Home »

Blog »

Dynamic Pips MT4 Settings Review: Full Configuration Analysis Dynamic Pips MT4 Settings Review: Full Configuration Analysis

What is Dynamic Pips MT4? Dynamic Pips MT4 is a purpose-built Expert Advisor (EA) featuring an enabled Grid and Martingale strategy, designed for traders with a high-risk tolerance and a focus on recovering losses through progressive lot sizing. It is highly mechanical, using a wide risk-to-reward ratio and allowing heavy grid deployment for increased trade frequency.

📌📌📌 Buy this unlimited Dynamic Pips MT4 product here 📌📌📌

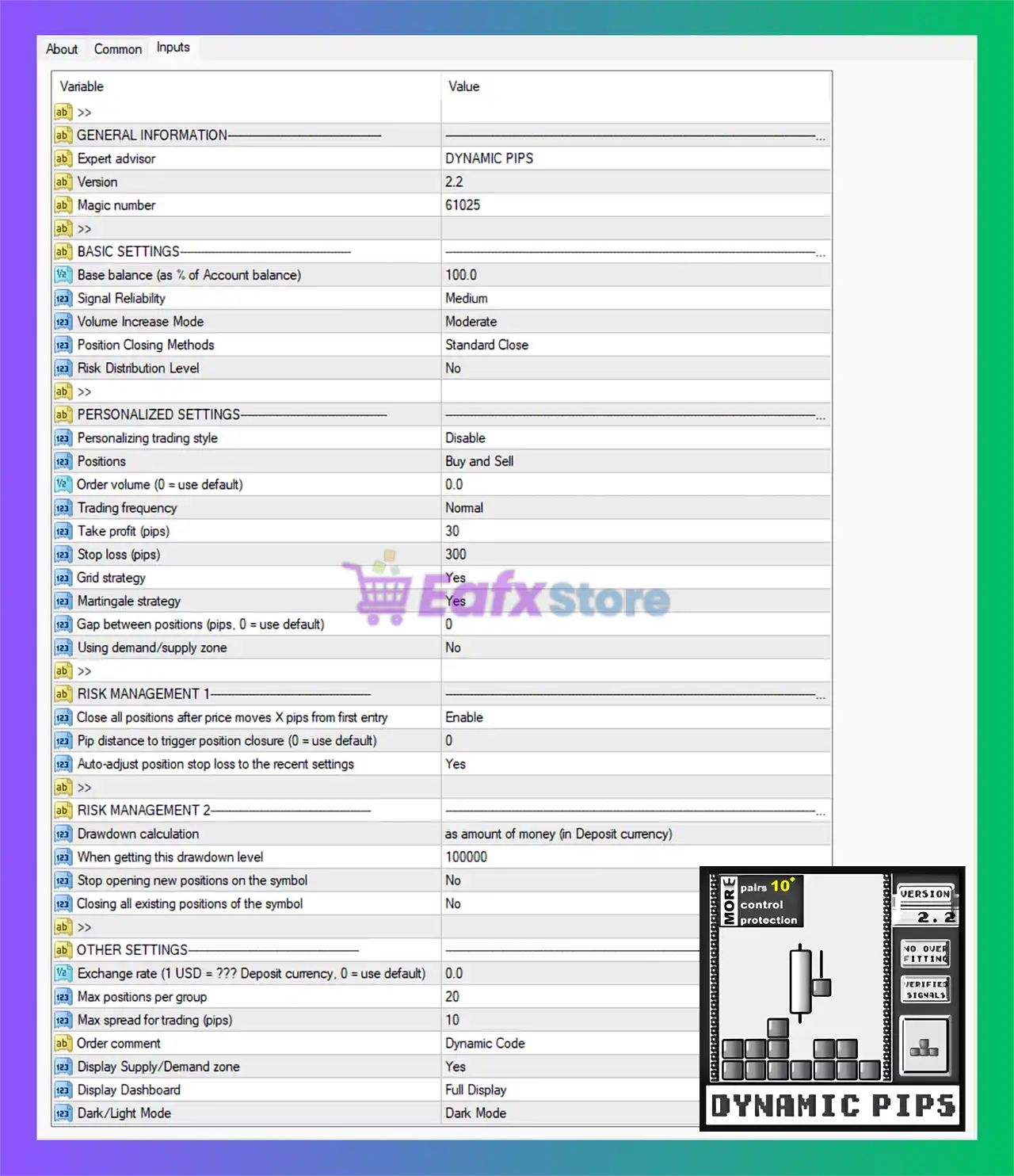

Dynamic Pips MT4 Settings Review: Full Configuration Analysis 4 Parameter Value Expert Advisor Dynamic Pips Version 2.2 Magic Number 61025

✅ This indicates a custom-built EA with a unique identifier (magic number) for tracking trades.

⚙️ Basic Settings

Setting Value Base Balance (% of Account) 100.0 Signal Reliability Medium Volume Increase Mode Moderate Position Closing Methods Standard Close Risk Distribution Level No

🔎 Analysis :

Base balance at 100% means the EA uses the full account balance to calculate trade sizes.Signal reliability at Medium suggests balanced trade filtering.Moderate volume increase may imply a mild lot-scaling or martingale-type progression.Standard Close means trades likely close via TP/SL rather than indicators.Risk Distribution: No indicates risk isn’t being spread across multiple strategies or symbols.

🧠 Personalized Settings

Setting Value Personalizing trading style Disable Positions Buy and Sell Order Volume 0.0 (use default) Trading Frequency Normal Take Profit 30 pips Stop Loss 300 pips Grid Strategy Yes Martingale Strategy Yes Gap Between Positions 0 Using Demand/Supply Zone No

🔎 Analysis :

Martingale + Grid enabled : A high-risk combo. This EA will increase lot sizes after losses (Martingale) and place multiple orders at intervals (Grid).Stop Loss = 300 pips , Take Profit = 30 pips: Suggests a wide risk-to-reward ratio, typical for grid/martingale systems.No personalization or demand/supply filtering : This may make it more mechanical and less adaptive to current market sentiment.

