🧩 What is Virtual Trendline Scalper EA?

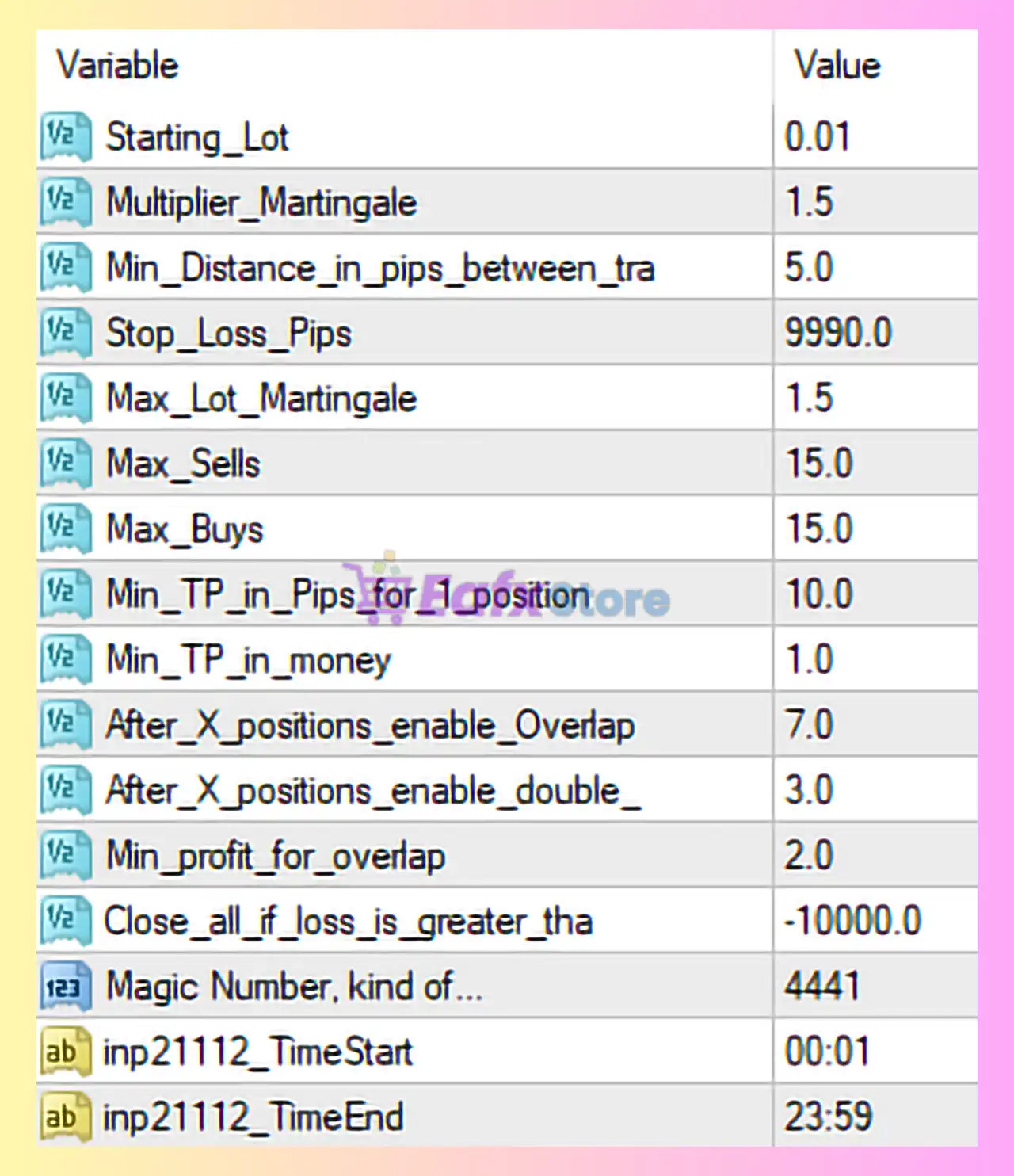

This article provides a comprehensive review of the Virtual Trendline Scalper EA for MT4, focusing on how each setting affects risk management, trade behavior, scalability, and overall account safety. The configuration shown is clearly designed for high-frequency scalping combined with a martingale/grid recovery system.

