🌐 What is US30 Omega EA?

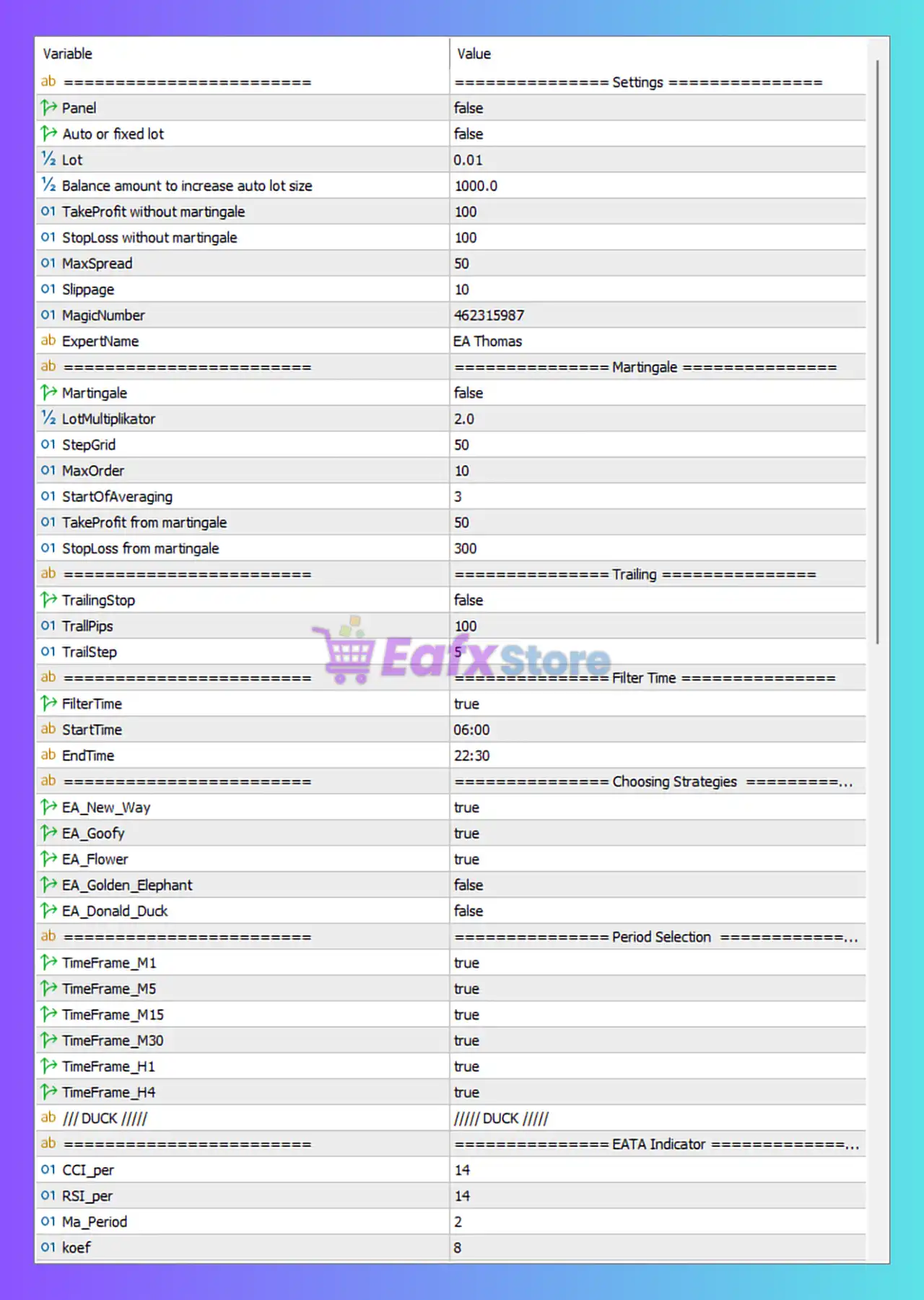

The US30 Omega EA settings panel reveals a highly sophisticated and flexible Expert Advisor (EA) designed for trading the US30 index (Dow Jones). It combines multiple technical systems — including Moving Averages (MA), RSI, CCI, and SuperTrend filters — and offers modular trading modes that can be fine-tuned for specific market conditions.

