🧩 Overview of AW Stochastic EA

AW Stochastic EA is an automated trading system for MetaTrader 4 (MT4) that uses the Stochastic Oscillator as its main signal generator, combined with averaging (grid) logic, trailing take profit, and risk protection mechanisms.

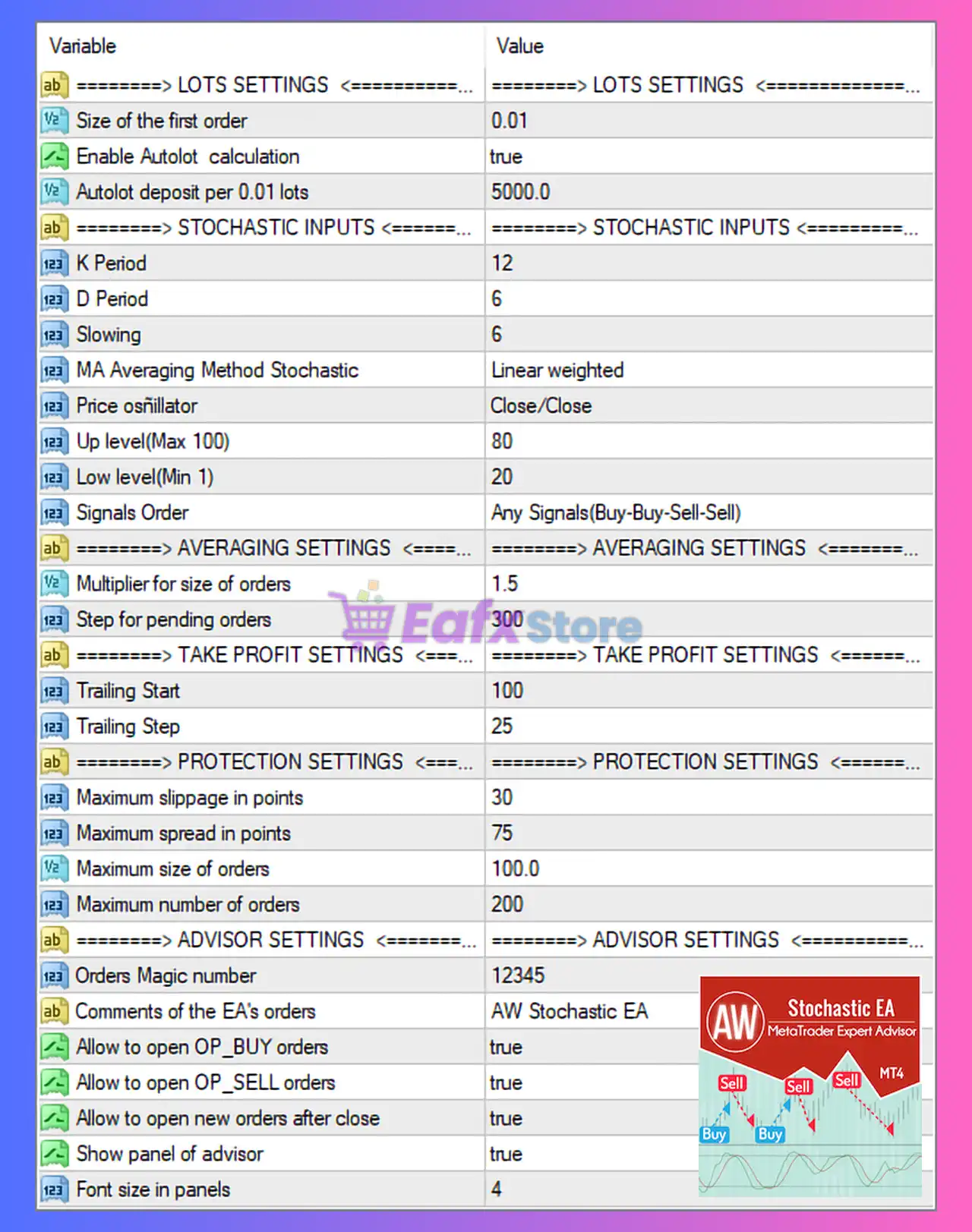

The configuration displayed in the image represents a moderate-risk, trend-reversal grid strategy, suitable for ranging and corrective market conditions.

