🧩 What is Fortune EA MT5?

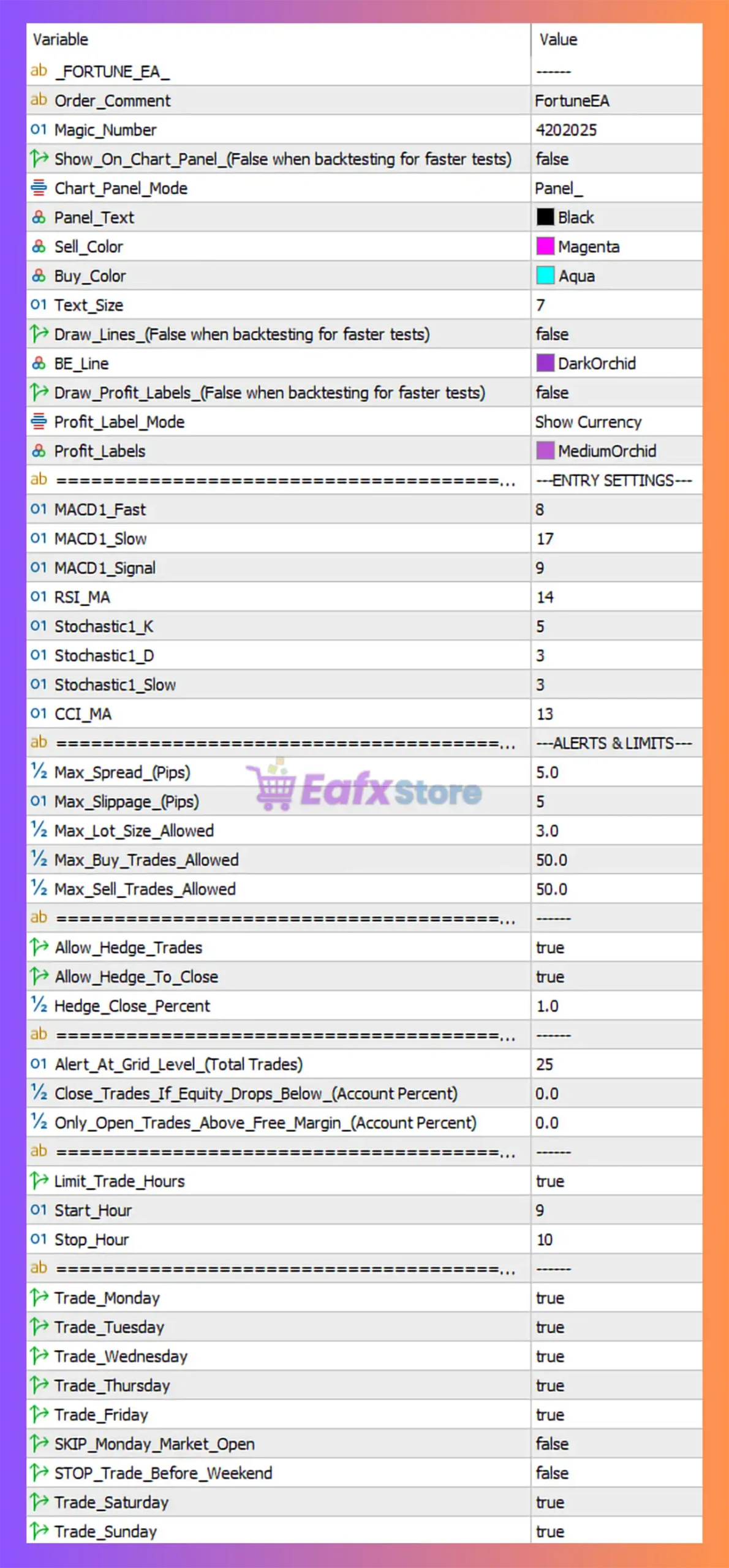

The Fortune EA MT5 is an advanced automated trading system that leverages a Dynamic Grid Strategy combined with technical oscillators. Below is a detailed breakdown of its configuration to help traders balance profitability and risk.

➡️ Vender Website: View here

🧩 Core Trading Strategy & Entry Logic

The EA does not trade blindly. It uses a sophisticated “Confluence Model” to trigger trades, ensuring entries occur during high-probability market turns.

| Feature | Variable | Technical Impact |

| Primary Trend | MACD (8, 17, 9) | Filters the mid-term trend direction. |

| Momentum | RSI (14) & CCI (13) | Identifies overbought/oversold exhaustion points. |

| Execution | Stochastic (5, 3, 3) | Pinpoints the exact entry trigger on price reversals. |

| Trading Window | 09:00 – 10:00 | Focuses on high-liquidity sessions to avoid “flat” markets. |

