After you analyze the pair you want to trade and decide to open a new order, have you asked yourself where the take profit will be? Take profit order is very important and no less important than analyzing the pair because if you do not know where you will exit the market, you will not be able to make profits, of course, analyzing and finding a good area to enter is important, but finding the exit area after making profits is no less important.

Discover the power of Take Profit

1 – What is Take Profit?

Take profit is an order to close the trade at a certain level determined by the trader before or after entering the trade. Take-profit is considered like any order you do in Forex. For example, if you want to open a buy order on the EUR/USD, you will write the Lot, specify the buy order, and then write the take profit price. All of these are important orders related to managing the trade to get profits in the end.

If you open the trade without determining the take-profit, this means that the trade will continue until you close it yourself or close it as a result of Stop out. Determining the take profit is very important if you think that the price will not be able to give you more profits and may reverse at any time.

How to set Take profit

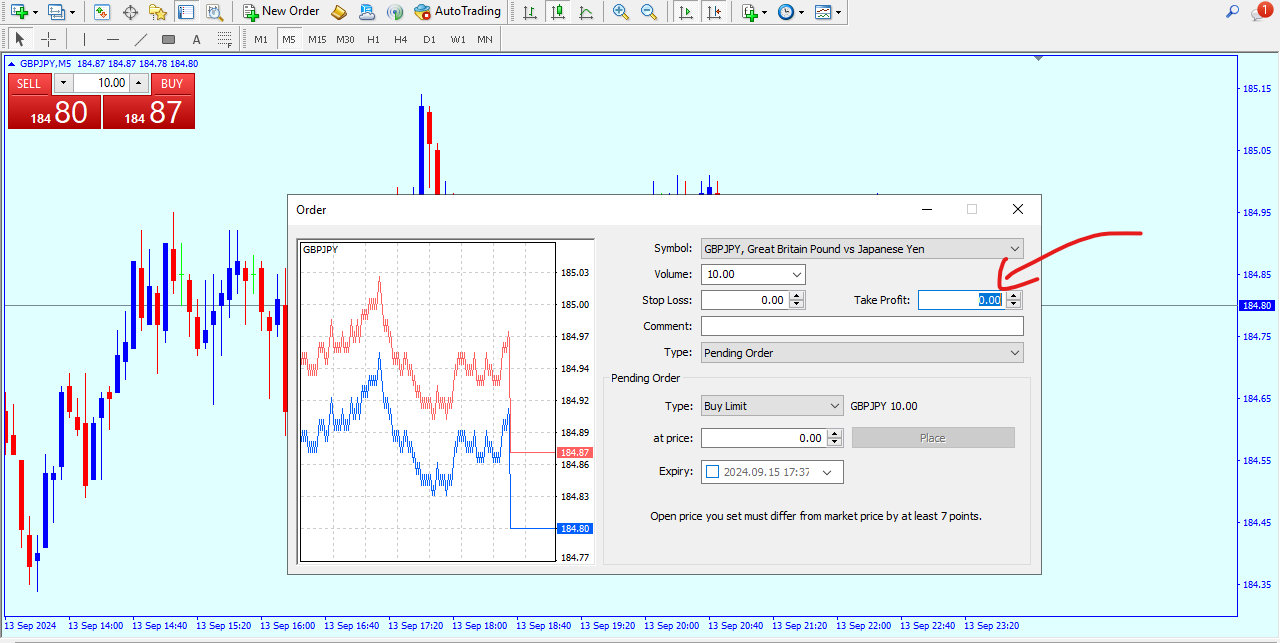

Placing the take profit is very easy and there are two ways to set the take profit, The First one is, that you write it before opening the trade. After you press New order or F9 and write the lot you want, you will write the take profit at which you want the trade to be closed with a profit. If the order type is buy, the take profit will be above the price at which you bought and vice versa. When selling, the take profit will be below the price at which you opened the sell order.

