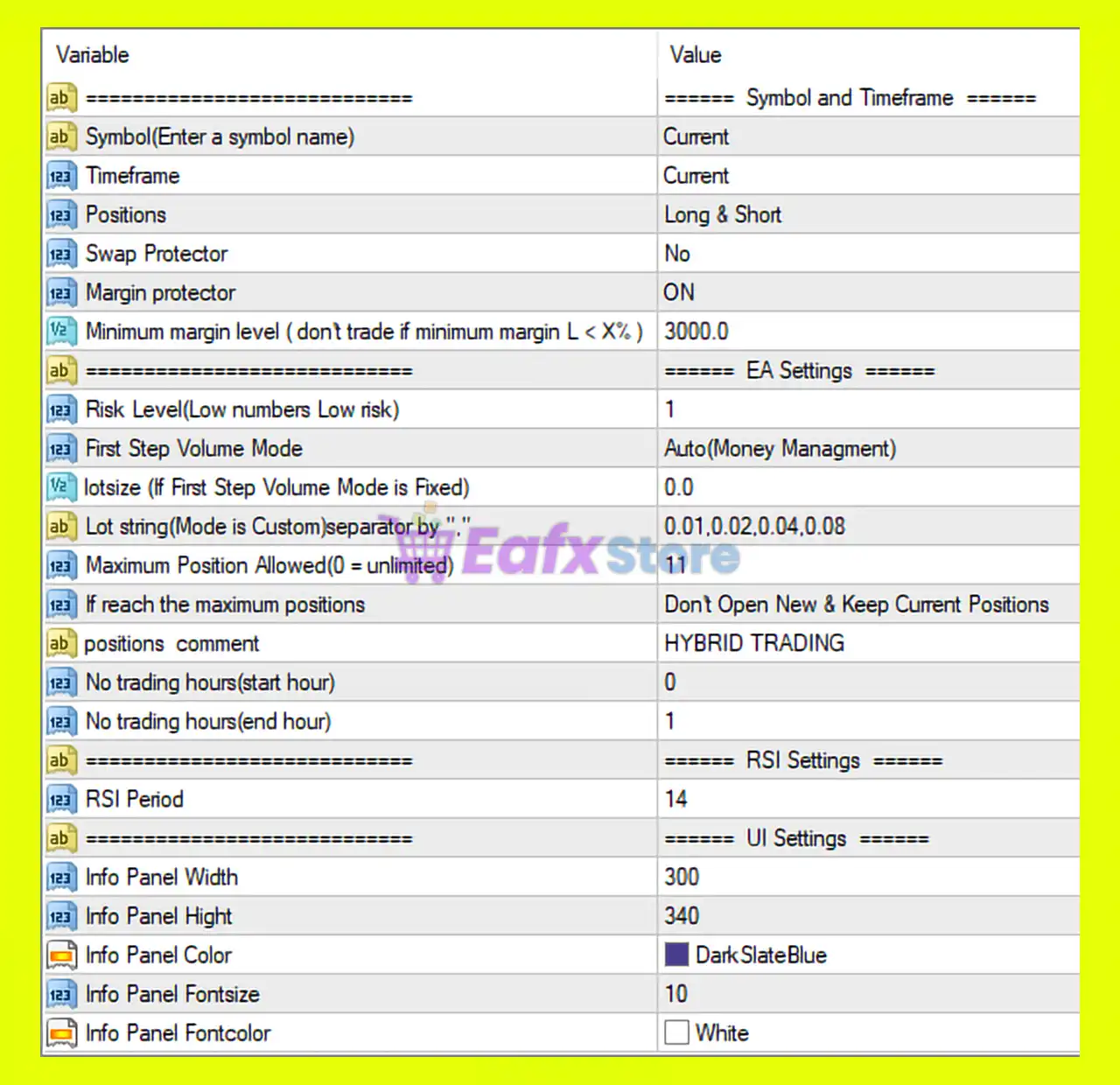

🧩What is Hybrid Trading RSI Divergence MT4?

