🧩 What is PAM Scalper PRO FX?

PAM Scalper PRO FX is a professional MT5 scalping Expert Advisor (EA) designed for high-precision, short-term trades with strong risk control. The EA supports multiple strategies, adaptive stop-loss logic, session filters, and advanced money management, making it suitable for PAMM accounts, prop firms, and disciplined retail traders.

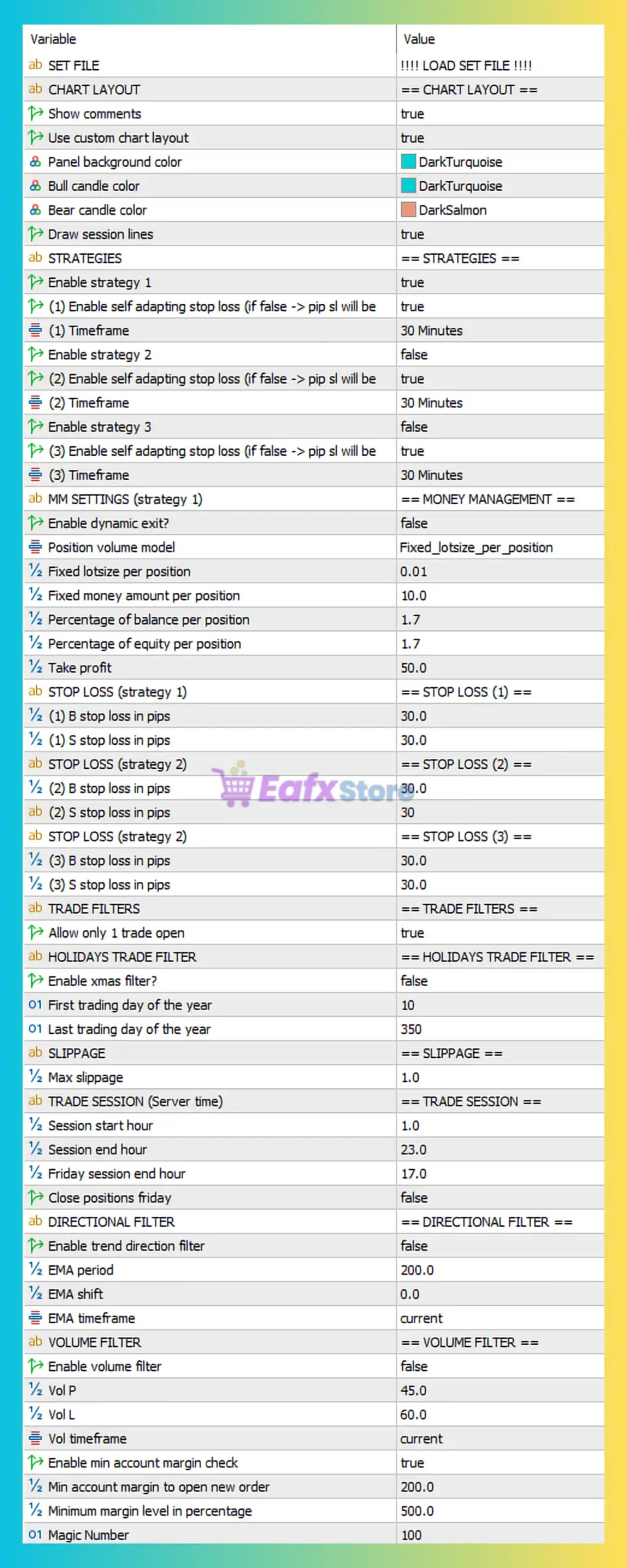

🧩 Chart Layout & Visual Settings

- Custom chart layout: Enabled

- Background color: Dark Turquoise

- Bull candle: Dark Turquoise

- Bear candle: Dark Salmon

- Session lines: Enabled

- Comments display: Enabled

📌 These settings do not affect performance but improve visual clarity, session awareness, and trade monitoring—useful for live scalping environments.

