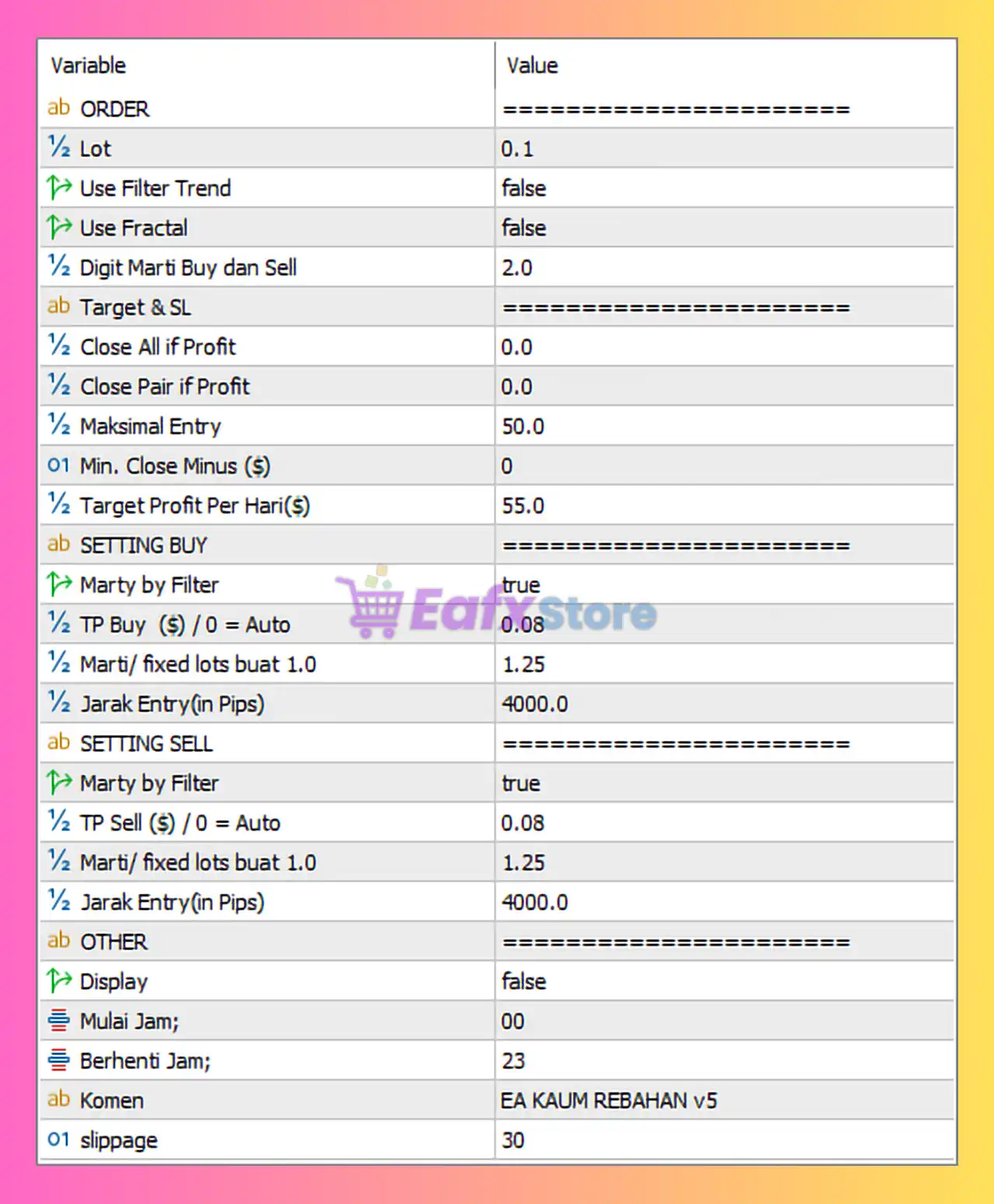

The configuration panel of JS Hedging Pro MT5 reveals a dual-direction hedging engine powered by controlled martingale scaling, customizable entry distances, and a fixed daily target. The parameters indicate a strategy designed for steady accumulation, wide-range hedging, and high adaptability in both trending and ranging markets.