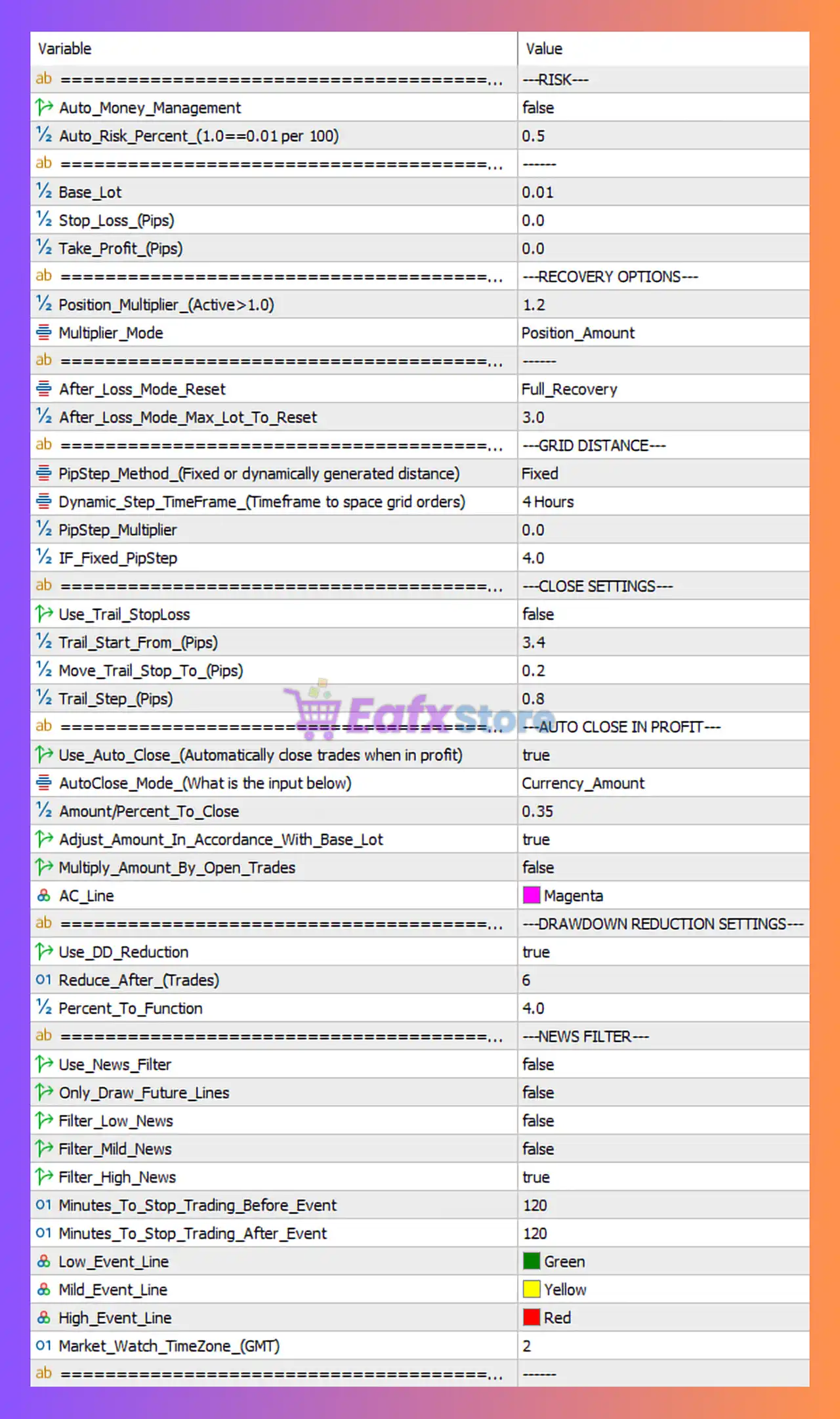

🧩 Risk Management & Recovery Settings

The “Recovery” section defines how the EA handles losing trades. It uses a conservative Martingale approach to break even faster.

| Variable | Value | Risk Assessment |

| Position Multiplier | 1.2 | Conservative. Much safer than the standard 1.5x or 2.0x multipliers. |

| Multiplier Mode | Position_Amount | Calculates the next lot based on the total exposure. |

| PipStep (Fixed) | 4.0 Pips | Aggressive. Frequent trade placement; requires low-spread ECN accounts. |

| Max Lot Size | 3.0 | A hard cap to prevent the EA from over-leveraging the account. |

🧩 The “Drawdown Reduction” Innovation

This is the standout feature of Fortune EA. It is designed to “clean up” bad trades without waiting for a full price recovery.

- Activation: Starts after 6 trades are open.

- Mechanism: It uses the profit from the newest, largest orders to close out the oldest, most negative orders (at a 4% profit threshold).

- Benefit: This lowers the “Break-Even” line, allowing the EA to exit a grid cycle much earlier during a trend.

🧩 Safety & News Filtering

| Setting | Status | Recommendation |

| News Filter | False | Action Required: Turn to True for live trading to avoid slippage. |

| Max Spread | 5.0 Pips | Protects against execution during high-volatility gaps. |

| Hedge Trades | True | Allows the EA to buy and sell simultaneously to balance equity. |

🧩 Final Verdict

🔶 Pros:

- Smart Recovery: The 1.2x multiplier and Drawdown Reduction make it more resilient than basic grid bots.

- Time-Vested: Limiting trade hours reduces exposure to unpredictable “after-hours” moves.

- Transparency: Offers clear visual labels (AC Line, BE Line) on the chart.

🔶 Cons:

- Tight Grid: A 4.0 PipStep is very sensitive to market “noise” and may lead to many open trades quickly.

- Manual News Filter: In the provided screenshot, the news filter is off, which is risky for Martingale strategies.

🧩Recommended Optimization Tips

- For Low Risk: Increase

IF_Fixed_PipStepfrom 4.0 to 12.0 – 15.0. - For Capital Safety: Ensure

Use_News_Filteris set to True with a 120-minute buffer. - Broker Choice: Use an IC Markets or Pepperstone Raw Spread account to handle the tight 4-pip grid.