Pip Locker Pro EA Overview

Pip Locker Pro EA is a cutting-edge Forex trading software designed for the MetaTrader 4 (MT4) platform. This expert advisor (EA) is built to automate trading decisions and identify highly profitable opportunities in the Forex market with precision.

Through extensive testing, Pip Locker Pro EA has delivered remarkable results. With an initial capital of just $1,000, the EA successfully grew the account to nearly $25,000 in just three months. This showcases its high-performance strategy and potential for substantial profit.

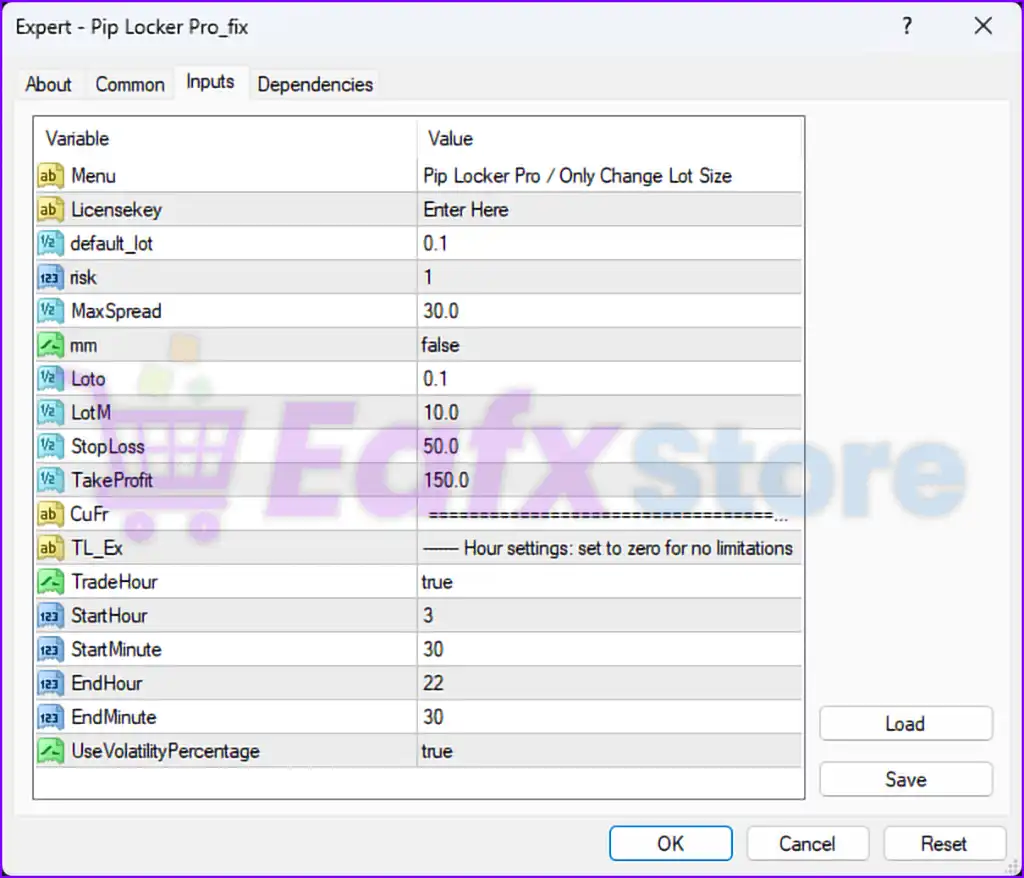

Installation Panel Details

1. General Settings

- Menu:

Pip Locker Pro / Only Change Lot Size- This suggests the EA focuses on lot size adjustments, possibly allowing manual configuration of risk and money management.

- Licensekey:

Enter Here- The EA requires a license key for activation.

2. Lot and Risk Management

- default_lot:

0.1- The EA starts with a fixed lot size of 0.1 lots per trade.

- risk:

1- This could indicate 1% risk per trade or a risk level setting that dynamically adjusts lot size.

- MaxSpread:

30.0- The EA will not execute trades if the spread is above 30 pips, which is relatively high and could lead to costly trades in low-liquidity conditions.

- mm (Money Management):

false- Disables automatic money management, meaning lot size does not adjust dynamically based on account balance.

- Loto:

0.1- Another reference to lot size, likely reinforcing the fixed lot size setting.

- LotM (Maximum Lot Size):

10.0- The maximum lot size per trade is 10 lots, preventing excessive exposure.

3. Stop-Loss and Take-Profit

- StopLoss:

50.0- The stop-loss is set to 50 pips, meaning trades are exited at this loss threshold.

- TakeProfit:

150.0- The take-profit is set to 150 pips, resulting in a risk-to-reward ratio of 1:3, which is a favorable setup.

4. Time Filters for Trading

- TradeHour:

true- The EA follows specific trading hours rather than running continuously.

- StartHour:

3, StartMinute:30- Trading starts at 03:30 AM.

- EndHour:

22, EndMinute:30- Trading stops at 10:30 PM, covering the major trading sessions but avoiding the late-night low-liquidity period.

5. Volatility-Based Trading

- UseVolatilityPercentage:

true- This enables volatility-based adjustments in trade execution, possibly modifying entry/exit points based on market conditions.

Analysis and Recommendations

1. Positive Aspects

- Good Risk-to-Reward Ratio

- A 1:3 (SL:TP = 50:150 pips) means profitable trades can recover multiple losses.

- Trading Time Control

- The EA avoids low-liquidity periods by restricting trading between 03:30 AM – 10:30 PM.

- Volatility-Based Adjustments

- With

UseVolatilityPercentage = true, the EA adapts to market conditions, possibly avoiding bad entries during extreme volatility.

- With

2. Potential Issues & Improvements

- High Max Spread Allowed (

30 pips)- 30 pips is excessive for most currency pairs.

- Recommended: Reduce MaxSpread to 5-10 pips to avoid poor trade executions.

- Fixed Lot Size (

mm = false)- Disabling money management (

mm = false) means trades won’t scale with account size. - Recommended: Enable dynamic lot sizing if capital grows.

- Disabling money management (

- Stop-Loss May Be Too Tight for Some Pairs

- A 50-pip SL is small for high-volatility pairs like XAUUSD (Gold).

- Recommended: Adjust SL based on ATR (Average True Range).

- Maximum Lot (

10 lots) Could Be Risky- Allowing up to 10 lots per trade can lead to large drawdowns.

- Recommended: Limit max lot size to 2-5 lots unless trading a large account.

Recommended Settings for Optimization

| Parameter | Current Value | Suggested Value |

|---|---|---|

| Max Spread | 30 pips | 5-10 pips |

| Stop-Loss | 50 pips | 50-100 pips (Based on ATR) |

| Take-Profit | 150 pips | 100-200 pips (Based on strategy) |

| Money Management (mm) | false | true (Enable Auto Lot Sizing) |

Max Lot (LotM) | 10.0 | 2-5 (Depends on risk appetite) |

Final Summary

Pip Locker Pro EA is a structured trading system with controlled lot sizing, trading hours, and a good risk-reward setup. However, it needs spread limitations, better SL/TP tuning, and dynamic lot sizing for improved risk management.