What is Gyroscope MT5?

Gyroscopes MT5 is a high-frequency Expert Advisor (EA) that employs a Grid strategy combined with flexible Money Management for automated capital control. It uses an extremely small Grid Step for scalping minimal price movements, and implements dual exit control through both virtual and absolute Stop Loss/Take Profit for enhanced trade management.

📌📌📌 Buy this unlimited Gyroscopes MT5 product here 📌📌📌

Money & Risk Management: The Key to Survival

This is the most critical group of settings, determining your trade volume and the overall risk exposure of your account.

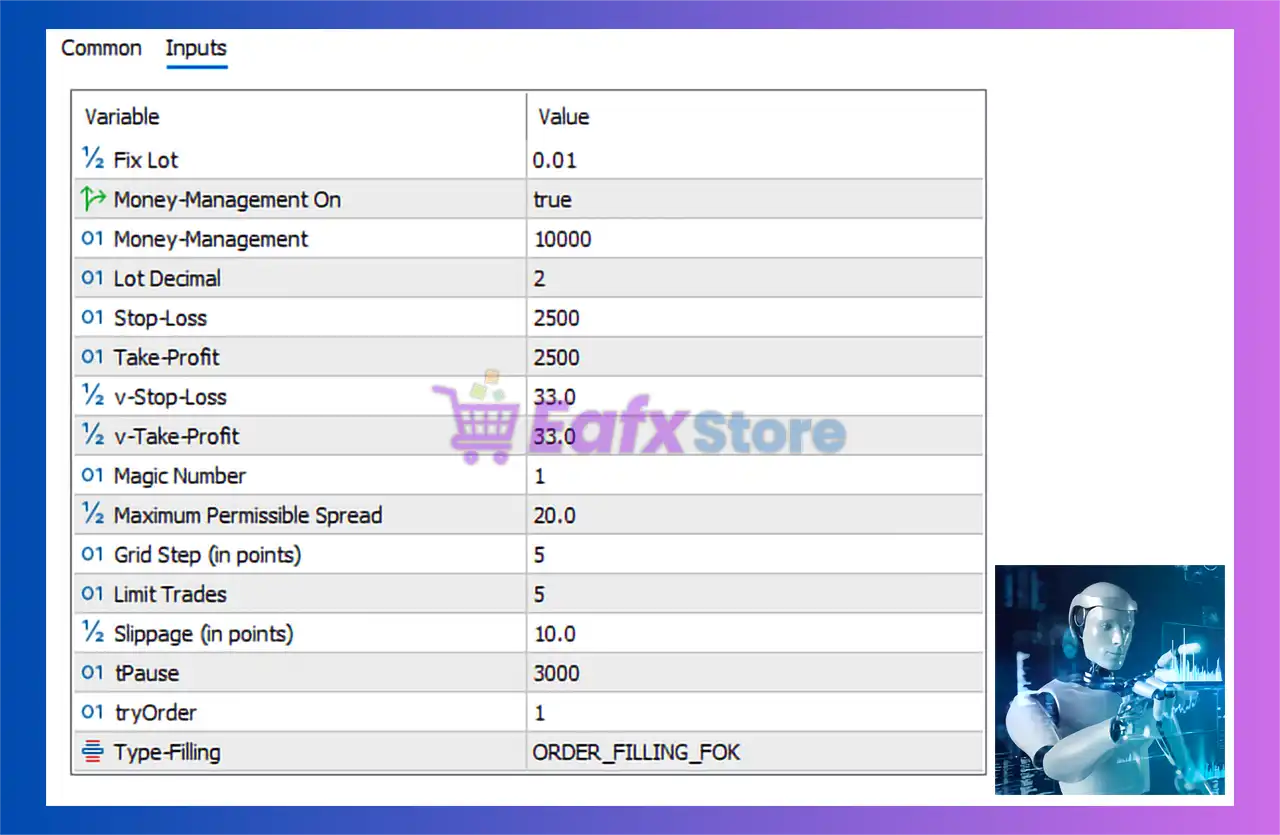

| Parameter | Value | Meaning (Simplified) | Importance |

| Money-Management On | true | Enables automatic capital management. The EA will calculate the lot size based on your account balance or equity. | Crucial. Should generally be set to true for better risk control. |

