⭐ What is The Seed of a Big Tree EA?

The Seed of a Big Tree EA is a scaling/averaging system designed for slow and steady growth, mirroring the metaphor in its name. It follows a grid/martingale-style expansion model suitable for larger account balances. The system prioritizes equity protection and steady accumulation of profits.

📌📌📌 Buy this unlimited The Seed of a Big Tree EA MT4 product here 📌📌📌

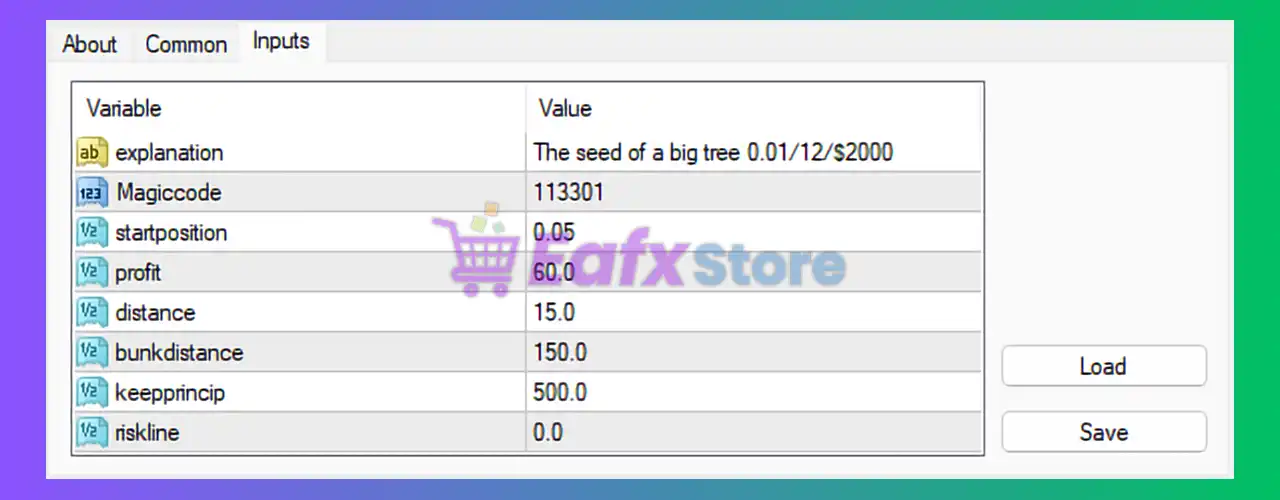

⭐ Explanation

Value: “The seed of a big tree 0.01/12/$2000”

This text summarises the EA’s intended money-management model:

- 0.01 lot per $2000 balance recommended

- 12 levels (likely maximum averaging levels)

- Designed to grow slowly and steadily like a “seed” expanding into a larger structure

This statement hints that the EA follows a grid/martingale-style expansion, where balance adequacy is crucial.

⭐ MagicCode = 113301

The Magic Number identifies trades exclusively opened by this EA.

This enables:

- Accurate monitoring

- Avoiding conflict with other EAs

- Clean backtesting results

⭐ StartPosition = 0.05

This parameter defines the initial lot size of each new trading cycle.

- A starting lot of 0.05 is relatively high for small accounts

- This reinforces that the robot is meant for larger balances (≥ $2000)

- Risk increases proportionally due to the grid structure

⭐ Profit = 60.0

This likely represents:

- Take profit in dollars, or

- Total basket profit target

For most grid systems, this value indicates the amount of profit the EA aims to collect before closing all positions.

A modest target like $60 per cycle suggests:

- Frequent closures

- Lower exposure time

- Steady accumulation instead of long drawdowns

⭐ Distance = 15.0

Distance between orders is 15 pips, which controls how far apart averaging orders are spaced.

- Smaller grid distance = more frequent trades

- Higher risk in volatile markets

- Smoother equity curve but higher exposure

This EA uses a tight grid, suitable for ranging markets.

⭐ BunkDistance = 150.0

This is usually:

- Emergency distance

- Or an extended spacing used in exceptional conditions

At 150 pips, this adds a wide safety buffer, suggesting the EA may switch to protective recovery mode if the price moves too far.

⭐ KeepPrincip = 500.0

Likely indicates account equity protection, such as:

- Minimum equity that must remain untouched

- Stop-trading equity threshold

If equity falls near this level, the EA may halt new trades or close cycles.

This is a strong safety feature, reducing catastrophic failure risk.

⭐ RiskLine = 0.0

RiskLine = 0 may indicate:

- Risk control disabled, or

- No automatic stop-loss line is defined

This suggests the EA relies primarily on its grid + equity protection system, not on hard stop losses.

Conclusion — Is The Seed of a Big Tree EA Safe and Effective?

Based on the configuration panel, The Seed of a Big Tree EA is clearly a grid-based, averaging recovery system designed for steady profit generation on larger accounts. The settings show:

🧩Strengths

- Small but consistent profit targets ($60 per cycle)

- Structured grid spacing (15 pips)

- Emergency spacing at 150 pips

- Equity protection via KeepPrincip

- Recommended capital model ensures safer operation

🧩Trading Style

- Medium-risk grid strategy

- Requires a calm market environment

- Best suited for major pairs with stable volatility

🧩Who Should Use It

- Traders using accounts $2000+

- Users who accept grid-based recovery trading

- Those seeking slow and steady growth rather than aggressive returns

🧩Risks

- Grid systems can experience large drawdowns

- No explicit stop-loss unless account protection triggers

- Not recommended for small accounts or highly volatile markets