The Matrix Mind AI MT4 Overview

The Matrix Mind AI sets a new benchmark in Forex trading by integrating advanced matrix factorization techniques to reveal hidden market patterns. Unlike conventional trading advisors, it goes beyond text and graphical AI, delivering precise, noise-filtered signals and dynamically adapting to market shifts.

Designed for traders of all levels—prop firms, experienced investors, and even beginners—The Matrix Mind AI offers a strategic edge in XAUUSD trading. With a minimum deposit of just $100 and optimal performance on ECN or raw spread accounts, this expert advisor ensures flexibility, risk optimization, and enhanced profitability.

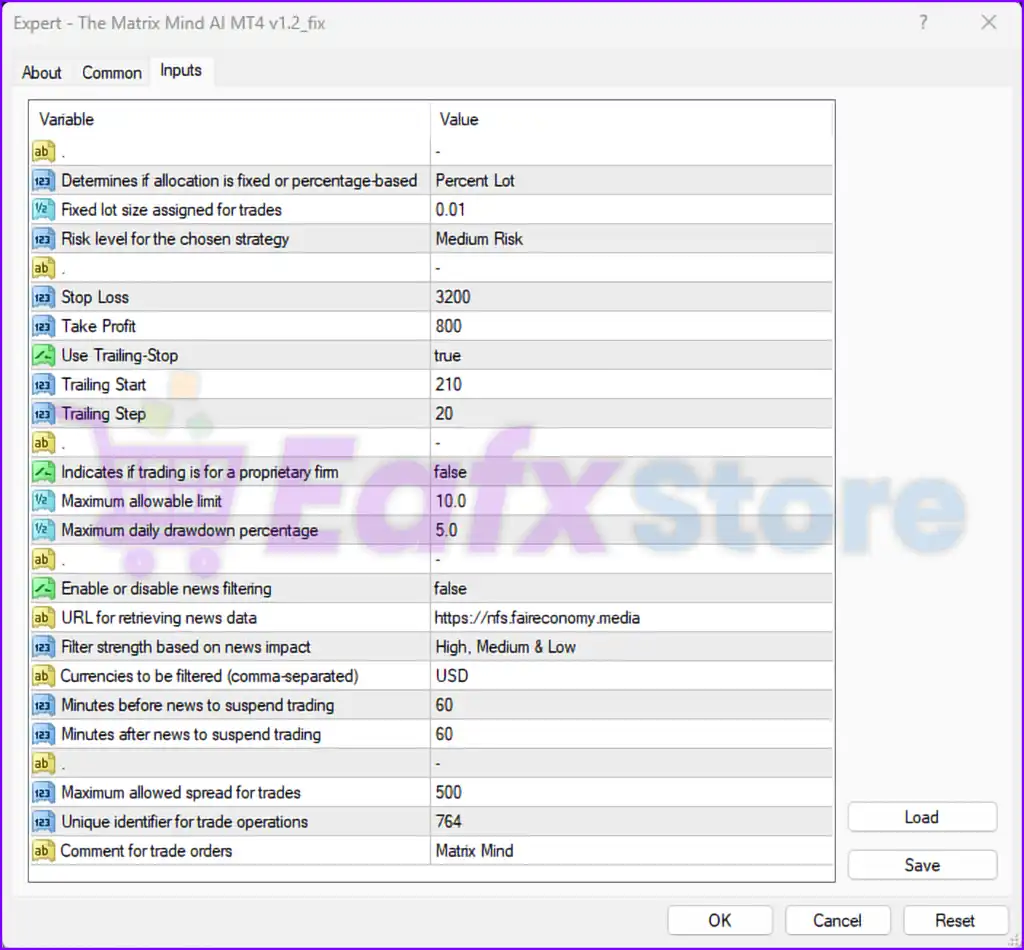

1. Lot Sizing and Risk Management

- Determines if allocation is fixed or percentage-based:

Percent Lot- The EA uses a percentage-based lot sizing method rather than a fixed lot size. This allows for dynamic risk scaling based on account size.

- Fixed lot size assigned for trades:

0.01- If fixed lot sizing were enabled, each trade would open with 0.01 lots.

- Risk level for the chosen strategy:

Medium Risk- The EA operates under a medium-risk setting, suggesting a balance between conservative and aggressive trading.

2. Stop-Loss and Take-Profit

- Stop Loss:

3200- The stop-loss is set at 3200 points (320 pips), which is quite large. This suggests the EA holds trades longer, possibly using a trend-following strategy.

