What is Stop Loss? You may have heard this term as soon as you entered Forex and at first glance, you may not like this term because it involves losing your money, but you will discover that most traders cannot do without such a useful tool in their trading.

The Importance of Stop Loss in the Forex Market

1 – What is Stop loss?

Stop loss is like any other order in the Forex market. It is an order that you set to automatically close the trade at the price you want. It is used by traders so that they do not lose more money in the event that the price reverses against them more and more.

Stop loss is like a brake on your loss. For example, if you wanted to buy the EUR/USD, but the pair fell to a very low level, you can place the stop-loss at the last level from which the pair might rebound so that you do not lose more money if it falls further, It is one of the most important tools in Forex. Not using such a tool will make you vulnerable to losing your entire account in one moment.

How to set Stop loss

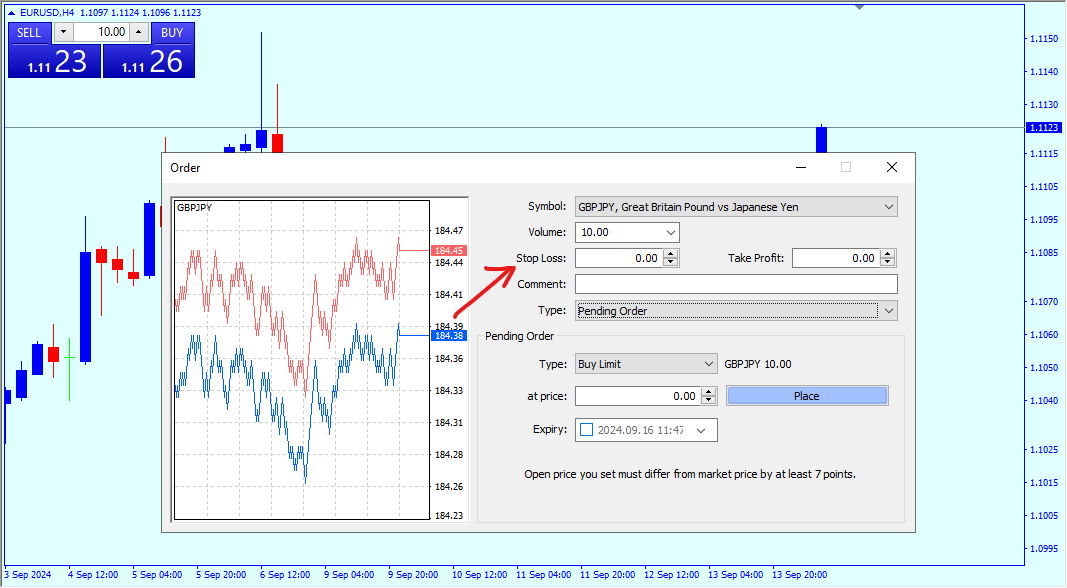

There are two ways to determine the stop loss. The first way is by writing the stop loss when opening the trade by pressing New Order or F9. After you write the lot you want, you write the price at which you want the trade to be closed at a loss.

If you intend to open a buy trade, the stop-loss will be lower than the current price because if the price falls, you will lose, and vice versa if you want to open a sell order, the stop-loss will be higher than the current price.

You can also write the stop loss if you want to open a pending order. It is not necessary to write it at the time of entering the trade. After you specify the type of order, whether it is a limit order or a stop order, write the price at which you want to execute the trade, and then specify the stop loss.

The second method is if you open the trade without specifying a stop loss, there is no problem. You can add it by double-clicking on the order or right-clicking and then choosing modify or delete, then specifying the stop-loss.

You can also simply set a stop loss by dragging the order line on the chart and this will make it much faster, Please be careful when moving the trade line up or down because if you open a buy order and move the line up, you will be setting the take profit in this way and not the stop loss, so you must know the type of order first before moving the line.

Stop loss at Break-Even

You can also place a stop loss at the entry area, which is something most traders use in case they make some profits in the trade. For example, if you buy the EUR/USD from the 1.1000 level and the pair rises to 1.1050, you can secure your trade so that you do not lose some of your capital by placing a stop loss at the entry-level. If the stop loss is hit, you will only lose the profit you made and the trade will be closed without profit or loss.

This strategy is used by traders to manage their trade in the event that the price may reverse against them and make them lose, so they place a stop loss at the Break Even, i.e. the entry area. The stop loss can be determined at the entry area by writing it or dragging the order line on the chart.

You can also book some profits by adding a stop-loss after the order line on the chart. For example, if the current price of the EUR/USD is 1.1100 and you bought it at the level of 1.1000, you can place a stop loss at 1.1050. This way, you will exit the market with a profit of 50 pips. You can use this feature if your analysis supports a decline in the event of breaking this level.

2 – Why is Stop loss Important?

