MarketFollower EA MT4 (Latest version) - Unlimited

Subscriptions for Special Plan

- 30 EA package is more economical!

- Special package with 99%

- Download 1 EA/Day

Subscriptions for Premium Membership

- Download Unlimited in 1 Year

- Get 100% Discount

- Get free access to all

Subscriptions for Gold Membership

- 1 Year Membership

- Get 100% Discount

- Access EA+Indicator+Course

Frequently bought together 🎁

Add these products to enhance your purchase

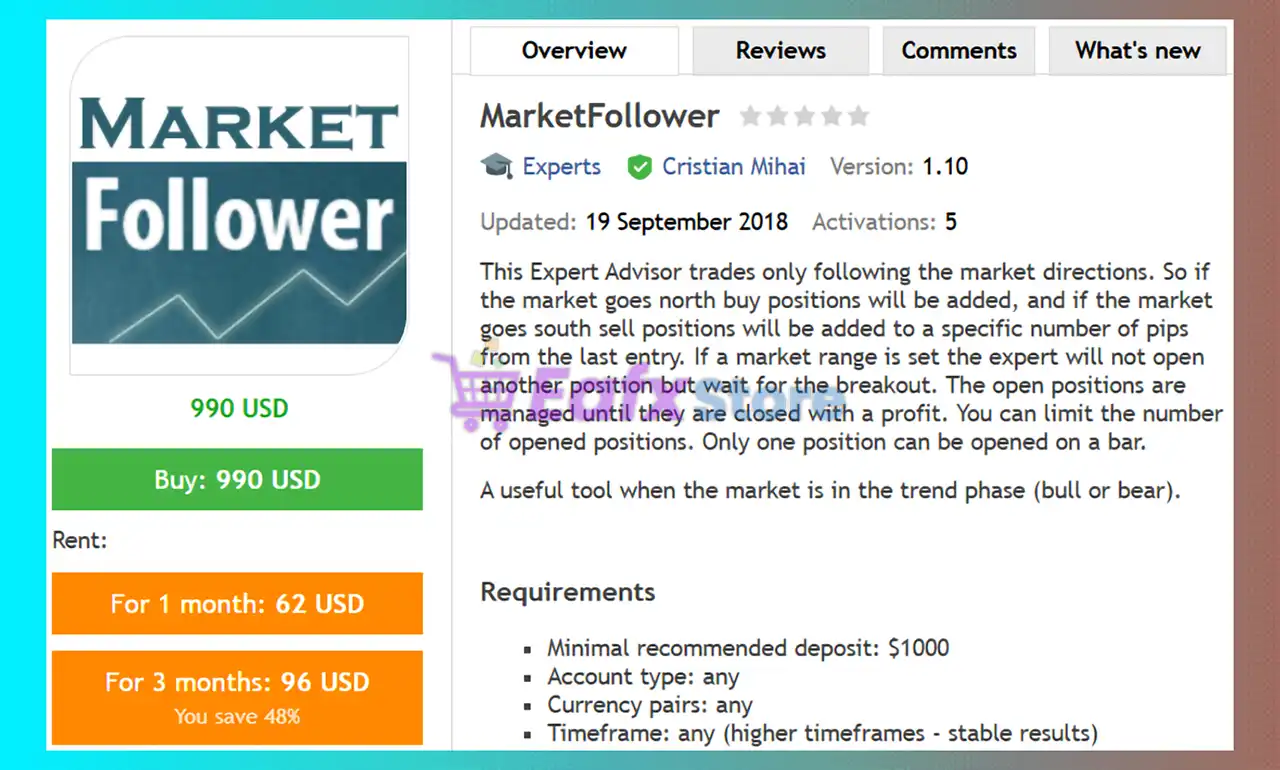

What is MarketFollower EA?

MarketFollower EA is a trend-based Expert Advisor (EA) built for automated trading across multiple instruments and timeframes. It adds positions only in the direction of the prevailing market movement, using structured distance logic and controlled scaling. Designed for stability and adaptability, it integrates profit targets, drawdown protection, and exposure limits to maintain disciplined risk management during trending conditions.

About the Author

This product is compiled by Cristian Mihai. This author has more than +8 years of experience working on MQL5 with many famous products such as MarketFollower EA MT4, MarketFollower EA MT5 and other advisors. Among them, MarketFollower EA is his best performing product.

Delivery time 24h-48h after payment.

Refund if not delivered.

You will receive the current version without any limitations (ID+Time).

MarketFollower EA MT4 Review

Key Features of MarketFollower EA for MT4

🔹 Trend-Following Execution: Adds Buy or Sell positions strictly in market direction.