The settings shown belong to Hybrid Trading RSI Divergence, an MT4 Expert Advisor (EA) built around RSI divergence logic combined with hybrid position management.

From the parameters, this EA is designed for balanced risk trading, allowing multiple positions, automatic money management, and both long & short market exposure.

This configuration emphasizes controlled scaling, margin safety, and signal-based entries, rather than aggressive grid or martingale behavior.

🧩Symbol & Timeframe Settings

- Symbol: Current

- Timeframe: Current

✅ Analysis:

The EA automatically adapts to the chart symbol and timeframe it is attached to. This provides flexibility but requires the trader to choose an appropriate timeframe (commonly M15–H1 for RSI divergence strategies).

🧩Position & Exposure Management

- Positions: Long & Short

→ EA trades both BUY and SELL setups. - Maximum Positions Allowed: 11

- If reach the maximum positions: Don’t Open New & Keep Current Positions

✅ Analysis:

This ensures the EA never overexposes the account. Once the limit is reached, risk is capped and no further trades are opened.

🧩Swap & Margin Protection

- Swap Protector: No

- Margin Protector: ON

- Minimum Margin Level: 3000%

🔒 Risk Control Insight:

- EA will stop opening trades if margin level falls below 3000%.

- This is a very conservative safety threshold, ideal for account protection.

✅ Analysis:

Excellent for preventing margin calls and forced liquidation, especially when multiple positions are open.

🧩Risk & Money Management Settings

🔹 Risk Profile

- Risk Level: 1 (Low Risk)

→ Lowest risk setting.

🔹 Lot Management

- First Step Volume Mode: Auto (Money Management)

- Lotsize (if fixed): 0.0

- Lot String: 0.01, 0.02, 0.04, 0.08

📌 Explanation:

The EA uses progressive lot scaling, but only within predefined and limited steps.

⚠ Important:

- This is NOT classic martingale.

- Lot increases are controlled and capped by max positions.

✅ Analysis:

This approach balances profit acceleration and drawdown control, suitable for intermediate traders.

🧩Trading Hours Control

- No Trading Hours (Start): 0

- No Trading Hours (End): 1

🕒 Interpretation:

EA avoids trading during the 00:00 – 01:00 server time window, typically:

- Low liquidity

- Spread widening

- Session rollover

✅ Analysis:

This is a smart filter to reduce poor-quality entries.

🧩Strategy Core – RSI Settings

- RSI Period: 14

📊 Strategy Insight:

RSI 14 is the industry standard for divergence detection, suitable for:

- Reversal entries

- Trend exhaustion zones

✅ Analysis:

This confirms the EA is focused on technical accuracy rather than overfitting.

🧩User Interface (UI) Settings

- Info Panel Width: 300

- Info Panel Height: 340

- Panel Color: DarkSlateBlue

- Font Size: 10

- Font Color: White

🧩 Analysis:

Purely visual settings. They do not affect trading performance but improve monitoring clarity.

🧩Final Conclusion – Is This a Good Hybrid Trading RSI Divergence Setup?

✅ Strengths

✔ Low risk level (Risk = 1)

✔ Strong margin protection (3000%)

✔ Controlled multi-position strategy

✔ No aggressive martingale

✔ Trades both market directions

✔ Avoids low-liquidity trading hours

✔ Proven RSI divergence logic

⚠ Potential Weaknesses

✘ No swap protection (not ideal for long-term holding)

✘ Requires correct timeframe selection

✘ Multiple positions can still increase drawdown if market trends strongly

⭐ Overall Verdict

Hybrid Trading RSI Divergence MT4, with the settings shown, is a low-risk, technically driven automated trading system that focuses on RSI divergence signals combined with strict margin and position control.

This setup is best suited for:

- Conservative to moderate traders

- Accounts prioritizing capital protection

- Traders avoiding grid & full martingale systems

- Medium-term automated trading (scalping to intraday)

➡️ Overall Rating: ⭐⭐⭐⭐☆ (4.4 / 5)