What is Silicon Ex MT5?

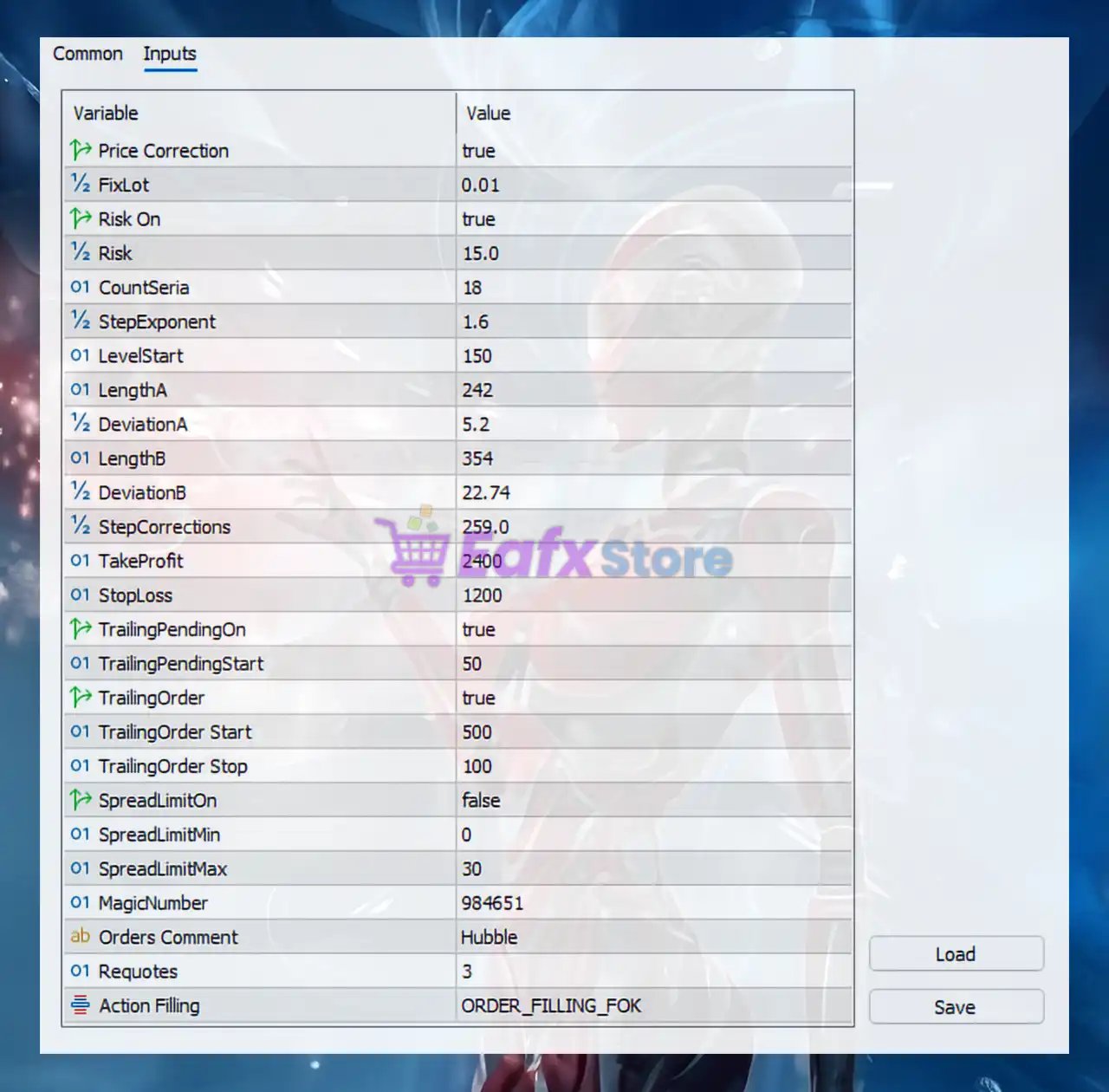

Silicon Ex MT5 is an Expert Advisor (EA) designed for deposit acceleration, employing an aggressive Martingale/Grid strategy with an exponential Step Exponent of 1.6. It is characterized by high-risk leverage (15% risk per trade) and advanced order management tools like dynamic trailing for both pending and executed orders, allowing for rapid accumulation and recovery.

📌📌📌 Buy this unlimited Silicon Ex MT5 product here 📌📌📌

Capital Management & Risk: The Financial Leverage

This section defines the risk level based on your capital percentage and how the EA increases trade volume.

| Parameter | Value | Meaning (Simplified) | Impact on Risk |

| Risk On | true | Enables percentage-based risk management. The EA automatically calculates the lot size based on your account balance and the set risk percentage. | Necessary for proper trade size control. |

| ½ Risk | 15.0 | Risk Percentage per Trade. This means the EA calculates the lot size so that if the trade hits the StopLoss (1200 points), you will lose 15% of your current capital. | Extremely High! Most professional traders use a maximum of 1-3% risk per trade. This level carries significant risk. |

| ½ FixLot | 0.01 | Minimum/Base Lot Size for the first trade, used if Risk On is disabled, or as the starting lot before multiplication. | The standard smallest volume (0.01 Lot). |

| Price Correction | true | Enables price adjustment. The EA attempts to ensure the execution price is as close as possible to the requested price, minimizing slippage effects. | Helps increase the precision of the entry point. |

