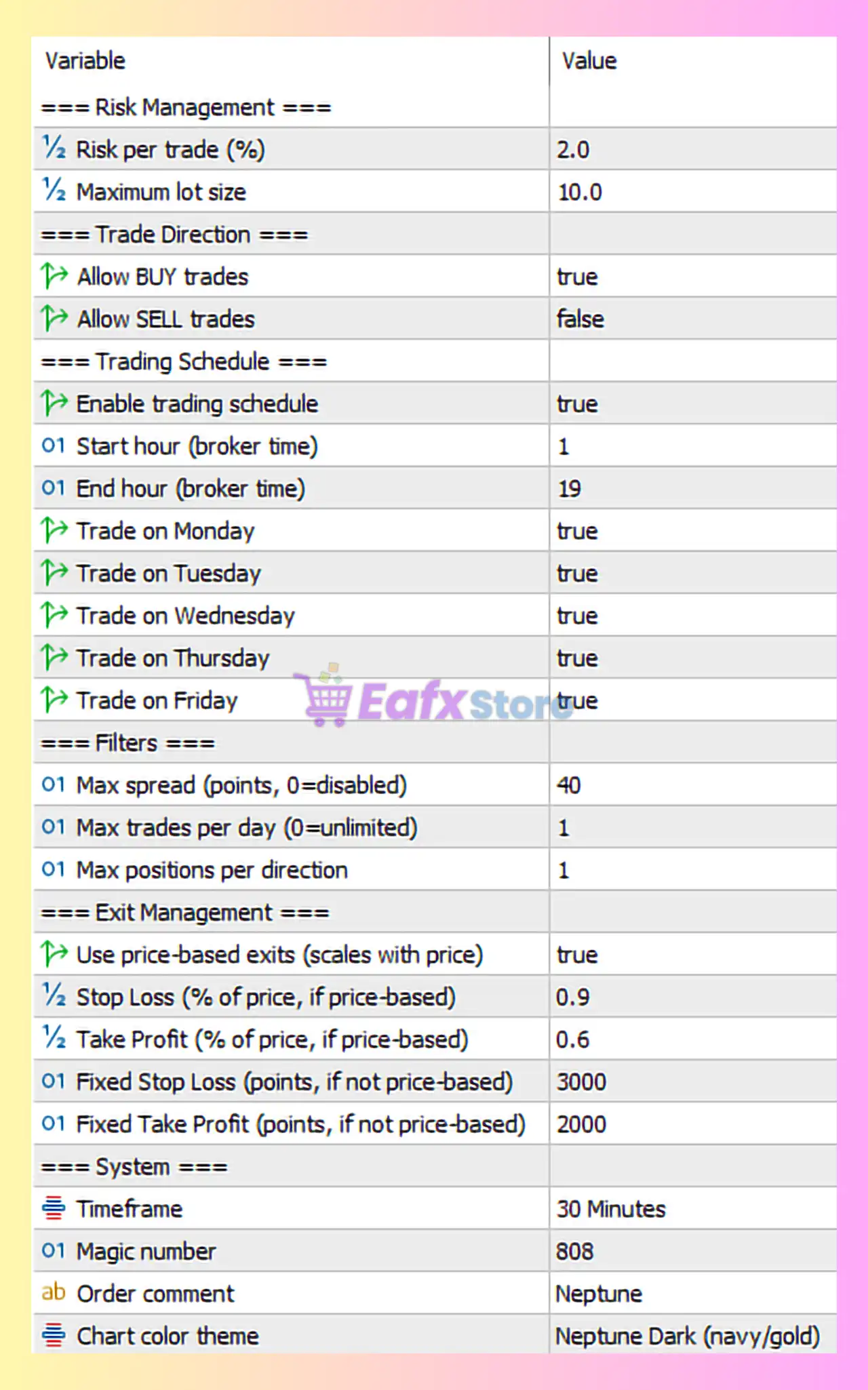

🧩 What is Neptune EA?

Neptune EA is an automated trading robot for MetaTrader 5 (MT5) designed with a low-frequency, high-control trading logic. Based on the settings shown, this EA focuses on strict risk management, limited exposure, scheduled trading hours, and price-based exits, making it suitable for conservative and disciplined traders.