📌📌📌 Buy this unlimited US30 Omega EA MT5 product here 📌📌📌

🧠 Strategy Framework and Indicators

The EA uses several layers of technical confirmation to manage entries and exits:

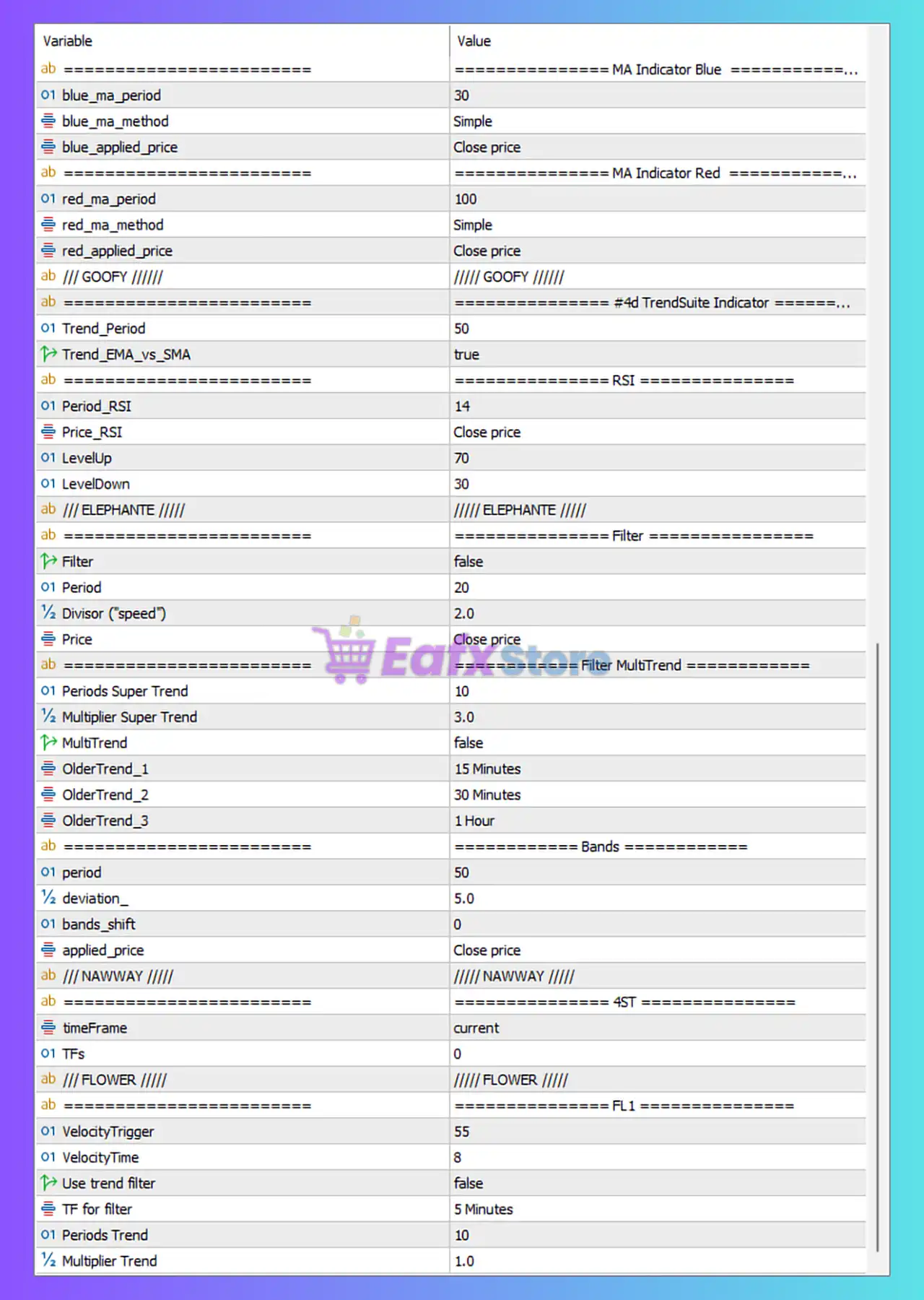

- MA Indicator Blue (Period 30) and MA Indicator Red (Period 100) use Simple Moving Averages on the Close Price.

