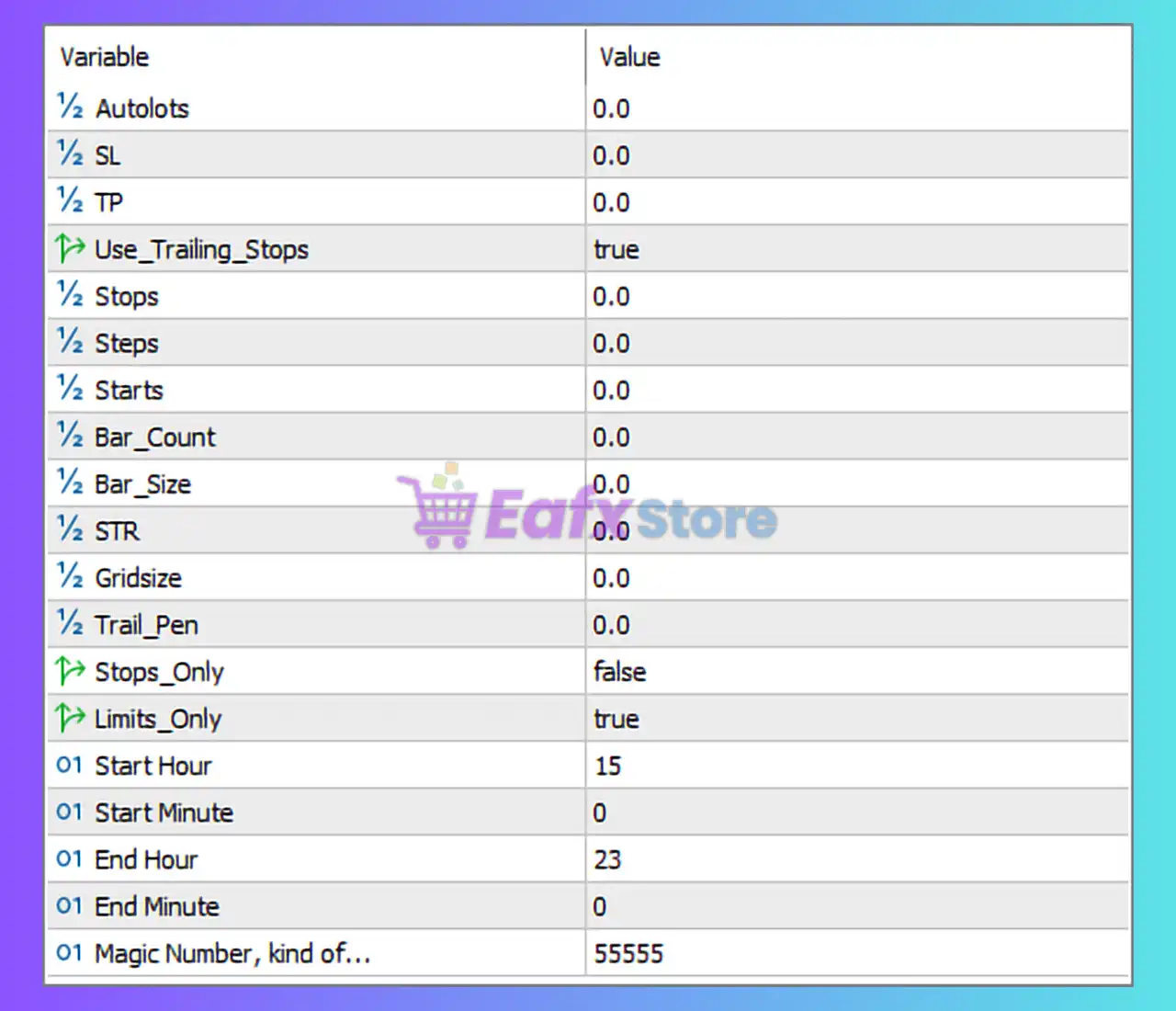

This configuration table represents the core trading logic and risk control system of the Smart HFT EA for MetaTrader 5 (MT5).

Overall, the settings suggest a High-Frequency Trading (HFT) with time-based execution, trailing stop management and strict order filtering.

📌📌📌 Buy this unlimited Smart HFT EA MT5 product here 📌📌📌

📊 SMART HFT EA Parameters Explained

| Parameter | Value | Description & Trading Impact |

|---|---|---|

| Autolots | 0.0 | Automatic lot sizing is disabled. Lot size must be managed manually or by external logic. |

| SL (Stop Loss) | 0.0 | No fixed stop loss is set. Risk is likely controlled via trailing stops or limits logic. |

| TP (Take Profit) | 0.0 | No fixed take profit. The EA may rely on trailing stops or exit conditions. |

| Use_Trailing_Stops | true | Trailing stop system is enabled to dynamically lock in profits. |

| Stops | 0.0 | No predefined stop distance. Trailing or algorithmic exits dominate. |

| Steps | 0.0 | Step-based trailing is inactive. Continuous trailing logic may be used. |

| Starts | 0.0 | No delayed trailing activation. Trailing may start immediately. |

| Bar_Count | 0.0 | Bar-based logic is disabled or unused in this setup. |

| Bar_Size | 0.0 | Candle size filter is inactive. |

| STR | 0.0 | Strength or strategy threshold not applied. |

| Gridsize | 0.0 | Grid trading is disabled (important for risk control). |

| Trail_Pen | 0.0 | No trailing penalty or buffer defined. |

| Stops_Only | false | EA is allowed to open trades, not just manage stops. |

| Limits_Only | true | EA places only pending limit orders, avoiding market orders (HFT-friendly). |

| Start Hour | 15 | Trading starts at 15:00 server time. |

| Start Minute | 0 | Exact start at the top of the hour. |

| End Hour | 23 | Trading ends at 23:00 server time. |

| End Minute | 0 | Stops trading exactly at 23:00. |

| Magic Number | 55555 | Unique identifier for EA trades to avoid conflicts with other EAs. |

🔍 Strategic Interpretation

✅ Strengths:

- High-Frequency Optimized

Using limit orders only reduces slippage and spread costs—ideal for HFT strategies. - Time-Filtered Trading

Trades only during 15:00–23:00, likely targeting London–New York overlap for high liquidity. - Dynamic Exit Management

Trailing stops replace static SL/TP, allowing profits to run in volatile conditions. - No Grid, No Martingale

Zero grid size = safer risk profile.

⚠️ Potential Risks:

- No Fixed Stop Loss

Without SL, risk management depends entirely on trailing logic and broker execution. - Manual Lot Control

Autolot disabled means incorrect lot sizing can increase drawdown risk. - Highly Broker-Dependent

HFT EAs require low latency, tight spreads, and fast execution.

🧠 Conclusion

The SMART HFT EA configuration shown is designed for professional high-frequency trading, prioritizing limit orders, trailing stop exits, and strict trading hours. This setup avoids dangerous grid or martingale strategies and instead relies on precision execution and market liquidity.

However, it is best suited for experienced traders who:

- Understand HFT risk dynamics

- Use ECN/RAW spread brokers

- Actively monitor drawdown and execution quality

👉 Recommendation:

Use this setup on low-spread symbols (e.g., EURUSD, XAUUSD) and test thoroughly on a demo or cent account before live deployment.