🧩 What is Finvesting EA?

Finvesting EA MT4 is a professional Expert advisor (EA) built for automated Forex trading with a focus on stability, adaptability, and disciplined risk management. It analyzes market data, sentiment, and price behavior to execute trades objectively, helping traders reduce emotional decisions while maintaining consistent performance across changing market conditions.

📌📌📌 Buy this unlimited Finvesting EA MT4 product here 📌📌📌

This review breaks down each parameter group, explains how they interact, and provides a professional conclusion on performance expectations.

🧩 Risk Management Settings (Core Strength)

🔶 Lot Sizing & Risk Control

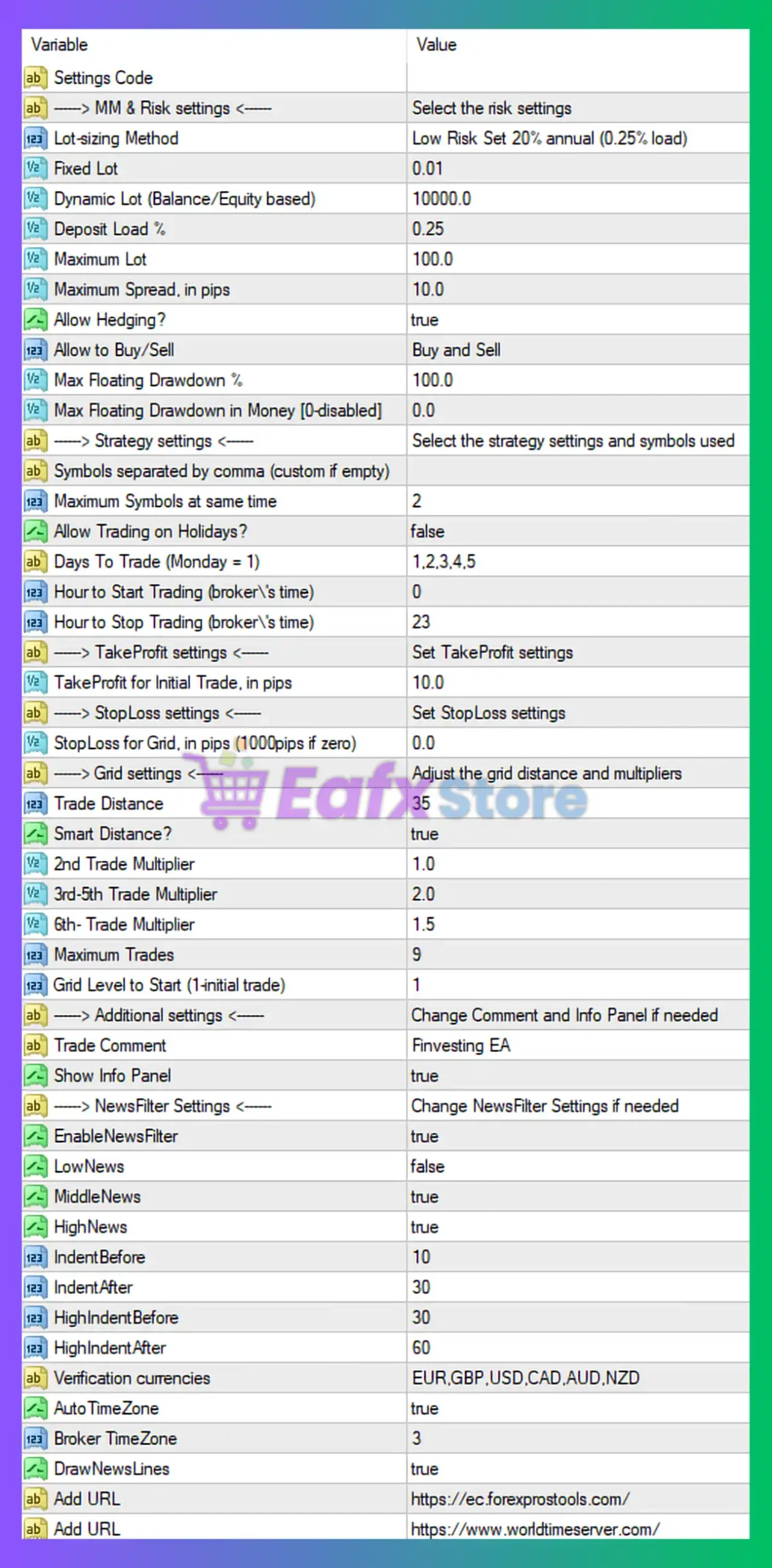

- Lot-sizing method: Low Risk – 20% annual (0.25% load)

