🧩 What is Trade Vantage v4?

Trade Vantage v4 is a high-performance analytical tool that uses a specialized algorithm to trade both Forex and cryptocurrency markets. It operates by identifying the strength and amplitude of price movements using a unique signal system, allowing it to anticipate trend reversals and manage capital with high-precision risk controls.

📌📌📌 Buy this unlimited Trade Vantage v4 MT4 product here 📌📌📌

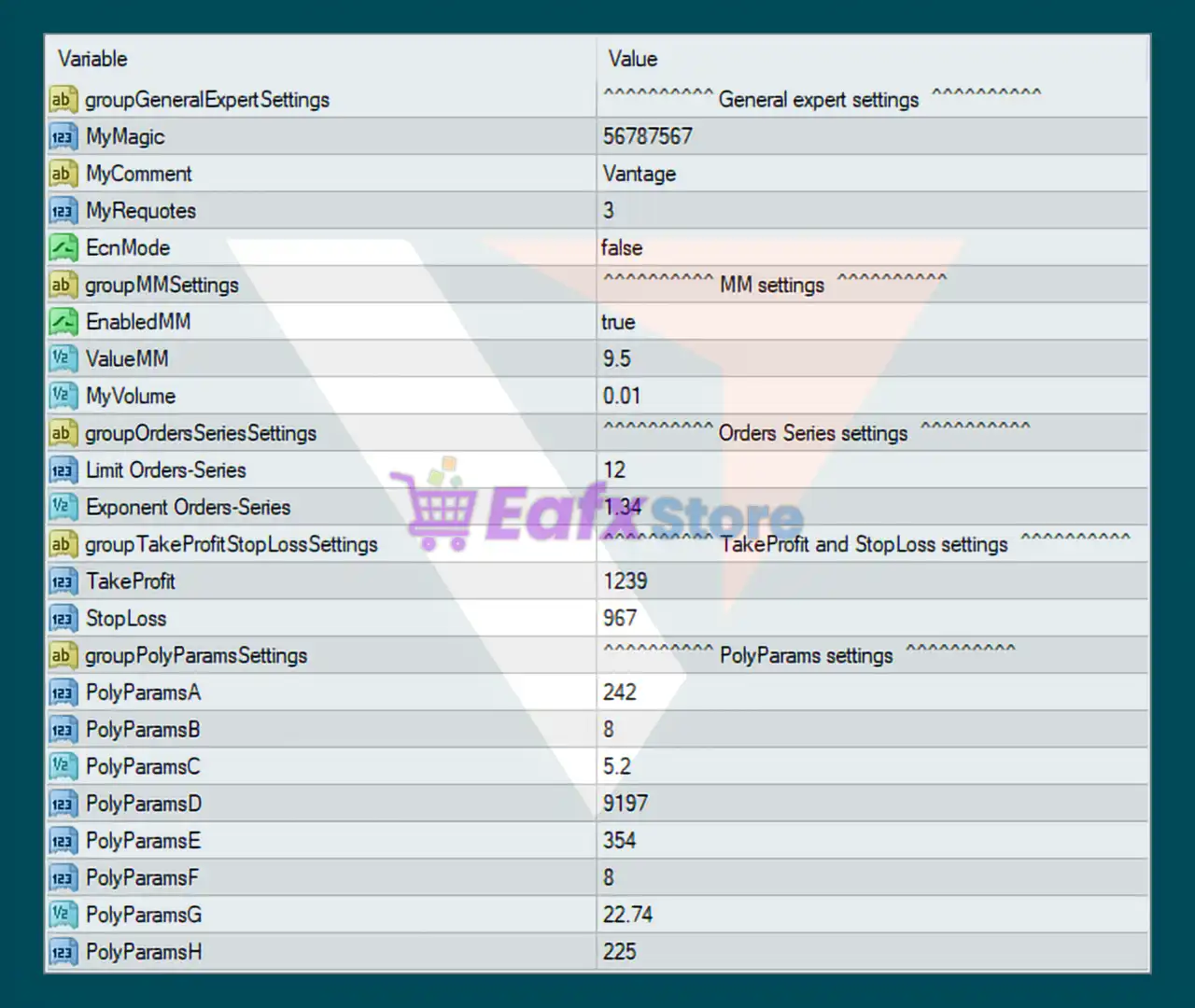

🧩 General Expert Settings

➡️ MyMagic: 56787567

- A unique Magic Number used to identify and manage orders opened by Trade Vantage v4.

