🧩 What is Golden Zephyr EA MT5?

Golden Zephyr EA is an automated trading system designed with clear risk controls, directional flexibility, and built-in news protection. Based on the settings shown, this Expert advisor (EA) appears to target stable, rules-based trading rather than aggressive growth, making it suitable for disciplined traders and prop-firm style environments.

📌📌📌 Buy this unlimited Golden Zephyr EA MT5 product here 📌📌📌

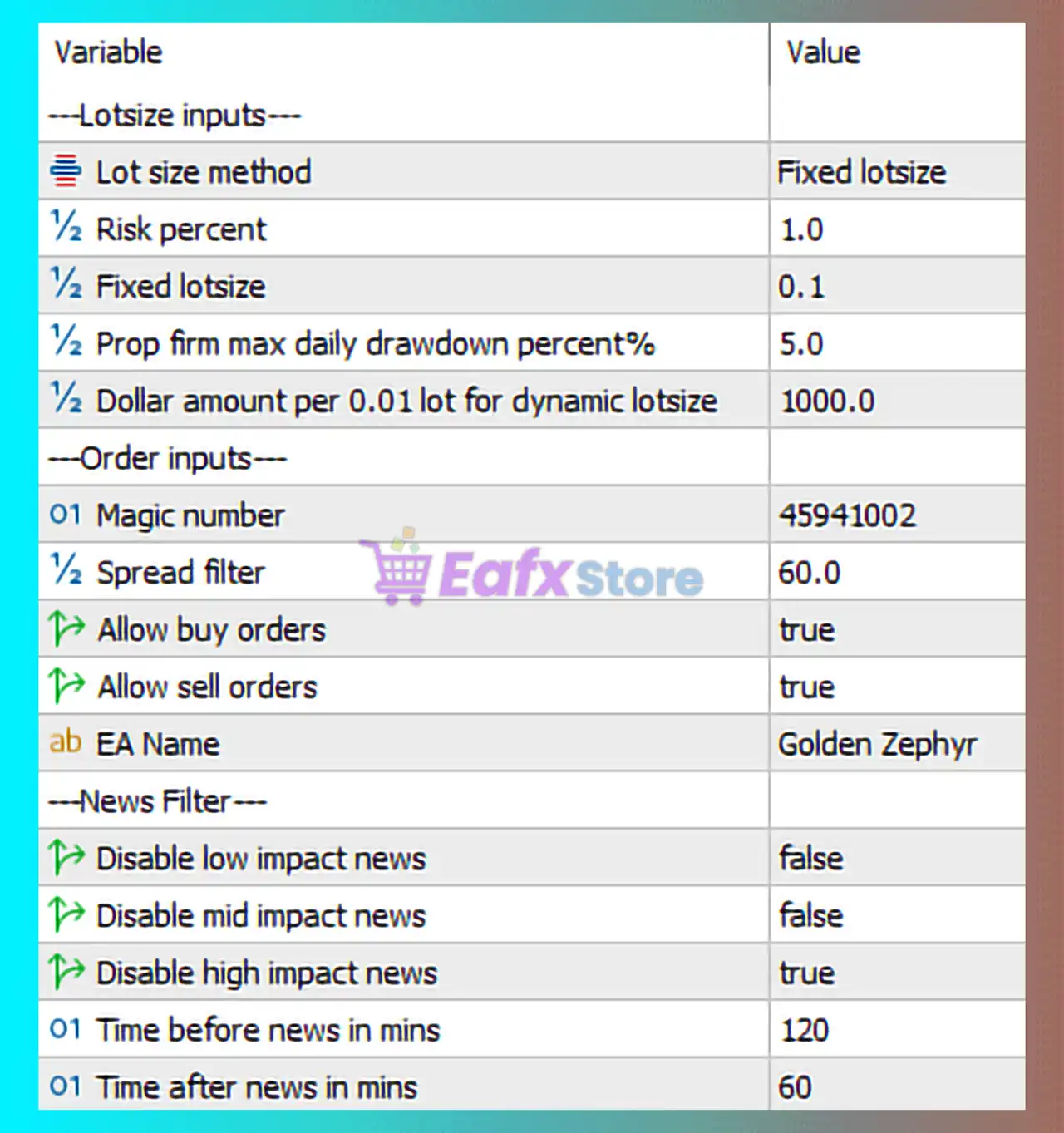

🧩 Lot Size & Risk Management Settings

Lot Sizing Configuration

- Lot size method: Fixed lotsize

- Fixed lotsize: 0.1

- Risk percent: 1.0 (inactive due to fixed lot mode)

