The Grid strategy is very popular among traders because it is easy to use and helps traders Turn their losing trades into winning ones. This will be very easy if the market is in a clear trend… Learn more about the Grid strategy and what are its advantages and disadvantages.

How the Grid Strategy Works in Forex

If you open a buy trade on the EUR/USD at 1.1100 but the price drops immediately and reaches 1.1050, it is possible that this drop will continue. If that happens, you will lose because you have a buy trade from a higher level, so you will open a sell trade from this level with a lot size higher than the previous one.

But what will happen if the pair goes up? You will open a buy order to compensate for the losses that occurred with the selling order with the higher lot… etc. This is a Grid strategy that depends on opening more orders in case the price reverses against you and you aim for it to reach a good level where you exit all these orders with a small profit.

2 – The logic behind Grid strategy

The Grid strategy depends on the pair’s movement in one direction, whether it’s up or down, If the pair goes up and you have a sell order, the Grid strategy will save you and achieve good profits too. The same thing happens in the case of a downward trend, but what will happen if the pair moves sideways?

The strength of the strategy lies in the fact that pairs do not always remain sideways and must break out of this trend at some point, but what if a sideways trend occurs and this trend lasts for weeks? Of course, you may lose because in this case, you will open many buy and sell orders.

If you look at the chart, you will find that the pairs are making Highs and Lows. No pair moves in a sideways forever. This is what the strategy focuses on. These are its strengths: it can correct wrong decisions in the event that you do not know the trend well and decide to buy, but the next movement will be downward… etc.

