What is Burning Grid MT5?

Burning Grid MT5 is a Multi-Pair Grid Expert Advisor (EA) designed for stability and Prop Firm compliance, using a highly conservative 1% risk per trade and a balance-based risk calculation. It features an Auto Mode that adjusts logic automatically for different account types and integrates an Event Filter to avoid trading during high-impact volatility.

📌📌📌 Buy this unlimited Burning Grid EA MT5 product here 📌📌📌

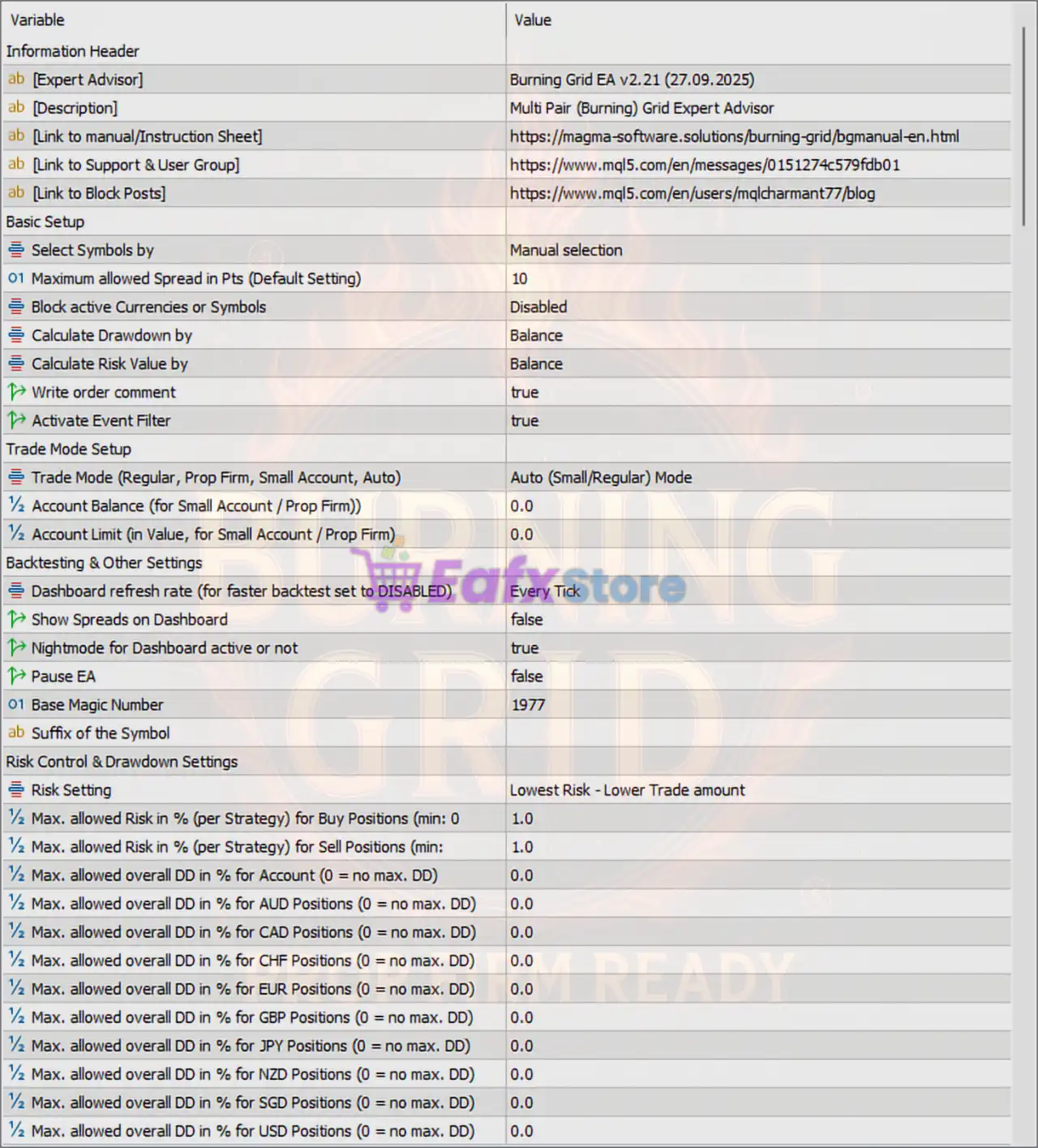

General Information

| Parameter | Value | Description & Function |

|---|---|---|

| [Expert Advisor] | Burning Grid EA v2.21 (27.09.2025) | Version and release date. Ensures compatibility with current MT5 platform. |

| [Description] | Multi Pair (Burning) Grid Expert Advisor | The EA uses a grid strategy across multiple symbols. |

| [Link to manual/Support/Blog] | mql5.com & magma-software.solutions | Access to documentation, updates, and community support. |