🔹 Step-Based Position Scaling: Opens new trades at defined pip distances from last entry.

🔹 Global Take Profit (TP) Control: Closes all open positions when profit target is reached.

🔹 Drawdown Stop Protection: StopOut closes all trades if equity drop exceeds threshold.

🔹 Maximum Order Limitation: Caps total open trades to control exposure risk.

🔹 Single Trade Per Candle Rule: Prevents overtrading by limiting one position per bar.

What is the MarketFollower EA Trading Strategy?

🔹 Directional Market Logic: Follows bullish or bearish trends without countertrend entries.

🔹 Breakout Waiting Mechanism: Pauses new trades during range until breakout occurs.

🔹 Step Distance Framework: Uses predefined pip intervals for structured scaling.

🔹 Portfolio Profit Closure: Uses cumulative Take Profit (TP) to exit all trades.

🔹 Equity Risk Safeguard: Applies StopOut as a protective Stop Loss (SL) mechanism.

MarketFollower EA MT4 Review

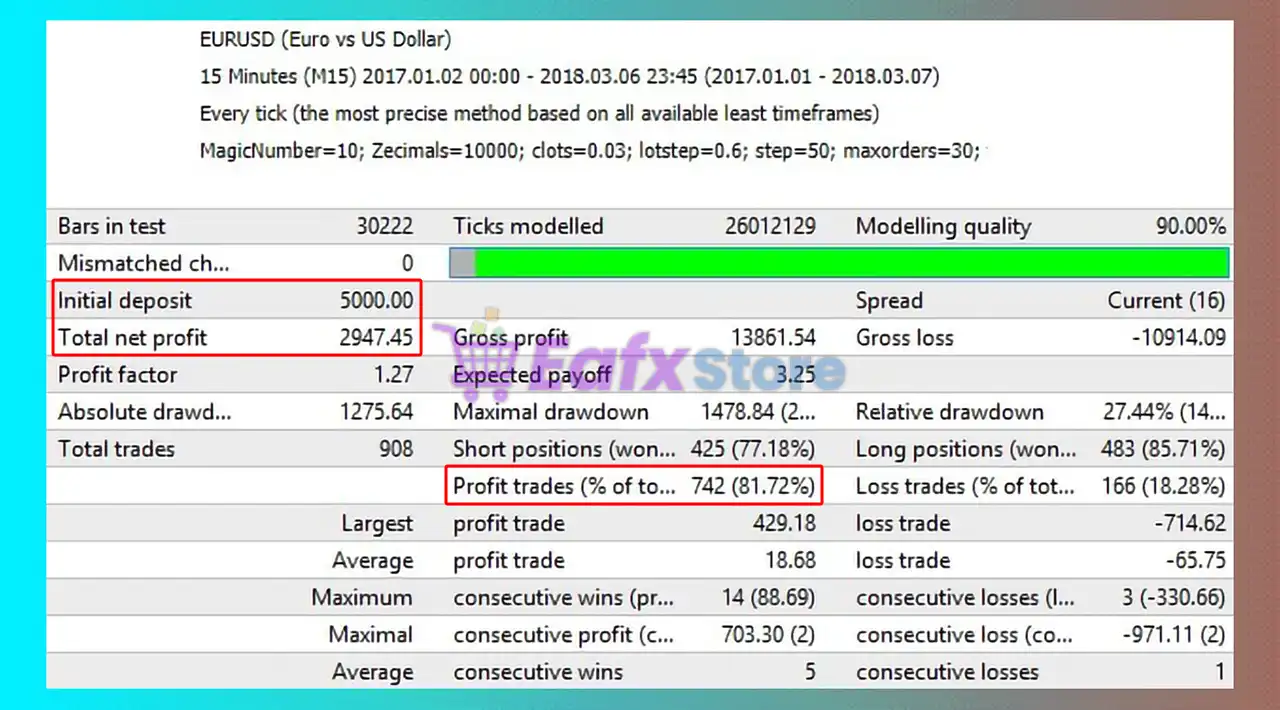

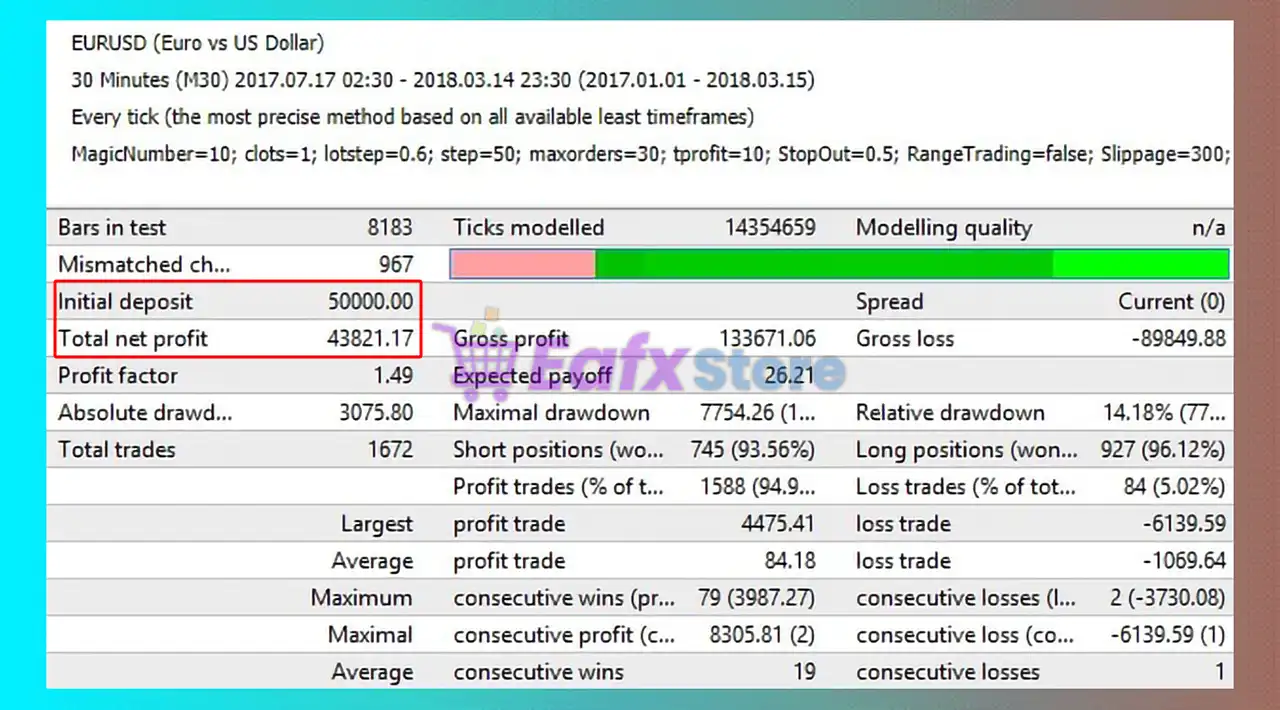

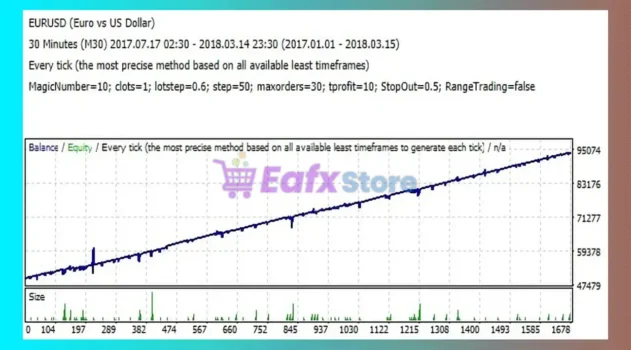

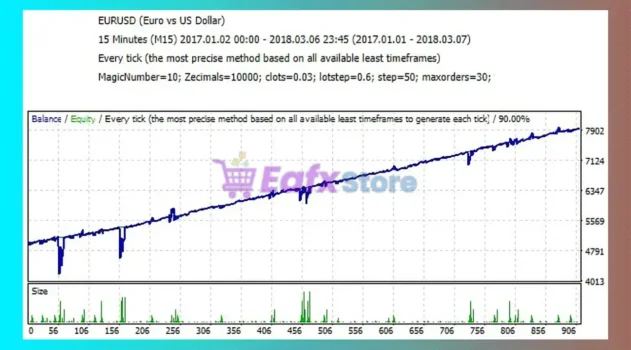

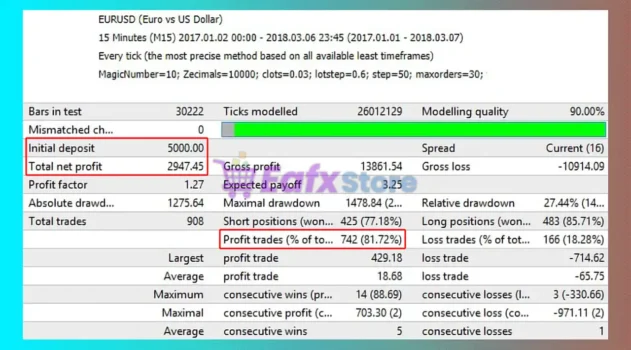

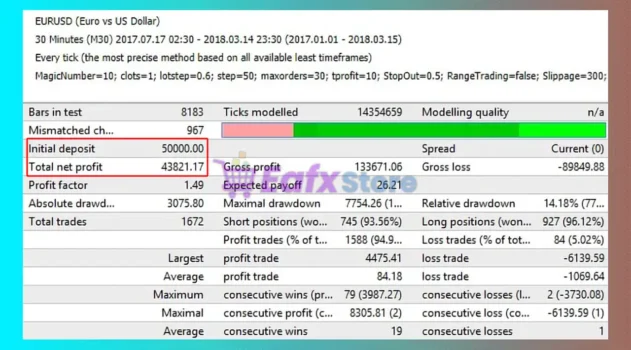

The MarketFollower EA has achieved impressive profit performance over many years of trading reversion tests with EURUSD. This EA demonstrates excellent ability to master the market and increase profits.

✅ Initial Deposit: $5,000

✅ Total Net Profit: $2,947.45

✅ Win Rate (% of total): 81.72%

✅ Maximum Drawdown: 27.44%

MarketFollower EA MT4 Backtest

MarketFollower EA Backtest

Why Choose & Use MarketFollower EA?