You can also set a take profit for pending orders. If you want to open a pending order at a specific price, you can set a take profit after writing the price at which the trade will be opened.

The second method is if you open the trade directly without specifying the take profit, you can add it by double-clicking on the order or right-clicking and choosing modify or delete, then writing the price at which you want to close the trade with a profit.

You can also set the take profit after opening the order by holding the order line on the chart and dragging this line up if the trade is a buy and down if it is a sell.

Please note that if you do the opposite, you will be setting a stop loss in this case and not a take profit. For example, if you buy the EUR/USD and you drag the order line down, you have set a stop loss and not a take-profit. Therefore, you must first make sure before you leave the line that there are profits written at the end of the line on the left, in order to make sure that the trade is not closed at an unwanted loss.

Take Profit at Break-Even

It is also possible to place a take profit at the level at which you opened the trade (Break Even). This is a good strategy used by most traders. For example, if you opened a sell order on EUR/USD at the 1.2000 Level and the pair rose and reached 1.2050, and based on the analysis you did, you expect that it will rebound from the 1.2000 level (Your entry-level).

But it is possible that the pair may rebound and rise again, it will make you lose again. To avoid such situations, you can place a take profit in the entry area, for example, And exit the market without profit or loss, This is a good strategy to get traders out of the market with the least possible loss in case the price reverses against them.

Because no one wants to lose more money, right? But if you see that the price will not respect your analysis, do not try to defy the market. Your decisions must be based on the analysis without building hopes that the price will go to take your profit without any logical reason.

The take profit can also be negative if the trade is in a loss. For example, if you bought the EUR/USD at 1.2050 and it fell to 1.2000 and you wanted to close the trade with the least possible losses because you think that the pair may fall further, you can place a take-profit order, for example, at 1.2020 or Break Even (BE)

You will write the take profit order in the take profit section because if the price rises in that case the loss will be less of course.

Trailing stop vs Take profit

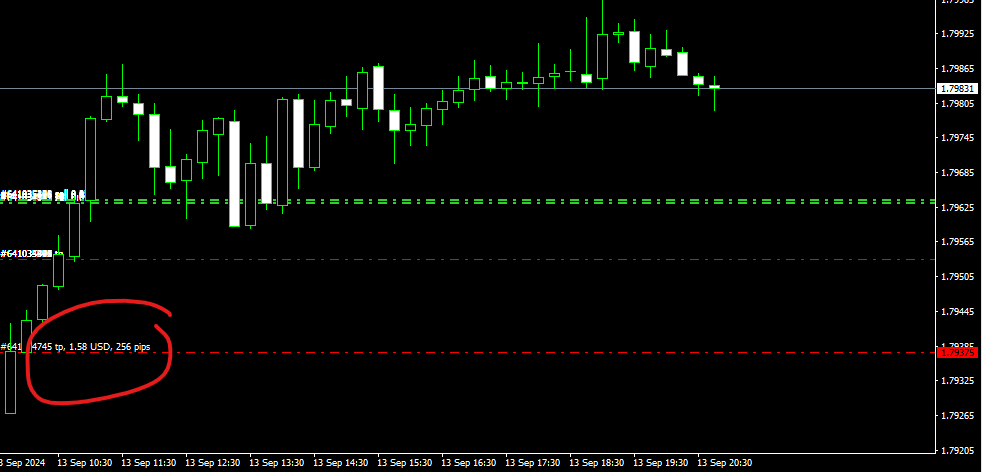

This type of order can be called a moving Stop loss But it is also considered as take profit. because it automatically reserves part of the profits without any intervention from you. This is actually a very wonderful thing because if you are away from the chart and busy with something else, the Trailing Stop will always reserve the profits of the trade. As long as the trade is making profits and moving in its direction, it will book more and more profits.

What is meant by booking profits here is that if you buy a pair and the pair goes up, and you set a trailing stop at 20 pips, for example, the pair must fall 20 pips in order for the trade to be closed automatically.

