Institutional Predictive Pro MT5 Unlimited

Subscriptions for Special Plan

- 30 EA package is more economical!

- Special package with 99%

- Download 1 EA/Day

Subscriptions for Premium Membership

- Download Unlimited in 1 Year

- Get 100% Discount

- Get free access to all

Subscriptions for Gold Membership

- 1 Year Membership

- Get 100% Discount

- Access EA+Indicator+Course

Frequently bought together 🎁

Add these products to enhance your purchase

What is Institutional Predictive Pro?

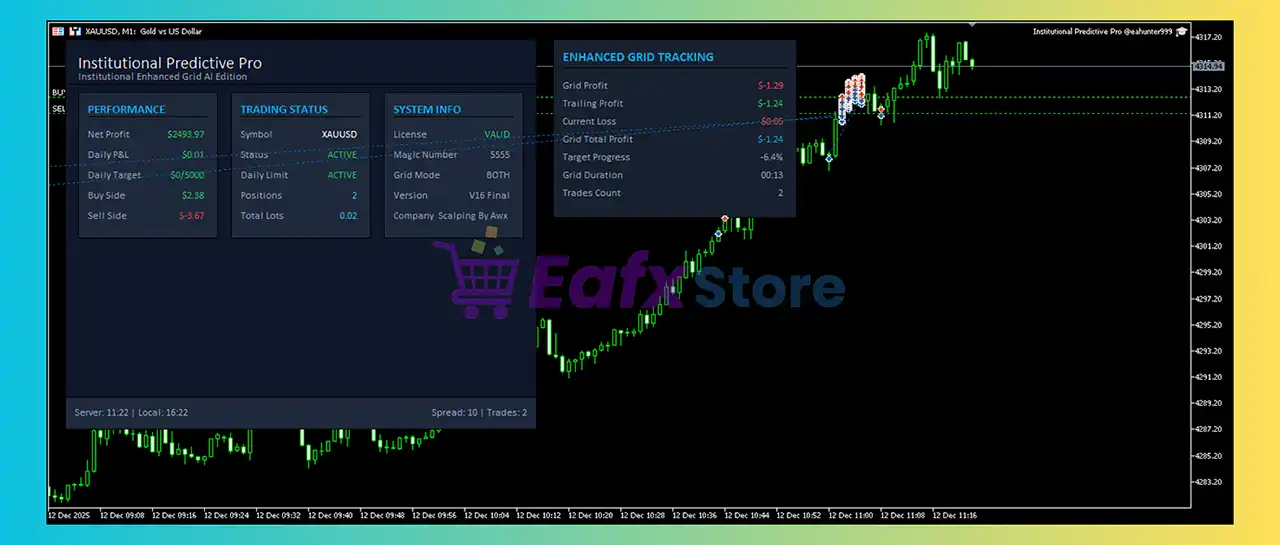

Institutional Predictive Pro is an advanced multi-layer Grid system that combines volatility filtering, profit cycle control, and adaptive tracking logic. The system aims for daily consistency through structured ratio adjustments, intelligent spacing, and automatic resets, ideal for proprietary trading and high-precision risk management.