🔹 Stability in Trending Markets: Designed to perform during sustained bull or bear phases.

🔹 High Adaptability: Custom settings allow optimization per instrument and timeframe.

🔹 Controlled Scaling Logic: Step and lotstep parameters manage gradual exposure growth.

🔹 Discipline-Focused Automation: Eliminates emotional countertrend trading decisions.

🔹 Marketplace-Ready Solution: Ideal for traders seeking structured trend automation.

Recommended settings

Recommended settings and parameters to pay attention to from developers and experts:

| Features | Type |

|---|---|

| Trading platform | MetaTrader 4 (MT4) |

| Time frames | Any |

| Currency pairs | Any |

| Minimum / Recommended deposit | $1,000 |

| Minimum / Recommended leverage | Any |

| Account types | Any |

| Product type | NoDLL / Unlimited / Unlocked |

| Additional services | Unlock and Decompile |

| Recommended brokers | Exness Broker, Icmarkets Broker |

| Recommended VPS | MyfxVPS.com (Blue VPS, Golden VPS). Lowest Latency, 2 week Free Trial, 100% Free for 12-18 Months. |

Product Download Package?

The download package of the product suite includes:

Conclusion

In short, MarketFollower EA stands out as a reliable automated trend trading EA for MT4, combining directional logic with controlled position scaling. Its maximum order limits, cumulative profit targets, and StopOut safeguards enhance capital protection. Ideal for traders seeking stable performance during strong bull or bear phases, it provides rule-based and emotion-free execution.

User Reviews

Only logged in customers who have purchased this product may leave a review.

❓ What trading strategy does MarketFollower EA use?