Export to Sheets

Advanced Martingale/Grid Strategy

These are the core strategic parameters, defining how the EA accumulates trades and increases volume exponentially. These indicators require close monitoring.

| Parameter | Value | Meaning (Simplified) | Strategy Implication |

| 01 CountSeria | 18 | Maximum number of consecutive orders allowed to be open in a single trade chain or grid. | This is a high number, indicating a strategy designed to withstand significant drawdowns by opening many recovery orders. |

| ½ StepExponent | 1.6 | The Lot Multiplier for the subsequent trade. The new trade volume will be the old volume multiplied by 1.6. | Example: Trade 1 (0.1 Lot), Trade 2 (0.1 * 1.6 = 0.16 Lot), Trade 3 (0.16 * 1.6 = 0.256 Lot)… This is an aggressive Martingale strategy, carrying high risk. |

| 01 LevelStart | 150 | The distance in points to open the first order or the minimum distance between grid orders (Grid Step). | 150 points is likely 15 pips (or 1.5 pips). A medium distance for a Grid strategy. |

| ½ StepCorrections | 259.0 | Minimum distance in points between correction orders. When the market moves adversely, a “correction” order is opened 259 points away from the previous one (about 25.9 pips). | A crucial parameter in the strategy for loss recovery and hedging. |

| 01 LengthA / 01 LengthB | 242 / 354 | Cycle/Time length (possibly Moving Average periods, RSI cycles, or other calculation lengths) for signals A and B. | Base parameters the EA uses to determine entry signals. |

| ½ DeviationA / ½ DeviationB | 5.2 / 22.74 | Signal Threshold/Deviation for signals A and B. For instance: The value must deviate by ±5.2 or ±22.74 from some average to trigger an order. | Determines the sensitivity of the entry signals. |

Export to Sheets

Advanced Order Management: Trailing & Capital Protection

These parameters dictate how the EA protects profit and manages pending orders (limit/stop orders).

| Parameter | Value | Meaning (Simplified) | Functionality |

| 01 TakeProfit | 2400 | Absolute Take Profit (TP) in points. Equivalent to 240 pips (or 24 pips). | The basic profit target for the trade. |

| 01 StopLoss | 1200 | Absolute Stop Loss (SL) in points. Equivalent to 120 pips (or 12 pips). | The basic cut-loss level. The current R:R ratio is 2:1 (TP is double the SL). |

| TrailingPendingOn | true | Enables Trailing for Pending Orders. Buy Limit/Stop or Sell Limit/Stop orders will automatically move along with the price. | Optimizes the entry point for limit/stop orders. |

| 01 TrailingPendingStart | 50 | Point distance to start trailing pending orders. If the price moves 50 points (5 pips) in a favorable direction, the pending orders will move. | Adds flexibility to pending order placement. |

| TrailingOrder | true | Enables Trailing Stop. The SL of an executed trade will automatically move to lock in profit as the price moves favorably. | Essential for protecting profits in trending markets. |

| 01 TrailingOrder Start | 500 | Profit level (in points) to activate Trailing Stop. When a trade is 500 points (50 pips) in profit, the Trailing Stop is activated. | The trigger threshold for Trailing Stop. |

| 01 TrailingOrder Stop | 100 | Stop Loss distance (in points) to trail behind the price once the Trailing Stop is activated. The SL will be placed 100 points (10 pips) away from the current price. | Ensures 400 points (500 – 100) of profit are immediately locked in when the Trailing Start condition is met. |

Export to Sheets

Operational & System Settings

| Parameter | Value | Meaning (Simplified) | Purpose |

| 01 MagicNumber | 984651 | The unique identification number for this EA’s trades. | Differentiates the EA’s trades from manual trades or other EAs. |

| ab Orders Comment | Hubble | A custom note attached to the orders. | Used for logging and tracking trades. |

| 01 Requotes | 3 | Maximum number of retries to fill an order when a Requote is received. | Increases the chance of order execution during volatile market conditions. |

| Action Filling | ORDER\_FILLING\_FOK | Order Filling Type: Fill Or Kill (FOK). The entire order volume must be filled immediately, or it will be canceled. | Ensures speed and execution accuracy. |

| SpreadLimitOn | false | Disables the Spread limit. The EA will open trades regardless of the current Spread. | Warning! This can lead to the EA opening trades when the Spread is extremely high (e.g., during news), severely impacting profitability. |

| 01 SpreadLimitMin/Max | 0 / 30 | No effect since SpreadLimitOn = false. If enabled, this would be the maximum acceptable Spread. | For safety, you should consider enabling (true) this parameter and setting a suitable Max Spread (e.g., 30 = 3 pips). |

Export to Sheets

Strategy Risk Summary

This EA employs a High-Risk Leverage strategy (15% Risk) combined with an Aggressive Martingale (Step Exponent 1.6) and a High Number of Trades (CountSeria 18).

- Pros: High potential for rapid profit generation in sideways or weak trending markets, quick recovery from minor losses.

- Cons: Extremely high Drawdown risk. If the market experiences a prolonged, strong trend, the account could face margin call or be wiped out very quickly due to the exponentially increasing lot sizes.

Crucial Advice: Given the 15% risk setting and 1.6 Martingale, you absolutely must not use this on a live account until you reduce the ½ Risk to below 5% (or ideally 1-3%) and have thoroughly backtested long-term trend scenarios.