🧩 What is Gold Stallion EA?

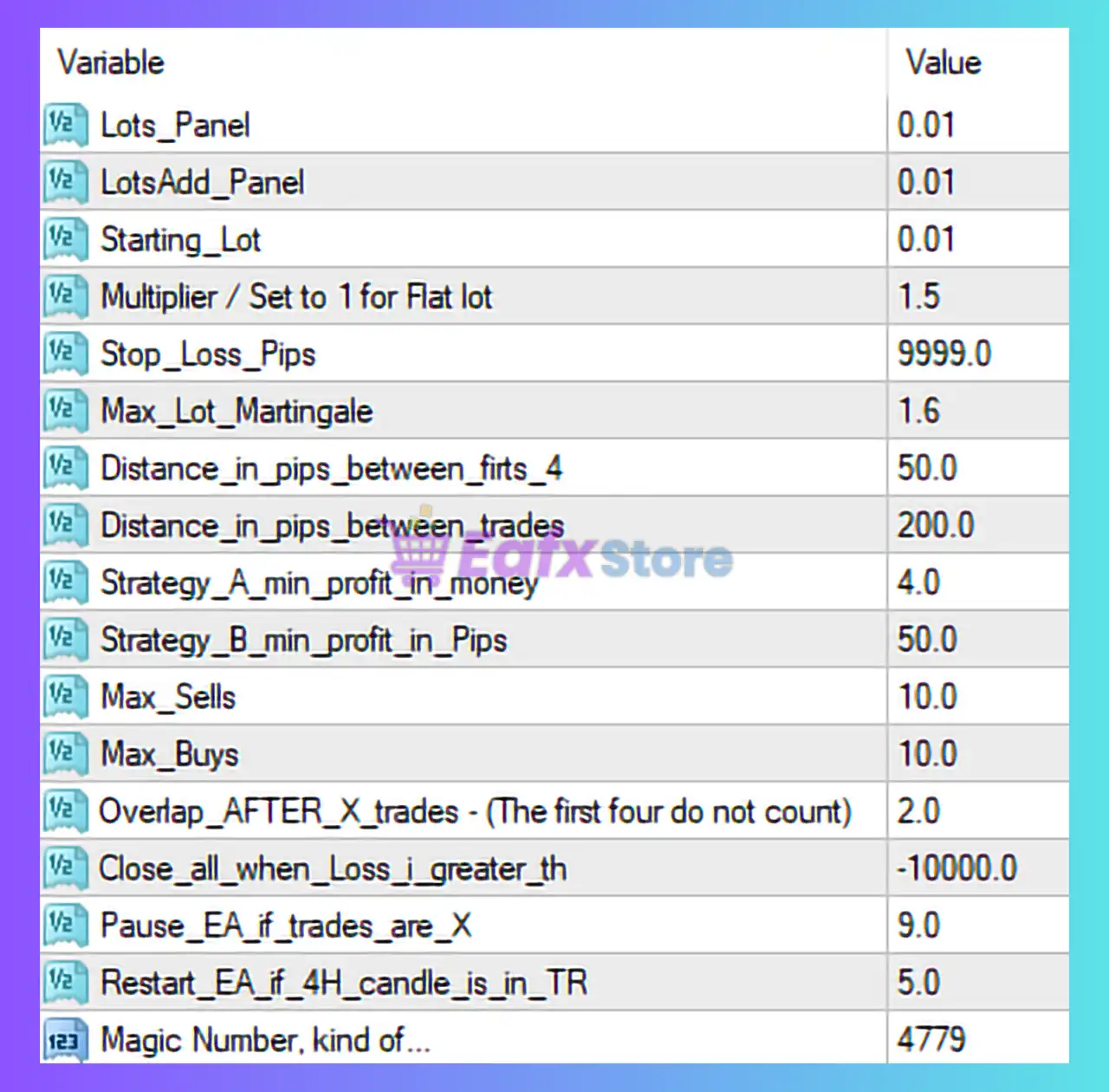

This review provides an in-depth analysis of the Gold Stallion EA for MT4, a trading robot designed mainly for Gold (XAUUSD) using a grid + martingale recovery logic combined with profit basket management. The parameters shown in the image indicate a setup focused on controlled trade frequency with aggressive recovery potential.

🧩 Lots Panel – 0.01

Description:

Lot size displayed or managed via the EA’s panel.

Analysis:

- Very small lot size

- Suitable for small or medium trading accounts

- Reduces initial exposure when trades begin

Risk Level: ⭐☆☆☆☆ (Low)

🧩 LotsAdd Panel – 0.01

Description:

Additional lot increment controlled by the panel.

