🧩 Overview of Ilan Dynamic Pro EA

Ilan Dynamic Pro is an advanced grid-based automated trading system that combines dynamic lot sizing, technical indicators, and trailing stop logic. Based on the configuration shown in the image, this EA is optimized for moderate-to-high risk trading, targeting consistent profits during ranging and corrective market conditions rather than strong trends.

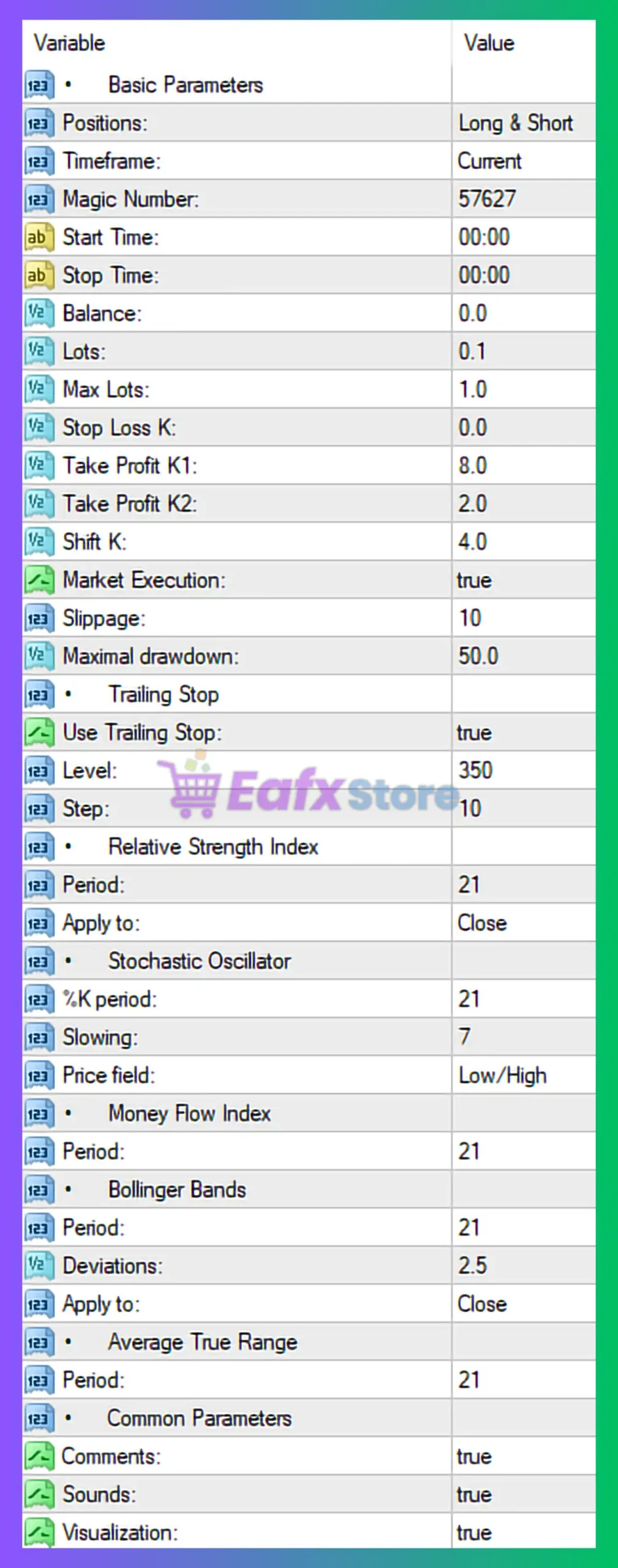

🧩 BASIC PARAMETERS – Core Trading Configuration

1. Position & Trade Direction

- Positions: Long & Short

- EA can open both buy and sell positions.

- Enables profit opportunities in both bullish and bearish markets.

- Timeframe: Current

- Trades on the chart timeframe.

- Performance depends heavily on timeframe selection (best on M15–H1).

