What is Orion Gold Scalper EA?

The Orion Gold Scalper EA is an automated trading tool designed to help traders profit from the gold market. It is built for the MetaTrader 4 (MT4) platform and uses a combination of AI technology, scalping strategies, and risk management features to identify and capitalize on trading opportunities.

Orion Gold Scalper EA’s performance has been verified by Myfxbook in January 2024. The results showed a total profit gain of +13.42% with a moderate drawdown of 15.93%, demonstrating the advisor’s potential for profitable trading.

- View Transaction Results: View Here

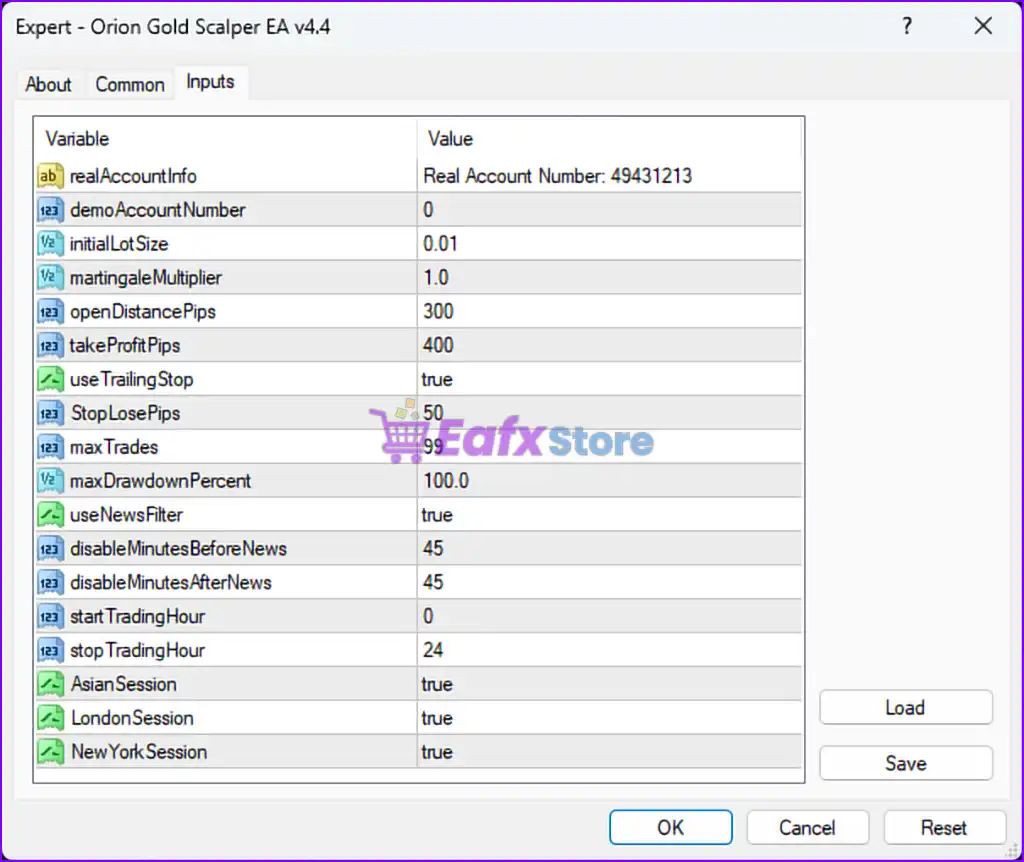

Installation panel Parameters

Below are the details of the parameters in the advisor’s trading system settings table:

1. General Account Information:

- realAccountInfo:

Real Account Number: 49431213- Indicates the EA is running on a real trading account with the specified account number.

- demoAccountNumber:

0- Demonstrates that this EA is not configured for demo accounts.

2. Lot Sizing and Risk Management:

- initialLotSize:

0.01- The starting lot size for trades, suitable for small accounts or low-risk trading.

- martingaleMultiplier:

1.0- The multiplier for lot size after a losing trade. A value of 1.0 indicates no Martingale strategy is in use.