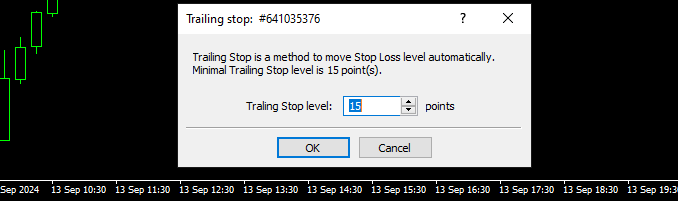

To specify the trailing stop, right-click on the Order, then choose trailing stop and choose Custom to specify the number of points you want.

2 – Why is Take Profit Important?

Take profit is one of the most important orders in the Forex market. It protects you from the loss that may occur if the trade is not closed. If there is a rebound level that is about to make the price reverse its direction, you can place the take profit in this area in order to keep the profits you have collected and not lose them.

Many traders use take profit as an essential part of their trading plan. If the strategy does not require a take profit, the trader will have to sit in front of the chart until he closes the trade. Of course, sitting in front of the chart all day is not the best thing you can do in your day.

The take-profit is much better than closing the trade manually because if you intend to close the order manually, you will be affected by different market factors, such as you may close the trade early or be emotionally affected by the loss that may occur while you are in front of the chart. If you set the take profit, you will close the platform completely and forget about the trade because in that case, you will be sure that if the price reaches the area you want, it will be closed automatically without the need for you to be in front of the chart.

Take profit also protects you from being greedy for more profits. If you get good profits, you might be greedy for more and more. If you decide not to place a take profit, you will keep the trade open until you get the profit that satisfies you, and not based on the appropriate area at which you should close the trade.

Mistakes to Avoid When Setting Take Profit

Among the mistakes you may encounter regarding take profit are:

Take profit at random levels (Based on the profit, not the important levels)

There are some traders who do not like making a lot of profit for themselves, so they set the take profit based on the logical profit that suits them and not based on the area from which the pair may rebound. For example, if the trader’s balance is $10,000 and he opens a trade with a risk of 1%, it is natural for him to target the area from which the pair will rebound, and this zone for example will make him achieve a 10% profit, but he will target only $50 because he is not accustomed to making a lot of profit.

The reason may also be the fear of losing the account and not achieving all these profits, as trading is largely linked to the trader’s psychology.

Not putting Take profit

Some traders do not prefer to set a take profit because the price may reach the take profit and continue its direction, in which case he will lose more profits.

This way of thinking is devoid of logic and analysis because it is natural for the trader to place the take profit from the area from which he thinks the price will rebound. If the area is not suitable, he will place it in another one, right?

3 – Using Take profit with Risk management

Risk management is closely linked to taking profit, as taking profit is determined based on the target profit. If the open order has a risk of 1%, then take profit will be 2% to 5%, for example. This percentage may decrease if you decide to close part of the order in order to be able to reap part of the profits in case the price reverses against you.

Partial lot closure

Closing part of the order is a very good feature to manage your capital so that you can always reserve part of the profits. This feature is only available in MT5 and is somewhat similar to Trailing Stop, but only part of the order is closed in this case and not the entire Trade. For example, if the trade has achieved $100 profit and you want to close 50% of the order, you will get $50 immediately after closing half of the trade and the order will remain open.

Slippage vs take profit

When placing a take profit, do not expect that when the price reaches it at the time of the news, the trade will be closed, because a price slippage may occur at this time. Price slippage is the failure to execute the order at the specified price, meaning that the trade may be closed at a price completely different from the price at which you set the take profit.

It is possible that the trade will be closed with a profit greater than the specified profit or a profit less than the specified profit in the event of a price slippage (the loss may occur too), and it is possible that the trade will not be closed at all, and this varies from one broker to another and according to the policy of each broker.