✅ Analysis:

The EA is developed by Magma Software, which maintains a consistent update history. It focuses on multi-pair grid trading, meaning one EA can manage multiple currency pairs under the same logic and settings.

Basic Setup & Functionality

| Parameter | Value | Description & Real-World Impact |

|---|---|---|

| Select Symbols by | Manual Selection | You can manually choose which symbols to trade. |

| Maximum Allowed Spread (Default) | 10 Pips | Prevents trading during high-spread periods (e.g., during news). |

| Block Active Currencies or Symbols | Disabled | The EA can trade multiple symbols without restrictions. |

| Calculate Drawdown by | Balance | Drawdown is calculated based on balance, not equity, to maintain stable risk calculation. |

| Calculate Risk Value by | Balance | Consistent risk-per-trade calculation without being affected by floating profits/losses. |

| Write Order Comment | True | The EA includes trade info (symbol, strategy ID, etc.) in each order for tracking. |

| Activate Event Filter | True | Enables the EA to avoid trading during high-impact news or volatility spikes. |

✅ Analysis:

These parameters show a balance between flexibility and safety. The EA avoids volatile conditions (via spread filter and event filter) but still allows flexibility in symbol choice. The usage of Balance-based calculation helps keep the EA stable, especially on multiple-pair trading.

Trade Mode Setup

| Parameter | Value | Description & Impact |

|---|---|---|

| Trade Mode (Regular, Prop Firm, Small Account, Auto) | Auto (Small/Regular) | Automatically detects trading conditions and adjusts behavior for either small retail or prop firm accounts. |

| Account Balance / Limit (for Small Account / Prop Firm) | 0.0 | Default placeholder; EA uses the broker’s actual balance. |

| Base Magic Number | 1977 | A unique identifier for all trades, prevents conflict with other EAs or manual trades. |

| Dashboard Refresh Rate | Every Tick | Updates the data in real-time, suitable for backtesting and optimization. |

| Show Spreads on Dashboard | False | Disabled for faster performance during testing. |

| Night Mode for Dashboard Active | True | Cosmetic change to reduce screen glare during long-term usage. |

| Pause EA | False | The EA is fully active (not paused). |

| Suffix of Symbol | — | Used when the broker uses special symbol names (e.g., EURUSD.m, GBPUSD_i). |

✅ Analysis:

The “Auto Mode” is a standout feature — the EA can adjust its logic automatically for different account types (e.g., small accounts vs. prop firm rules such as Max Daily DD). The Magic Number setting is crucial for portfolio management and multi-EA usage.

Risk Control & Drawdown Management

| Parameter | Value | Description & Explanation |

|---|---|---|

| Risk Setting | Lowest Risk – Lower Trade Amount | Conservative mode, emphasizes account safety. |

| Max Allowed Risk % (Buy/Sell) | 1.0% | Risk per trade; standard for low-risk grid trading. |

| Max Allowed Overall DD (Total) | 0.0% (no max DD) | No DD limit → the EA will keep trading unless manually stopped. |

| Max Allowed Overall DD (Per Currency) | 0.0% for all AUD, CAD, CHF, EUR, GBP, JPY, NZD, USD pairs | No per-currency DD limit — 100% of capital can be utilized. |

✅ Analysis:

The EA runs under 1% risk per trade — this is very conservative for grid trading and shows a safety-first design. However, because overall DD limits = 0%, the trader must monitor the EA or set limits manually to prevent excessive exposure during extreme volatility.

