🧩 What is Bitcoin Smart EA?

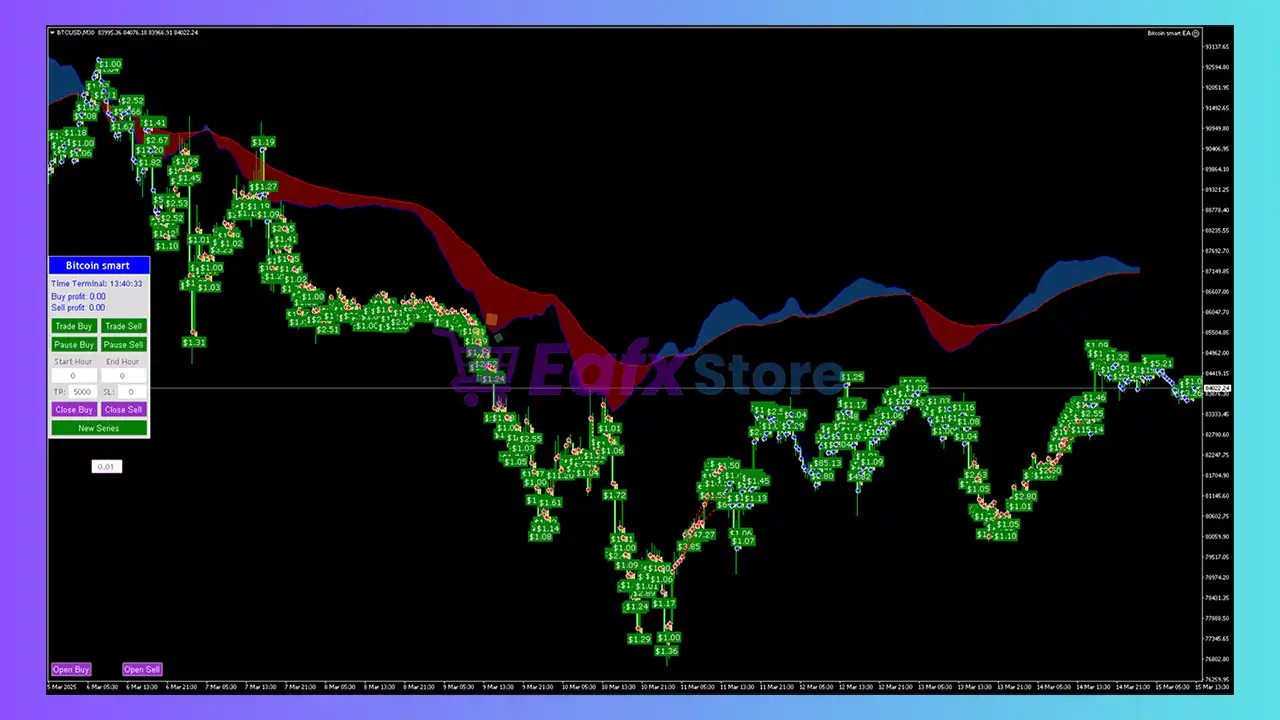

The Bitcoin Smart EA is an automated Expert Advisor (EA) designed for high-volatility assets like BTCUSD, focusing on controlled grid expansion, dynamic distance management, and adaptive drawdown reduction. Its configuration reveals a balance between flexibility, safety, and profitability — ideal for traders seeking algorithmic precision in crypto trading.

