The BB AO EMA is an automated trading Expert advisor (EA) for MetaTrader 5 that combines multiple indicators — Bollinger Bands (BB), Awesome Oscillator (AO), and Exponential Moving Averages (EMA) — to identify entry and exit points with trend confirmation.

📌📌📌 Buy this unlimited BB AO EMA MT5 product here 📌📌📌

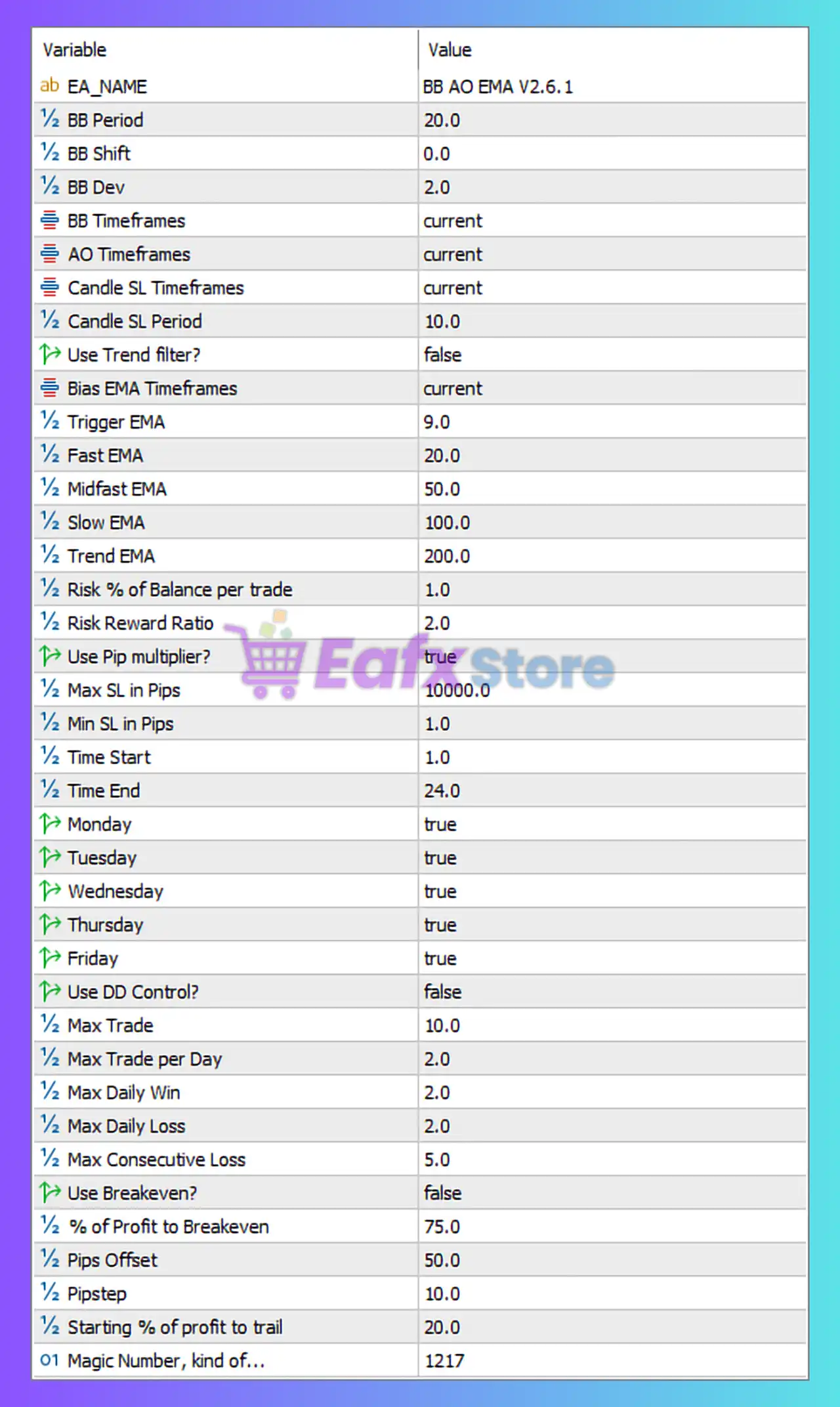

🧩General Parameters

- EA Name:

BB AO EMA V2.6.1

The version of the Expert Advisor being used.