🧩 Starting Lot – 0.01

Description:

Defines the initial trade size when the first position is opened.

Analysis:

- 0.01 lot is the smallest standard lot size

- Very safe for small accounts or cent accounts

- Helps control early drawdown when the grid starts

Risk Level: ⭐☆☆☆☆ (Low)

🧩 Multiplier Martingale – 1.5

Description:

Controls how much the lot size increases for each new recovery trade.

Analysis:

- A 1.5 multiplier is considered moderate

- Slower lot escalation compared to aggressive martingale systems (2.0+)

- Reduces margin stress and risk of account wipeout

Impact:

✔ Balanced recovery speed

✔ Better long-term survivability

🧩 Min Distance in Pips Between Trades – 5.0

Description:

Minimum price distance required before opening the next grid trade.

Analysis:

- 5 pips is extremely tight

- Indicates high-frequency scalping behavior

- Suitable for low-spread symbols (e.g., EURUSD, GBPUSD)

- Dangerous on volatile pairs or during news

Risk Factor: ⚠ High trade density

🧩 Stop Loss (Pips) – 999.0

Description:

Maximum stop loss level per trade.

Analysis:

- Effectively no real stop loss

- Relies entirely on grid + martingale recovery

- Can lead to large floating drawdown

Warning:

❗ High exposure during strong trends

🧩 Max Lot Martingale – 1.5

Description:

Caps the maximum lot size used by the martingale system.

Analysis:

- Limits runaway lot growth

- Acts as a safety brake

- Still risky if market trends strongly against positions

Protection Level: ⭐⭐⭐☆☆

🧩 Max Sells / Max Buys – 15 / 15

Description:

Maximum number of sell or buy orders allowed.

Analysis:

- Allows up to 15 grid levels per direction

- Combined with small spacing = very dense grid

- High margin usage potential

Suitable for:

✔ Large balance

✖ Small leverage accounts

🧩 Min TP in Pips for 1 Position – 10.0

Description:

Minimum take profit for a single open trade.

Analysis:

- 10 pips TP aligns with scalping logic

- Quick trade closure in ranging markets

- Low reward per trade, compensated by frequency

🧩 Min TP in Money – 1.0

Description:

Minimum profit in account currency before closing trades.

Analysis:

- Ensures trades close with at least $1 profit

- Prevents premature exits due to spread or commissions

🧩 After X Positions Enable Overlap – 7.0

Description:

Allows overlapping positions after a certain number of trades.

Analysis:

- Increases recovery efficiency

- Raises trade complexity and risk

- Designed to accelerate basket closure

🧩 After X Positions Enable Double – 3.0

Description:

Activates more aggressive lot scaling after 3 positions.

Analysis:

- Early aggression in recovery

- Speeds up breakeven but raises drawdown sharply

🧩 Min Profit for Overlap – 2.0

Description:

Minimum profit required before overlapping trades can close.

Analysis:

- Ensures basket exits are meaningful

- Helps offset swap and commission costs

🧩 Close All If Loss Is Greater Than – -10000.0

Description:

Emergency equity protection level.

Analysis:

- Extremely wide loss threshold

- Functions more as a last-resort account protection

- Not effective for small or medium accounts

🧩 Magic Number – 4441

Description:

Unique identifier for EA trades.

Analysis:

- Prevents conflict with other EAs or manual trades

- Essential for multi-EA setups

🧩 Trading Time – 00:01 to 23:59

Description:

Defines when the EA is allowed to trade.

Analysis:

- Trades almost 24/7

- No session filtering

- Vulnerable during high-impact news and rollovers

🧩 Overall Conclusion – Is This Virtual Trendline Scalper EA Setup Safe?

Based on the image, this Virtual Trendline Scalper EA configuration is clearly:

✔ A high-frequency scalping EA.

✔ Strongly dependent on grid + martingale logic.

✔ Optimized for ranging, low-volatility markets.

🔶 Strengths:

- Small starting lot.

- Controlled martingale multiplier.

- Fast profit capture.

- High trade frequency.

🔶 Weaknesses:

❌ No effective stop loss.

❌ Very tight grid spacing.

❌ High drawdown risk in trending markets.

❌ Requires large balance and strict broker conditions.