⚠️ Risk Management 1

Setting Value Close all positions after X pips from first entry Enable Pip distance to trigger closure 0 Auto-adjust Stop Loss Yes

🔎 Analysis :

Auto-stop loss adjustment can help reduce risk during volatile markets.Closure after pip distance = 0 means the EA may use internal logic to exit trades when a certain total loss/win is reached.

⚠️ Risk Management 2

Setting Value Drawdown Calculation Amount of money Drawdown Level 100,000 Stop Opening New Positions No Close All Existing Positions No

🔎 Analysis :

$100,000 drawdown limit is only effective on high-capital accounts.No restrictions to stop or close trades at drawdown : Risk of full account wipeout in worst-case scenarios.

🔧 Other Settings

Setting Value Exchange Rate 0.0 (use default) Max Positions Per Group 20 Max Spread for Trading 10 pips Order Comment Dynamic Code Display Supply/Demand Zone Yes Display Dashboard Full Display Dark/Light Mode Dark Mode

🔎 Analysis :

Max spread = 10 pips is quite high; this EA may trade even during volatile or low-liquidity conditions.20 max trades per group : Supports heavy grid deployment.Dark mode UI improves user experience, but not functionality.

✅ Conclusion: Is the Dynamic Pips EA Safe and Effective?

Based on the settings:

Risk Level : 🔴 HIGH – Enabled grid and martingale strategies, large stop losses, no adaptive drawdown controls.User-Friendliness : ✅ Good – Clear display, customizable input.Best Suited For : Traders with high-risk tolerance , experience with recovery strategies , and larger account balances .Not Recommended For : Beginners, or those with small accounts or low drawdown tolerance.

⚠️ Warning : Martingale and Grid strategies can lead to significant losses if not closely monitored or used without proper capital allocation.