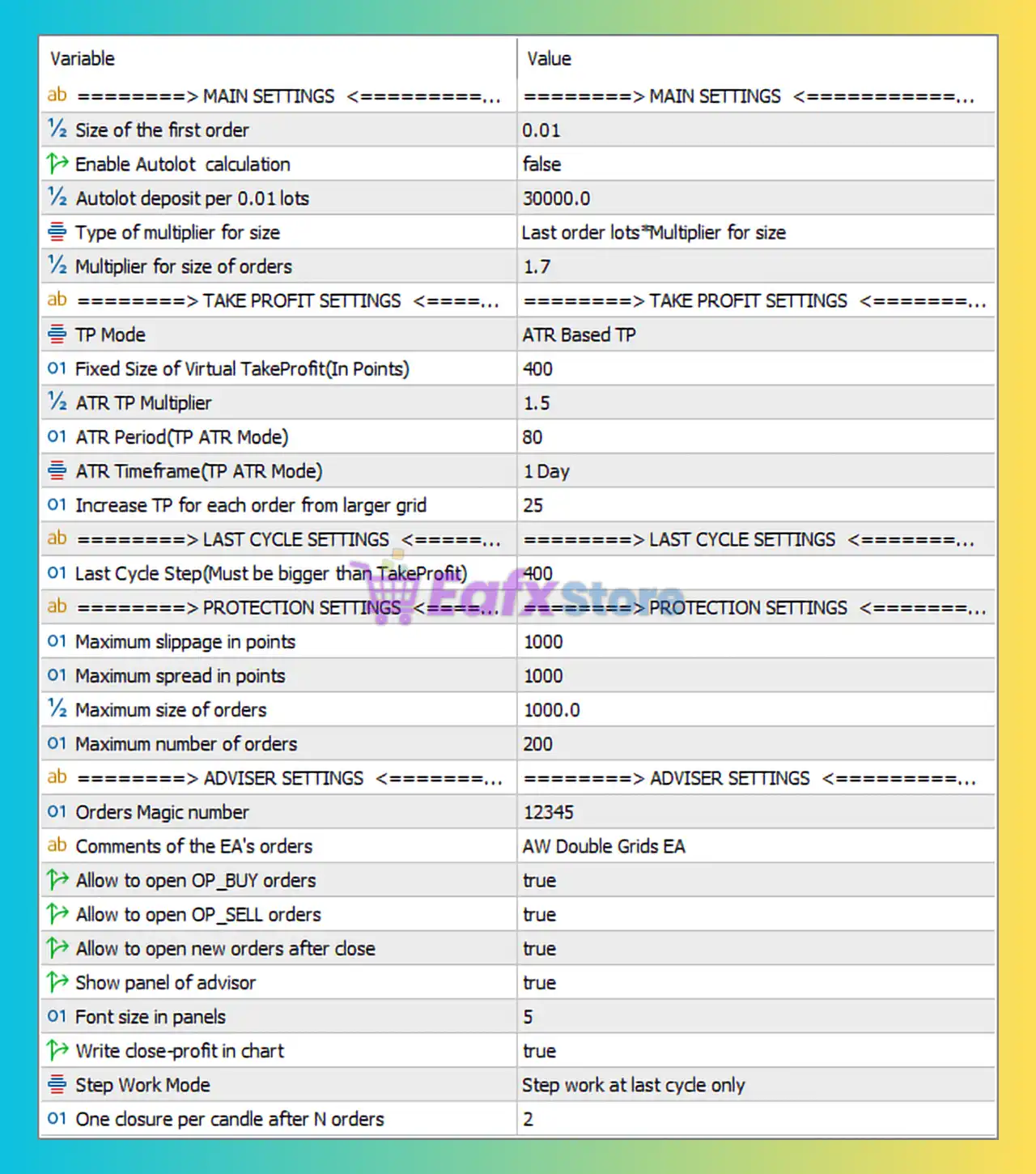

🧩 What is AW Double Grids EA MT5?