Institutional Predictive Pro MT5 Review

Key Features of Institutional Predictive Pro for MT5

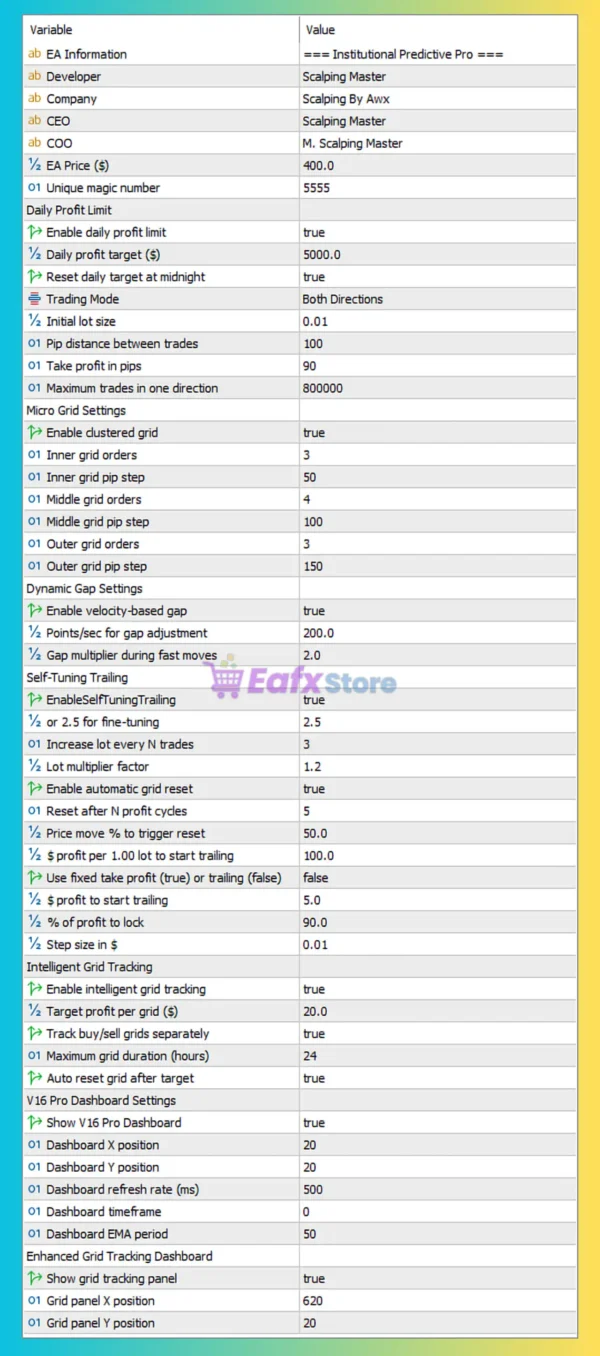

🔹Adaptive Grid Engine: Uses inner, middle, and outer grid layers with dynamic spacing for safer scaling in expanding markets.

🔹Daily Profit Control: Automates profit-limit resets to maintain stable daily cycles and prevent prolonged exposure.

🔹Volatility Gap Detection: Expands spacing during fast price movements using a speed-based gap multiplier.

What is the Institutional Predictive Pro trading strategy?

🔹Bi-Directional Grid Logic: Runs buy and sell cycles together with tiered clustering for balanced trend and countertrend entries.

🔹Self-Tuning Trailing: Uses momentum-based profit locking and micro-step adjustments to optimize exits during reversals.

🔹Cycle Reset Method: Resets after completed profit rounds to reduce floating drawdown and maintain system stability.

Institutional Predictive Pro MT5 Review

The core strategy is Tiered Grid Architecture with Volatility Adaptation and Martingale Scaling. The EA operates in Both Directions simultaneously. It builds a defensive position using a clustered grid where spacing expands from $\text{50}$ to $\text{150}$ pips, scaling positions intelligently.

