🧩 What is BlueDreams MT5?

BlueDreams MT5 is a grid-based recovery Expert Advisor (EA) that combines trend filtering, multi-indicator confirmation, dynamic grid spacing and drawdown reduction logic. From the settings shown, this EA is clearly designed for medium–high frequency trading with controlled risk, rather than aggressive martingale scalping.

🧩 General & Interface Settings

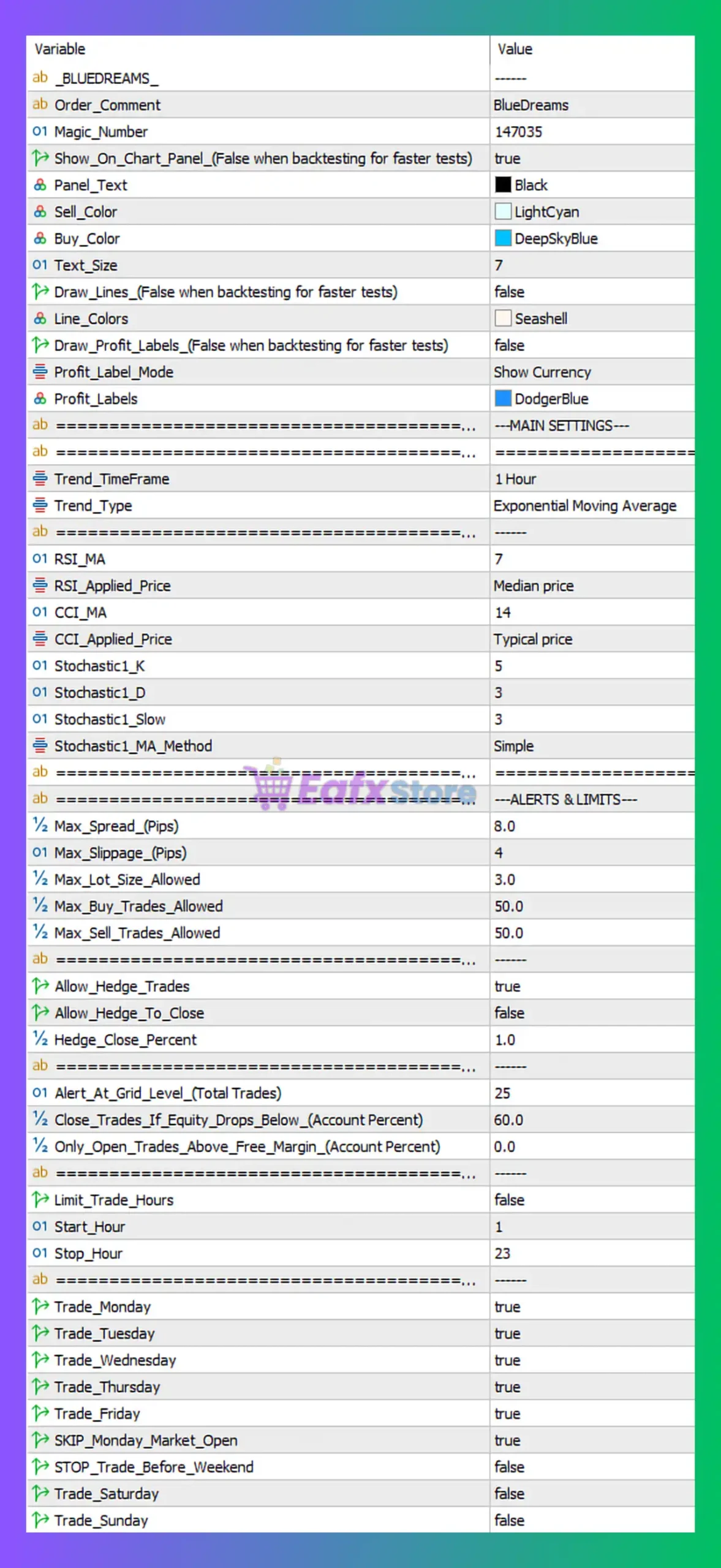

- Magic Number: 147035

→ Ensures unique trade identification, safe for multi-EA usage. - Order Comment: BlueDreams

→ Useful for trade tracking and analytics. - On-Chart Panel & Visuals: Enabled

→ Includes panel display, profit labels, and optional grid lines (disabled for faster backtesting).

