🧩 What is Stratos Goldwind EA?

Stratos Goldwind EA is an automated trading system for MetaTrader 4 (MT4) that combines indicator-based entries (Stratos Pali Indicator) with grid and position scaling logic. The EA is designed for trend-following entries with controlled grid expansion and predefined take-profit rules.

Based on the settings shown, this configuration focuses on moderate risk, high trade control, and intraday to short-term swing trading.

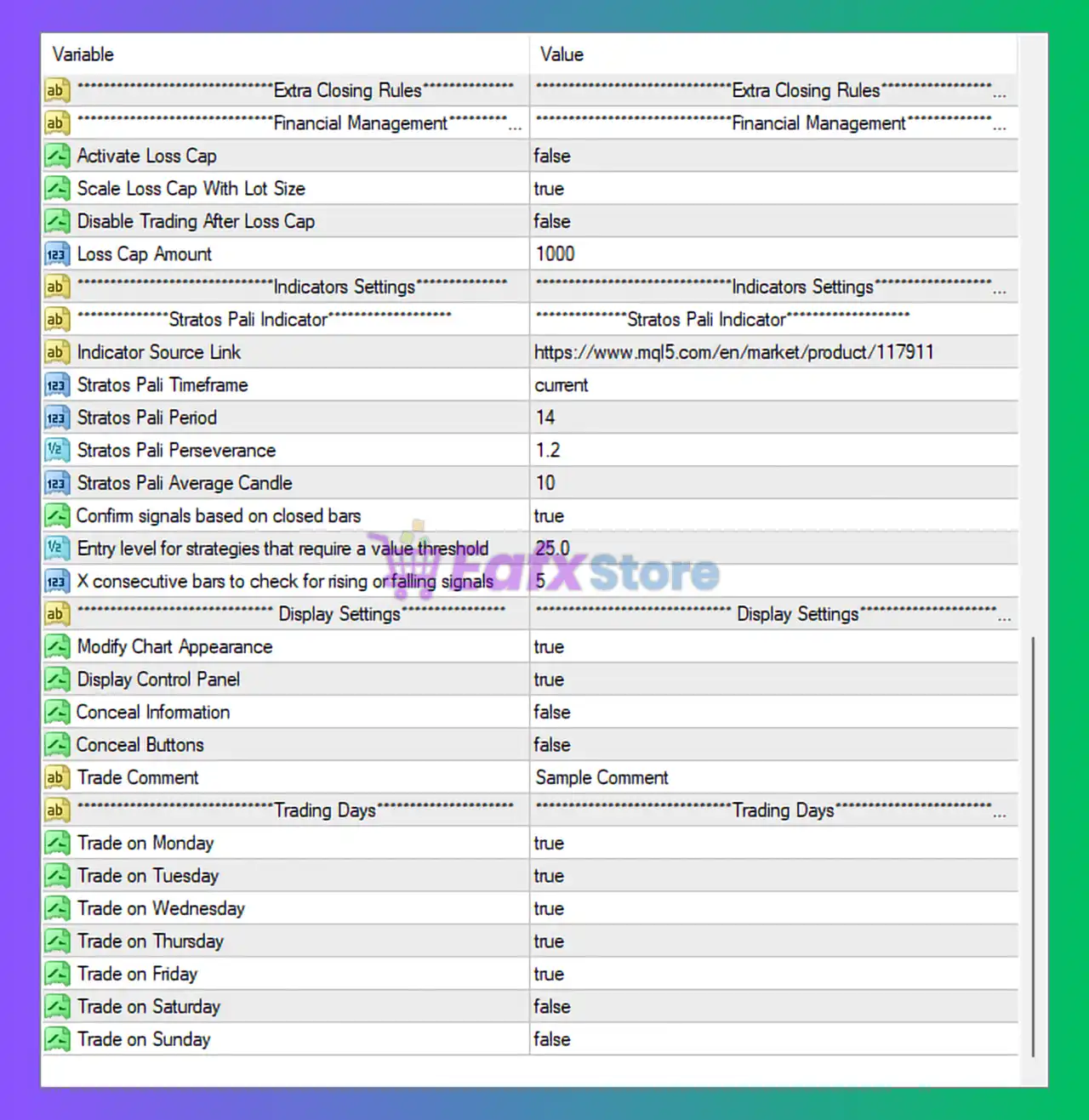

🧩 Financial Management & Risk Control

Loss Cap Settings

- Activate Loss Cap: ❌ Disabled

- Scale Loss Cap With Lot Size: ✅ Enabled

- Disable Trading After Loss Cap: ❌ Disabled

- Loss Cap Amount: 1000

Analysis:

Although the loss cap is defined, it is not active, meaning the EA will not stop trading after reaching a loss threshold. However, scaling the loss cap with lot size helps normalize risk when volume increases. This setup suggests the trader relies more on grid management and take profit logic rather than hard stop-loss protection.

⚠️ Risk Note: Enabling the loss cap would significantly improve capital protection during strong market trends.

🧩 Indicator & Signal Logic (Stratos Pali Indicator)

- Indicator Timeframe: Current chart timeframe

- Period: 14

- Perseverance (Sensitivity): 1.2

- Average Candle: 10

- Closed Bar Confirmation: ✅ Enabled

- Entry Threshold Level: 25.0

- Consecutive Bars for Confirmation: 5

Analysis:

This setup prioritizes signal accuracy over frequency:

- Closed-bar confirmation reduces repainting.

- Multiple consecutive bars ensure trend stability.

- Moderate sensitivity (1.2) filters weak signals.

📈 Best suited for: Trending markets such as Gold (XAUUSD) or major Forex pairs during active sessions.

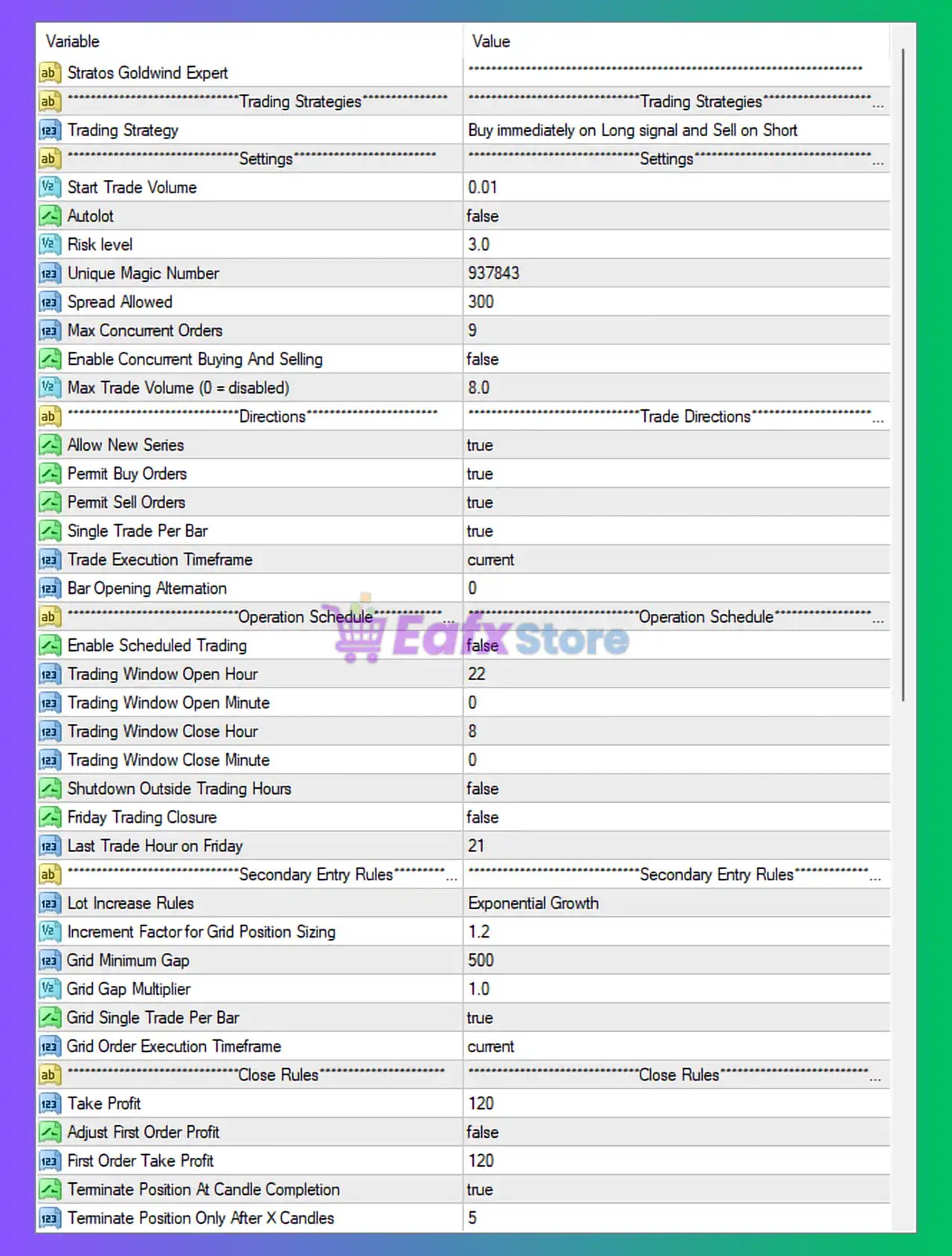

🧩 Trading Strategy & Execution Rules

Core Strategy

- Trading Strategy: Buy immediately on Long signal, Sell on Short signal

- Single Trade Per Bar: ✅ Enabled

- Concurrent Buy & Sell: ❌ Disabled

- Max Concurrent Orders: 9

Analysis:

The EA strictly follows one directional bias at a time, avoiding hedging. This improves clarity and reduces drawdown complexity.

🧩 Lot Size & Position Sizing

- Start Lot Size: 0.01

- Autolot: ❌ Disabled

- Risk Level: 3.0

- Max Trade Volume: 8.0

Analysis:

Manual lot sizing with a low starting volume indicates a conservative approach. Risk level 3.0 suggests moderate exposure, suitable for small to medium accounts.

🧩 Grid & Secondary Entry Rules

- Lot Increase Rule: Exponential Growth

- Increment Factor: 1.2

- Grid Minimum Gap: 500 points

- Grid Gap Multiplier: 1.0

- Grid Single Trade Per Bar: ✅ Enabled