MarketFollower EA applies a strict trend-following strategy, adding positions only in the direction of the prevailing market movement.

❓ How does MarketFollower EA add new trades?

MarketFollower EA opens additional positions at predefined pip distances using a structured step-based scaling system.

❓ Does MarketFollower EA trade against the trend?

MarketFollower EA avoids countertrend entries and focuses exclusively on bullish or bearish continuation setups.

❓ How does MarketFollower EA manage overall profit?

MarketFollower EA uses a global Take Profit target that closes all open trades once cumulative profit is reached.

❓ What risk protection features does MarketFollower EA include?

MarketFollower EA integrates a StopOut equity protection system to close trades if drawdown exceeds a defined threshold.

❓ Can MarketFollower EA limit the number of open trades?

MarketFollower EA includes a maximum order cap to control exposure and prevent excessive position stacking.

❓ Does MarketFollower EA prevent overtrading?

MarketFollower EA follows a single trade per candle rule to reduce unnecessary entries during volatile phases.

❓ Is MarketFollower EA suitable for all currency pairs?

MarketFollower EA is adaptable to multiple instruments and timeframes with customizable parameters.

❓ What market conditions suit MarketFollower EA best?

MarketFollower EA performs best during sustained trending markets where directional momentum remains consistent.

❓ What is the recommended deposit for MarketFollower EA?

MarketFollower EA recommends a minimum deposit of $1,000 to support structured scaling and risk control.

There are no reviews yet.