Analysis:

- Keeps manual or semi-automatic adjustments minimal

- Helps maintain consistency in risk allocation

🧩 Starting Lot – 0.01

Description:

Initial trade volume when the EA opens the first position.

Analysis:

- Conservative starting size

- Ideal for volatile instruments like Gold

- Allows the grid system to build gradually

🧩 Multiplier / Set to 1 for Flat Lot – 1.5

Description:

Martingale multiplier for increasing lot sizes in recovery trades.

Analysis:

- 1.5 is a moderate martingale factor

- Balances recovery speed and margin safety

- Less aggressive than classic martingale (2.0+)

Suitability:

✔ Medium-risk traders

✖ Not ideal for very small leverage accounts

🧩 Stop Loss (Pips) – 9999.0

Description:

Maximum stop loss per trade.

Analysis:

- Effectively no real stop loss

- EA relies on grid, averaging, and basket closure

- High floating drawdown possible during strong trends

⚠ Critical Risk Note:

No hard stop loss means account safety depends entirely on equity and margin.

🧩 Max Lot Martingale – 1.6

Description:

Maximum lot size allowed by the martingale system.

Analysis:

- Prevents unlimited lot escalation

- Adds a basic risk cap

- Still risky under prolonged adverse trends

🧩 Distance in Pips Between First 4 Trades – 50.0

Description:

Spacing between the first four grid trades.

Analysis:

- Wide spacing reduces early trade clustering

- Suitable for Gold’s volatility

- Helps control drawdown in the initial phase

🧩 Distance in Pips Between Trades – 200.0

Description:

Grid distance after the first four positions.

Analysis:

- Very wide grid

- Indicates low trade frequency

- Strongly reduces margin pressure

Advantage:

✔ Better survivability in trending markets

🧩 Strategy A – Minimum Profit in Money – 4.0

Description:

Minimum basket profit (in account currency) to close Strategy A trades.

Analysis:

- Ensures trades close only with meaningful profit

- Helps cover spread, commission, and swap costs

🧩 Strategy B – Minimum Profit in Pips – 50.0

Description:

Minimum profit target in pips for Strategy B.

Analysis:

- Large TP target

- Designed for swing or extended moves

- Fewer but higher-quality trade closures

🧩 Max Sells – 10.0

Description:

Maximum number of sell orders allowed.

Analysis:

- Caps downside exposure

- Limits grid expansion in bearish conditions

🧩 Max Buys – 10.0

Description:

Maximum number of buy orders allowed.

Analysis:

- Same protection logic as Max Sells

- Helps preserve margin during bullish trends

🧩 Overlap After X Trades (First 4 Do Not Count) – 2.0

Description:

Allows overlapping strategies after 2 additional trades.

Analysis:

- Enables faster basket recovery

- Increases complexity and risk

- Used to accelerate breakeven

🧩 Close All When Loss Is Greater Than – -10000.0

Description:

Emergency equity stop for closing all trades.

Analysis:

- Extremely wide threshold

- Acts only as a last-resort protection

- Ineffective for small or medium accounts

🧩 Pause EA If Trades Are More Than X – 9.0

Description:

Temporarily pauses the EA when trade count exceeds a limit.

Analysis:

- Useful safety mechanism

- Prevents runaway grid expansion

- Improves long-term account survival

🧩 Restart EA If H4 Candle Is in Trend Range – 5.0

Description:

Market condition filter based on H4 candles.

Analysis:

- Attempts to re-engage EA during stable market conditions

- Helps avoid chaotic market phases

🧩 Magic Number – 4779

Description:

Unique identifier for EA trades.

Analysis:

- Prevents conflicts with other EAs or manual trades

- Essential for multi-EA environments

🧩Overall Conclusion – Is This Gold Stallion EA Setup Reliable?

Based on the image, this Gold Stallion EA MT4 configuration shows a design focused on:

✅ Conservative starting exposure.

✅ Wide grid spacing.

✅ Controlled martingale escalation.

✅ Basket-based profit taking.

✅ Limited trade count.

🔶 Strengths:

- Suitable for Gold’s volatility.

- Low trade frequency.

- Strong margin control after initial trades.

- Designed for medium to large accounts.

🔶 Weaknesses:

❌ No real stop loss.

❌ High reliance on grid recovery.

❌ Large floating drawdown possible.

❌ Requires patience and sufficient equity.

Final Verdict

This Gold Stallion EA setup is best suited for experienced traders with medium-to-large accounts who can tolerate drawdowns and understand grid/martingale risks.

It prioritizes account survival and controlled exposure over fast profit generation, making it more suitable for long-term Gold trading rather than aggressive scalping.