Cypher GOLD EA Overview

Cypher GOLD EA is an advanced Expert Advisor (EA) designed for MetaTrader 4 (MT4) that automates gold (XAU/USD) trading. It combines powerful algorithmic strategies with robust risk management to deliver consistent and stable profits for traders of all experience levels.

Cypher GOLD EA empowers traders to achieve long-term success in the gold market. With its powerful features and user-friendly design, it’s an ideal tool for both experienced traders and those new to automated trading.

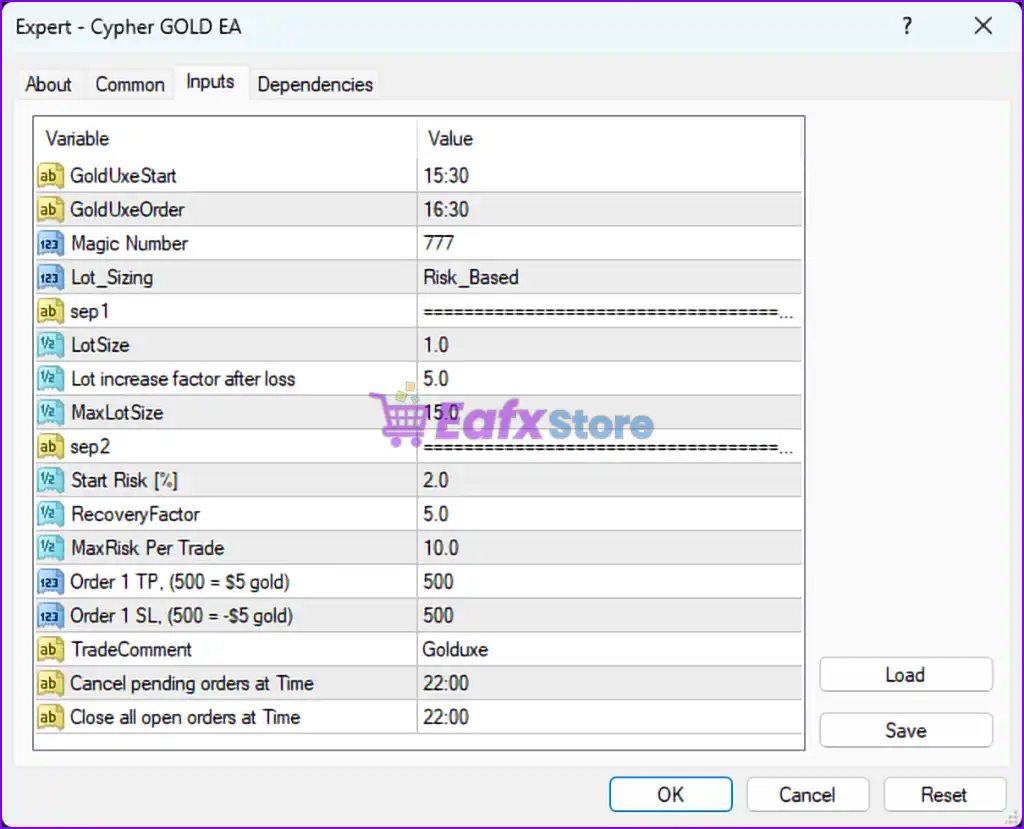

Installation panel Parameters

Below are the details of the parameters in the advisor’s trading system settings table:

1. General Information:

- GoldUxeStart:

15:30- The EA begins monitoring or trading activities at 15:30.

- GoldUxeOrder:

16:30- The EA likely places orders or finalizes its trading setup at 16:30.

- Magic Number:

777- A unique identifier for trades executed by this EA to distinguish them from other EAs or manual trades.

2. Lot Sizing and Risk Management:

- Lot_Sizing:

Risk_Based- The EA uses a risk-based approach to determine lot sizes rather than fixed lot sizing.

- LotSize:

1.0- The initial lot size is set to 1.0 (may vary if dynamic sizing is applied).

- Lot increase factor after loss:

5.0- If a loss occurs, the lot size increases by a factor of 5 for the next trade. This is a form of Martingale strategy and can lead to rapid drawdowns.

- MaxLotSize:

15.0- The maximum lot size is capped at 15 lots to prevent excessive risk.

- Start Risk [%]:

2.0- The EA risks 2% of the account balance per trade, which aligns with standard risk management practices.

- RecoveryFactor:

5.0- The EA attempts to recover losses by increasing trade sizes by a factor of 5. This is an aggressive recovery mechanism.

- MaxRisk Per Trade:

10.0- The maximum allowable risk per trade is capped at 10% of the account balance.

3. Order Parameters:

- Order 1 TP (500 = $5 gold):

500- The take-profit level for trades is set to 500 points (pips) or $5 for gold.

- Order 1 SL (500 = $5 gold):

500- The stop-loss level for trades is also set to 500 points (pips) or $5 for gold, creating a 1:1 risk-to-reward ratio.

- TradeComment:

Golduxe- Trades executed by this EA are labeled with the comment “Golduxe.”

4. Time-Based Management:

- Cancel pending orders at Time:

22:00- Any pending orders that are not executed will be canceled at 22:00.

- Close all open orders at Time:

22:00- All open positions are force-closed at 22:00, likely to avoid overnight or weekend risk.

Analysis and Recommendations

1. Risk Management:

- Lot Increase Factor: The Martingale-style approach (5x lot increase after a loss) is very aggressive and can lead to significant drawdowns during losing streaks. Consider reducing this factor for safer trading.

- Maximum Risk: With a maximum risk of 10% per trade, this EA is high-risk. A lower percentage, such as 2–5%, is recommended for better account preservation.

- Stop Loss and Take Profit: The 1:1 risk-to-reward ratio (SL and TP both at 500 points) may not be optimal in volatile gold markets. Adjust these values to reflect a higher reward-to-risk ratio, such as 1.5:1 or 2:1.

2. Trading Behavior:

- Dynamic Lot Sizing: Risk-based lot sizing is beneficial as it adjusts according to the account balance. However, ensure the account has sufficient capital to sustain the Martingale recovery strategy.

- Time Restrictions: The EA operates within specific time windows (15:30–22:00), likely targeting active gold trading sessions. Ensure this aligns with your trading objectives.

Recommendations

- Test in Demo: Test the EA in a demo account to evaluate its performance, particularly the Martingale strategy and its impact on drawdowns.

- Adjust Lot Increase: Reduce the “Lot increase factor after loss” to minimize risk during prolonged losing streaks.

- Reassess SL/TP Ratio: Modify the stop-loss and take-profit levels to achieve a higher reward-to-risk ratio.

- Monitor Close Times: Ensure the order cancellation and position closure at 22:00 align with your trading preferences and avoid unnecessary losses.

Conclude

The Cypher GOLD EA is designed for gold trading with risk-based lot sizing and time-based trade management. While it incorporates aggressive recovery mechanisms, such as a Martingale strategy and increased lot sizes after losses, these can lead to significant risks during adverse market conditions. Proper testing, fine-tuning of parameters, and conservative settings are crucial for maximizing its potential while managing risks effectively.