control or completely disable Martingale. The second is a Super Delayed Grid, designed for more aggressive performance with internal validation logic. This bi-directional approach allows the EA to profit from both market rises and falls in volatile ranges.

❓ Who is the developer behind DualGrid EA?

The EA is developed by Phathutshedzo Tshivhasa, an experienced MQL5 programmer with a portfolio of successful products including Gold Throne, AllPair Engine, and GoldTick EA. DualGrid EA is currently recognized as the author’s top-performing flagship product.

❓ How does the "Martingale Neutralization" feature work?

One of the unique features of DualGrid is the ability to neutralize Martingale behavior. By setting the "Lots Multiply" input to 1.0 in the first strategy, the EA converts into a pure grid system. This gives conservative traders the flexibility to avoid aggressive lot-size increases while still benefiting from grid-based entries.

❓ Which currency pairs and timeframes are recommended?

While the EA can be used on multiple symbols, it is highly optimized for XAUUSD (Gold). The recommended timeframe for both backtesting and live trading is M30 (30-minute). This timeframe provides a good balance between signal accuracy and market noise reduction.

❓ What were the backtest results for XAUUSD?

In long-term historical simulations (24 months) on Gold:

✅ Initial Deposit: $300

✅ Total Net Profit: Over $29 million (using high-risk compounding settings).

✅ Win Rate: 99.94%

✅ Maximum Drawdown: 0.77%

➡️ Note: These results often reflect "compounding" and "high-risk" settings; live performance will vary based on user-defined risk parameters.

❓ Is DualGrid EA suitable for small accounts?

Yes. The minimum recommended deposit is $100. The EA supports flexible position sizing, including Auto Lot (based on balance) and Fixed Lot (manual control), allowing traders to scale their risk according to their account size.

❓ Does the EA include high-impact news filtering?

DualGrid features Advanced Market Filtering. It is designed to reduce market noise and avoid placing unnecessary trades during periods of extreme instability. This helps protect the grid from becoming over-extended during "black swan" events or major economic data releases.

❓ Can I run both internal strategies at the same time?

While the EA allows it, the developer does not recommend running Strategy 1 and Strategy 2 simultaneously on a live account. Doing so can lead to a high number of concurrent trades, which may over-leverage the account and increase the risk of a significant drawdown.

❓ How do I handle the risk management settings?

Traders have full authority over strategy activation. You can enable or disable Buy and Sell logic separately for each strategy. For example, if you expect a long-term downtrend, you can set the EA to only execute Sell grids to stay aligned with the primary market direction.

❓ Is DualGrid EA "Prop Firm" friendly?

Because DualGrid allows you to disable Martingale and provides strict control over drawdown levels, it can be adjusted for Prop Firm challenges. However, traders must carefully configure the Max Drawdown and Lot Sizing to comply with the specific daily loss limits of the prop firm.

There are no reviews yet.