➡️ Evaluation: These settings are clean and professional, focusing on usability without overloading the chart during testing.

🧩 Trend & Indicator Configuration

- Trend Timeframe: H1 (1 Hour)

- Trend Filter: Exponential Moving Average (EMA)

🔶 Indicator Parameters:

- RSI Period: 7 (Median Price)

- CCI Period: 14 (Typical Price)

- Stochastic:

- %K = 5

- %D = 3

- Slowing = 3

- MA Method = Simple

Analysis:

This combination creates a fast-reacting momentum filter:

- RSI (7) → Early momentum detection

- CCI (14) → Market strength confirmation

- Stochastic → Entry timing precision

👉 Ideal for trend-following grid entries, reducing random trades in ranging noise.

🧩 Trade Limits & Execution Control

- Max Spread: 8 pips

- Max Slippage: 4 pips

- Max Lot Size: 3.0

- Max Buy Trades: 50

- Max Sell Trades: 50

Interpretation:

BlueDreams allows deep grid coverage, but enforces:

- Spread protection

- Lot size caps

This is essential for broker safety and slippage control during volatile conditions.

🧩 Hedging & Equity Protection

- Allow Hedge Trades: true

- Allow Hedge to Close: false

- Hedge Close Percent: 1.0%

- Close Trades if Equity Drops Below: 60%

- Only Open Trades Above Free Margin: 0%

Risk Insight:

The EA supports hedging as a defensive mechanism, not for aggressive exposure.

The 60% equity stop acts as a last-resort capital protection layer.

🧩 Trading Schedule

- Trading Days: Monday → Friday (enabled)

- Weekend Trading: Disabled

- Skip Monday Market Open: true

- Trade Hours: 01:00 – 23:00

Conclusion:

These settings reduce exposure to:

- Weekend gaps

- Low-liquidity market opens

Excellent for stable live trading conditions.