➡️ Vendor website: View here

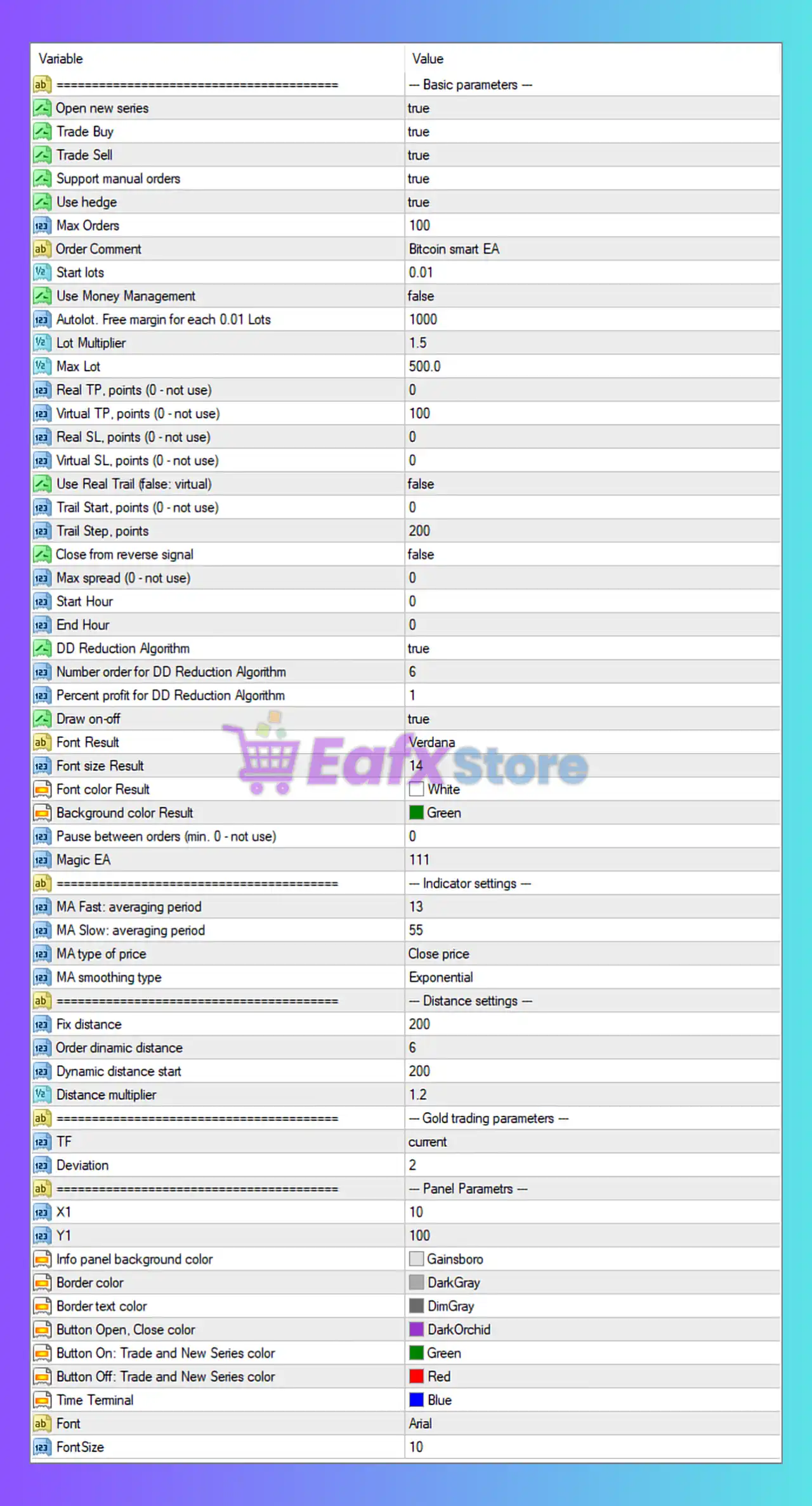

⚙️ Core Trading Logic

- Open New Series: ✅ Enabled

- Buy/Sell Orders: ✅ Both directions allowed

- Support Manual Orders: ✅ True

- Use Hedge: ✅ True

- Max Orders: 100

This setup indicates that the EA uses a bidirectional grid strategy with hedging, allowing it to open buy and sell positions simultaneously. The support for manual trades gives users flexibility to intervene or adjust entries when needed — an important advantage in volatile Bitcoin markets.

💰 Lot Management and Money Control

- Start Lot: 0.01

- Lot Multiplier: 1.5

- Max Lot: 500

- Autolot: Disabled

- DD Reduction Algorithm: Enabled (Step 6, 1% reduction)

The 1.5 lot multiplier suggests a moderate Martingale-style scaling, increasing position size after losses to recover drawdowns. Combined with the Drawdown Reduction Algorithm, this EA is designed to stabilize equity curves, gradually reducing exposure when volatility spikes.

📈 Indicator and Entry Logic

- MA Fast: 13

- MA Slow: 55

- MA Type: Exponential

- MA Price: Close price

This configuration confirms that Bitcoin Smart EA uses an Exponential Moving Average (EMA) crossover strategy to detect short-term momentum shifts. The EMA(13,55) combination helps capture early trend reversals — ideal for scalping or swing trading Bitcoin during sharp market moves.

🧠 Distance and Grid Management

- Fixed Distance: 200 points

- Dynamic Distance Start: 200

- Order Dynamic Distance: 6

- Distance Multiplier: 1.2

These settings reveal a dynamic grid system that adapts to price volatility. The EA spaces out new orders as price movements increase, minimizing overexposure during sudden price spikes — a critical safety measure for BTCUSD trading.

⏰ Time & Spread Filters

- Start Hour / End Hour: 0–0 (Full day trading)

- Max Spread: Disabled (0)

The EA trades 24/7, which is suitable for cryptocurrencies since the Bitcoin market never closes. The absence of a spread filter allows flexibility but requires a low-spread ECN broker for optimal performance.

🧮 Risk Management Features

- Hedging Enabled: True

- Trailing Step: 200 points

- Close from Reverse Signal: False

- DD Reduction Algorithm: True

Hedging and trailing-stop features help lock in profits and limit risk exposure, while the drawdown reduction algorithm gradually scales back orders during adverse movements — enhancing long-term survival in high-volatility markets.

🎨 Interface & Visualization

- Panel Colors: Modern UI with Gainsboro background, DarkGray borders, and Gold/Orchid trade indicators.

- Font: Arial, size 10

- MA Results Display: Font “Verdana” in white on a green background

This clean, color-coded design improves readability and visual monitoring, making it easy for traders to assess live trade status and system health.

🪙 Trading Focus

- Symbol: BTCUSD (optimized for Bitcoin)

- Deviation: 2

- Timeframe: Current chart

The EA is clearly tuned for Bitcoin trading, but with proper optimization, it could also adapt to other high-volatility pairs or crypto assets.

🏁 Conclusion

The Bitcoin Smart EA stands out as a well-balanced algorithmic trading system built for Bitcoin’s fast-paced environment. It merges EMA-based trend detection, dynamic grid spacing, and drawdown reduction logic to offer controlled yet aggressive performance.

With its robust hedging mechanism, smart grid control, and appealing visual interface, this EA is ideal for traders who value automation with built-in risk adaptation. When combined with a reliable broker and optimized VPS setup, Bitcoin Smart EA can be a powerful tool for consistent crypto trading.