AW Double Grids is a grid-based Expert advisor (EA) designed for MetaTrader 5, focusing on controlled position scaling, ATR-based take profit, and risk protection through strict order limits. The settings in the image reflect a semi-aggressive but well-protected grid strategy, suitable for medium to large accounts.

🧩 Main Settings Analysis

➡️ First Order Size

- Size of the first order:

0.01 lot

✅ Very conservative starting lot size

🔍 Ideal for reducing initial exposure and allowing the grid to develop safely

➡️ Auto Lot Management

- Enable Autolot calculation:

false - Autolot deposit per 0.01 lots:

30000(inactive due to autolot disabled)

🔶 Lot size is fixed, not balance-adaptive

✔️ Recommended for traders who want full manual risk control

➡️ Grid Multiplier Settings

- Type of multiplier:

Last order lots * Multiplier for size - Multiplier for size of orders:

1.7

🔎 Interpretation:

- Each new grid order increases lot size by 70%

- This is a moderate martingale-style scaling, not overly aggressive

⚠️ Risk Note:

- Prolonged trending markets can increase drawdown

- Best used with sufficient capital and strict max order limits

🧩 Take Profit (TP) Settings Review

➡️ TP Mode

- TP Mode:

ATR Based TP

✅ Dynamic take profit adjusts to market volatility

✔️ Superior to fixed TP in changing market conditions

➡️ ATR Configuration

- ATR TP Multiplier:

1.5 - ATR Period:

80 - ATR Timeframe:

1 Day

📊 Effect:

- Long-term volatility measurement

- Smoother TP targets, fewer premature exits

- Best suited for swing or position grid trading

➡️ Grid TP Expansion

- Increase TP for each order from larger grid:

25 points

✔️ Helps compensate for increased risk at deeper grid levels

✔️ Improves overall basket profitability

🧩 Last Cycle Settings

- Last Cycle Step:

400 points

(Must be larger than TakeProfit)

🔎 Purpose:

- Ensures the EA allows enough price movement to complete a full grid cycle

- Prevents forced closures too early

✔️ Well-balanced relative to TP and grid expansion

🧩 Protection & Risk Management Settings

➡️ Execution Safety

- Maximum slippage:

1000 points - Maximum spread:

1000 points

⚠️ These values are very high

- EA will trade even during high volatility or news

- Useful for crypto or exotic symbols

- Risky for forex during news events

➡️ Order Limits

- Maximum size of orders:

1000 lots - Maximum number of orders:

200

🔐 These are hard safety caps

- Prevents runaway grid expansion

- Protects account from EA malfunction

✔️ Recommended for VPS and long-term operation

🧩 Adviser (EA) Operational Settings

➡️ Trading Permissions

- Allow OP_BUY orders:

true - Allow OP_SELL orders:

true

➡️ EA trades both directions, forming a true double-grid strategy

➡️ Post-Cycle Behavior

- Allow to open new orders after close:

true - Step Work Mode:

Step work at last cycle only

🔍 Meaning:

- EA only intensifies grid logic at the final cycle

- Reduces overtrading during normal conditions

➡️ Order Management

- One closure per candle after N orders:

2

✔️ Prevents mass closures in a single candle

✔️ Improves execution stability and broker safety

🧩 Interface & Logging

- Show panel of advisor:

true - Font size:

5 - Write close-profit in chart:

true

📈 Useful for monitoring performance and transparency

✔️ Especially helpful for manual supervision

🧩 Final Conclusion

The AW Double Grids MT5 configuration shown in the image represents a balanced grid trading strategy with moderate risk scaling and strong structural protections. With a low initial lot size (0.01), ATR-based take profit, and a controlled multiplier of 1.7, this setup is suitable for traders who:

- Prefer manual lot control

- Trade medium to long-term grids

- Have sufficient account balance

- Can tolerate floating drawdown in exchange for higher recovery probability

➡️ Best Use Case:

✔️ Medium to large accounts

✔️ Forex majors, gold, or crypto (with caution)

✔️ VPS-based continuous operation

✔️ Traders experienced with grid and martingale concepts

⚠️ Not recommended for:

- Small accounts

- High-impact news scalping

- Traders who cannot manage drawdown psychologically