- Dollar amount per 0.01 lot (dynamic): 1000.0

- Prop firm max daily drawdown: 5.0%

📊 Analysis:

- The EA uses a fixed lot size of 0.1, regardless of account balance.

- Risk percent and dollar-based sizing are ignored in this mode.

- The presence of a prop firm drawdown parameter indicates the EA is designed with funded account rules in mind.

⚠️ Risk Note:

- A fixed lot of 0.1 can be aggressive on small accounts, but reasonable on balances of $5,000+ (especially on Gold or major FX pairs).

✅ Strengths:

- Predictable risk per trade

- No martingale or lot escalation

- Prop-firm compatible structure

🧩 Order & Execution Settings

Core Order Controls

- Magic Number: 45941002

- Spread filter: 60.0

- Allow Buy Orders: true

- Allow Sell Orders: true

- EA Name: Golden Zephyr

📌 Interpretation:

- Trades both long and short positions.

- Spread filter prevents trading during high-spread or low-liquidity conditions.

- Magic number ensures clean separation from other EAs or manual trades.

✅ Assessment:

This setup favors stable execution and controlled entries, avoiding poor fills during volatile market moments.

🧩 News Filter & Fundamental Risk Control

News Filter Configuration

- Disable Low Impact News: false

- Disable Mid Impact News: false

- Disable High Impact News: true

- Time before news: 120 minutes

- Time after news: 60 minutes

📰 Analysis:

- Trading is blocked only during high-impact news events.

- EA stops trading 2 hours before and 1 hour after major news.

- Medium and low impact news do not affect trading.

🚨 Key Insight:

This is a balanced and professional news filter setup, especially suitable for:

- Gold (XAUUSD)

- USD-based pairs

- Volatile sessions (London & New York)

🧩 Overall Trading Behavior & Strategy Style

Based on the settings, Golden Zephyr EA follows a strategy that emphasizes:

- Fixed exposure per trade

- Bidirectional market participation

- Spread and news protection

- Compliance with prop firm rules

🧠 Implied Trading Style:

- Swing or intraday trading

- Moderate trade frequency

- Focus on quality entries over quantity

🧩 Risk Profile Summary

| Component | Risk Level |

|---|---|

| Fixed lot (0.1) | Medium |

| No martingale/grid | Low |

| Spread filter enabled | Low |

| High-impact news filter | Low |

| Prop firm drawdown logic | Low |

| Dynamic risk disabled | Neutral |

📊 Overall Risk Level: Medium (well-controlled)

🧩 Who Should Use This Configuration?

✅ Best For:

- Accounts $5,000 – $25,000

- Prop firm challenges & funded accounts

- Traders who prefer rule-based automation

- Gold and major FX pair traders

❌ Not Ideal For:

- Very small accounts (< $1,000)

- Traders wanting aggressive compounding

- Scalping strategies with ultra-tight spreads

🧩 Final Conclusion – Golden Zephyr EA MT5 Settings Review

With the configuration shown, Golden Zephyr EA MT5 presents a disciplined, professional-grade automated trading setup, focused on risk control, news protection, and execution quality.

✔️ Key Strengths

- Fixed, predictable lot sizing

- High-impact news filtering enabled

- Spread protection

- No martingale or recovery logic

- Prop-firm friendly structure

⚠️ Key Limitations

- Fixed lot size may be aggressive for small balances

- No dynamic risk adjustment

- Strategy performance highly dependent on symbol volatility

⭐ Final Verdict

Golden Zephyr EA MT5, using these settings, is a medium-risk, well-controlled trading EA suitable for traders seeking consistency over aggression. When paired with adequate account size and proper broker conditions, this setup is well-aligned with modern prop firm and risk-managed trading requirements.