🧩 Overview of the Strategy Configuration

This Opening Range Breakout EA is configured as a rule-based, semi-aggressive intraday trading system with:

- Fixed lot sizing

- Defined daily profit and loss limits

- Multiple ORB time windows

- Breakout continuation enabled

- Trailing stop-based trade management

- Strong risk containment via daily shutdown rules

The setup is designed to capture volatility breakouts while strictly controlling downside risk.

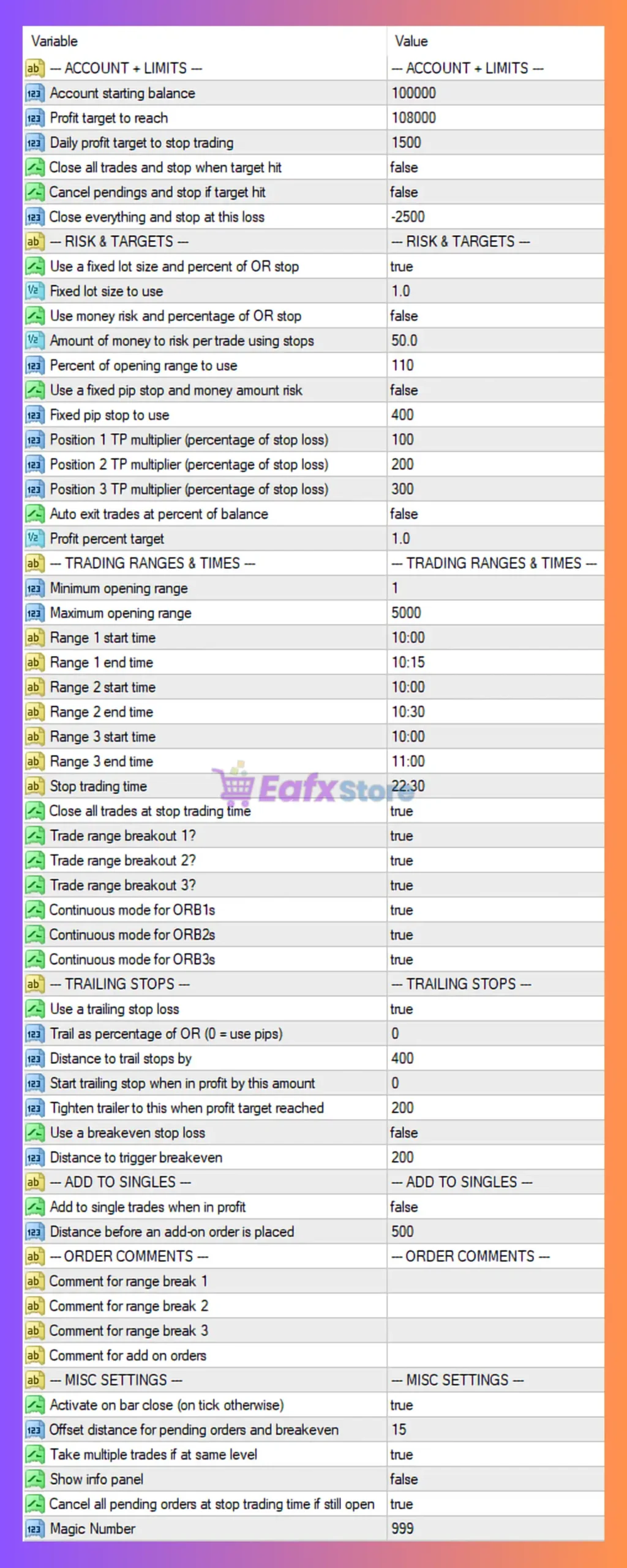

🧩 Account & Limits Settings

➡️ Key Parameters

- Starting Balance: 100,000

- Profit Target to Reach: 108,000

- Daily Profit Target: 1,500

- Daily Loss Stop: -2,500

- Close All Trades at Stop Trading Time: Enabled

➡️ Analysis

This section shows professional account protection logic:

- Trading stops once daily profit of 1,500 is reached

- Trading also stops after a daily loss of 2,500, preventing emotional overtrading

- No forced closure on profit target hit (allows trades to finish naturally)

🔎 Risk-to-reward per day ≈ 1 : 1.67, which is conservative and sustainable.

