🧩 What is AW Double Grids EA?

AW Double Grids EA is a classic grid-based Expert advisor (EA) for MT4 that operates using simultaneous buy and sell grid cycles, combined with lot multiplication and ATR-based take profit logic. The settings shown in the image reflect a medium-to-high risk grid strategy, designed to capture market volatility rather than directional trends.

This EA is best suited for experienced traders, large balance accounts, or controlled conditions such as cent or demo accounts.

🧩 Main Settings – Lot Size & Grid Scaling

🔹 Initial Lot & Autolot

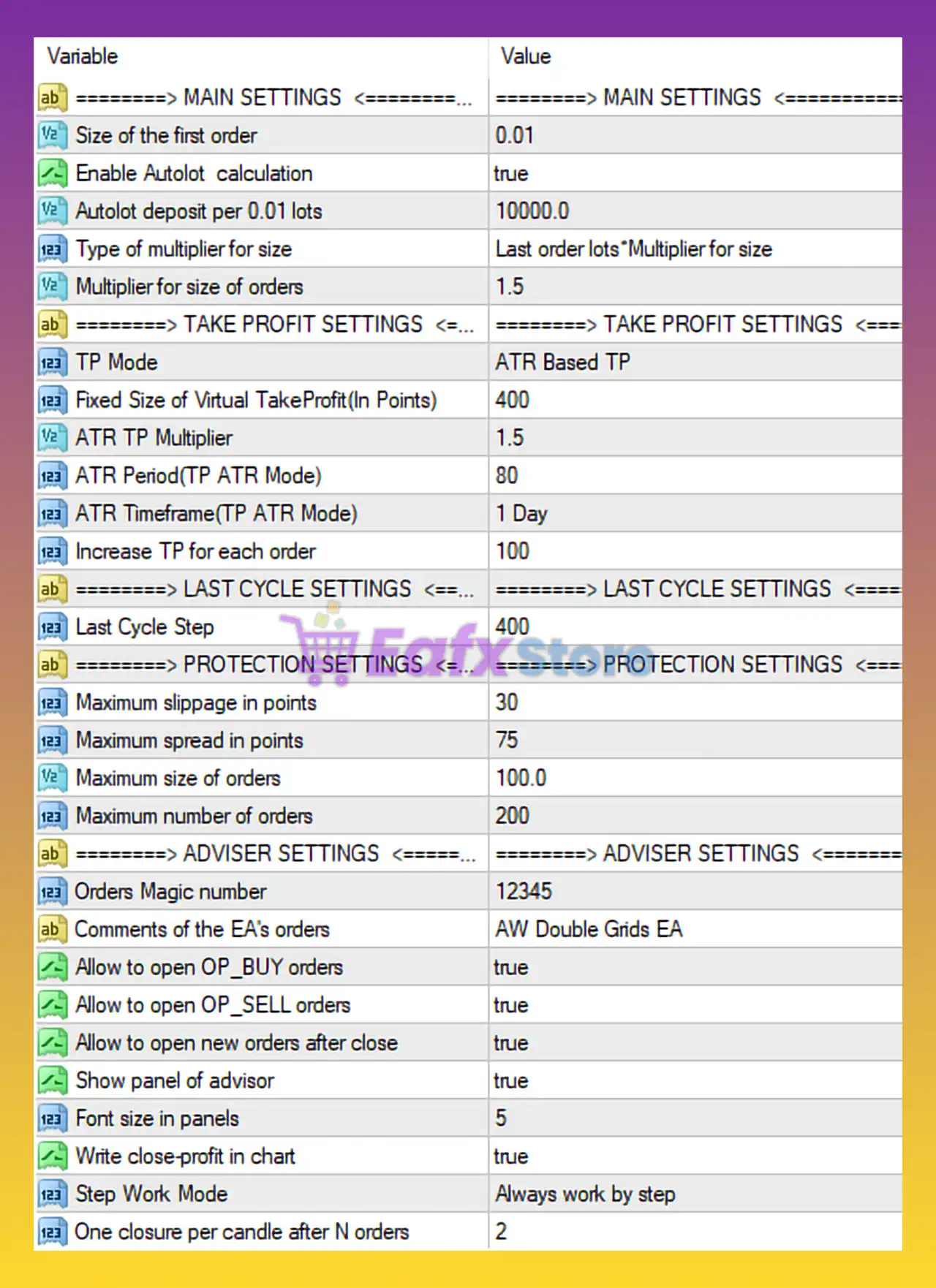

- Size of the first order:

0.01 - Enable Autolot calculation:

true - Autolot deposit per 0.01 lots:

10,000

👉 Analysis:

The EA automatically adjusts lot size based on account balance. For every $10,000, it uses 0.01 lot. This is a conservative autolot ratio, suitable for large accounts but potentially slow for small balances.