Institutional Predictive Pro EA Review

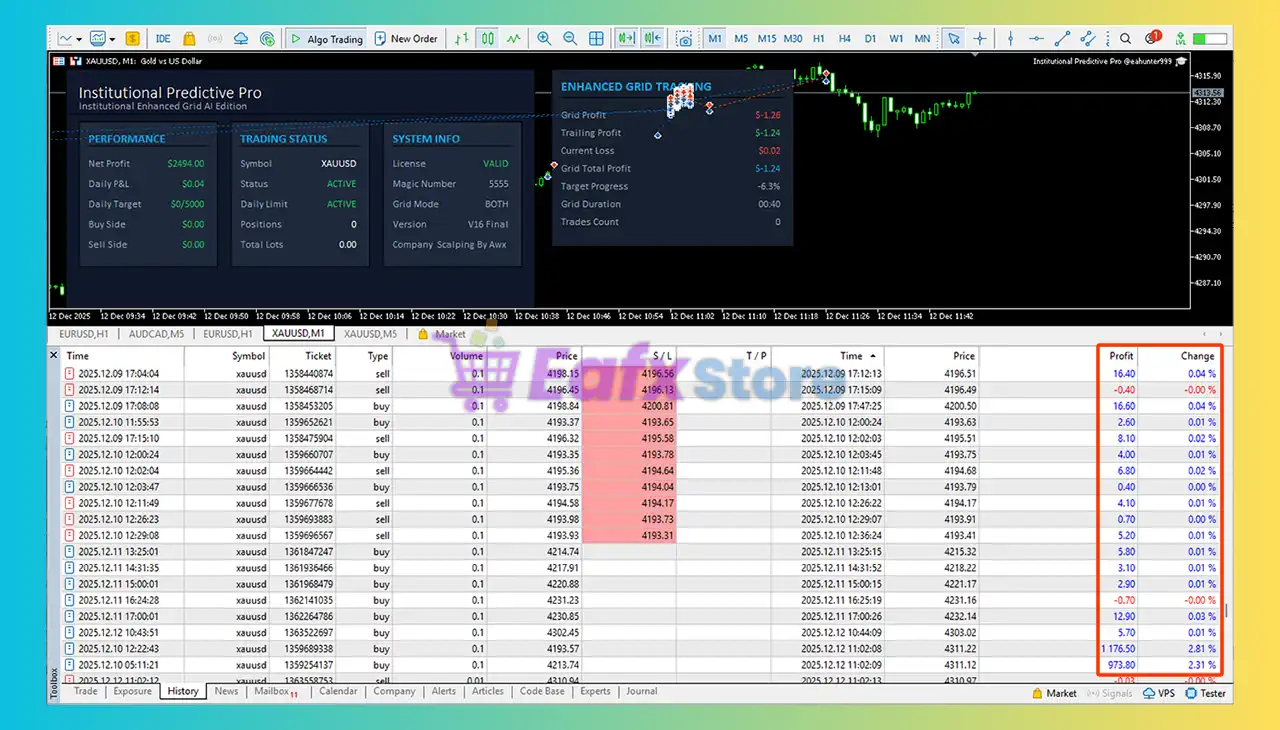

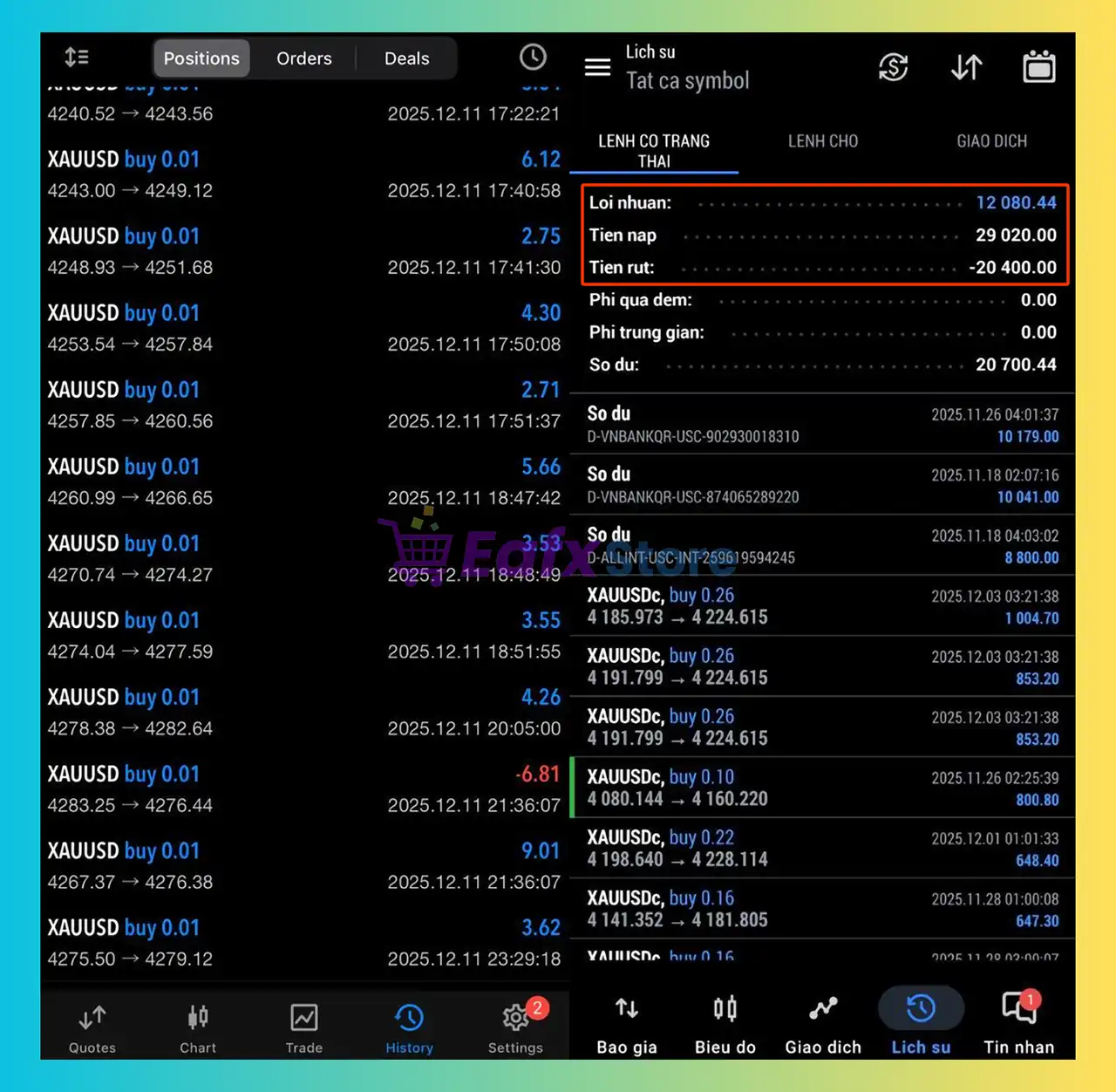

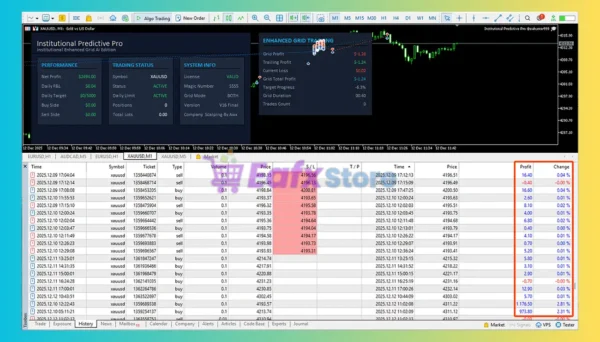

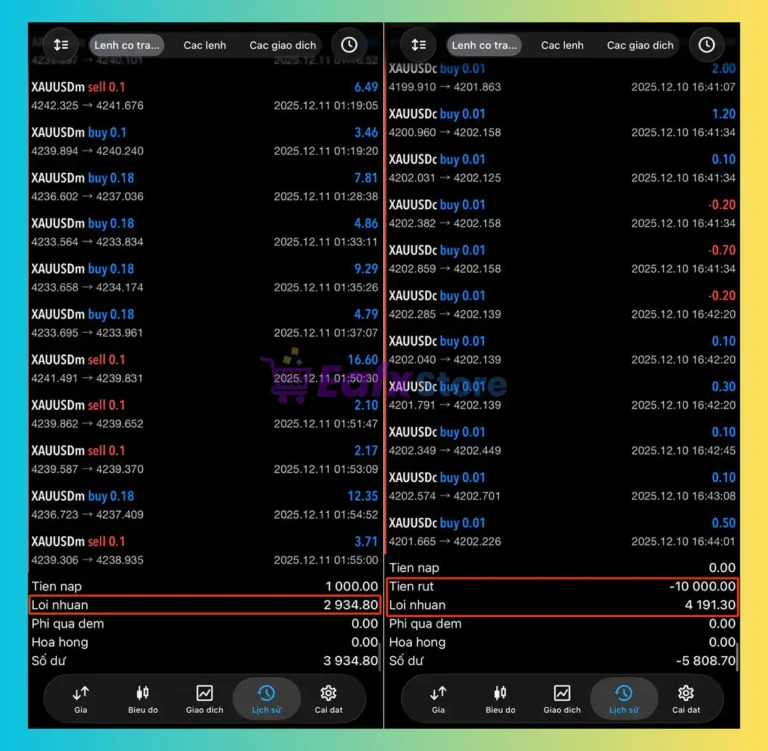

Institutional Predictive Pro MT5 Trading Results

Institutional Predictive Pro EA Trading Results

Why choose & use Institutional Predictive Pro MT5?

🔹High Stability Under Volatility: Dynamic spacing and smart clustering reduce risk during sudden market expansions.

