🧩 What is The US30 Market Maker MT5?

The US30 Market Maker EA is a professional-grade automated trading system for MetaTrader 5, specifically engineered to navigate the unique liquidity and volatility profiles of the Dow Jones Industrial Average (US30). Unlike standard retail robots that often use simple lagging indicators, this EA adopts a “Market Maker” approach—prioritizing liquidity grabs, false breakout exploitation, and volatility-adaptive exits.

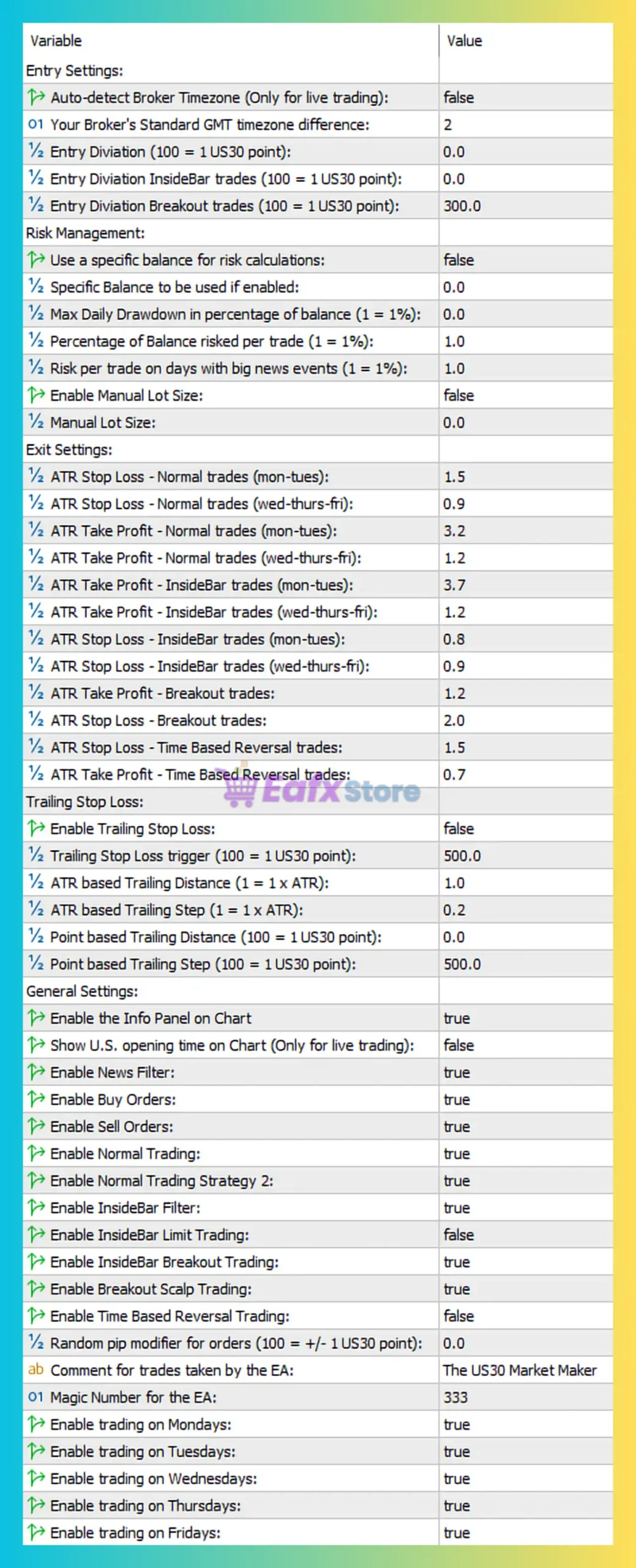

🧩 Entry Settings

🔹 Auto-detect Broker Timezone: false

- The Expert advisor (EA) does not automatically detect broker timezone, meaning trading hours rely on manual GMT configuration.

- This is suitable for traders who already know their broker’s server time and want full control.

🔹 Broker’s Standard GMT Difference: 2

- Broker server time is GMT+2, a common setup for MT5 brokers.

- Correct GMT configuration is critical for session-based and time-sensitive strategies.

🔹 Entry Deviation – US30 Point Settings

- Normal Trades:

0.0 - InsideBar Trades:

0.0 - Breakout Trades:

300.0(≈ 3 US30 points)

Analysis:

- Zero deviation on normal and InsideBar trades ensures precise entries, ideal for market-maker logic.

