What is Gold BO ATR EA?

The Gold BO ATR MT5 configuration indicates a structured trading system focused on time-regulated operation, controlled risk, multi-order flexibility, and trailing stop-based profit management. This setup suggests the EA is optimized for Gold trading sessions with stability and risk control in mind.

📌📌📌 Buy this unlimited Gold BO ATR MT5 product here 📌📌📌

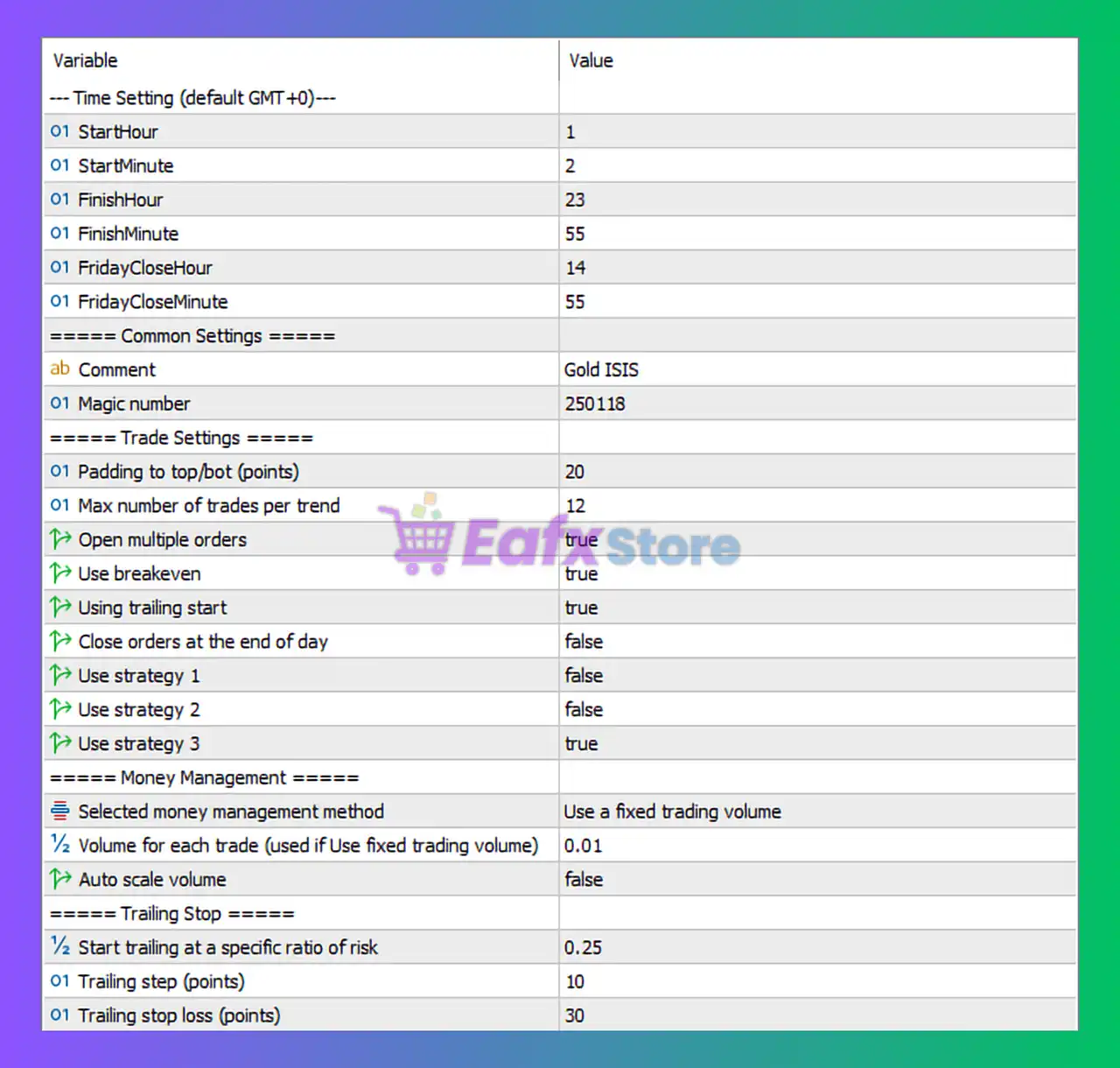

1. Time Settings

- Start trading: 01:02 → The EA begins trading early in the session.

- End trading: 23:55 → Operates almost the entire day.

- Friday trading cut-off: 14:55 → Reduces overnight/weekend gap risk.

➡️ This configuration helps avoid high-risk weekend volatility and ensures continuous market coverage.

2. Common Settings

- Comment: Gold ISIS (internal tag for tracking)

- Magic Number: 250118: Unique ID for trade recognition and multi-EA compatibility.

➡️ Useful for portfolio trading to avoid trade conflict with other EAs.

3. Trade Settings

| Parameter | Value | Interpretation |

|---|---|---|

| Padding to top/bot (points) | 20 | Market buffer to avoid impulsive entries |

| Max orders per trend | 12 | Allows scaling into trends with multiple positions |

| Open multiple orders | true | Supports multi-position strategy |

| Use breakeven | true | Protects capital once trade is favorable |

| Using trailing start | true | Locks profit dynamically |

| Strategy usage | Strategy 3 only | Indicates the EA is configured to operate one strategy setup |

➡️ The EA is trend-adaptive with controlled pyramiding, using breakeven and trailing SL to secure profits. Strategy 3 being enabled suggests the selected approach may be optimized for XAUUSD volatility patterns.

4. Money Management

- Method: Fixed lot volume

- Volume per trade: 0.01

- Auto-scale volume: false

➡️ This reflects a conservative risk mode, suitable for small-medium accounts. No lot scaling reduces drawdown risk and provides stable, predictable exposure.

5. Trailing Stop Configuration

| Parameter | Value | Meaning |

|---|---|---|

| Risk ratio for trailing activation | 0.25 | Trailing activates when profit reaches 25% of risk target |

| Trailing step | 10 points | Tight step helps secure profits quickly |

| Trailing stop loss | 30 points | Maintains working room while controlling risk |

➡️ The trailing setup is tight and responsive, designed for active volatility environments like Gold. It aims to protect gains quickly while still allowing trend continuation.

Conclusion

In short, Gold BO ATR is configured for nearly full-day trading with Friday risk reduction, multi-order trend management, fixed conservative lot sizing, and a protective breakeven + trailing stop system. The EA prioritizes steady growth, controlled exposure, and smart profit locking, making it a solid option for Gold traders seeking safety-focused automation with scalable potential. With strategy 3 activated and up to 12 orders per trend, it is suitable for trending markets and medium-long trade cycles while maintaining strong risk control.