- Magic Number: 57627

- Unique identifier for EA-managed trades.

2. Trading Session & Lot Control

- Start Time: 00:00 | Stop Time: 00:00

- No time restriction.

- EA trades 24/5.

- Balance: 0.0

- Uses real account balance.

- Lots: 0.1

- Starting lot size is relatively aggressive.

- Suitable only for well-capitalized accounts.

- Max Lots: 1.0

- Caps maximum exposure.

- Helps prevent uncontrolled lot escalation.

✅ Risk is partially controlled by max lot limitation.

3. Profit, Stop & Grid Logic

- Stop Loss K: 0.0

- No fixed stop loss.

- EA relies on grid recovery and trailing stop logic.

- Take Profit K1: 8.0

- Take Profit K2: 2.0

- Dynamic profit coefficients.

- Adjust take profit levels based on market conditions and trade sequence.

- Shift K: 4.0

- Controls grid spacing between orders.

- Wider spacing reduces trade frequency but increases holding time.

4. Execution & Risk Protection

- Market Execution: true

- Uses market orders instead of pending orders.

- Slippage: 10

- Allows higher slippage.

- Suitable for volatile conditions but may increase execution cost.

- Maximal Drawdown: 50.0

- EA stops trading after 50% drawdown.

- High risk tolerance setting.

⚠️ This drawdown level is very aggressive for most traders.

🧩 TRAILING STOP SETTINGS

- Use Trailing Stop: true

- Enables dynamic trade exit.

- Level: 350

- Step: 10

- Trailing stop activates after price moves 350 points in profit.

- Adjusts every 10 points.

🔍 Helps lock profits during favorable moves but activates relatively late.

🧩 INDICATOR-BASED ENTRY SYSTEM

5. Relative Strength Index (RSI)

- Period: 21

- Apply to: Close

- Detects overbought and oversold conditions.

- Longer period reduces false signals.

6. Stochastic Oscillator

- %K Period: 21

- Slowing: 7

- Price Field: Low/High

- Confirms momentum reversals.

- Works well in sideways markets.

7. Money Flow Index (MFI)

- Period: 21

- Combines volume and price analysis.

- Filters weak signals.

8. Bollinger Bands

- Period: 21

- Deviations: 2.5

- Apply to: Close

- Identifies volatility expansion and price extremes.

9. Average True Range (ATR)

- Period: 21

- Measures volatility.

- Used to dynamically adapt grid spacing and trade logic.

🧩 COMMON PARAMETERS & USER INTERFACE

- Comments: true

- Sounds: true

- Visualization: true

Provides real-time monitoring and alerts.

🧩 Overall Trading Profile

| Aspect | Evaluation |

|---|---|

| Risk Level | Medium – High |

| Trading Style | Grid + Indicator Confirmation |

| Stop Loss | Not Used |

| Max Drawdown | 50% |

| Market Type | Ranging / Corrective |

| Lot Size | Aggressive |

| Best Timeframe | M15 – H1 |

| Suitable Account | Medium to Large |

🧩 Final Conclusion

Based on the displayed settings, Ilan Dynamic Pro EA is configured as a high-performance grid trading robot that leverages multiple technical indicators and trailing stop mechanisms to capture market retracements. The Expert Advisor (EA) is designed for experienced traders who understand grid-based risk and can tolerate deep drawdowns during unfavorable market conditions.

✅ Strengths:

- Multi-indicator confirmation system

- Dynamic take profit logic

- Trailing stop for profit protection

- Max lot limitation to control exposure

- Trades both long and short

⚠️ Weaknesses:

- No hard stop loss

- High starting lot (0.1)

- Large allowed drawdown (50%)

- Sensitive to strong trending markets

🔑 Best Use Case:

- Well-funded accounts

- Sideways or mildly trending markets

- Traders seeking aggressive profit potential

🚫 Not Recommended For:

- Small accounts

- Conservative or beginner traders

- High-impact news periods