| 01 Money-Management | 10000 | This is the base equity needed to trade a standard 1.0 Lot (or 0.1 Lot, depending on the programming). If you have $1,000, the EA will open 1/10th of the base lot, e.g., 0.1 Lot. | Needs adjustment based on your actual capital and acceptable risk level. |

| ½ Fix Lot | 0.01 | Minimum/Fixed Lot Size. This is used as the base lot or the fixed lot if Money Management is turned false. With true, it serves as the base lot. | Represents the smallest order volume, indicating a low-risk starting point. |

| 01 Lot Decimal | 2 | Allows the Lot Size to have two decimal places (e.g., 0.15, 0.03…). | Ensures flexibility and precision when calculating exact lot sizes. |

Export to Sheets

Stop Loss & Take Profit: Setting the Boundaries

These parameters define the exit points for trades, helping to protect your capital (Stop Loss) and secure profits (Take Profit).

| Parameter | Value | Meaning (Simplified) | Important Note |

| 01 Stop-Loss | 2500 | Absolute Stop Loss measured in points. 2500 points equals 250 Pips (for 5-digit pairs like EURUSD) or 25 Pips (for 3-digit pairs like XAUUSD/Gold). | This is a relatively wide SL. You must confirm the correct unit (pip or point) to know the actual risk. |

| 01 Take-Profit | 2500 | Absolute Take Profit also measured in points. The current Risk/Reward (R:R) ratio is 1:1. | An R:R of 1:1 requires a high winning rate to be consistently profitable. |

| ½ v-Stop-Loss | 33.0 | Virtual Stop Loss (VSL). The EA will close the trade when the loss reaches 33.0 currency units (e.g., $33), regardless of the absolute SL level. | Virtual SL allows for faster reaction but carries a slight risk if the system loses connection. |

| ½ v-Take-Profit | 33.0 | Virtual Take Profit (VTP). The EA closes the trade when the profit reaches 33.0 currency units. | This manages trades based on a specific dollar/money amount, which can be easier to control than pip values. |

Export to Sheets

Execution Mechanism & Grid Strategy Details

These settings suggest the EA employs a Grid strategy (opening multiple orders at fixed intervals) and define its limits and execution rules.

| Parameter | Value | Meaning (Simplified) | Strategy Implication |

| 01 Grid Step (in points) | 5 | Minimum distance between consecutive orders (Grid Step). 5 points often equals 0.5 pips (extremely small). | This tiny distance indicates a High-Frequency Scalping/Grid EA, capitalizing on minimal price movements. |

| 01 Limit Trades | 5 | The maximum number of trades the EA can open simultaneously (or within the grid series). | Limits excessive stacking of orders, helping to mitigate high grid risk. |

| 01 Magic Number | 1 | The unique ID assigned to trades opened by this specific EA. | Essential for the EA to manage only its own trades, avoiding manual or other EA’s orders. |

| ½ Maximum Permissible Spread | 20.0 | Maximum acceptable price difference (Spread) to open a trade (likely 2.0 pips). | Ensures the EA does not enter trades when the market Spread is too wide (e.g., during news events). |

| ½ Slippage (in points) | 10.0 | Maximum acceptable slippage when placing an order (likely 1.0 pip). | If the execution price deviates by more than 10 points from the requested price, the order will be rejected. |

| Type-Filling | ORDER\_FILLING\_FOK | Order Filling Type: Fill Or Kill (FOK). Requires the entire order volume to be filled immediately. If not, the order is canceled. | Common for Scalping EAs that require fast and precise execution. |

| 01 tPause | 3000 | Pause Time set to 3 seconds (3000 milliseconds). | The cool-down period between attempts to open an order or after a trading cycle is completed. |

Export to Sheets

Key Advice for Beginners

- Test on a Demo Account: With a Grid EA and such a small step size (

Grid Step = 5), you must backtest and forward-test on a Demo account for several weeks to understand its behavior in various market conditions. - Confirm the “Point” Unit: Ask the EA developer how their “point” translates to Pips (i.e., is 10 points = 1 pip, or 1 point = 1 pip?). This will clarify whether the 2500 SL/TP is 25 pips or 250 pips.

- Adjust Money Management: The

10000setting must be adjusted based on the actual risk you are willing to take for every $1,000 of your capital.