Secret Impulse EA Overview

The Secret Impulse MT4 is a sophisticated trading system designed to capitalize on market momentum during the high-volume New York trading session. This powerful Expert Advisor (EA) is specifically optimized for Gold (XAUUSD) trading and boasts a proven track record of profitability on real accounts.

Developed by Eugen Funk, a seasoned MQL5 developer with over 2 years of experience, the Secret Impulse MT4 stands out among his creations, including the AI for Gold EA.

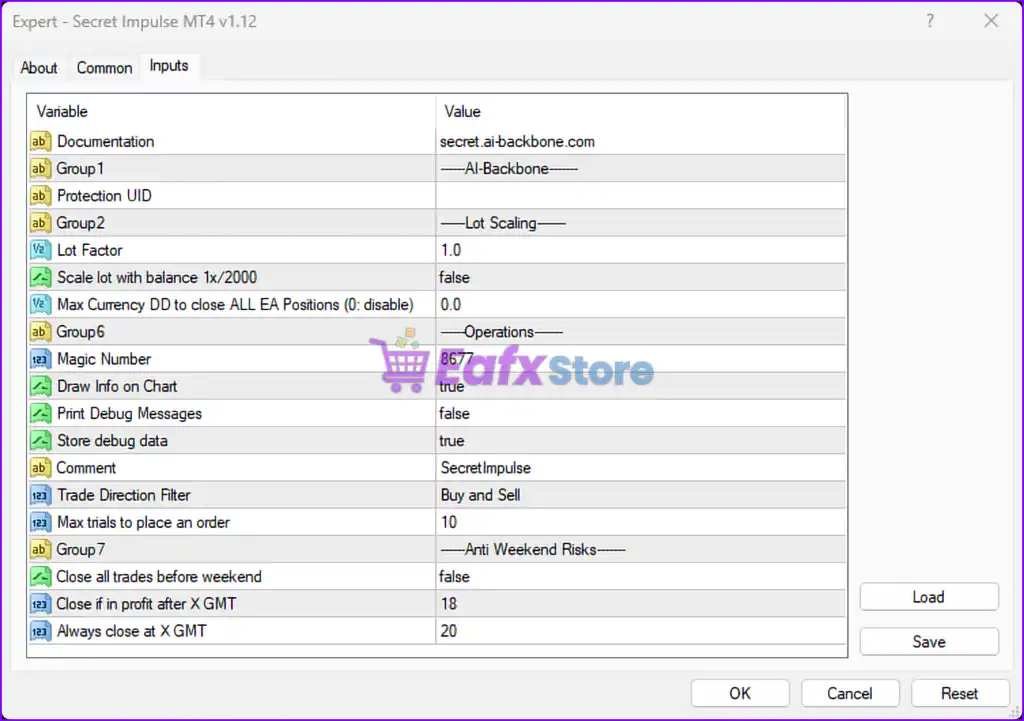

Installation panel Parameters

Below are the details of the parameters in the advisor’s trading system settings table:

1. Documentation:

- Documentation:

secret.ai-backbone.com- Reference link for detailed information about the EA. This likely directs users to the developer’s documentation or support resources.

2. AI-Backbone:

- Group1/Group2: Section headers

- These are separators for better organization of settings.

3. Lot Scaling:

- Lot Factor:

1.0- The default lot size multiplier. This determines the position size relative to the EA’s base configuration.

- Scale lot with balance 1x/2000:

false- Disables automatic lot scaling based on the account balance. When enabled, the EA would adjust the lot size proportionally, e.g., 1 lot for every 2000 units of balance.

4. Risk Management:

- Max Currency DD to close ALL EA Positions (0: disable):

0.0- Drawdown protection is disabled. When set to a non-zero value, all positions will be closed if the drawdown for a currency exceeds the specified percentage.

5. Operations:

- Magic Number:

8677- A unique identifier for trades opened by this EA. This ensures trades are not affected by other EAs or manual trades.

- Draw Info on Chart:

true- Displays trading and performance information directly on the chart for better visibility.

- Print Debug Messages:

false- Disables detailed debugging messages in the terminal, which are usually for developers or advanced troubleshooting.

- Store debug data:

true- Enables logging of debug data for review or troubleshooting.

- Comment:

SecretImpulse- The comment added to trades executed by this EA for identification.

- Trade Direction Filter:

Buy and Sell- The EA is configured to take both buy and sell trades based on its signals.

- Max trials to place an order:

10- The EA will attempt up to 10 retries to place a trade if conditions are not met initially (e.g., due to slippage or rejection).

6. Anti Weekend Risks:

- Close all trades before weekend:

false- Disables the feature to close all positions before the market closes on Friday. When enabled, this reduces exposure to weekend gaps.

- Close if in profit after X GMT:

18- If enabled, the EA will close all profitable trades after 18:00 GMT.

- Always close at X GMT:

20- If enabled, the EA will force-close all trades at 20:00 GMT regardless of their profit or loss status.

Analysis and Recommendations

1. Risk Management:

- Lot Scaling: Lot scaling is currently disabled. If the account grows, enabling this feature can help automatically adjust lot sizes in proportion to the balance, improving efficiency.

- Drawdown Protection: Drawdown protection is set to

0.0(disabled). To mitigate risk, consider enabling this by setting an appropriate percentage (e.g., 20%) to close all positions when a specific drawdown threshold is reached.

2. Trade Management:

- Magic Number: The unique magic number ensures trades opened by this EA are easily identifiable. Do not duplicate this number with other EAs running on the same account.

- Retry Mechanism: The EA retries up to 10 times to place a trade. This is useful in volatile markets but could lead to delays. Monitor if this behavior affects execution quality.

3. Weekend and Time-Based Settings:

- Anti Weekend Risks:

- Disabling the feature to close trades before weekends may lead to exposure to potential gaps when markets reopen on Sunday. Consider enabling this feature if trading on volatile instruments.

- The time-based closures at

18:00 GMT(profitable trades) and20:00 GMT(all trades) can provide an additional layer of risk management for sessions nearing the weekend.

Recommendations for Use

- Enable Risk Management Features: Set appropriate levels for drawdown protection and weekend trade closures to minimize potential risks.

- Use Lot Scaling: For automated risk adjustment based on account balance, enable the “Scale lot with balance” feature.

- Time Management: Ensure the time-based closing mechanisms align with your trading strategy, especially if the market you’re trading has high volatility near session closures.

- Debugging: If issues arise, enable “Print Debug Messages” temporarily for detailed logs in the terminal to identify the cause of problems.

Conclude

The Secret Impulse EA is equipped with a structured risk and trade management system, though some critical features (e.g., drawdown protection, weekend risk management) are currently disabled. It supports both buy and sell trades with retry mechanisms to ensure execution. Fine-tuning these settings based on your trading preferences and market conditions is key to optimizing the EA’s performance.