- Larger deviation for breakout trades allows entries during high volatility spikes, reducing missed opportunities.

🧩 Risk Management Settings

🔹 Use Specific Balance for Risk Calculations: false

- EA uses the real account balance dynamically.

- This is safer and more adaptive for live trading.

🔹 Max Daily Drawdown (%): 0.0

- No hard daily drawdown cap set inside the EA.

- Risk control likely relies on external rules (prop firm) or lot sizing logic.

🔹 Percentage of Balance Risked per Trade: 1.0

- Each trade risks 1% of account balance.

- This is a balanced risk level, suitable for indices like US30.

🔹 Risk per Trade on Big News Events: 1.0

- No risk reduction during high-impact news.

- Indicates confidence in the EA’s market-maker and volatility-aware logic.

🔹 Manual Lot Size: false

- Fully automatic lot sizing based on risk percentage.

- Ideal for consistent risk management and scalability.

🧩 Exit Settings (ATR-Based Logic)

The EA heavily relies on ATR (Average True Range), making it adaptive to market volatility.

🔹 Normal Trades

- ATR Stop Loss (Mon–Tue):

1.5 - ATR Stop Loss (Wed–Fri):

0.9 - ATR Take Profit (Mon–Tue):

3.2 - ATR Take Profit (Wed–Fri):

1.2

➡️ Early week favors wider targets, while late week focuses on faster exits and reduced exposure.

🔹 InsideBar Trades

- ATR SL (Mon–Tue):

0.8 - ATR SL (Wed–Fri):

0.9 - ATR TP (Mon–Tue):

3.7 - ATR TP (Wed–Fri):

1.2

➡️ InsideBar trades aim for high reward-to-risk ratios, especially earlier in the week.

🔹 Breakout Trades

- ATR Stop Loss:

2.0 - ATR Take Profit:

1.2

➡️ Breakouts prioritize higher protection, acknowledging false breakout risks in US30.

🔹 Time-Based Reversal Trades

- ATR SL:

1.5 - ATR TP:

0.7

➡️ Conservative profit targets reflect the counter-trend nature of reversal logic.

🧩 Trailing Stop Loss Settings

🔹 Enable Trailing Stop Loss: false

- Trailing stops are disabled.

- The EA relies on fixed ATR-based exits, which is common for scalping and market-maker strategies.

(Trailing parameters are configured but inactive, allowing future activation without re-tuning.)

🧩 General Trading Logic & Filters

🔹 Info Panel on Chart: true

- Displays live EA data for transparency and monitoring.

🔹 Show US Open Time on Chart: false

- Not required for this strategy, as logic is rule-based rather than session-visual.

🔹 News Filter: true

- News filter enabled, reducing exposure during unpredictable macro events.

🔹 Buy & Sell Orders: true

- EA trades both directions, consistent with market-maker behavior.

🔹 Strategy Modules Enabled

- Normal Trading:

true - Normal Trading Strategy 2:

true - InsideBar Filter:

true - InsideBar Limit Trading:

false - InsideBar Breakout Trading:

true - Breakout Scalp Trading:

true - Time-Based Reversal Trading:

false

➡️ The EA focuses on:

- Liquidity grabs

- False breakouts

- InsideBar expansions

- Short-term scalps

🔹 Random Pip Modifier: 0.0

- No randomization in entries.

- Ensures consistent and backtest-accurate execution.

🔹 Trade Comment: The US30 Market Maker

- Useful for trade tracking and analytics.

🔹 Magic Number: 333

- Unique identifier to avoid conflicts with other EAs.

🧩 Trading Days Configuration

- Trading enabled from Monday to Friday.

- No weekend trading, aligning with US30 index market structure.

🧩 Final Conclusion – Is This a Good US30 EA Setup?

The configuration shown represents a professional-grade, volatility-adaptive market-maker strategy specifically optimized for US30 (Dow Jones) trading.

✅ Key Strengths

- ATR-based dynamic exits adapt to market conditions

- Multiple strategy layers (Normal, InsideBar, Breakout)

- Balanced 1% risk per trade

- Smart weekday-based parameter adjustments

- News filtering enabled

- Fully automated lot sizing

⚠️ Considerations

- No internal max daily drawdown limit

- No reduced risk during major news

- Best suited for experienced traders or prop firm accounts with external risk rules

⭐ Overall Rating

8.8 / 10 – Highly optimized for US30 scalping and market-maker logic.