📌📌📌 Buy this unlimited Neptune EA MT5 product here 📌📌📌

🧩 Risk Management Settings

🔹 Risk per Trade (%) – 2.0

Each trade risks 2% of account equity.

✔️ This is a moderate and professional risk level, commonly recommended for long-term trading.

🔹 Maximum Lot Size – 10.0

Caps the position size regardless of account growth.

✔️ Prevents over-exposure on large accounts

✔️ Adds an extra layer of capital protection

Conclusion:

Neptune EA prioritizes capital preservation over aggressive growth.

🧩 Trade Direction Control

🔹 Allow BUY Trades – true

🔹 Allow SELL Trades – false

The EA is configured to trade BUY positions only.

✔️ Suitable for:

- Bullish or trend-following strategies

- Instruments with long-term upward bias (e.g., indices, gold)

⚠️ Limitation:

- Misses opportunities in bearish markets

🧩 Trading Schedule (Time Filter)

🔹 Enable Trading Schedule – true

🔹 Trading Hours (Broker Time)

- Start Hour:

01 - End Hour:

19

✔️ Avoids low-liquidity periods

✔️ Excludes rollover and late-session volatility

🔹 Trading Days

- Monday → Friday: All enabled

Conclusion:

Neptune EA trades only during high-liquidity, structured market hours, reducing spread spikes and slippage.

🧩 Filters & Trade Limits

🔹 Max Spread (points) – 40

Trades will only open when spread ≤ 40 points.

✔️ Excellent protection against:

- High volatility

- News-driven spread widening

🔹 Max Trades per Day – 1

Only one trade per day is allowed.

✔️ Extremely conservative

✔️ Prevents overtrading and emotional market noise

🔹 Max Positions per Direction – 1

Only one BUY position can be open at a time.

✔️ No grid

✔️ No martingale

✔️ Very clean exposure model

🧩 Exit Management (Advanced)

🔹 Use Price-Based Exits – true

Stop Loss and Take Profit are calculated as a percentage of price, not fixed points.

✔️ Automatically adapts to:

- Volatility changes

- Different symbols and price ranges

🔹 Stop Loss (% of price) – 0.9

A relatively wide dynamic stop loss.

✔️ Allows trades room to breathe

⚠️ Can increase drawdown if market reverses sharply

🔹 Take Profit (% of price) – 0.6

Smaller TP relative to SL.

📌 Risk-Reward Insight:

- Slightly negative R:R

- Likely relies on high win rate

🔹 Fixed SL / TP (Fallback)

- Stop Loss:

3000 points - Take Profit:

2000 points

Used only if price-based exits are disabled.

🧩 System & Technical Settings

🔹 Timeframe – M30 (30 Minutes)

Medium-term trading logic.

✔️ Less noise than lower timeframes

✔️ Suitable for swing-style entries

🔹 Magic Number – 808

Unique identifier for EA trades.

✔️ Safe for multi-EA usage

🔹 Order Comment – Neptune

Used for trade tracking and reporting.

🔹 Chart Color Theme – Neptune Dark (navy/gold)

Purely visual, no impact on performance.

🧩 Final Verdict: Is Neptune EA MT5 Safe?

✅ Strengths

✔ Strong risk control (2% risk, 1 trade/day).

✔ No martingale, no grid.

✔ Time-based and spread filters.

✔ Price-adaptive exits.

✔ BUY-only directional clarity.

⚠️ Weaknesses

❗ Does not trade SELL positions.

❗ Relies on win rate due to R:R structure.

❗ Limited trade frequency = slower growth.

⭐ Overall Conclusion

The Neptune EA MT5 settings shown represent a highly conservative, low-risk trading configuration. This EA is clearly designed for capital protection, consistency, and long-term sustainability, not aggressive compounding.

👉 Best suited for:

- Conservative traders.

- Funded account challenges.

- Prop firms.

- Traders who value stability over fast growth.

👉 Not ideal for:

- Small accounts seeking rapid gains.

- Traders who prefer high-frequency or scalping strategies.