- Fixed lot: 0.01

- Dynamic lot (Balance/Equity based): 10,000

- Deposit load: 0.25%

- Maximum lot: 100.00

🔍 Analysis:

The EA uses dynamic lot scaling, starting very conservatively. Risk per trade is extremely small, which:

- Protects against margin calls

- Makes the EA suitable for medium to large accounts

- Reduces emotional volatility

✅ Ideal for conservative traders and long-term growth

🔶 Drawdown Protection

- Max floating drawdown (%): 100.0

- Max floating drawdown (money): 0.0 (disabled)

⚠️ Observation:

While percentage drawdown protection is enabled, the value is set to 100%, effectively disabling forced equity protection. This means:

- The EA relies more on grid recovery logic

- Account survival depends on market behavior and margin

👉 Recommendation: Lower this to 30–50% for additional safety.

🧩 Trade Direction & Execution Logic

- Allow hedging: true

- Allow Buy/Sell: Buy and Sell

- Maximum symbols at same time: 2

🔍 Analysis:

The EA can:

- Open both buy and sell positions

- Hedge across market movements

- Limit exposure by trading only 2 symbols simultaneously

This significantly reduces correlation risk and overtrading.

🧩 Trading Schedule & Time Filter

- Trading days: Monday to Friday

- Trading hours: 00:00 – 23:00 (broker time)

- Allow trading on holidays: false

🔍 Analysis:

The EA trades almost 24 hours but avoids holidays, which:

- Prevents low-liquidity traps

- Improves execution quality

🧩 Take Profit & Stop Loss Settings

🔶 Take Profit

- Initial trade TP: 10 pips

🔶 Stop Loss

- Stop loss for grid: 0.0 (disabled)

🔍 Analysis:

This confirms a grid/martingale recovery strategy:

- Small take profits

- No hard stop loss

- Relies on averaging and price retracements

⚠️ This increases exposure during strong trends.

🧩 Grid Strategy Configuration (Core Engine)

- Trade distance: 35 pips

- Smart distance: true

- Grid start level: 1

- Maximum trades: 9

🔶 Lot Multipliers

- 2nd trade multiplier: 1.0

- 3rd–5th trade multiplier: 2.0

- 6th+ trade multiplier: 1.5

🔍 Analysis:

This is a moderately aggressive grid:

- Smart distance adapts to volatility

- Controlled lot progression (not classic martingale)

- Max 9 trades limits runaway exposure

✅ Balanced grid logic with risk awareness

🧩 Spread & Market Conditions Filter

- Maximum spread: 10 pips

🔍 Analysis:

Protects the EA from:

- High spreads during news

- Broker manipulation

- Low-liquidity sessions

🧩 News Filter (Advanced Protection)

- News filter enabled: true

- Middle & High impact news: true

- Low impact news: false

- Stop trading before news: 10 minutes

- Resume after news: 30 minutes

- Highlighted news window: 30–60 minutes

🔍 Analysis:

This is a professional-grade news filter:

- Avoids volatility spikes

- Reduces slippage and grid expansion

- Ideal for safer grid trading

🧩 Symbols & Currency Verification

- Allowed currencies: EUR, GBP, USD, CAD, AUD, NZD

- Auto time zone: true

- Broker time zone: GMT+3

🔍 Analysis:

Focuses on major and stable currencies, improving:

- Spread consistency

- Execution reliability

🧩 User Interface & Monitoring

- Show info panel: true

- Draw news lines: true

- Trade comment: “Finvesting EA”

📊 Enables easy monitoring and transparency.

🧩Final Conclusion – Is This a Good Finvesting EA Setup?

✅ Strengths

- Strong risk control via low lot sizing.

- Smart grid logic with capped trades.

- Advanced news filter.

- Spread and symbol limitations.

- Suitable for long-term automated trading.

⚠️ Weaknesses

- No hard stop loss.

- 100% drawdown limit is risky.

- Grid systems remain vulnerable to strong trends.

⭐ Overall Rating: 7.8 / 10

✔ Medium to large accounts.

✔ Low-risk grid trading.

✔ VPS + ECN broker.

✔ Traders who prefer slow, steady equity growth.