What is Argos Rage MT5?

Argos Rage EA is an advanced automated trading system built for MetaTrader 5, blending AI-driven decision logic with deep market analysis under the DeepSeek architecture.

The configuration displayed demonstrates a balanced yet aggressive setup, emphasizing precision entries, controlled risk, and intelligent adaptation to market behavior through the integration of DeepSeek-Chat and Rage Mode.

This setup indicates the EA’s primary goal: achieving high-efficiency trading with AI-enhanced adaptability while maintaining defined risk parameters.

📌📌📌 Buy this unlimited Argos Rage EA MT5 product here 📌📌📌

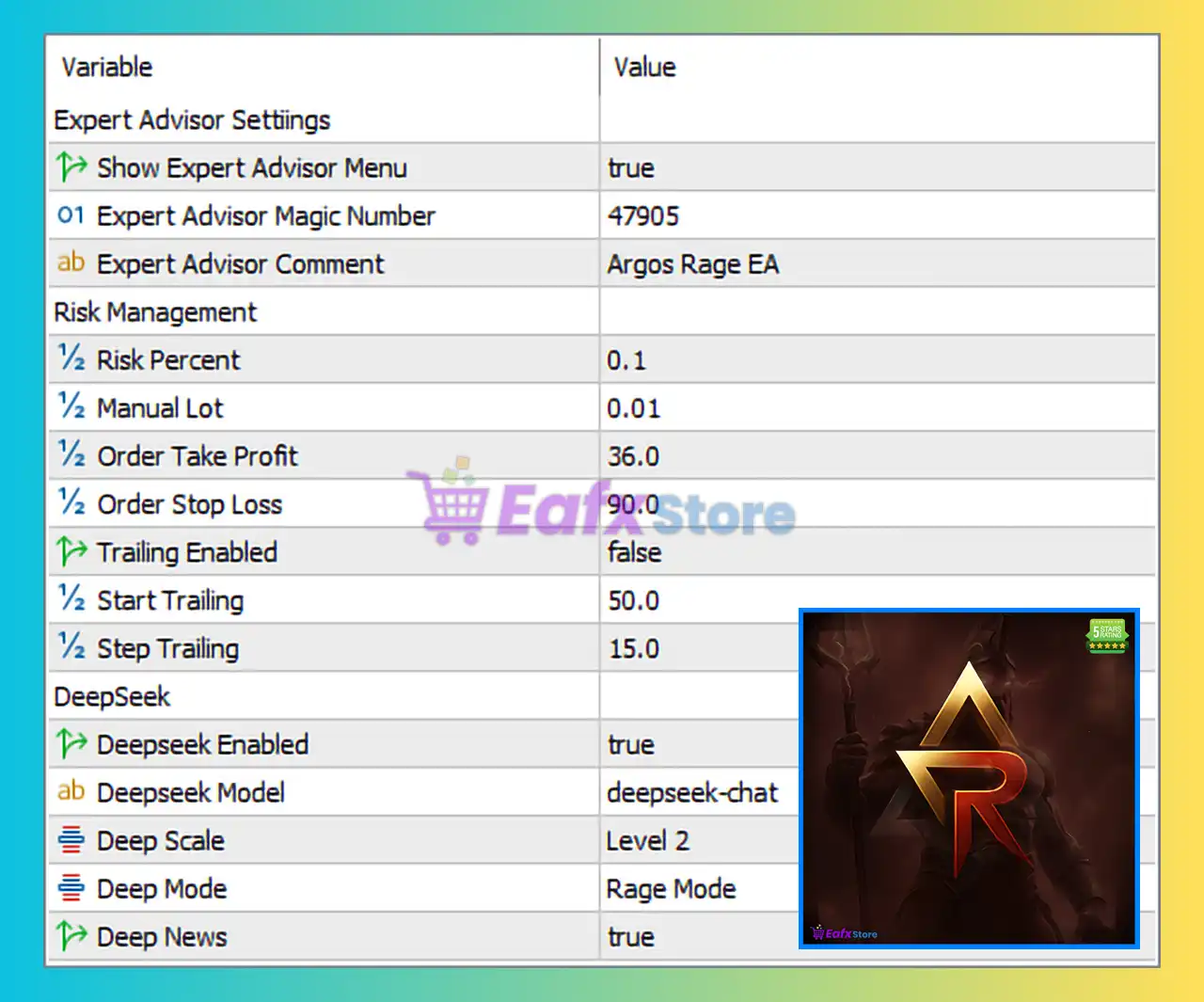

General Expert Advisor Settings

🔹 Show Expert Advisor Menu: True

This setting enables full visibility and manual control of the Expert Advisor (EA) interface within MetaTrader 5.