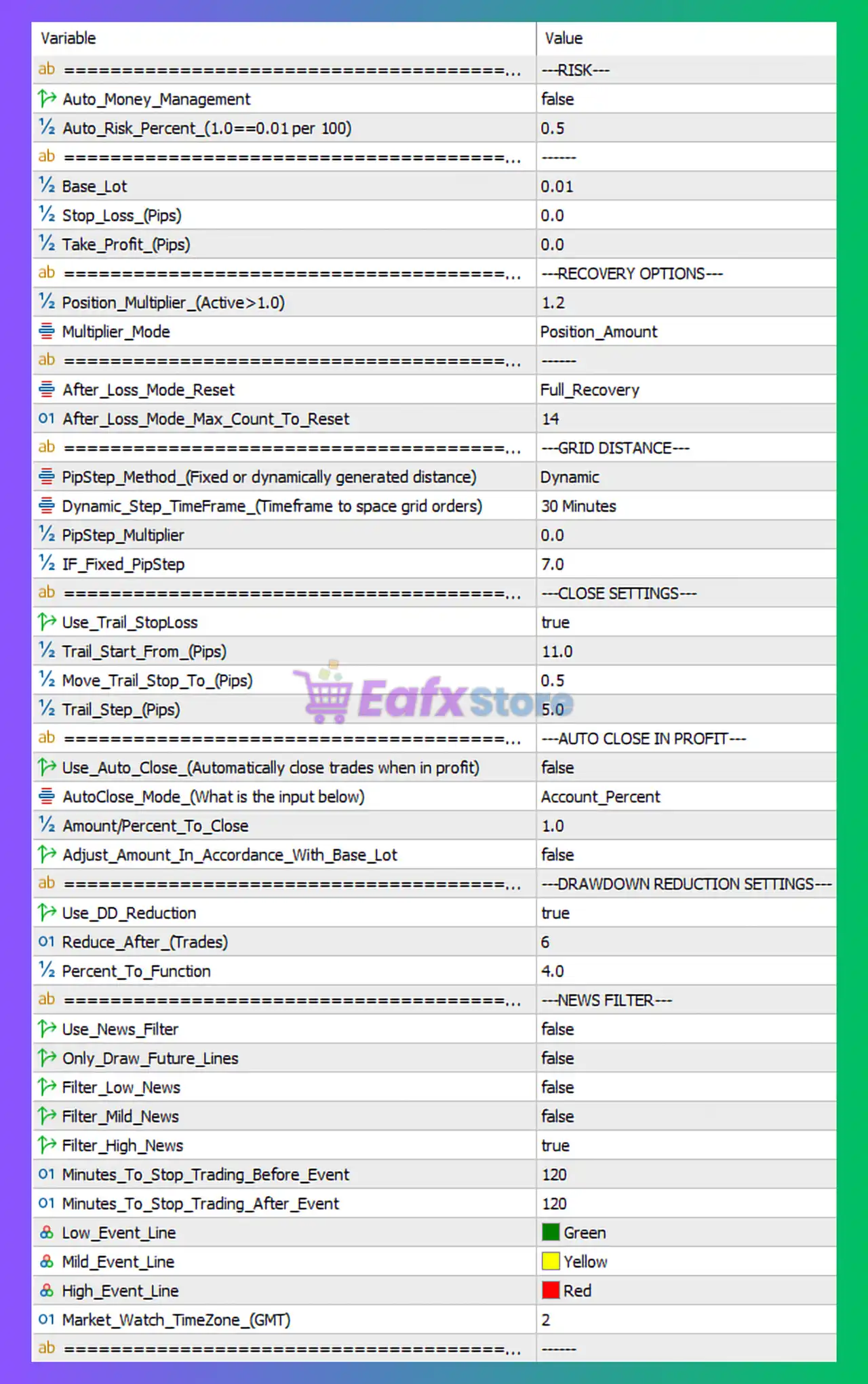

🧩 Risk Management

- Auto Money Management: false

- Risk Percent (if enabled): 0.5%

- Base Lot: 0.01

- Stop Loss / Take Profit: 0 (managed internally)

Assessment:

BlueDreams relies on grid recovery and trailing logic, not fixed SL/TP.

Using low base lot sizing significantly improves survivability.

🧩 Recovery & Grid Strategy

🔶 Recovery Logic:

- Position Multiplier: 1.2

- Multiplier Mode: Position Amount

- After Loss Reset Mode: Full Recovery

- Max Loss Count to Reset: 14

🔶 Grid Distance:

- Pip Step Method: Dynamic

- Dynamic Step Timeframe: M30

- Fixed Pip Step (fallback): 7 pips

Expert Insight:

This is a controlled grid system, not an aggressive martingale:

- Low multiplier (1.2)

- Dynamic spacing based on market behavior

- Reset mechanism prevents infinite drawdown cycles

🧩 Trade Exit & Profit Handling

- Trailing Stop: Enabled

- Start: 11 pips

- Step: 5 pips

- Move to: 0.5 pips

- Auto Close in Profit: Disabled

➡️ Implication: The EA allows profits to run while securing gains via trailing stop, instead of closing baskets too early.

🧩 Drawdown Reduction System

- Use Drawdown Reduction: true

- Reduce After Trades: 6

- Percent to Function: 4%

➡️ Key Advantage: This feature actively reduces position exposure once grid depth increases, helping stabilize equity during prolonged trends.

🧩 News Filter Settings

- News Filter: Disabled (but configured)

- High Impact News Filter: Enabled

- Stop Trading Before/After News: 120 minutes

- GMT Offset: +2

➡️ Evaluation: Although currently off, the configuration is professional and conservative, especially suitable for funded accounts when enabled.

🧩 Final Verdict – Is BlueDreams MT5 Worth Using?

✅ Strengths:

- Smart trend-filtered grid strategy.

- Conservative lot multiplier (1.2).

- Dynamic grid spacing.

- Built-in drawdown reduction.

- Equity protection & time filters.

- Suitable for prop firm and long-term accounts.

⚠️ Risks:

- No fixed Stop Loss (grid-dependent).

- Requires low starting lot size.

- Best performance depends on stable spreads.

⭐ Overall Conclusion

BlueDreams MT5 is a well-engineered, semi-conservative grid trading robot, optimized for traders who prioritize capital preservation, recovery logic, and long-term account survival over aggressive short-term gains.

When used with proper risk settings and reliable brokers, BlueDreams MT5 can be a solid choice for swing-based grid trading on major forex pairs.