Price slippage is a very natural occurrence in any broker because during news violent movements occur, that make prices move strongly and this movement may be faster than the speed of the broker’s execution of the order, so it is preferable to close the trade before the release of important news if you do not want to expose yourself to price slippage or you can close it manually if you see that the price will reach the area you have specified.

Spread vs take profit

The spread is closely related to the take profit because if you open a trade and set the take profit 10 points away for example and the current spread of the pair is 2 pips then the price must move 12 points to reach the take profit but what will happen if the spread increases?

Increasing the spread means that the price must move more points in order to achieve the profit you want because the spread may increase more than normal. For example, during news time, the spread increases insanely and may reach 10 pips. In this case, if the take profit is 10 points away, the price must move 20 points! In order for the trade to close automatically (in the absence of price slippage, of course).

The spread also increases at midnight (after the New York session closes). If you have left the trade for the next day and it is close to take profit, the spread will increase a few points due to the decrease in supply and demand in the market, but these points may affect your trade. It is possible that after the trade reaches the take profit level, it will not be closed automatically due to the high spread taken by the broker.

This spread was at market close time (same as midnight) and the spread was 3 points and rose by 2 points. These 2 points can affect the trade of course, but this rise does not last long. After an hour or two, it returns to what it was.

4 – How to Set Effective Take Profit Levels

There are different strategies for setting the take profit and there is no fixed way to determine where you want to close the deal. Of course, you have complete freedom to close the deal after earning 10 points, 100 points, or even one point. Each trader has his strategy and deals with the market in a way that makes profits.

Important Tools

Whatever strategy you use to make profits in Forex, most strategies agree on one idea in determining the take profit level, which is to determine it in the rebound areas. That is, if you enter a buy order, you will find the important resistance areas so that you can determine whether the price will respect them or not.

Determining such areas helps you place your take profit below them because if the price respects these levels and bounces back from them, you will have achieved the maximum possible profit from this movement. This is the goal of any trader, which is to achieve the maximum profit from Forex. This is the main goal of your joining Forex, right?

But it is possible not to place the take profit from the rebound areas and dispense with some of the profits that you may achieve because there are some factors that may push you to close the trade early, for example, such as important news or the appearance of important signals indicating a reversal of the trend. In this case, exiting the order is the best choice and not sticking to the take profit level because in that case you will exit the market as a winner and it will be a smart move, of course.

You can determine the appropriate retracement areas for you based on support and resistance lines or the Fibonacci tool, or you can even use indicators such as the moving average or MACD. If you see a divergence, for example, you will exit the trade, many factors may make you exit the trade without caring about where to take the profit. These factors differ from one Strategy to another, and you alone will decide when you can do that and when you should stick to the take profit.

Martingale strategy

It is possible that in the event that the price reverses more than necessary, you can open more trades of the same type of order to be able to reduce the loss that occurred, and the take profit, in this case, will be either at the first order or after it if you want.

This type of strategy carries with it many risks because if the pair is moving in a strong trend, you will incur many losses when you try to open more lots to compensate for the losses that occurred previously.

Risk-to-reward ratio

Determining the risk-to-reward ratio is very important because this matter relates to Risk management. You must first determine the risk before entering the trade, and then set a take profit of 1:2, i.e. double the stop loss or more. But what if the rebound area is before this ratio, i.e. it will achieve 1:1?

The bounce area is more important than the profit percentage that you will get because the take-profit is based on the market condition and not on the profit percentage that we want to get, so the target profit may be ignored sometimes.

Conclusion

Take profit is one of the most important orders in the market. Determining the take profit helps the trader manage his trades well. It is like an automatic closing of the trade if it reaches the target level without the need for the person to be in front of the chart. In some cases, it is possible to dispense with take profit.

Such as the presence of important news on the pair being traded, in that case, the price will not respect the take profit and there may be a price slippage and a significant increase in the spread, so it is preferable to close the order manually if the price reaches the target level and it is better to close the trade before the news is issued so as not to expose the account to loss.