🧩 What is Dynamic Breakout MT5?

Dynamic Breakout MT5 is an automated trading Expert Advisor (EA) designed to trade price breakouts within predefined ranges, using dynamic lot sizing, trailing stop management, and recovery logic. From the settings shown, this EA targets volatile breakout moves while maintaining structured risk control through percentage-based money management and configurable execution rules.

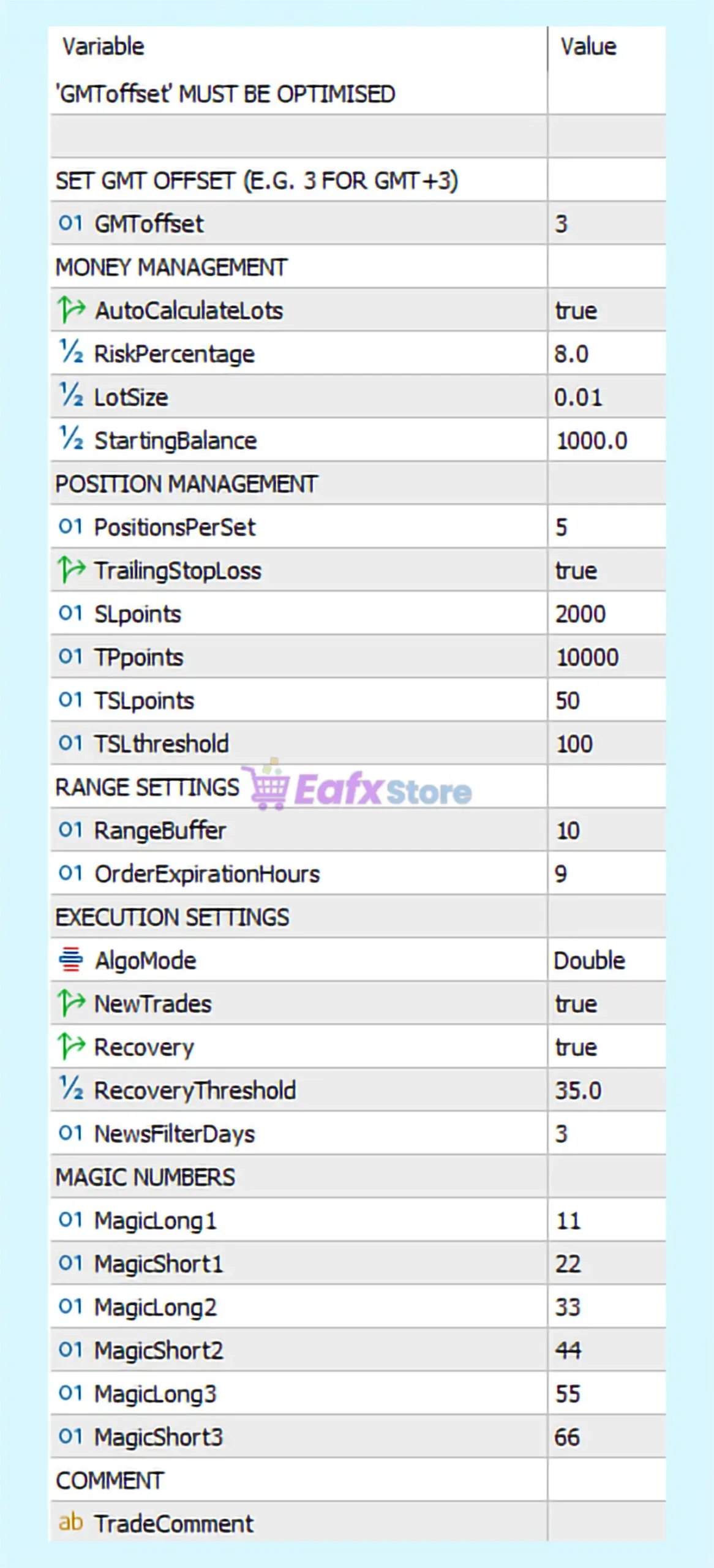

⏰ GMT Offset & Time Synchronization

| Parameter | Value | Explanation |

|---|---|---|

| GMT Offset | 3 | Adjusts EA logic to broker server time |

➡️ Important Note: Correct GMT offset is critical. An incorrect value may cause trades to trigger at the wrong market sessions.

