🧩 What is Gold Atlas EA?

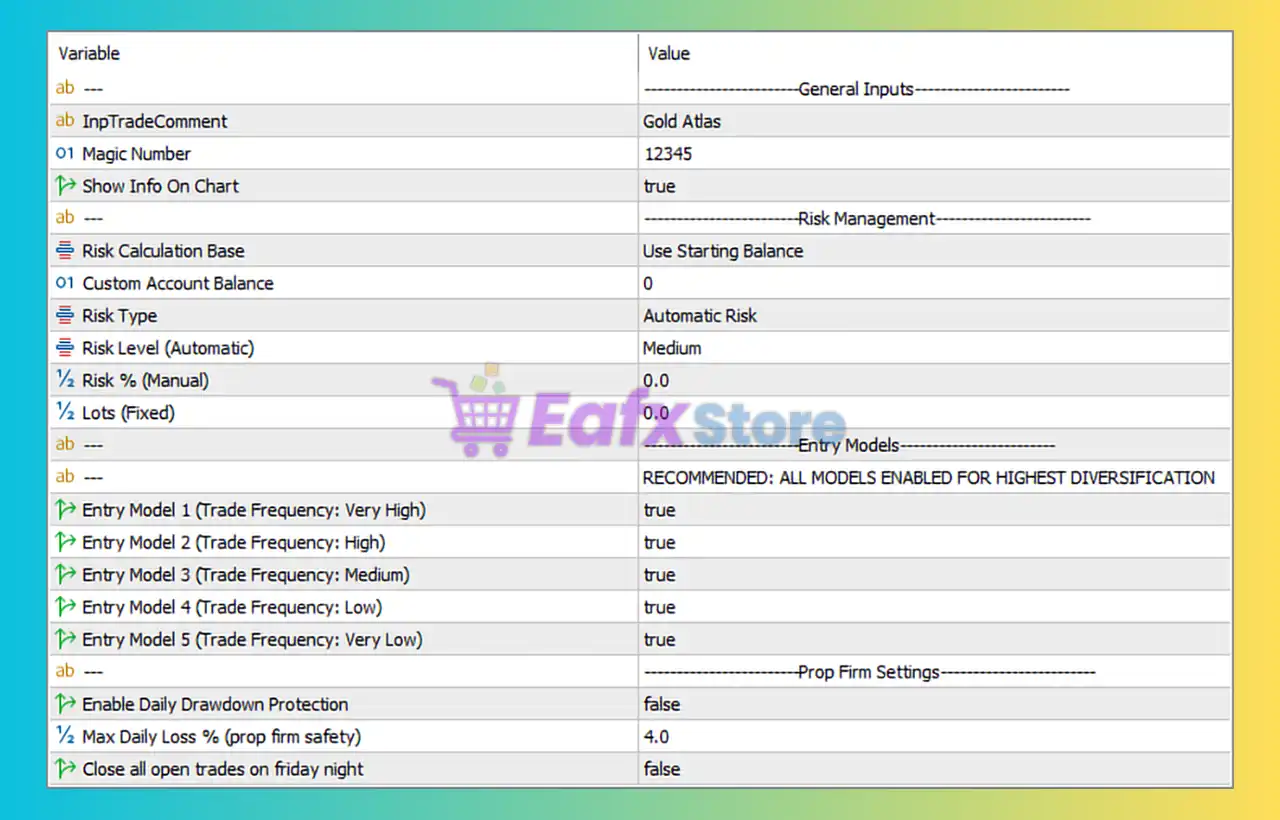

Gold Atlas EA for MT5 is an automated trading system specifically optimized for Gold (XAUUSD) trading. From the settings shown, this EA focuses on diversified entry logic, adaptive risk management, and optional prop firm compliance, making it suitable for both retail traders and funded account challenges.

This review explains each parameter group, evaluates their trading impact, and concludes with a professional assessment.

📌📌📌 Buy this unlimited Gold Atlas EA MT5 product here 📌📌📌

🧩 General Inputs

➡️ Key Parameters

- Trade Comment: “Gold Atlas”

Helps identify EA trades clearly in account history and reports. - Magic Number: 12345

A unique identifier ensuring that Gold Atlas EA trades do not conflict with other EAs or manual trades. - Show Info On Chart: true

Displays real-time trading statistics and EA status directly on the chart, improving transparency and monitoring.

✅ Assessment:

Clean and professional general setup, designed for clarity, tracking, and multi-EA environments.

🧩 Risk Management Settings

➡️ Risk Calculation

- Risk Calculation Base: Use Starting Balance

Risk is calculated based on the initial account balance instead of floating equity, ensuring consistent position sizing. - Custom Account Balance: 0

Disabled, meaning the EA uses the real account balance automatically.

➡️ Risk Type

- Risk Type: Automatic Risk

- Risk Level (Automatic): Medium

The EA dynamically calculates lot size based on a predefined “Medium” risk profile, making it beginner-friendly while still controlled.

➡️ Manual Overrides

- Risk % (Manual): 0.0

- Lots (Fixed): 0.0

These values confirm that manual risk and fixed lot sizing are disabled, allowing full automation.

✅ Assessment:

This is a well-balanced risk management model, prioritizing account stability and reducing human error.

🧩 Entry Models (Core Trading Logic)

➡️ Multi-Model Entry System

The EA enables five independent entry models, each with a different trade frequency:

- Entry Model 1 – Very High Frequency

- Entry Model 2 – High Frequency

- Entry Model 3 – Medium Frequency

- Entry Model 4 – Low Frequency

- Entry Model 5 – Very Low Frequency

👉 All entry models are set to true (enabled).

The EA itself recommends:

“All models enabled for highest diversification”

This approach allows the EA to:

- Trade in multiple market conditions

- Balance aggressive and conservative entries

- Reduce dependency on a single strategy logic

✅ Assessment:

This is a diversification-driven architecture, similar to portfolio-based trading inside one EA.

🧩 Prop Firm Safety Settings

➡️ Drawdown Protection

- Enable Daily Drawdown Protection: false

- Max Daily Loss %: 4.0

Although daily drawdown protection is currently disabled, the limit is pre-defined and can be activated when trading prop firm challenges.

➡️ Weekend Risk Control

- Close all open trades on Friday night: false

Trades are allowed to remain open over the weekend, indicating a swing-trading or position-holding strategy.

✅ Assessment:

Flexible prop firm controls allow traders to adapt the EA to funded account rules when needed.

🧩 Strategy Profile & Ideal Trader Type

➡️ Strengths

✔ Automated and adaptive risk management

✔ Multiple entry models for market diversification

✔ Clear prop firm compatibility options

✔ Optimized for Gold (XAUUSD) volatility

✔ Beginner-friendly automation with professional logic

➡️ Best Suited For

- Gold (XAUUSD) traders

- Traders seeking diversification within one EA

- Prop firm challenge participants

- Swing and intraday hybrid strategies

- Traders who prefer automated risk control

🧩 Final Conclusion – Expert Review

The Gold Atlas EA settings displayed in the image reveal a robust, diversified, and risk-aware automated trading system. Its biggest advantage lies in the multi-entry model framework, which allows the EA to adapt across varying Gold market conditions.

By combining:

- Medium automatic risk

- Multiple trade frequencies

- Optional prop firm safety rules

Gold Atlas EA positions itself as a professional-grade Gold trading EA, suitable for both conservative and growth-oriented traders.