→ This creates a dual moving average crossover system that helps define short-term and long-term market trends. - RSI Filter (Period 14) with levels 70/30 detects overbought or oversold conditions, supporting mean-reversion logic.

- SuperTrend Filter and MultiTrend options (with 15-min to 1-hour timeframes) enhance directional accuracy and volatility filtering.

- Bands and Deviation settings (Period 50, Deviation 5.0) act as a volatility-based boundary similar to Bollinger Bands, assisting in breakout detection.

These combined indicators suggest that the EA aims to capture both trend-following and countertrend opportunities, depending on the selected strategy.

⚙️ Core Trade Settings

- Lot Size: 0.01 (adjustable with balance-based scaling).

- Auto/Fix Lot: false — manual or custom risk management is required.

- TakeProfit / StopLoss: 1000 / 100 points without Martingale.

→ This 10:1 reward-to-risk ratio reflects a swing-trading bias, seeking large movements with controlled exposure. - Slippage: 10 — moderate tolerance to price deviation.

- Max Orders: 10 — allows multi-layered entries (e.g., scaling into trades).

- Start of Averaging: 3 — grid-like averaging starts after 3 positions.

- StepGrid: 50 points — distance between grid orders.

💥 Risk and Martingale Control

While Martingale is disabled (false) by default, the EA includes parameters such as:

- LotMultiplier = 2.0

- StopLoss from Martingale = 300

- TakeProfit from Martingale = 50

These parameters allow traders to enable controlled Martingale progression if desired, but with limits to prevent runaway risk.

The Max Risk per Strategy = 6.0% offers solid protection for prop firm traders, aligning with typical funding firm requirements.

🔁 Trailing and Filtering Systems

- TrailingStop: false (can be activated for dynamic profit locking).

- TrailPips: 100, TrailStep: 5 — precise trailing configuration for incremental gains.

- FilterTime: true, trading window set from 06:00 to 22:30 — avoids low-liquidity periods and rollover spreads.

🌐 Multi-Strategy Integration

The EA integrates several embedded trading systems:

- EA_New_Way: true — likely a momentum-based engine.

- EA_Goofy: true — possibly a trend-reversal logic module.

- EA_Flower: true — may apply volatility breakouts or channel trading.

- EA_Golden_Elephant / EA_Donald_Duck: disabled — advanced optional strategies that can be activated.

This modular design lets users combine or isolate systems to create a hybrid trading model — ideal for adapting to different volatility phases in US30.

⏱ Timeframe and Multi-Timeframe Logic

- Enabled timeframes: M1, M5, M15, M30, H1, H4

→ The EA conducts multi-timeframe analysis for entry synchronization and trend alignment, enhancing trade accuracy. - EATA Indicator Section:

- CCI_per = 14, RSI_per = 14

- Ma_Period = 2, koef = 8

→ This unique module suggests adaptive confirmation based on momentum and correlation filters.

📊 Adaptive Behavior and Trend Confirmation

The parameters VelocityTrigger (55) and VelocityTime (8) indicate that the EA tracks market acceleration — filtering fake moves and confirming valid impulses before entering trades.

The “Use Trend Filter = false” by default can be toggled to enforce stricter entry validation across multiple timeframes.

💼 Overall Performance Outlook

With its combination of:

- Multi-indicator synergy (MA, RSI, CCI, SuperTrend)

- Multi-timeframe confirmation

- Modular trading engines

- Tight trade-time filtering

- Flexible risk control

…the US30 Omega EA MT5 demonstrates a professional-grade algorithmic structure suitable for both manual traders seeking automation and prop firm traders demanding drawdown discipline.

🧩 Final Conclusion

The US30 Omega EA MT5 is a multi-strategy Expert Advisor blending trend-following, mean-reversion, and volatility-based filters. It’s designed for high-performance trading on US30 (Dow Jones) with adaptability to changing market conditions.

✅ Strengths:

- Highly configurable and modular logic

- Safe default settings with Martingale disabled

- Time-filtered trading for reduced risk exposure

- Multi-timeframe and indicator confirmation system

⚠️ Weaknesses:

- Requires optimization per broker and spread conditions

- Complexity may challenge beginners without EA experience

🔹 Verdict:

A robust, flexible, and well-structured EA for professional traders focusing on US30 scalping and swing trading. With the right optimization, it can deliver consistent, low-drawdown performance and meet prop firm trading standards.