- Take Profit:

800- The take-profit is set at 800 points (80 pips), meaning the risk-to-reward ratio is approximately 4:1 (SL:TP). This ratio is not ideal since the risk is much higher than the reward.

3. Trailing Stop Features

- Use Trailing-Stop:

true- The EA employs a trailing stop to lock in profits as the trade moves in a favorable direction.

- Trailing Start:

210- The trailing stop activates once the trade reaches 210 points (21 pips) in profit.

- Trailing Step:

20- The trailing stop moves in 20-point (2 pip) increments as the price continues moving in a favorable direction.

4. Proprietary Trading Firm Settings

- Indicates if trading is for a proprietary firm:

false- The EA is not configured specifically for prop firm challenges or accounts.

- Maximum allowable limit:

10.0- The maximum lot size the EA can trade is capped at 10 lots.

- Maximum daily drawdown percentage:

5.0- The EA will stop trading or take risk-mitigating actions if the account experiences a 5% drawdown in a single day.

5. News Filtering

- Enable or disable news filtering:

false- News filtering is disabled, meaning the EA will not pause trading during high-impact news events.

- URL for retrieving news data:

https://rfs.faireconomy.media- The EA can fetch news data from this source if news filtering is enabled.

- Filter strength based on news impact:

High, Medium & Low- The EA can filter trades based on all levels of news impact if news filtering is enabled.

- Currencies to be filtered (comma-separated):

USD- The EA can avoid trading USD pairs during major USD-related news events.

- Minutes before news to suspend trading:

60 - Minutes after news to suspend trading:

60- If enabled, the EA will pause trading 60 minutes before and after news events to avoid volatile conditions.

6. Execution and Trading Conditions

- Maximum allowed spread for trades:

500- The EA will only execute trades if the spread is below 50 pips (500 points), which is relatively high.

- Unique identifier for trade operations:

764- A specific magic number assigned to distinguish trades opened by this EA from others.

- Comment for trade orders:

Matrix Mind- The EA tags trades with this comment for easy identification.

Analysis and Recommendations

1. Risk Management

- High Stop-Loss and Low Take-Profit:

- The EA’s 320-pip SL vs. 80-pip TP creates an unfavorable risk-to-reward ratio (4:1).

- A more balanced risk-to-reward ratio (e.g., 1:2 or 1:3) would improve profitability.

- Daily Drawdown Protection:

- A 5% max daily drawdown limit is a good safety measure, especially for prop trading challenges.

- However, this setting may conflict with the large stop-loss, which could lead to premature drawdown limits.

2. Trade Execution and Trailing Stop

- Trailing Stop Activation:

- The trailing stop activates at 21 pips and follows the price by 2-pip steps.

- This is too tight for high-volatility markets, as it could close trades before reaching full profit potential.

- Recommended: Increase trailing start to 30-40 pips and step to 5-10 pips to avoid premature exits.

- Maximum Spread Limit:

- The EA allows trades with a 50-pip spread, which is too high.

- Recommended: Reduce to 10-20 pips to avoid executing trades in illiquid market conditions.

3. News Filtering

- News Filtering is Disabled:

- The EA does not avoid trading during high-impact news events.

- If enabled, the EA would stop trading 1 hour before and after news events.

- Recommended: Enable news filtering for better risk control.

4. Lot Sizing Strategy

- Percentage-Based Lot Sizing:

- The EA adjusts lot sizes dynamically based on account size, which is good for long-term scalability.

- Ensure this risk percentage is not too aggressive in volatile markets.

Recommendations for Optimization

| Setting | Current Value | Recommended Value |

|---|---|---|

| Stop-Loss (SL) | 3200 (320 pips) | 1600-2400 (160-240 pips) |

| Take-Profit (TP) | 800 (80 pips) | 800-1200 (80-120 pips) |

| Risk-to-Reward Ratio | 4:1 (High Risk) | 1:2 or 1:3 (Balanced) |

| Trailing Start | 210 (21 pips) | 300 (30 pips) |

| Trailing Step | 20 (2 pips) | 50 (5 pips) |

| Max Spread for Trades | 500 (50 pips) | 100-200 (10-20 pips) |

| News Filtering | Disabled | Enable for High-Impact News |

| Drawdown Limit | 5% | 3-5% (Keep as is) |

Final Summary

The Matrix Mind AI MT4 EA is a medium-risk, percentage-based trading system with trailing stops and news filtering capabilities (currently disabled). It uses a high stop-loss (320 pips) with a lower take-profit (80 pips), leading to an unfavorable risk-to-reward ratio. Adjusting SL/TP ratios, trailing stop logic, and enabling news filtering would improve performance and reduce unnecessary risks.