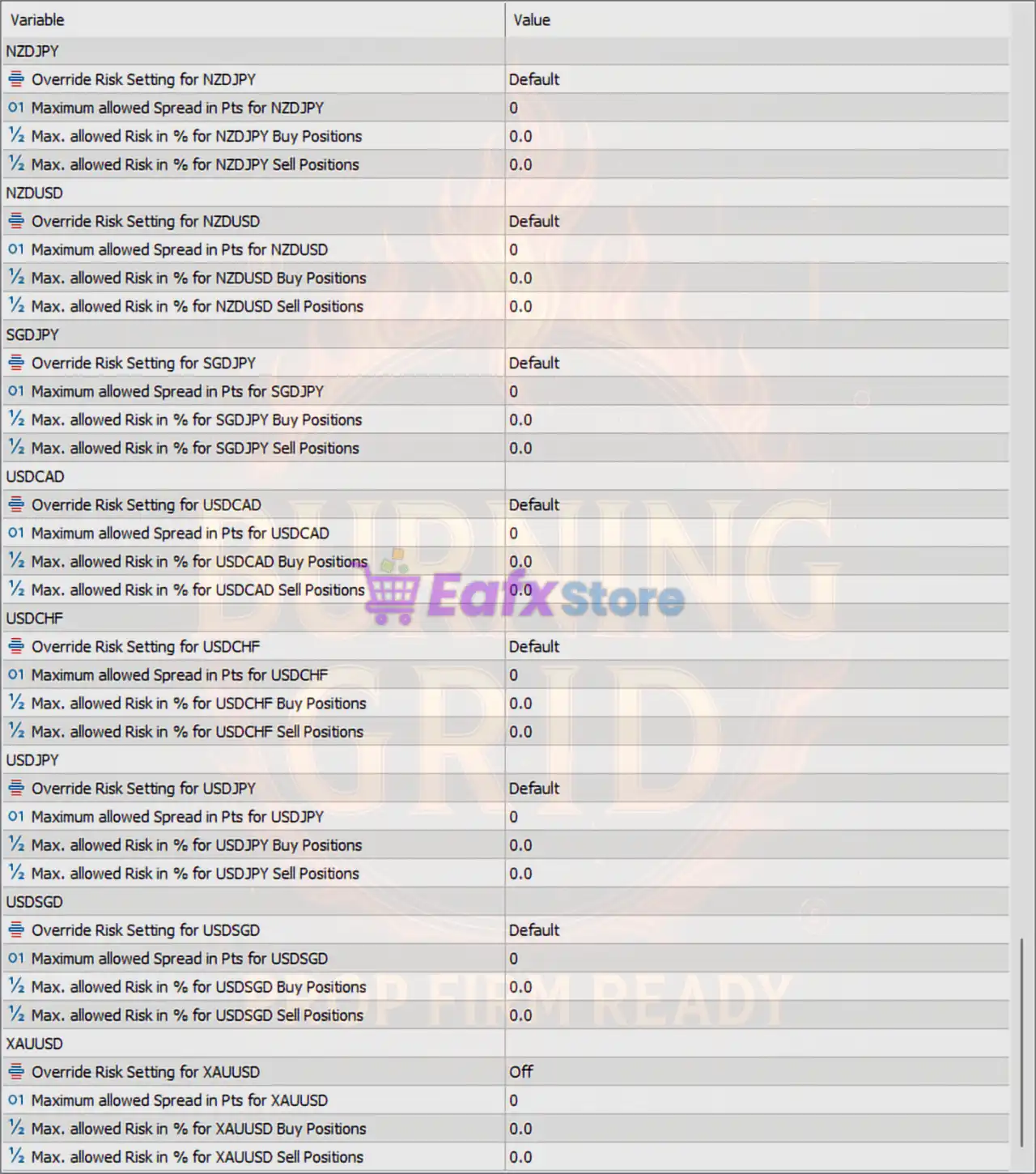

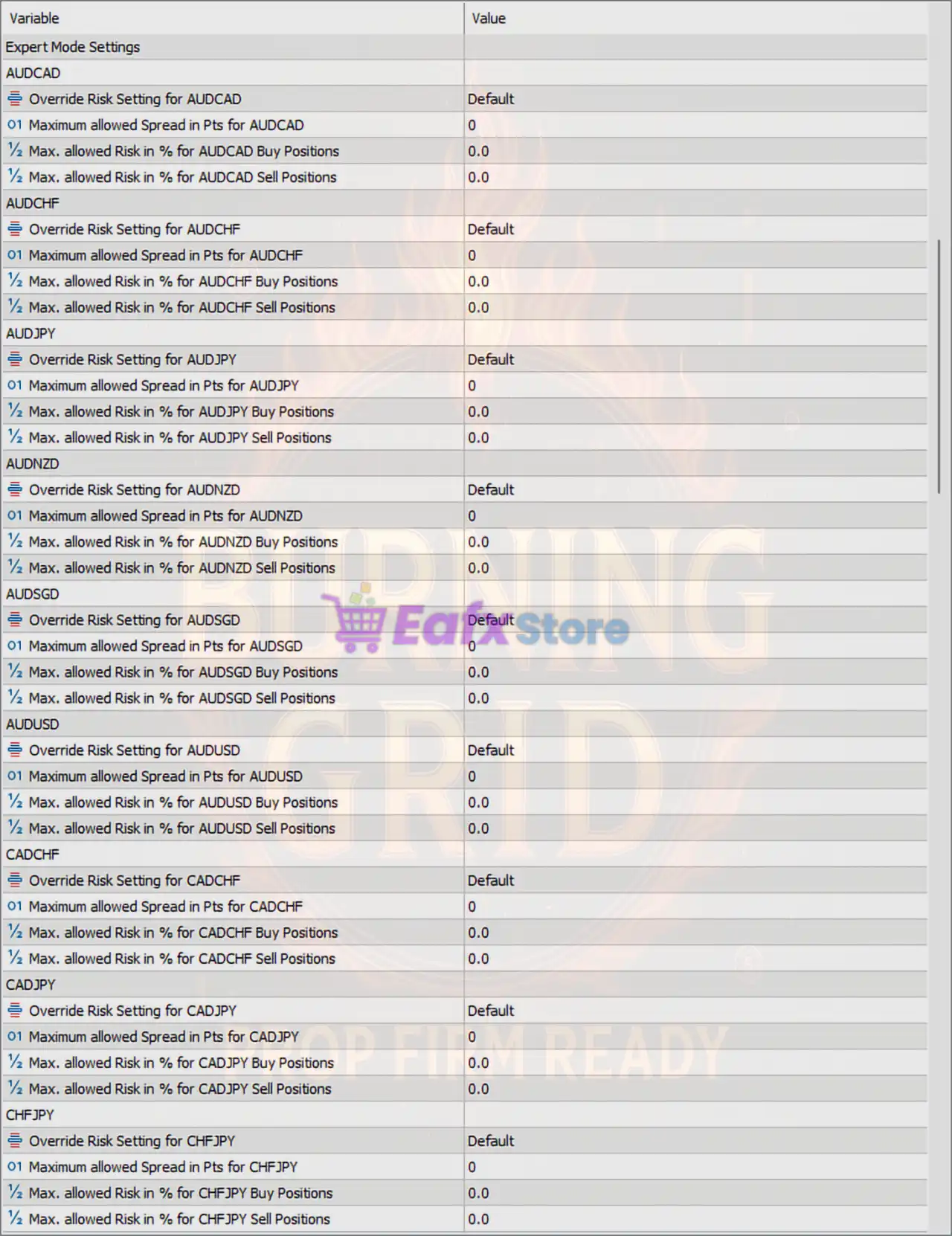

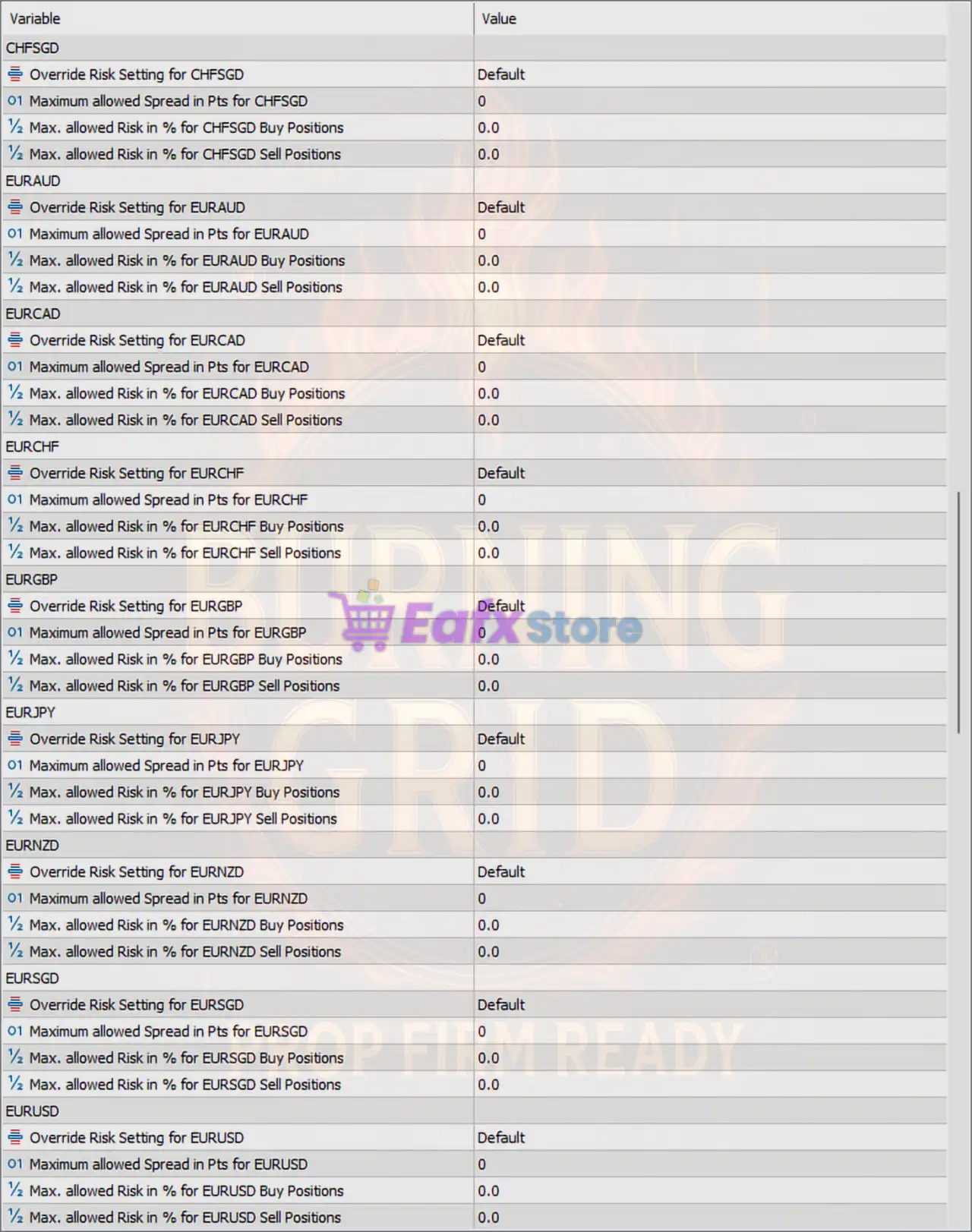

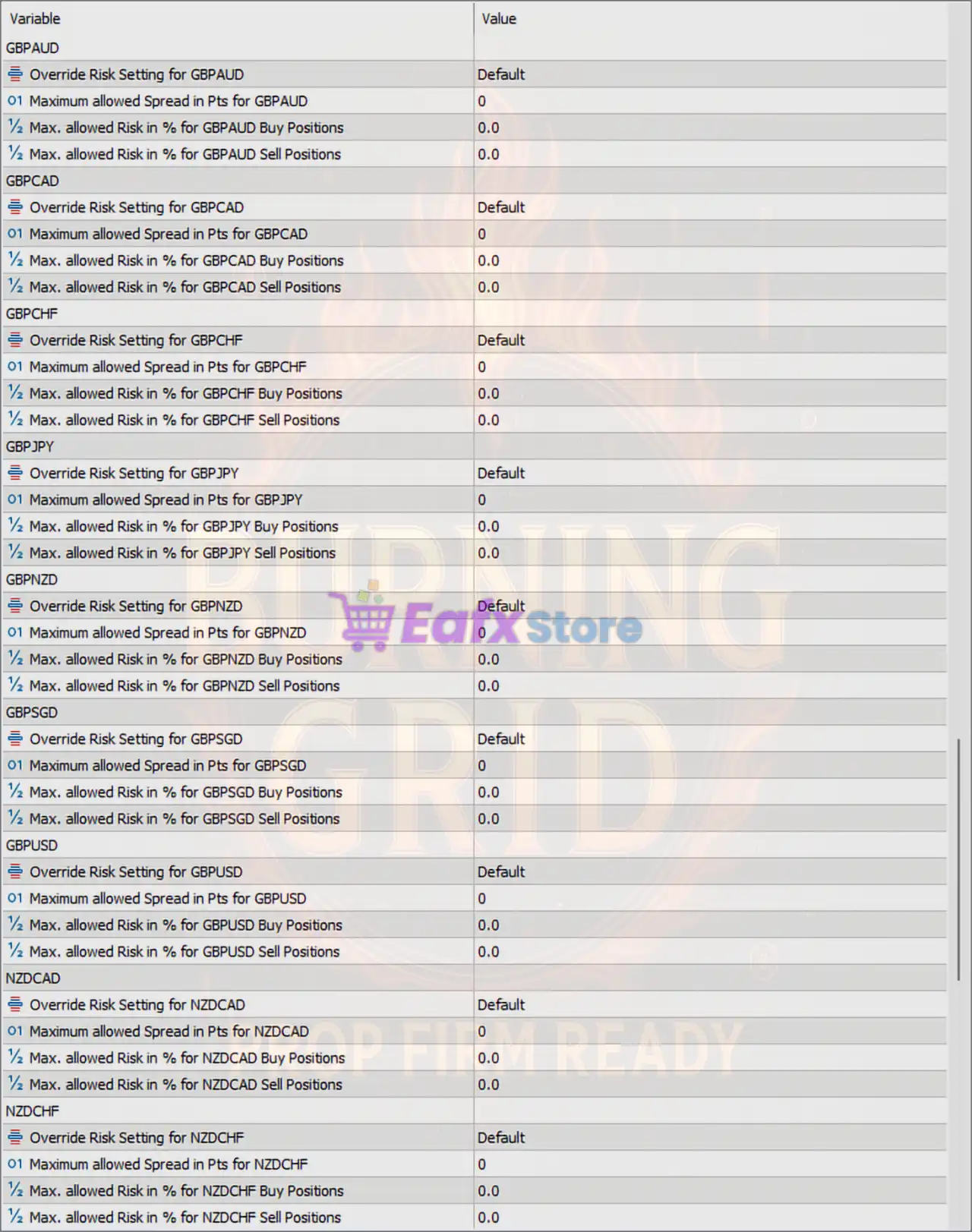

Expert Mode Settings (Per-Pair Configurations)

Pairs Covered:

AUD, CAD, CHF, EUR, GBP, JPY, NZD, SGD, USD (20+ combinations)

| Key Parameters (Same for Each Pair) | Description & Usage |

|---|---|

| Override Risk Setting (e.g., for EURUSD, GBPJPY, etc.) | Default/Off |

| Maximum Allowed Spread (Pips) | 0 |

| Max Allowed Risk in % (Buy/Sell) | 0.0 |

✅ Analysis:

The per-pair settings are currently disabled or neutral (0 / Default) — this means the EA operates under a centralized control logic. It’s ready for customization if the trader wants to optimize one specific symbol (e.g., GBPUSD or EURUSD). The developer leaves this flexibility for advanced users or prop firm adaptation.

Risk Strategy & Trading Logic

The EA uses grid-based entries, but unlike traditional grid EAs that often risk over-leverage, Burning Grid EA emphasizes risk segmentation:

- Trades can be scaled across multiple pairs to smooth equity curve.

- “Event Filter” reduces exposure during major news (a common cause of grid EAs blowing up).

- Risk per trade = 1%, which is unusually conservative for a grid system.

The EA’s name “Burning Grid” implies a dynamic grid logic — the EA likely uses momentum-based grid placement rather than pure averaging, which can keep the risk low and the grid density adaptive.

Conclusion

The Burning Grid for MT5 is a multi-pair, low-risk grid system designed for both regular traders and prop firm compliance. With 1% risk per trade, event-based protection, and multi-currency flexibility, it balances between safety and scalability.

Traders can utilize its Auto Mode for dynamic environment adaptation or fine-tune each symbol for optimization. While the default setup prioritizes safety, manual drawdown limits and per-pair settings should be refined for maximum profit.

✅ Best Use Case:

Swing grid trading on multiple pairs (GBPUSD, EURUSD, USDJPY) under low-risk, balance-based conditions.

⚙️ Recommended Broker Setting:

Raw spread (ECN), low commission broker, and stable news conditions (avoid NFP, CPI, etc.).