Stop loss is an integral part of any strategy. It works as a tool to help stop further losses that may occur in the account. Of course, none of us wants to lose his money. Placing a stop-loss order is not easy to do because if the price reaches this level, you will lose the money that you worked hard to obtain. But is the loss that you determine better or the loss of the entire account?

The loss in the short term is better than the long term because if the price reverses against you, you will inevitably lose, but based on the analysis that you have done, you will expect that the price will bounce back from certain areas, and if it does not bounce back, it will cost you more and more money.

So setting a stop loss is like a brake on this loss and you will only lose the amount you have set, not the amount the market wants from you, so deal with the stop loss on this basis: Do you want to lose the amount you can afford or will you leave it to the market to determine that?

Another benefit of the stop loss is that it is not necessary to remain in front of the chart to close the trade at the level you want. Once you have determined the stop-loss, you can leave the platform completely and close the chart, and the trade will be closed automatically when it reaches this level.

Stop Loss also helps you control your emotions during your Forex journey because if you do not place a stop loss, you will make illogical decisions such as closing the trade when you feel you will lose your account or opening more trades…etc. The best solution is to place a stop-loss and close the platform so that your emotions do not control you during trading.

Mistakes to Avoid When Setting Stop Loss

There are some mistakes that you should avoid when setting the stop loss. For example, placing the stop loss very close to the entry level will make the trade close quickly when the price makes some simple movements. You should place the stop-loss in places somewhat far from the entry area.

I do not mean too far away. The stop loss must be in a suitable place, neither too far nor too close, and it must be based on the expected rebound area.

Stop loss at random levels (Based on the amount of loss, not the important levels)

When opening a trade and determining the stop loss and take profit, you must completely ignore the amount of loss that you will take. For example, if your account is $1,000 and you decide to place the stop-loss 50 pips away from the entry area, You must be sure that the stop-loss is in the right place and do not try to move it from its place just because you do not want to lose this amount of money.

The same thing If you decide to enter the trade directly and ignore the amount of risk you want to take, you will close the trade with the least losses that occur in the account without taking into account the analysis you have done, as the trader’s psychology has a major role in the stop loss.

To avoid placing the stop loss in random places, calculate the amount you intend to risk, for example, $50 per trade. Then determine the number of pips that the price may move against you, and then you will get the appropriate lot.

Not putting Stop loss at all

Some traders dispense with the stop loss, and in fact I cannot say that this is 100% wrong. It is possible to dispense with the stop-loss, as there are strategies that depend on not having a stop-loss because it is possible to close the trade manually. For example, if you are trading using the MACD, the divergence will be your entry signal, and the Exit signals may also be divergence. In this case, there is no need for a stop loss (But the risk ratio must be chosen carefully in case of any reversal movement).

There are also some strategies that depend on risking 100% of the capital. It is possible to deposit a small amount in the account and leave the rest of the capital in a side account. After that, trading is done on this account with high risk without the need to place a stop loss. In the event of a loss, the trader will lose the entire account (and the rest of the capital will remain in the other account).

Such strategies are used by traders to protect their capital from price slippages, as price slippages occur during news and midnight, and when this happens, the trader may lose more than the amount he specified in the stop loss.

Price slippages can occur in the market and it is the execution of the order at a price different from the specified price. This execution can apply to the stop-loss or opening or closing of the trade.

If you are not an experienced trader, the decision not to place a stop loss will most likely not be in your favor because placing a stop loss is very important, especially for beginner traders, it protects their money from further losses if their analysis is wrong.

3 – Using Stop loss with Risk management

Stop loss is a very important factor in Risk management. When you make a trading plan that suits you, you must calculate the risk that you will take in a single Trade. Even if you decide not to set a stop loss, you must determine the amount of your loss in each trade so that you can remain in the market for the longest possible period.

There are several methods that you can follow to determine the appropriate Risk management for you, but before that, you must first determine whether you are a scalper, intraday trader, or an investor, because each of these types has its method for determining the percentage of risk that it intends to risk in the trade.

For example, a scalping trader opens many trades during the day, so he may risk 1% per trade and place a stop loss based on that percentage. As for the daily trader, this percentage may increase slightly to 3% because his trades are fewer, and the investor is the same. He may risk 10% of his capital because he enters long-term trades.

Slippage vs Stop loss

If a price slippage occurs, the stop loss will be completely ignored and the trade will be closed at a price different from the one you specified. Therefore, price slippage is the number one enemy of traders because any order they take will not be executed at the same price they want.

The best decision during price slippages is to close the trade manually because the price will not respect the stop loss or not to set a stop-loss at all because the price may rebound again and reach the take profit, But the trade must be able to withstand the potential reversal at the time of the news.

It is also possible not to take risks at these times and close the trade half an hour before the news is released, for example, in order to protect your capital from the major risks that occur at the time of the news and so that it does not affect your decisions in the future. It is possible that when a Big loss occurs, you will modify your trading plan and the stop loss will be an essential part of this modification.