📌📌📌 Buy this unlimited JS Hedging Pro EA MT5 product here 📌📌📌

🧩 ORDER SETTINGS

These settings determine the EA’s core position-opening logic.

• Lot = 0.1

Initial trade size starts at 0.10 lots, considered moderate risk depending on account size. Not purely micro-scalping—this EA aims for meaningful returns per cycle.

• Use Filter Trend = false

Trend filtering is disabled.

→ The EA does not rely on trend direction and will trade both ways freely, consistent with hedging strategies.

• Use Fractal = false

No fractal-based filtering means entries are algorithmic and not dependent on swing-high/swing-low confirmations.

• Digit Marti Buy dan Sell = 2.0

The martingale multiplier for both buy and sell positions is 2.0, reflecting a traditional doubling recovery model.

→ Higher profit recovery speed

→ Higher drawdown potential if price trends aggressively

This is powerful but requires proper capital management.

🧩 TARGET & STOP-LOGIC

• Close All if Profit = 0.0

No global equity close based on profit.

The EA instead uses daily targets.

• Close Pair if Profit = 0.0

Pair-level profit closure is also disabled.

• Maksimal Entry = 50.0

Maximum allowed positions: 50 trades.

This is aligned with hedging + martingale structures, allowing wide defensive grids.

• Min. Close Minus ($) = 0

No minimum loss threshold for closing cycles.

• Target Profit Per Hari ($) = 55.0

This is one of the most important settings.

The EA aims to close all trading cycles once daily profit hits $55.

This daily target model helps:

- reduce exposure

- avoid overnight unpredictable volatility

- lock consistent daily returns

🧩 BUY SETTINGS

These settings define how the EA manages long-side hedging and martingale.

• Marty by Filter = true

Martingale is controlled by a filter mechanism to avoid unnecessary grid expansion.

• TP Buy ($) = 0.08

Take-profit per BUY cycle is $0.08, extremely small, meaning the EA is scalping micro profits per mini-cycle.

• Marti / fixed lots buat 1.0 = 1.25

Martingale multiplier for BUY = 1.25

This is softer than the global 2.0 multiplier above—indicating a more moderate recovery model on buy side.

• Jarak Entry (in Pips) = 4000

Entry distance = 4000 pips (400 points if 5-digit broker).

This is a wide grid distance, meaning:

- Larger market swings needed before adding new positions

- Reduced grid density

- Lower drawdown risk

- More suitable for long-term hedging

🧩 SELL SETTINGS

SELL logic mirrors buy logic.

• Marty by Filter = true

Controlled martingale also applies to short positions.

• TP Sell ($) = 0.08

Matched micro-target for sell cycles.

• Marti multiplier = 1.25

Sell-side recovery uses the same moderate multiplier.

• Jarak Entry (in Pips) = 4000

Same wide grid spacing—consistent behavior for symmetrical hedging.

🧩 OTHER SETTINGS

• Display = false

Dashboard is hidden for lighter performance.

• Mulai Jam = 00

Trading starts from midnight server time.

• Berhenti Jam = 23

Trading ends at 23:00—effectively running 23 hours a day.

• Komen = EA KAUM REBAHAN v5

Internal EA labeling, not affecting trading behavior.

• Slippage = 30

High slippage tolerance allows trades during volatile moments but may result in less accurate entries.

🧩 Conclusion

The JS Hedging Pro configuration shows a hedging-based grid system that relies on controlled martingale scaling, wide 4000-pip spacing, and a structured daily profit target of $55. With trend and fractal filters disabled, the EA takes a neutral, market-agnostic approach, allowing positions in both directions and recovering through measured martingale multipliers. Its 50-trade maximum entry capacity supports deep hedging cycles, while micro TP values enable steady accumulation throughout the day. These settings position JS Hedging Pro as a robust option for traders seeking consistent daily earnings through long-range hedging, provided adequate capital is used to support its grid and martingale structure.