- This helps prevent conflicts when running multiple Expert Advisors (EAs) on the same MT4 account.

➡️ MyComment: Vantage

- Custom trade comment for easier tracking in the terminal and trading history.

- Useful for audit, optimization, and performance review.

➡️ MyRequotes: 3

- Maximum number of requote attempts before the EA stops trying to enter a trade.

- A value of 3 balances execution reliability and slippage control.

➡️ ECN Mode: false

- Indicates the EA is configured for standard brokers, not strict ECN execution.

- Suitable for most MT4 retail brokers.

🧩 Money Management (MM) Settings

➡️ EnabledMM: true

- Automatic money management is enabled.

- Position size is dynamically adjusted based on risk parameters.

➡️ ValueMM: 9.5

- Risk coefficient used in lot size calculation.

- A value of 9.5 reflects a moderate-to-aggressive risk profile, suitable for experienced traders or higher-risk strategies.

➡️ MyVolume: 0.01

- Base lot size.

- This acts as a minimum trade volume, making the EA usable on small or test accounts.

🧩 Orders Series Settings (Grid / Scaling Logic)

➡️ Limit Orders-Series: 12

- Maximum number of trades allowed in a single order series.

- A relatively high cap, indicating a grid or recovery-based trading strategy.

➡️ Exponent Orders-Series: 1.34

- Controls lot size growth for subsequent trades in the series.

- A multiplier of 1.34 is controlled and safer than aggressive martingale values (e.g., >1.5).

🧩 Take Profit and Stop Loss Settings

➡️ TakeProfit: 1239

- Take Profit value in points.

- A large TP suggests the EA aims to capture extended price movements rather than quick scalps.

➡️ StopLoss: 967

- Stop Loss in points.

- A wide SL aligns with grid or recovery systems that need room for price fluctuation.

➡️ Risk Insight:

- The TP/SL ratio favors trend continuation and recovery logic rather than tight risk control.

🧩 PolyParams Settings (Advanced Strategy Logic)

These parameters define the core mathematical and algorithmic behavior of Trade Vantage v4.

| Parameter | Value | Analysis |

|---|---|---|

| PolyParamsA | 242 | Primary sensitivity factor |

| PolyParamsB | 8 | Signal smoothing |

| PolyParamsC | 5.2 | Volatility adjustment |

| PolyParamsD | 9197 | Historical depth / calculation range |

| PolyParamsE | 354 | Trade timing filter |

| PolyParamsF | 8 | Entry confirmation strength |

| PolyParamsG | 22.74 | Market condition scaling |

| PolyParamsH | 225 | Signal threshold |

➡️ Overall Observation:

- These values indicate a complex, data-driven trading model combining volatility analysis, trend filtering, and adaptive entries.

- The configuration favors stability over overtrading, which is essential for grid-based systems.

🧩 Overall Performance & Risk Assessment

➡️ Strengths:

- Well-balanced grid and money management structure

- Controlled exponent growth (1.34) reduces account blow-up risk

- High adaptability through advanced PolyParams

- Suitable for medium to long-term automated trading

➡️ Potential Risks:

- Wide Stop Loss and high order limit require sufficient account equity

- Not ideal for very small accounts without proper leverage

- Not optimized for high-impact news trading (ECN Mode disabled)

🧩 Final Conclusion

The Trade Vantage v4 settings shown in the image represent a moderately aggressive yet technically sophisticated automated trading configuration. With enabled money management, controlled grid expansion, and advanced PolyParams logic, this setup is best suited for traders who understand drawdown behavior and have adequate capital.

When used under stable market conditions and proper broker selection, these parameters can deliver consistent long-term performance, but they should always be tested on a demo account before live deployment.

➡️ Recommended for:

✔ Experienced MT4 traders

✔ Grid and recovery strategy users

✔ Accounts with moderate-to-high equity

➡️ Not recommended for:

✘ Beginners

✘ Small balance accounts without risk controls