Bayern Bot is a precision-engineered algorithmic trading robot designed for trend-based and volatility-aware strategies. The settings you’ve provided indicate a balanced and conservative configuration optimized for intraday trading with technical filters and strict risk management.

📌📌📌 Buy this unlimited Bayern Bot MT5 product here 📌📌📌

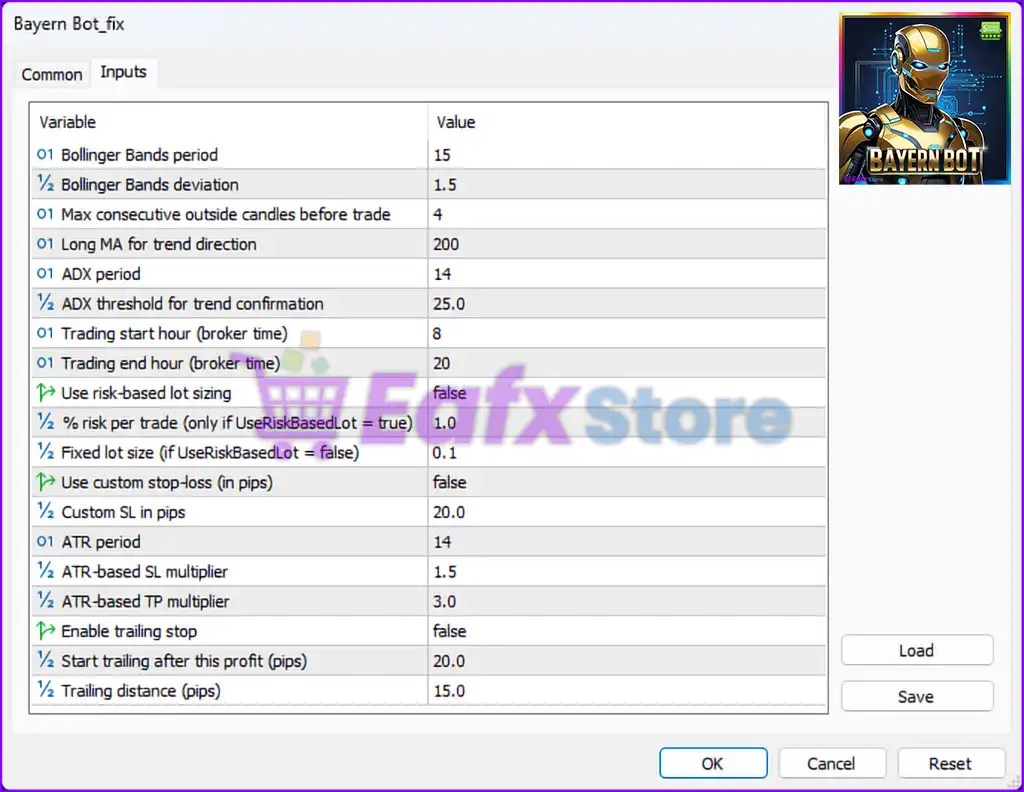

📊 Technical Indicators Configuration

- Bollinger Bands Period:

15

Defines the number of periods used to calculate the Bollinger Bands, focusing on mid-term price volatility. - Bollinger Bands Deviation:

1.5

A narrower band setting to detect smaller breakouts or reversion zones, favoring scalping or semi-aggressive entries. - Max Consecutive Outside Candles Before Trade:

4

Prevents entries after excessive volatility by limiting trades when candles close outside the Bollinger Bands too frequently. - Long MA for Trend Direction:

200

A classic long-term moving average to determine the overall trend direction, ensuring trades align with higher timeframe trends. - ADX Period:

14

Used to calculate trend strength; the ADX indicator helps avoid choppy market conditions. - ADX Threshold for Trend Confirmation:

25.0

Only trades when the trend strength (ADX) exceeds 25, filtering out ranging or weak trends for better accuracy.

🕒 Trading Time Settings

- Trading Start Hour (Broker Time):

8

EA begins trading at 08:00 broker/server time, often capturing early market volatility (e.g., London open). - Trading End Hour (Broker Time):

20

EA stops trading at 20:00, avoiding low-volume late sessions and overnight uncertainty.

💼 Lot Sizing and Risk Management

- Use Risk-Based Lot Sizing:

false

The EA is currently set to fixed lot mode rather than dynamic risk-based lot sizing. - % Risk per Trade:

1.0(inactive)

Would be used if risk-based lot sizing was enabled — calculates lot size to risk 1% of equity. - Fixed Lot Size:

0.1

All trades are executed using a micro lot size (0.1 lot), which is conservative and suitable for small accounts or low-risk trading.

🚫 Stop Loss & Take Profit Settings

- Use Custom Stop-Loss (in pips):

false

Custom stop-loss is disabled; EA will use ATR-based SL if applicable. - Custom SL in Pips:

20.0(inactive)

Would apply only if the custom SL toggle is enabled. - ATR Period:

14

Used for dynamic SL/TP calculation based on volatility. - ATR-Based SL Multiplier:

1.5

Stop-loss is set to 1.5× the ATR, adapting to market conditions. - ATR-Based TP Multiplier:

3.0

Take-profit is set to 3× the ATR, ensuring a favorable risk-reward ratio.

🔁 Trailing Stop Settings

- Enable Trailing Stop:

false

Trailing stop is currently disabled. - Start Trailing After Profit (pips):

20.0(inactive)

The trailing would begin only after a position gains 20 pips. - Trailing Distance (pips):

15.0(inactive)

Once enabled, the trailing SL would maintain a 15-pip buffer from the current price.

✅ Key Takeaways – Bayern Bot MT5 Configuration

- 🎯 Trend-Confirmed Entries: Uses Bollinger Bands, 200 EMA, and ADX > 25 to ensure precision entries in strong directional markets.

- 🔒 Safe Risk Control: Trades with a fixed micro lot of 0.1, ensuring consistent exposure.

- 📈 Adaptive Targets: ATR-based SL/TP for dynamic risk-reward management based on volatility.

- 🕒 Intraday Focus: Trades only between 08:00 and 20:00, avoiding overnight risks and spread widening.

- 🚫 Trailing Stop Disabled: Strategy prioritizes predefined exit logic over reactive trailing.

🚀 Ideal Use Case for This Configuration

This Bayern Bot setup is perfect for low-risk, trend-following intraday strategies. It combines conservative fixed-lot sizing with strict entry filters and volatility-based exit logic. Traders looking for consistent, low-drawdown performance during active market hours will find this configuration well-optimized for stability and safety.