🔹 Grid Lot Multiplier

- Type of multiplier: Last order lots multiplier

- Multiplier for size of orders:

1.5

👉 Analysis:

This is a martingale-style grid. Each new grid order increases by 1.5x the previous one, which significantly accelerates exposure during drawdowns. While profitable in ranging markets, this increases account risk during strong trends.

🧩 Take Profit Settings – ATR-Based Logic

🔹 TP Mode

- TP Mode: ATR Based TP

- ATR Period:

80 - ATR Timeframe:

1 Day - ATR TP Multiplier:

1.5

👉 Analysis:

Using Daily ATR (D1) for take profit is a professional approach. It adapts TP targets to market volatility, allowing:

- Larger TP during volatile markets

- Smaller TP during quiet periods

This improves long-term stability compared to fixed pip targets.

🔹 Virtual Take Profit

- Fixed Virtual TP:

400 points - Increase TP for each order:

100 points

👉 Analysis:

As grid depth increases, TP expands. This helps compensate for higher drawdown but also means longer recovery times if price continues trending against the grid.

🧩 Last Cycle Settings – Grid Termination Logic

- Last Cycle Step:

400

👉 Analysis:

This setting defines the final grid spacing before the EA considers the cycle exhausted. A value of 400 points indicates the EA tolerates deep adverse movement, which increases risk but avoids premature forced closures.

🧩 Protection Settings – Risk & Execution Control

🔹 Spread & Slippage Protection

- Maximum slippage:

30 points - Maximum spread:

75 points

👉 Analysis:

These protections prevent trading during high-spread or unstable conditions, such as news releases or rollover periods. This is a positive risk-control feature for a grid EA.

🔹 Exposure Limits

- Maximum size of orders:

100.0 lots - Maximum number of orders:

200

👉 Analysis:

These values are extremely high and effectively do not limit risk for most retail traders. While they prevent broker rejection, they do not protect small or medium accounts from margin exhaustion.

🧩 Adviser Settings – Trade Management & Interface

🔹 Trade Permissions

- Allow BUY orders: Enabled

- Allow SELL orders: Enabled

- Allow new orders after close: Enabled

👉 Analysis:

The EA runs bi-directional grids (double grids), meaning it trades both directions simultaneously. This increases profit frequency in ranging markets but also doubles exposure.

🔹 Execution Logic

- Step Work Mode: Always work by step

- One closure per candle after N orders:

2

👉 Analysis:

This limits closures to one per candle, preventing chaotic mass closures and reducing execution slippage. This is a refined grid control mechanism.

🔹 Miscellaneous

- Magic Number:

12345 - Order Comment: AW Double Grids EA

- Panel Display: Enabled

- Write close-profit on chart: Enabled

These settings are mainly organizational and visual, with no impact on trading performance.

🧩 Strengths of This AW Double Grids EA Setup

✅ ATR-based dynamic take profit (adaptive to volatility)

✅ Conservative autolot ratio for large accounts

✅ Spread and slippage protection enabled

✅ Structured step-by-step grid execution

✅ Suitable for ranging and sideways markets

🧩 Weaknesses & Risks

⚠️ Martingale multiplier (1.5x) increases drawdown risk

⚠️ Very high maximum orders and lot limits

⚠️ No hard stop-loss or equity protection

⚠️ Vulnerable during strong trends or news events

🧩 Final Verdict: Is This a Good AW Double Grids EA Configuration?

This AW Double Grids EA configuration represents a classic high-risk grid trading strategy with modern improvements such as ATR-based take profit and execution protection. It is not a low-risk EA, but it can be profitable under the right market conditions.