Analysis:

This is a low-aggression grid system:

- A 1.2 multiplier is relatively mild compared to martingale strategies.

- Wide grid spacing (500 points) reduces overtrading.

- Single trade per bar limits execution spikes.

🛡️ Conclusion: Grid logic is designed for survivability rather than fast recovery.

🧩 Take Profit & Exit Rules

- Take Profit: 120 points

- First Order Take Profit: 120 points

- Adjust First Order TP: ❌ Disabled

- Terminate Position at Candle Completion: ✅ Enabled

- Minimum Candles Before Close: 5

Analysis:

Positions are closed with a fixed profit target, ensuring consistent exits. Candle-based termination adds discipline and avoids emotional holding.

🧩 Trading Schedule & Time Filters

- Scheduled Trading: ❌ Disabled

- Trading Days: Monday–Friday

- Weekend Trading: ❌ Disabled

- Friday Closure: ❌ Disabled

Analysis:

The EA runs continuously on weekdays, capturing global market sessions. However, no Friday cutoff may expose trades to weekend gaps.

📌 Recommendation: Enable Friday closure for safer long-term trading.

🧩 Display & Interface Settings

- Chart Appearance Modified: ✅ Enabled

- Control Panel Displayed: ✅ Enabled

- Conceal Information / Buttons: ❌ Disabled

Analysis:

User-friendly configuration, ideal for manual monitoring and strategy optimization.

🧩 Final Conclusion: Is This a Good Stratos Goldwind EA Setup?

✅ Strengths

- High-quality signal filtering

- Conservative grid expansion

- Clear take-profit logic

- Low starting risk

- Suitable for Gold and major Forex pairs

❌ Weaknesses

- Loss cap not activated

- No hard stop-loss

- No Friday risk protection

⭐ Overall Verdict

This Stratos Goldwind EA configuration is well-balanced for disciplined traders who prioritize signal quality and drawdown control over aggressive profit chasing. With minor improvements (activating loss cap and Friday closure), it can become a robust long-term automated trading setup.