🧩 Overview of Mystical EA Pro Trading Strategy

From the configuration panel, Mystical EA Pro appears to be a semi-aggressive automated trading system that combines:

- Fixed initial entries

- Grid / distance-based order placement

- Martingale position scaling

- Trailing stop & dynamic order modification

- Hedging and risk protection mechanisms

This setup is designed to maximize recovery from drawdowns while limiting catastrophic loss, suitable for traders with medium-to-high risk tolerance.

📌📌📌 Buy this unlimited Mystical EA Pro MT5 product here 📌📌📌

🧩 Detailed Parameter Analysis

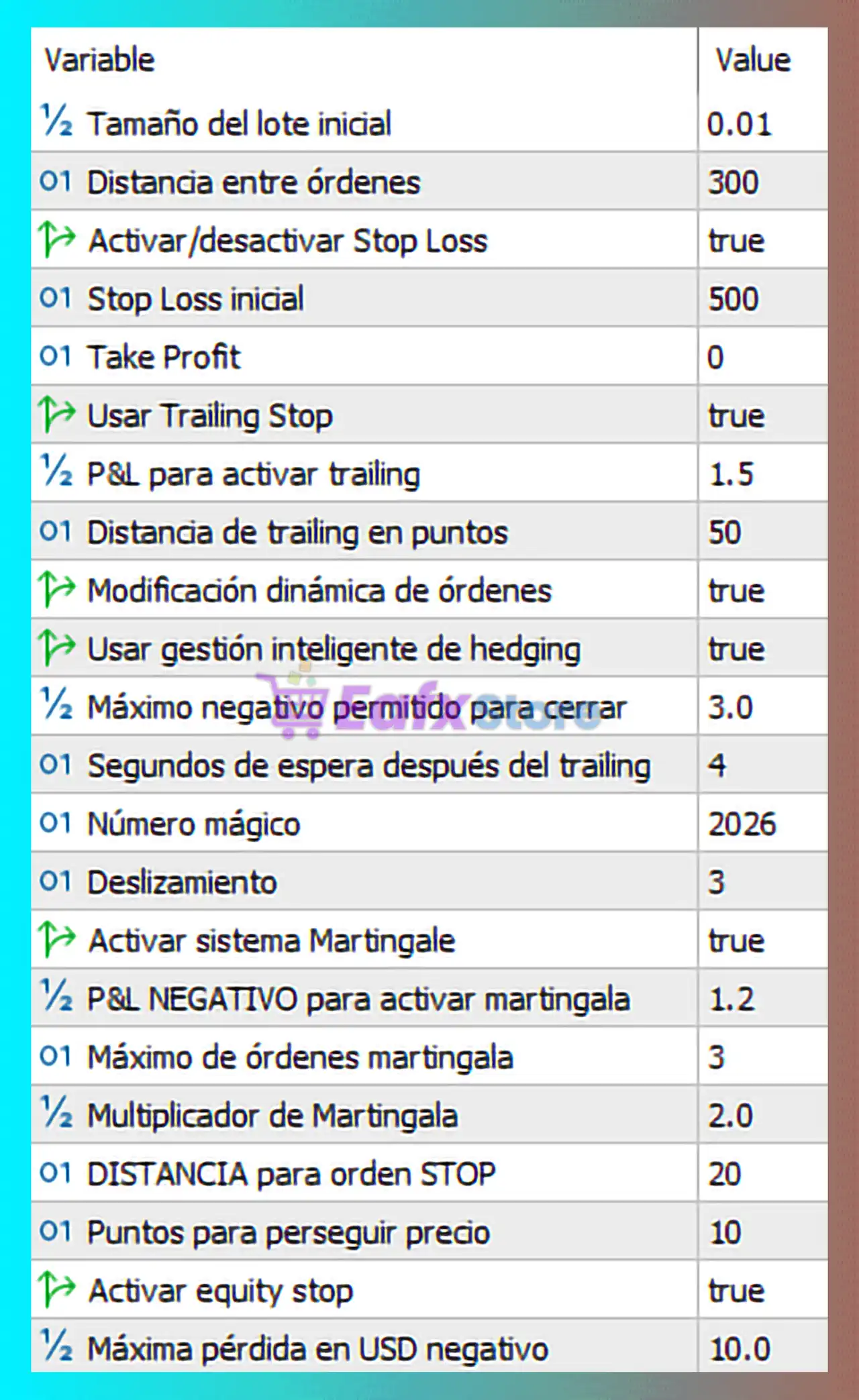

1. Lot Size & Order Placement

➡️ Initial Lot Size (0.01)