🧩 Risk & Position Sizing

➡️ Key Parameters

- Fixed Lot Size: 1.0

- Money Risk per Trade: 50 (inactive)

- Stop Loss Type: Fixed pip stop

- Stop Loss Size: 400 pips

- TP Multipliers:

- TP1 = 100% of SL

- TP2 = 200% of SL

- TP3 = 300% of SL

➡️ Analysis

The EA uses fixed lot trading, which is simpler but less adaptive than percentage risk.

The large 400-pip stop loss suggests:

- Designed for volatile instruments (e.g., indices, gold, crypto, or high-ATR FX pairs)

- Avoids premature stop-outs during news or session volatility

The multi-take-profit structure enables:

- Partial profit taking

- Letting winning trades run

- Improving overall expectancy

🧩 Trading Ranges & Time Windows (ORB Logic)

➡️ Opening Range Windows

- Range 1: 10:00 – 10:15

- Range 2: 10:00 – 10:30

- Range 3: 10:00 – 11:00

➡️ Other Rules

- Minimum OR Size: 1

- Maximum OR Size: 5,000

- Trade Breakout for All Ranges: Enabled

- Continuous Mode for ORB 1–3: Enabled

➡️ Analysis

This is a multi-layer ORB system, which is more advanced than standard ORB EAs.

Benefits:

- Captures early, mid, and late session breakouts

- Continuous mode allows re-entries if price keeps breaking structure

- Range size filters prevent trading during extremely low or extreme volatility

⚠️ This configuration can generate multiple trades per session, increasing exposure.

🧩 Trailing Stop & Trade Management

➡️ Key Parameters

- Trailing Stop: Enabled

- Trail Distance: 400 pips

- Start Trailing: Immediately (0 profit)

- Tighten Trail at Profit Target: 200 pips

- Breakeven: Disabled

➡️ Analysis

This is a pure trailing-stop-driven exit system.

Characteristics:

- Trades are protected early

- Profits are locked progressively

- No breakeven logic avoids micro-stop-outs

This approach works best in:

- Strong trending markets

- Breakout sessions with continuation

It may underperform in choppy or range-bound markets.

🧩 Add-On & Scaling Logic

➡️ Parameters

- Add to Winning Trades: Disabled

- Add-On Distance: 500 pips

➡️ Analysis

The EA does not pyramid positions, which:

- Reduces risk complexity

- Keeps drawdown predictable

- Makes results easier to analyze and optimize

This is a risk-first decision, suitable for long-term consistency.

🧩 Order Execution & Misc Settings

➡️ Key Parameters

- Execute on Bar Close: Enabled

- Offset for Pending Orders: 15 pips

- Multiple Trades at Same Level: Enabled

- Cancel Pending Orders at Stop Time: Enabled

- Magic Number: 999

➡️ Analysis

Execution logic is clean and robust:

- Bar-close execution reduces false breakouts

- Offset avoids spread manipulation

- Pending orders are cleared at session end (no overnight risk)

🧩 Final Conclusion

This Opening Range Breakout EA configuration represents a well-structured, disciplined breakout trading system designed for high-volatility instruments and intraday momentum strategies.

➡️ Strengths

✅ Strong daily risk control

✅ Multi-range ORB logic for flexibility

✅ Trend-following trailing stop system

✅ Scalable and backtest-friendly

✅ Suitable for prop-firm style rules

➡️ Weaknesses

⚠️ Fixed lot sizing (not balance-adaptive)

⚠️ Large stop loss requires sufficient capital

⚠️ Can overtrade in sideways markets

➡️ Best Use Case

- Indices (NASDAQ, DAX, Dow)

- Gold (XAUUSD)

- High-volatility FX sessions (London / New York open)

📌 Overall Verdict:

This is a professional-grade ORB EA setup, prioritizing risk management and consistency over aggressive growth, making it suitable for serious traders, funded accounts, and systematic trading environments.