🧩Bollinger Bands (BB) Settings

- BB Period:

20.0

Standard period used to calculate Bollinger Bands — suitable for most market conditions. - BB Shift:

0.0

No shift applied; bands are calculated on the current bar. - BB Deviation:

2.0

Standard deviation multiplier — typical for standard BB setups, capturing ~95% of price action. - BB Timeframes:

current

Uses the current chart timeframe, making it flexible for multi-timeframe setups.

🧩Candle and AO Settings

- Candle SL Timeframes:

current

Stop Loss based on the current timeframe candles. - Candle SL Period:

10.0

Likely measures recent candle movement for dynamic SL calculation. - AO Timeframes:

current

The Awesome Oscillator is calculated using the same timeframe as the chart.

🧩EMA (Exponential Moving Average) Filters

- Use Trend Filter:

false

Trend filtering is disabled — EA trades both directions based on signals rather than overall trend. - Bias EMA Timeframes:

current

EMA trend bias aligns with the current chart timeframe. - Trigger EMA:

9.0

Short-term EMA for entry signal trigger. - Fast EMA:

20.0

Medium-term EMA for momentum detection. - Midfast EMA:

50.0

Used to identify mid-range trends. - Slow EMA:

100.0

Long-term trend indicator. - Trend EMA:

200.0

Represents the overall market trend direction.

This EMA layering structure (9/20/50/100/200) provides both short-term and long-term trend confluence.

🧩Risk Management Settings

- Risk % of Balance per Trade:

1.0

Each trade risks 1% of the total balance — a conservative and sustainable risk level. - Risk Reward Ratio:

2.0

Targets twice the potential reward compared to risk — standard for professional systems. - Use Pip Multiplier:

true

Adjusts pip calculations dynamically based on symbol specifications. - Max SL in Pips:

10000.0

Extremely high limit; effectively disables strict SL cap to allow EA to manage SL dynamically. - Min SL in Pips:

1.0

Ensures a minimal SL exists on all trades.

🧩Trading Session Controls

- Time Start:

1.0, Time End:24.0

The EA trades almost 24 hours per day, starting just after midnight. - Monday–Friday:

true

EA trades all weekdays — a full-week strategy.

🧩Drawdown and Trade Limits

- Use DD Control:

false

Drawdown control is disabled, meaning EA won’t stop trading under DD conditions. - Max Trade:

10.0

Maximum number of open trades allowed at once. - Max Trade per Day:

2.0

Limits to two trades per day — avoids overtrading. - Max Daily Win:

2.0and Max Daily Loss:2.0

EA stops after reaching 2% profit or 2% loss in a single day. - Max Consecutive Loss:

5.0

Prevents continuous losing streaks beyond five trades.

🧩Breakeven and Trailing Settings

- Use Breakeven:

false

Breakeven not enabled — EA does not automatically move SL to entry after profit. - % of Profit to Breakeven:

75.0

If enabled, 75% profit level triggers breakeven move. - Pips Offset:

50.0

SL is moved 50 pips beyond breakeven once activated. - Pipstep:

10.0

Distance between grid trades or scaling levels. - Starting % of Profit to Trail:

20.0

Trailing stop activates once 20% of the profit target is achieved.

🧩Magic Number

- Magic Number:

1217

Unique trade identifier to separate this EA’s orders from others on the same account.

🧩Conclusion

The BB AO EMA EA configuration shown in the image is a balanced trend-following system combining Bollinger Bands, EMAs, and AO for multi-confirmation trading. The risk management is moderately conservative (1% per trade, 2:1 R/R) and the daily limits prevent overtrading. However, disabling the trend filter and breakeven may lead to higher drawdowns in volatile markets.

✅ Recommended Enhancements:

- Enable

Use Trend Filter = truefor better directional accuracy. - Activate

Use Breakevento protect profits during reversals. - Consider lowering

Max SLto avoid excessive exposure.

✅ Summary:

- Strategy Type: Trend-following & Momentum confirmation

- Risk Level: Moderate (1% per trade)

- Trade Frequency: Low (Max 2 trades/day)

- Recommended Timeframes: M15–H1

- Best Use: Swing or intraday trading with medium risk tolerance