🧩 Lots Settings (Money Management)

🔹 Size of the first order: 0.01

- Very small initial lot size.

- Ideal for cent accounts, small balances, or conservative traders.

🔹 Enable Autolot calculation: true

- EA automatically adjusts lot size based on account equity.

- Reduces manual risk management errors.

🔹 Autolot deposit per 0.01 lots: 5000.0

- Requires $5,000 balance to trade 0.01 lot.

- This is a highly conservative autolot ratio, significantly reducing drawdown risk.

✅ Assessment: Excellent money management, prioritizing account safety over aggressive growth.

🧩 Stochastic Indicator Inputs (Signal Logic)

🔹 K Period: 12

🔹 D Period: 6

🔹 Slowing: 6

- Smooth stochastic configuration.

- Reduces noise and false entries.

🔹 MA Averaging Method: Linear Weighted

- Gives more importance to recent price data.

- Improves responsiveness without being too aggressive.

🔹 Price oscillator: Close/Close

- Uses closing prices for accuracy and confirmation.

🔹 Up level (Max): 80

🔹 Low level (Min): 20

- Classic overbought/oversold levels.

- Trades are triggered near market extremes.

🔹 Signals Order: Any Signals (Buy-Buy-Sell-Sell)

- Allows consecutive same-direction trades.

- Enhances grid recovery efficiency.

✅ Assessment: Well-balanced stochastic settings, optimized for range trading and pullbacks.

🧩 Averaging (Grid) Settings

🔹 Multiplier for size of orders: 1.5

- Moderate martingale-style lot increase.

- Risk increases gradually rather than exponentially.

🔹 Step for pending orders: 300 points

- Wide grid spacing.

- Helps prevent overloading orders during tight consolidation.

⚠️ Assessment: Controlled grid strategy, but still requires sufficient margin during strong trends.

🧩 Take Profit & Trailing Settings

🔹 Trailing Start: 100 points

- Trailing activates only after a decent profit buffer.

- Prevents premature exits.

🔹 Trailing Step: 25 points

- Locks in profits efficiently while allowing price movement.

✅ Assessment: Smart trailing logic, suitable for volatile but non-trending markets.

🧩 Protection Settings (Risk Control)

🔹 Maximum slippage: 30 points

- Acceptable tolerance for most brokers.

🔹 Maximum spread: 75 points

- Prevents trading during high spread conditions (news, low liquidity).

🔹 Maximum size of orders: 100.0 lots

- Hard safety cap for autolot escalation.

🔹 Maximum number of orders: 200

- Very high order limit.

- Intended for large or cent accounts only.

⚠️ Assessment: Strong protection features, but max orders should be reduced for small or standard accounts.

🧩 Advisor (EA) Settings

🔹 Orders Magic Number: 12345

- Unique trade identifier.

- Avoids conflict with other EAs.

🔹 Comments: AW Stochastic EA

- Clear trade labeling in MT4 history.

🔹 Allow BUY orders: true

🔹 Allow SELL orders: true

- Trades both directions symmetrically.

🔹 Allow new orders after close: true

- EA resumes trading immediately after basket closure.

🔹 Show panel of advisor: true

🔹 Font size in panels: 4

- Compact interface for multi-chart setups.

🧩 Final Conclusion – Expert Review

The AW Stochastic EA settings shown in the image represent a conservative-to-moderate automated trading configuration with a strong focus on capital preservation and signal quality.

➡️ Key Strengths:

- ✅ Extremely conservative autolot calculation

- ✅ Smooth and reliable stochastic signal filtering

- ✅ Wide grid spacing to reduce overtrading

- ✅ Effective trailing profit mechanism

- ✅ Robust spread and slippage protection

➡️ Potential Risks:

- ⚠️ Grid and averaging logic can suffer during strong, one-directional trends

- ⚠️ Maximum order limit (200) is too high for small live accounts

⭐ Overall Rating: 8.7 / 10

Best suited for:

- Sideways and corrective markets

- Traders using VPS and low-spread brokers

- Medium to large accounts or cent accounts

- Users who prioritize stability over aggressive profit targets