🔹Prop-Firm Friendly: Daily caps, auto-resets, and controlled exposure align with strict funding-firm rules.

🔹Optimized for Long-Term Use: Intelligent tracking, visual dashboard, and layered safety systems support consistent performance.

Recommended settings

Recommended settings and parameters to pay attention to from developers and experts:

| Features | Type |

|---|---|

| Trading platform | MetaTrader 5 (MT5) |

| Time frames | M1 - H1 |

| Currency pairs | XAUUSD (Gold) |

| Minimum / Recommended deposit | $1,000 (use with Cent account) |

| Minimum / Recommended leverage | Any |

| Account type | Any |

| Product type | NoDLL / Umlimited / Fix |

| Additional services | Unlock and Decompile |

| Recommended brokers | Exness Broker, Icmarkets Broker |

| Recommended VPS | MyfxVPS.com ( Blue VPS, Golden VPS). Lowest Latency, 2 week Free Trial, 100% Free for 12-18 Months. |

➡️ Reviewed by David Easton

Product Download Package?

The download package of the product suite includes:

✅ Experts: Institutional Predictive Pro.ex5

➡️ Setting Guide: View here

Conclusion

In short, Institutional Predictive Pro MT5 delivers a robust grid-based architecture with adaptive spacing, volatility-aware scaling, and disciplined daily cycle management. Its bi-directional logic, smart trailing, and auto-reset system ensure stability even in fast markets. A powerful long-term solution built for prop-firm safety and consistent, intelligent performance.

User Reviews

Only logged in customers who have purchased this product may leave a review.

❓ What is Institutional Predictive Pro and how does it work?

Institutional Predictive Pro is a multi-layered grid trading system that uses adaptive spacing, volatility filtering, and automatic cycle resets. It operates bi-directionally, generating both buy and sell cycles while managing exposure through intelligent position scaling.

❓ How does the Adaptive Grid Engine improve safety?

The EA uses three grid layers—inner, middle, and outer—with dynamic spacing that widens during volatile conditions. This helps reduce trade density, slow down exposure growth, and prevent aggressive clustering when markets expand rapidly.

❓ Does Institutional Predictive Pro use martingale?

Yes, the system applies a controlled martingale progression, but it is paired with volatility-based spacing, cycle limits, and daily resets to maintain safer long-term behavior compared to traditional martingale EAs.

❓ What makes the EA suitable for prop-firm trading?

The EA includes daily profit caps, auto reset cycles, exposure limits, and stability-focused grid behavior, all designed to align with prop-firm drawdown rules and consistency requirements.

❓ Which currency pairs and timeframes are recommended?

Institutional Predictive Pro is optimized for XAUUSD (Gold) and works effectively across M1 to H1 timeframes, adapting its spacing and clustering logic based on real-time volatility conditions.

❓ How does the volatility gap detection system work?

The EA measures price speed and expands the grid spacing using a “gap multiplier.” When markets move fast, the system widens intervals between trades to prevent overexposure and reduce drawdown risk.

❓ What is the cycle reset method and why is it important?

After reaching a profit target, the EA automatically closes cycles and resets the position structure. This prevents long-term floating drawdown and maintains daily consistency for safer long-term trading.

❓ How does the bi-directional grid benefit performance?

Running buy and sell cycles simultaneously creates a balanced structure that captures trends in both directions. Tiered clustering allows the system to handle reversals more efficiently while stabilizing equity curves.

❓ What account size and leverage are recommended?

A minimum of $1,000 (Cent account recommended) is suggested for optimal performance. The EA operates with any leverage, though higher leverage may provide more breathing room for grid spacing.

❓ Is Institutional Predictive Pro beginner-friendly?

Yes. Despite its advanced architecture, the EA includes a clean interface, automatic cycle management, visual dashboards, and pre-configured safety settings—making it suitable for both novice and experienced traders.

🔥 Get This EA for FREE with Our Membership! 🚀🚀

Unlock access to this EA, premium Indicators, and exclusive trading tools completely FREE with any of our Membership Plans! Thousands of traders already benefit from our VIP library—join them and level up your trading instantly. Choose Your Membership:

- SPECIAL – 1 Month Membership

- GOLD – 1 Year Membership

- PREMIUM – 1 Year Membership

There are no reviews yet.