🧩 Strategy Configuration

➡️ Enabled Strategies

- Strategy 1: Enabled ✅

- Strategy 2: Disabled ❌

- Strategy 3: Disabled ❌

➡️ Timeframe

- Strategy timeframe: 30 Minutes (M30)

➡️ Adaptive Stop Loss

- Self-adapting stop loss: Enabled for all strategies

🔍 Analysis

The EA is running in a single-strategy mode, which significantly reduces overtrading and drawdown. Using M30 timeframe for scalping suggests the strategy focuses on intraday market structure rather than ultra-high-frequency noise.

Adaptive stop loss improves robustness by reacting to volatility instead of using static pip values.

🧩 Money Management (Strategy 1)

➡️ Position Volume Model

- Mode: Fixed lotsize per position

- Fixed lot size: 0.01

➡️ Alternative Risk Options (Not Active)

- Fixed money amount: 10.0

- % of balance per position: 1.7%

- % of equity per position: 1.7%

➡️ Take Profit

- TP: 50 pips

📊 Risk Insight

Although percentage-based options exist, the EA is configured conservatively with 0.01 fixed lots, ideal for:

- Small accounts

- PAMM master testing

- Prop firm evaluation phases

🧩 Stop Loss Configuration

➡️ Strategy 1 / 2 / 3

- Stop loss: 30 pips (all strategies)

📈 Risk-Reward Ratio

- SL: 30 pips

- TP: 50 pips

- RR ≈ 1:1.67

This ratio is well-balanced for scalping systems that rely on moderate win rates with controlled losses.

🧩 Trade Filters

➡️ Trade Limitation

- Allow only 1 trade open: Enabled

✅ This is a critical drawdown-protection feature, preventing trade stacking during volatile conditions.

🧩 Holiday Trading Filter

- Xmas filter: Disabled

- Trading day range: Day 10 to Day 350 of the year

📌 The EA avoids early-January and late-December low-liquidity periods, even without the Christmas filter enabled.

🧩 Slippage Control

- Maximum slippage: 1.0 pip

🔐 Very strict slippage control, suitable for:

- ECN brokers

- Low-spread accounts

- VPS-based execution

🧩 Trading Session Filter (Server Time)

- Session start: 01:00

- Session end: 23:00

- Friday end: 17:00

- Close trades on Friday: Disabled

📉 The EA stops opening new trades earlier on Friday, reducing weekend gap risk while allowing existing trades to manage themselves.

🧩 Directional Filter (Trend Filter)

- Enabled: No

- EMA period: 200

- EMA timeframe: Current

📌 Trend filtering is available but intentionally disabled, indicating this scalper is designed to trade both directions, likely using internal price action logic.

🧩 Volume Filter

- Enabled: No

- Volume parameters:

- Vol P: 45

- Vol L: 60

📊 The EA can filter trades based on volume but currently operates without this constraint, increasing trade frequency.

🧩 Margin Protection

- Minimum margin check: Enabled

- Min margin to open new order: 200%

- Minimum margin level: 500%

🛡️ This is a strong capital safety feature, preventing over-leveraging and protecting PAMM or investor accounts.

🧩 Magic Number

- Magic Number: 100 – Ensures clean trade identification and compatibility with other EAs.

🧩 Final Conclusion – Is PAM Scalper PRO FX Well Configured?

Yes. This setup is conservative, stable, and professionally structured.

➡️ Strengths

✔ Single-strategy focus (low overtrading).

✔ Adaptive stop loss logic.

✔ Strict margin and slippage control.

✔ One-trade-at-a-time protection.

✔ Suitable for PAMM & prop trading.

✔ Balanced risk-to-reward profile.

➡️ Risk Level

🟢 Low to Moderate, depending on account size and broker conditions..

➡️ Best Suitable For

- PAMM account managers.

- Prop firm challenges.

- Small to medium accounts.

- Traders prioritizing capital preservation over aggression.