Spread vs stop loss

The stop-loss is closely related to the spread because when you set the stop-loss you will find that the amount you will lose is the total amount of the trade in addition to the spread. For example, when you open a 1 lot order on the EUR/USD you will find the trade is negative and this is the spread. If the spread is 1 pip the trade will be minus $10, and if the stop loss is $100, that is, The trade will be closed after the price moves to 9 pips.

That is, the price will not move 10 pips in order to close the order at a loss of $100, so always take the spread points into account before entering any trade because the spread is an important factor in determining whether the trade will be profitable or losing.

Factors affecting spread

There are factors that may affect the spread. After knowing how the stop loss works and its correlation with the spread, what will happen if the spread increases? Of course, the trade will be closed early and it is possible that it will be closed at a level very close to the entry area because the spread may reach 10 pips or more.

There are factors that may affect the increase in the spread, and the most important of these factors is strong news. You will find this news in red in the economic calendar, including news about interest rates, inflation, and NFP. When such news occurs, the price moves insanely, causing price slippages and a significant increase in the spread. The spread may reach 10 or 14 pips on some pairs.

Midnight

The spread also increases at midnight (the closing time of the New York session). If the trade is left for the next day and the trade is very close to the stop-loss, it may be closed even if the price does not move, as a result of the increase in the spread at this time.

So do not rely too much on keeping the trade for the next day and placing a stop loss at this time. It is possible to cancel the stop-loss until two or three hours have passed. After this time, the spread returns to what it was, and then you can place the stop loss again.

There are fixed spread accounts and other accounts with 0 spread (but there is a commission Equal to spread). This may help you somewhat in midnight trades, but it will not prevent price slippages during news time because slippages are related to the speed of execution. At that time, you can close the trade manually.

4 – How to Set Effective Stop Loss Levels

There are many strategies for placing a stop loss, but most of these strategies, if not all, agree on one thing, which is placing the stop loss after the bounce zone. This is because if this zone fails to bounce the price again, this zone will be weak and will cause more losses for the trade. Therefore, the stop loss is placed in this zone to avoid any losses.

Rebound areas differ from one trader to another. It is possible to determine these areas based on support and resistance, order block, trend lines, or even using indicators such as moving average 200. The idea is the possibility of the price rebounding from these areas and placing a stop-loss in the event that this expectation fails.

Trailing stop vs stop loss

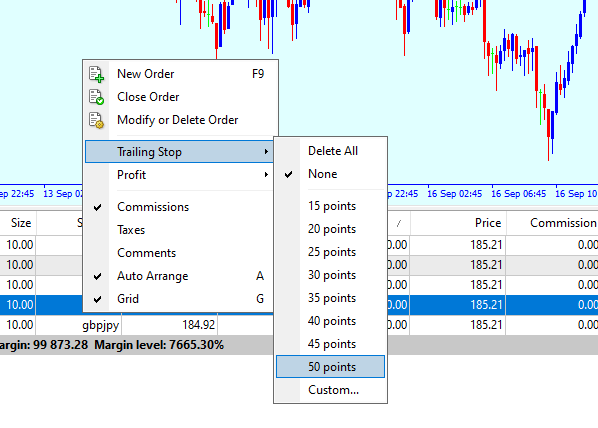

One of the tools that may help you in setting a stop loss is the trailing stop, which is a moving stop loss and is activated in the event of a profit in the trade. For example, if the trade is on a profit of 100 pips and the trailing stop is set at 50 points, the stop-loss will be set at a profit of 50 points, and if the price gives you another 50 pips, i.e. 150 total, the stop-loss will also rise by 50 points.

If the price rebounds and reaches the stop-loss, the trade will be closed, the trailing stop reserves profits for you continuously to ensure that you exit the market with a profit and not a loss.

Risk to Reward Ratio (RRR)

The Risk ratio must be aligned with the stop loss. This is also one of the Risk management tools that helps you stay in the market for the longest possible period. many traders use a ratio of 1:2, meaning that the take profit is double the stop-loss i.e. that in the event of losing two trades in a row, they will be compensated by 1 winning trade.

This ratio may be much higher if the stop loss is close to the entry-level and the trade is good. This ratio may increase to reach 1:10 or more. The factor affecting the increase or decrease is the trader himself, whether he is confident in his analysis or not.

Conclusion

The stop loss is no less important than the decision to enter the deal. The stop loss must be carefully determined based on the areas from which it is likely to bounce. Placing the stop-loss after these areas indicates the weakness of this area and protects your account from further losses. The trader may dispense with the stop-loss in the event of entering a very small lot deal at news time, for example.

But in general, dispensing with the stop-loss is not in the trader’s interest and comes with many consequences that may lead to losing the entire account. The stop-loss is like a brake that prevents further losses from occurring in the account.