- Very conservative starting volume

- Ideal for small accounts or cent-based trading

- Reduces early drawdown risk

➡️ Distance Between Orders (300 points)

- Wide spacing between grid orders

- Helps avoid overtrading during market noise

- Better suited for volatile instruments (XAUUSD, indices)

➡️ Order Number (2026)

- Unique identifier to manage EA-specific trades

- Prevents conflict with other EAs or manual trading

2. Stop Loss & Take Profit Management

➡️ Initial Stop Loss (500 points)

- Large stop loss indicates a grid / recovery strategy

- Designed to allow price fluctuation before closure

➡️ Take Profit (0 – Disabled)

- No fixed TP means profits are likely managed dynamically

- Relies on trailing stop and basket closure logic

➡️ Stop Loss Activation (Enabled)

- Despite grid logic, SL protection is active

- Improves account survivability in extreme trends

3. Trailing Stop System

➡️ Trailing Stop (Enabled)

➡️ Trailing Activation Multiplier (1.5)

➡️ Trailing Distance (50 points)

➡️ Delay After Trailing (4 seconds)

✔ This shows a smart trailing mechanism that:

- Activates only after sufficient profit

- Locks in gains gradually

- Avoids premature trade closure

This setup is ideal for trend-following exits after grid recovery.

4. Dynamic Order & Price Chasing

➡️ Dynamic Order Modification (Enabled)

➡️ Price Chasing Points (10)

- EA adjusts orders based on live price movement

- Improves entry precision during fast markets

- Reduces slippage and missed opportunities

5. Hedging & Risk Balancing

➡️ Hedging System (Enabled)

➡️ Maximum Negative Multiplier to Close (3.0)

- Allows opposite trades to reduce net exposure

- Helps stabilize drawdown during strong counter-trends

- Suitable for MT5 hedging accounts

6. Martingale System Analysis

➡️ Martingale Activation (Enabled)

➡️ Negative Multiplier to Trigger (1.2)

➡️ Martingale Multiplier (2.0)

➡️ Maximum Martingale Orders (3)

✔ This is a controlled martingale setup:

- Only activates after defined loss

- Limited to 3 levels

- Prevents unlimited lot escalation

This reduces the traditional dangers of martingale strategies while still enabling recovery potential.

7. Emergency & Capital Protection

➡️ Stop Distance (20 points)

➡️ Stop Chasing Price (Enabled)

➡️ Maximum Negative Loss (USD 10.0)

- Absolute account protection feature

- EA will close trades if losses exceed $10

- Strong safety net for small accounts

➡️ Slippage (3)

- Balanced tolerance for fast markets

- Avoids execution rejection during volatility

🧩 Strengths of This Configuration

✅ Low initial risk (0.01 lot)

✅ Controlled martingale with strict limits

✅ Trailing stop ensures profit protection

✅ Hedging adds drawdown stability

✅ Hard USD loss cap enhances account safety

✅ Suitable for volatile instruments

🧩 Potential Risks

⚠ Martingale is still present (risk increases with trend continuation)

⚠ No fixed take profit (depends on trailing logic)

⚠ Requires VPS for stable execution

⚠ Best used on ECN brokers with low spread

🧩 Final Conclusion – Is This a Good Mystical EA Pro Setup?

Yes, this configuration represents a balanced and professionally designed setup for Mystical EA Pro MT5.

It is best suited for:

- Small to medium accounts

- Traders seeking semi-aggressive growth

- Users who understand grid & martingale risks

- Markets with strong volatility and retracements

With proper broker selection and VPS usage, this setup offers a solid blend of profit potential and capital protection, making it suitable for disciplined automated trading.