💰 Money Management Settings

| Parameter | Value | Description |

|---|---|---|

| Auto Calculate Lots | true | Enables dynamic lot sizing |

| Risk Percentage | 8.0 | % of balance risked per cycle |

| Base Lot Size | 0.01 | Minimum starting lot |

| Starting Balance | 1000.0 | Reference balance for lot scaling |

➡️ Risk Profile: An 8% risk setting is considered aggressive and best suited for experienced traders or funded-style accounts with strict monitoring.

📊 Position Management

| Parameter | Value | Purpose |

|---|---|---|

| Positions Per Set | 5 | Maximum trades per breakout |

| Trailing Stop Loss | true | Locks in profit dynamically |

| Stop Loss Points | 2000 | Initial SL distance |

| Take Profit Points | 10000 | Large breakout target |

| Trailing SL Points | 50 | Trailing distance |

| Trailing SL Threshold | 100 | Profit required before trailing |

➡️ Trading Style Insight: Wide TP and SL indicate the EA is designed to capture large breakout moves, not small scalps.

📐 Range & Order Settings

| Parameter | Value | Explanation |

|---|---|---|

| Range Buffer | 10 | Breakout buffer in points |

| Order Expiration (Hours) | 9 | Pending order lifetime |

➡️ This prevents stale pending orders from executing in unsuitable conditions.

⚙️ Execution & Recovery Logic

| Parameter | Value | Description |

|---|---|---|

| Algo Mode | Double | Trades both directions |

| Allow New Trades | true | Continuous operation |

| Recovery Mode | true | Drawdown recovery enabled |

| Recovery Threshold | 35.0 | Activates recovery at DD |

| News Filter Days | 3 | Blocks trading around news |

➡️ Risk Consideration: Recovery logic increases exposure after losses. This can improve win rate but also increases risk if market trends persist.

🆔 Magic Number Configuration

| Trade Type | Magic Number |

|---|---|

| Long Trade 1 | 11 |

| Short Trade 1 | 22 |

| Long Trade 2 | 33 |

| Short Trade 2 | 44 |

| Long Trade 3 | 55 |

| Short Trade 3 | 66 |

➡️ These unique IDs allow precise tracking of each breakout leg.

🧠 Strategy Characteristics Summary

Dynamic Breakout MT5 operates with:

- Range-based breakout detection.

- Dynamic risk-based lot sizing.

- Multi-position breakout execution.

- Trailing stop for trend capture.

- Recovery system for drawdowns.

- News-aware trading logic.

➡️ This positions the EA as a trend-following breakout system, not a scalper or grid EA.

⚖️ Strengths & Limitations

🔶 Strengths

- Effective breakout logic for volatile markets.

- Large TP captures strong trends.

- Trailing stop protects gains.

- Automated lot scaling.

- Supports both long and short breakouts.

🔶 Limitations

- Aggressive risk setting (8%).

- Recovery system can amplify losses.

- Requires correct GMT configuration.

- Not suitable for low-balance accounts.

✅ Conclusion

Dynamic Breakout MT5 is a powerful, aggressive breakout trading EA designed for traders who want to capitalize on strong market movements rather than frequent small trades.

🔶 Best suited for:

- Experienced traders.

- Medium to large accounts.

- Volatile instruments and sessions.

- Users comfortable with recovery-based logic.

Final Verdict:

Dynamic Breakout MT5 delivers high potential during strong trends, but its aggressive risk and recovery system require disciplined account management and proper configuration.

For safer operation, consider reducing the risk percentage and testing extensively on a demo or small live account before full deployment.