Saviour Gold Bot Overview

Saviour Gold Bot is an Expert Advisor (EA) designed for the MetaTrader 4 (MT4) platform. It combines three core models – Price Channels, Pivots and Price Action – to offer a sophisticated yet user-friendly approach to effective Gold trading. Saviour Gold Bot also offers a variety of features, including support for multiple trading strategies, safety measures, and compatibility with different brokers and account types.

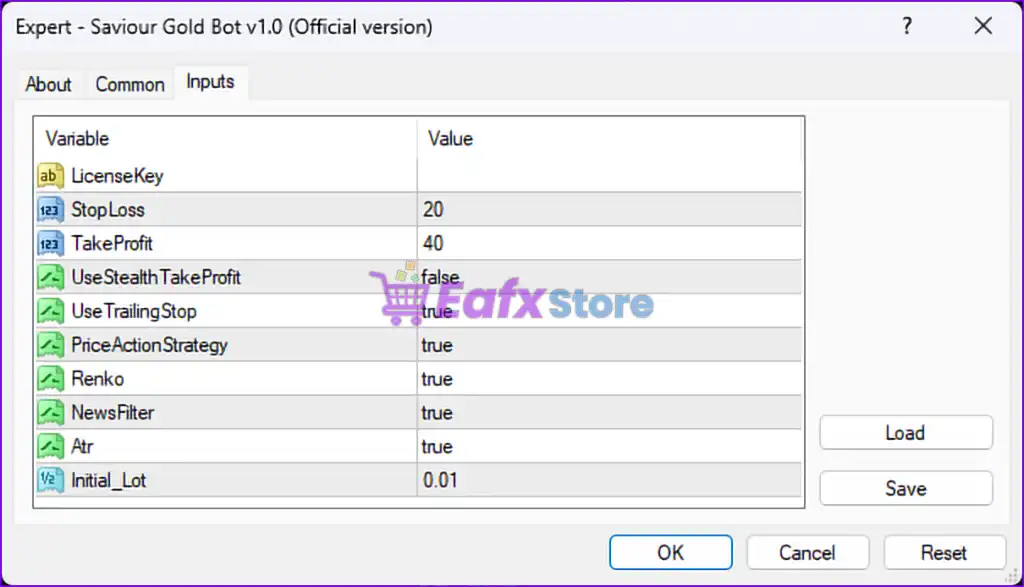

Installation panel Parameters

Below are the details of the parameters in the advisor’s trading system settings table:

1. General Information:

- LicenseKey: (Value not shown)

- The EA requires a valid license key to operate. This ensures the bot is used by authorized users only.

2. Risk and Reward Settings:

- StopLoss:

20- The stop-loss is set to 20 pips, limiting the maximum loss per trade.

- TakeProfit:

40- The take-profit is set to 40 pips, offering a 1:2 risk-to-reward ratio, which is favorable for most trading strategies.

- UseStealthTakeProfit:

false- The stealth take-profit feature is disabled. If enabled, the TP level would not be visible to brokers, potentially avoiding broker interference.

3. Trade Management:

- UseTrailingStop:

true- Trailing stops are enabled, allowing the EA to lock in profits as the trade moves favorably.

4. Strategy Settings:

- PriceActionStrategy:

true- Indicates the EA incorporates price action strategies for trade entries and exits, making decisions based on candlestick patterns or market behavior rather than purely technical indicators.

- Renko:

true- The EA uses Renko charts, which focus on price movement rather than time. This is ideal for filtering out market noise and identifying trends.

5. News and Volatility Filters:

- NewsFilter:

true- The news filter is enabled, meaning the EA will avoid trading during high-impact news events. This reduces exposure to extreme volatility.

- Atr:

true- The EA uses the Average True Range (ATR) indicator for dynamic risk or volatility-based decisions, such as setting stop-loss or position sizing.

6. Lot Size Management:

- Initial_Lot:

0.01- The starting lot size is set to 0.01, making it suitable for smaller account balances or conservative risk management.

Analysis and Recommendations

1. Risk Management:

- Risk-to-Reward Ratio: A 1:2 risk-to-reward ratio (20 pips SL vs. 40 pips TP) is favorable. However, ensure the market conditions align with this approach, especially when using Renko and price action strategies.

- Trailing Stop: Trailing stops help secure profits, but the trailing settings (e.g., step size or activation level) should be tested to ensure they align with your trading objectives.

2. Trading Strategy:

- Price Action and Renko: Combining price action and Renko charts is a strong approach for trend-following and noise reduction. Ensure that the Renko box size is optimized for the timeframe and asset being traded.

- News Filter: With the news filter enabled, the EA avoids trading during volatile periods caused by major economic events, reducing potential risks.

- Stealth Take-Profit: While stealth TP is disabled, enabling it can protect your TP levels from broker manipulation, especially in volatile markets.

3. Lot Sizing:

- Initial Lot Size: A fixed lot size of 0.01 is safe for small accounts. Consider enabling dynamic lot sizing based on account balance if supported by the EA.

Recommendations for Use

- Test Before Deployment: Run the EA in a demo environment to observe its performance under different market conditions, especially to test the effectiveness of the price action and Renko strategies.

- Fine-Tune Settings: Optimize the Renko box size, trailing stop parameters, and ATR period for the asset and timeframe you are trading.

- Enable Stealth TP: If trading with a broker known for wide spreads or slippage, enable the stealth TP feature to protect your profit targets.

- Monitor News Filter: Ensure the news source is reliable and updated in real time to maximize the effectiveness of the news filter.

Conclude

The Saviour Gold Bot combines price action, Renko charts, and a news filter to provide a robust and flexible trading approach. With a favorable risk-to-reward ratio and features like ATR and trailing stop, the EA is suitable for conservative trading. However, its success depends on market conditions and proper parameter tuning. Testing and optimization are highly recommended before live trading.

Salve vorrei sapere il time frame e su che conto adrebbe aperto