How it works

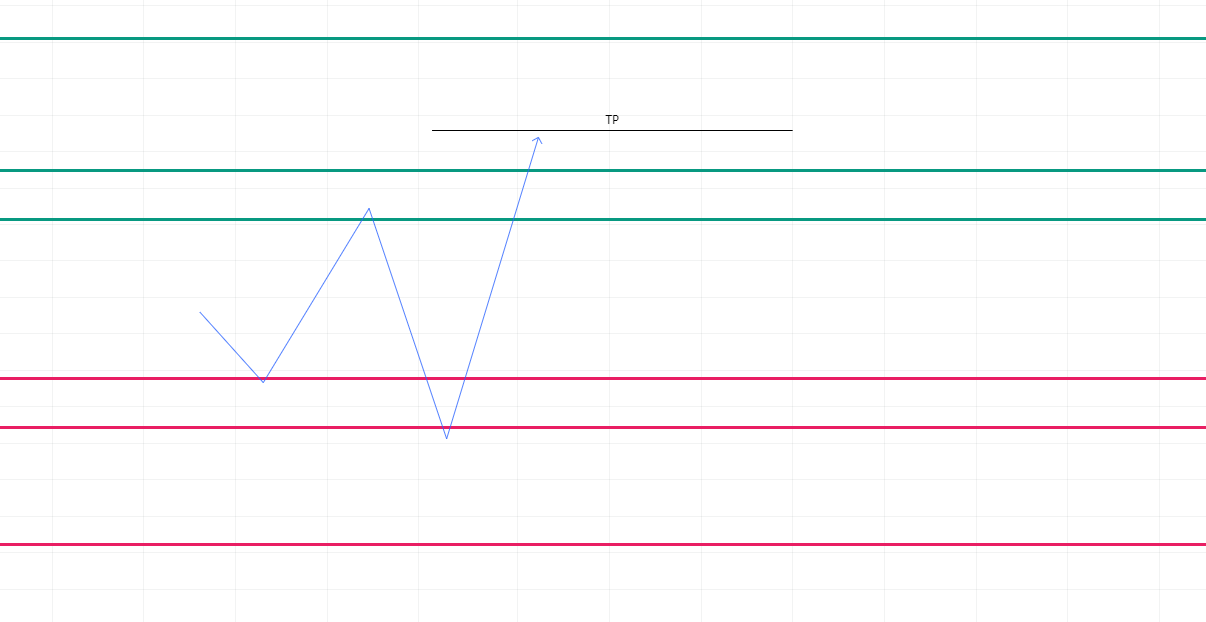

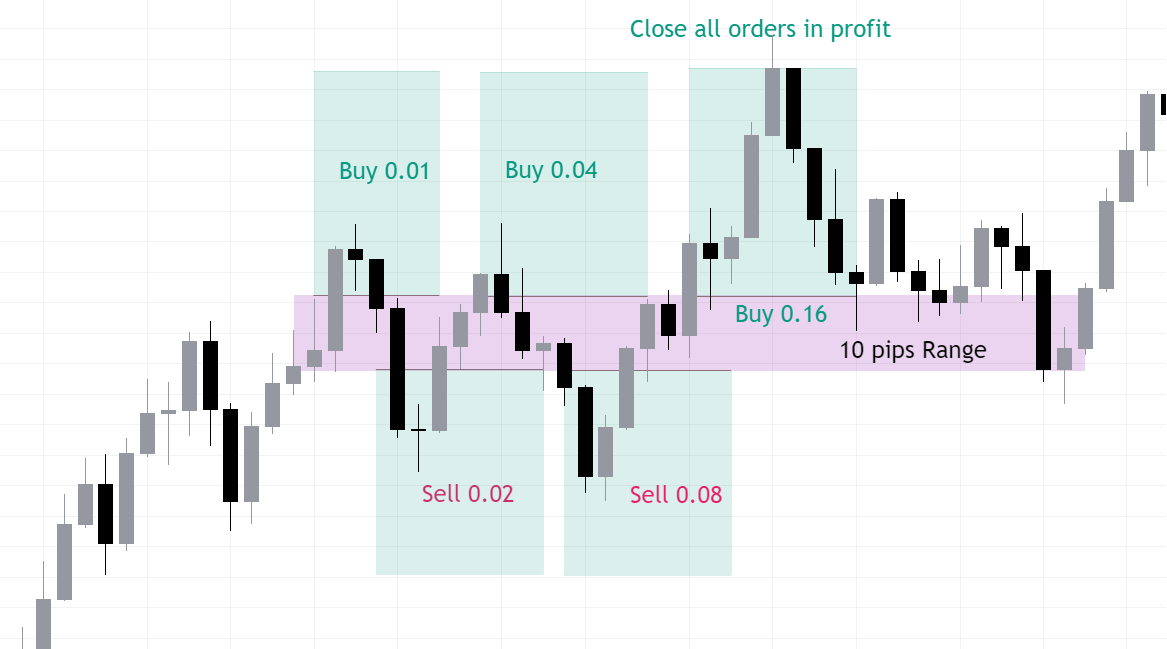

The Grid strategy works by placing pending orders in the opposite direction of the first trade. For example, if you open a buy order with 0.01 lot at the level of 1.1500, you will place a Sell Stop with 0.02 lot at the level of 1.1490, i.e. after only 10 pips. If the price falls, the sell order will be activated and all trades will be closed when the appropriate profit is achieved.

But if the price rises again before achieving the target, you will place a Buy Stop with 0.04 Lot in case the price rises again to the initial buying area, and when the trade is activated, you will place a Sell Stop for the same previous selling area… and so on.

The range may be more than 10 pips, and this varies from one pair to another, because there are pairs that fluctuate a lot. In this case, the range must be increased a little so that you do not find yourself opening many lots, and the account will not be able to handle them in this case.

After the pair leaves this range, all positions must be closed either manually or by placing a stop loss. The stop loss for buying positions will be the take profit for selling positions and vice versa.

Should all orders be closed?

It is also possible to close only winning trades if you want to keep losing trades open in the hope that the price will return and go in your favor, but this is followed by many risks.

Because the first method, which is to close all positions, does not require you to analyze the market. The Grid strategy saves you from predicting the current market trend. However, if you decide to close the buy orders and keep the sell orders in the hope that the pair falls, you may lose your entire account if it rises more and more.

But if you are confident that the pair will fall for several factors and are very sure of this decision, you can take this risk, but in my opinion, this is an undesirable risk because it puts your entire account at risk.

Trade against the Trend

Is the Grid strategy limited to hedging only?

There is another use for the Grid strategy, but it carries some risks. If you want to open a sell order and the pair goes up, you can open more sell orders with a Higher lot than the previous one until the pair makes some corrections so that you can exit all orders with a good profit or at least with the least possible loss.

This method carries with it many risks because trading against the general trend is of course dangerous, but it is possible to exploit some corrections that the pair may make and turn losing orders into profitable ones. The risks here lie if the pair continues to rise, in this case, you will incur many losses that the account may not be able to bear.

This strategy is based on having a limit on the movement of the pairs during the day and the week as well. If the pair reaches this limit, it is possible for it to make some corrections until the end of the day and a new day begins with new momentum, then it completes this movement. In this case, these corrections can be exploited. For example,

If the EUR/USD rises more than 80 pips on Monday, knowing that the EUR/USD movement during the week is from 80 to 150 pips, in this case, it is possible to take sell orders from a suitable level (Resistance or good Supply zone), targeting the pair to fall again.

Of course, this scenario can happen if there is no news. If there is strong news that affects this movement, the movement of the Euro Dollar may reach 300 pips during the week. In this case, do not rely too much on this method.

To apply the Grid strategy well, you must first choose the appropriate account for your capital. If the account capital is $1000, this is good, but it is better at the beginning to deposit $10 in a cent account so that you do not risk most of your capital in a new strategy.

Then choose the largest leverage with the broker. Some brokers offer leverage of up to 1:3000 and Unlimited. This is the best leverage you can get so that your account can withstand reversals and no part of the capital is reserved as a margin with the broker.

Then decide whether you want to work on this strategy as an aid to your trades or is it your main strategy? If it is an aid, determine the lots that you will open after the first trade because the first trade is based on your normal strategy and the next lot will be a doubling of this lot.

However, if you are going to rely entirely on the Grid strategy for entry and exit, you must determine whether you want to trade with the market (hedge) or against the market.

There are times when the market moves very slowly, and in this case, you will not gain anything from opening many orders because the market will not give you any results and a commission will be added to you for carrying the orders over to the next day (unless your account is Islamic), Therefore, you must choose the pairs that you will work on very carefully. Among the pairs that respect most strategies is the Euro Dollar. You will find that this pair has good movement and is compatible with the Grid strategy.

As for the time frame, there is no specific time frame, but there is a range that must be adhered to. If you choose the range that separates the buy and sell orders by 30 pips, for example, you must adhere to this number and not increase or decrease it so that you do not find that there are more losing trades than other trades.

News trading

Does Grid strategy work during news?

If you want to open buy and sell orders until the pair exits this range, the news will help you achieve that, as the news has a good effect on getting the pair out of the sideways movement.

But if the trend is clear and you have entered a trade against the trend, you should not enter at the time of the news so as not to make matters worse and carry the account with more losses. The best decision at such a time is to open hedge orders.