3. Trading Parameters:

- openDistancePips:

300- The minimum distance in pips between trades. This ensures the EA does not place trades too close to one another, reducing overtrading.

- takeProfitPips:

400- The take-profit level is set to 400 pips. This is a relatively high TP and aligns with a scalping strategy aimed at large moves.

- StopLosePips:

50- The stop-loss is set to 50 pips, which provides a risk-to-reward ratio of 1:8 (SL to TP). This is aggressive and assumes a high win rate.

- useTrailingStop:

true- Trailing stops are enabled, allowing trades to lock in profits dynamically as the market moves in favor.

4. Trade Limits:

- maxTrades:

99- The EA can open up to 99 trades at a time. This is a very high limit and may need to be adjusted based on account size and trading style.

- maxDrawdownPercent:

100.0- The maximum drawdown is set to 100% of the account balance. This effectively disables drawdown protection and may expose the account to complete loss.

5. News and Time Management:

- useNewsFilter:

true- The EA uses a news filter to avoid trading during high-impact economic events.

- disableMinutesBeforeNews:

45- Stops trading 45 minutes before a high-impact news event.

- disableMinutesAfterNews:

45- Resumes trading 45 minutes after a high-impact news event. This ensures the EA avoids volatile market conditions.

- startTradingHour:

0- The EA starts trading at midnight.

- stopTradingHour:

24- The EA trades continuously until the end of the day.

6. Session Filters:

- AsianSession:

true- Allows trading during the Asian market session.

- LondonSession:

true- Allows trading during the London market session.

- NewYorkSession:

true- Allows trading during the New York market session.

Analysis and Recommendations

1. Risk and Reward:

- Aggressive Risk-to-Reward Ratio:

- The SL (50 pips) vs. TP (400 pips) represents a very favorable 1:8 ratio. However, such a wide TP may lead to fewer successful trades, especially in volatile markets like gold.

- Consider testing with a slightly reduced TP for more frequent trade closures.

- Drawdown Protection: The max drawdown is set to 100%, effectively disabling it. This can be very risky. Reduce it to a reasonable percentage (e.g., 20-30%) to safeguard your account.

2. Trade Limits:

- Max Trades: Allowing 99 trades simultaneously may lead to overexposure, especially during market volatility. Reducing this to a smaller number (e.g., 5-10) is recommended for safer trading.

- Martingale Multiplier: The multiplier is set to 1.0, which means no Martingale is applied. This is a safer approach, but if Martingale is enabled in the future, closely monitor the drawdowns.

3. News Filter:

- Effective News Management: The news filter is a great risk mitigation tool. The 45-minute buffer before and after news is adequate for avoiding volatile spikes.

4. Session-Based Trading:

- All Session Enabled: The EA trades during the Asian, London, and New York sessions, ensuring full market coverage. However, some sessions may be less optimal for scalping gold. Monitor performance during each session to identify the most profitable periods.

Recommendations for Use

- Backtest and Optimize: Backtest the EA on historical data to verify its effectiveness with the given TP and SL settings. Optimize for different timeframes or sessions if needed.

- Adjust Risk Parameters: Enable drawdown protection by setting a reasonable percentage (e.g., 20-30%) to limit potential losses.

- Reduce Max Trades: Limit the number of simultaneous trades to avoid overexposure, especially in volatile conditions.

- Use Smaller Take Profit: Consider reducing the TP to improve the trade closure rate, especially in fluctuating market conditions.

- Monitor Session Performance: Analyze which sessions yield the best results and consider disabling less profitable ones.

Conclude

The Orion Gold Scalper EA is designed for scalping with wide take-profit and tight stop-loss levels, making it a high-reward but potentially high-risk strategy. Its use of news filtering and multi-session trading enhances flexibility, but the lack of drawdown protection and high trade limits could pose significant risks. Proper testing and parameter optimization are crucial for maximizing its performance while minimizing exposure.