It allows traders to monitor live operations, adjust settings on the fly, and ensure transparency in algorithmic execution.

🔹 Expert Advisor Magic Number: 47905

A unique identifier assigned to all trades placed by Argos Rage EA.

This prevents interference with trades from other EAs or manual entries, ensuring precise management and clear tracking of performance.

🔹 Expert Advisor Comment: Argos Rage EA

Every trade executed carries the EA’s name as a comment for easy recognition in trade history or Myfxbook verification reports — a professional detail that supports portfolio transparency.

Risk Management Configuration

🔹 Risk Percent: 0.1%

This ultra-low risk percentage reveals that Argos Rage EA operates with exceptional risk discipline, risking only 0.1% of account equity per trade.

Such precision is ideal for traders prioritizing capital protection and long-term account sustainability, including funded account users who must adhere to strict drawdown limits.

🔹 Manual Lot: 0.01

The EA starts with a fixed minimal lot size, suitable for both testing and conservative live trading.

This setup ensures low exposure during volatile conditions and enables safe position scaling when confidence or capital grows.

🔹 Order Take Profit: 36 pips

Each position aims for a target gain of 36 pips, implying a short- to medium-term trading horizon — characteristic of precision scalping or intra-day breakout strategies.

It shows that the EA seeks consistent profit accumulation through frequent, controlled trades.

🔹 Order Stop Loss: 90 pips

The stop-loss level is set wider at 90 pips, roughly 2.5 times larger than the take profit.

This ratio indicates that Argos Rage EA likely depends on high-probability trade entries, allowing for a higher success rate to offset the asymmetric risk-reward ratio.

The broader stop loss provides flexibility for volatile sessions, especially when the EA trades high-momentum assets like XAUUSD or GBPJPY — pairs where strong retracements can precede accurate entries.

Trailing and Dynamic Profit Protection

🔹 Trailing Enabled: False

Trailing stop is disabled in this configuration, suggesting that the EA uses fixed TP/SL logic or internal AI-based exit decisions.

Disabling trailing stop can enhance backtest consistency and predictable results, as price fluctuations do not alter the risk-reward structure during trade management.

🔹 Start Trailing: 50 pips | Step Trailing: 15 pips

Although trailing stop is off, these parameters show that Argos Rage EA supports advanced trailing logic, activating after 50 pips in profit and stepping every 15 pips thereafter.

If enabled, this would transform the system into a semi-dynamic trade protector, ideal for volatile momentum sessions.

DeepSeek Artificial Intelligence Integration

The DeepSeek system embedded within Argos Rage EA is the true intelligence layer — enabling contextual, adaptive market decision-making similar to cognitive AI logic.

🔹 DeepSeek Enabled: True

This confirms the EA is operating in AI-augmented mode, using deep analysis of market sentiment, price behavior, and volatility clusters.

DeepSeek technology enhances decision quality by learning from multi-timeframe signals and real-time price actions.

🔹 DeepSeek Model: deepseek-chat

This model operates like a neural conversational agent, capable of dynamically interpreting and responding to evolving market data.

It mimics human-level analysis while maintaining algorithmic precision, blending quantitative logic with contextual awareness.

🔹 Deep Scale: Level 2

Deep Scale determines the intensity of AI computation or data layering.

Level 2 suggests a balanced processing depth — not overly aggressive, but capable of adaptive reaction to mid-term volatility.

This provides a sweet spot between performance and computational efficiency, reducing resource load while maintaining responsiveness.

🔹 Deep Mode: Rage Mode

This is the core operational mode of the EA — “Rage Mode” signifies a high-reactivity trading style.

In this mode, the EA is optimized for breakout, reversal, or volatility-expansion environments, taking advantage of sudden price dislocations with precise AI timing.

Despite the intense name, the conservative 0.1% risk ensures that aggressive entries are tempered by strict risk control.

🔹 Deep News: True

This setting activates the EA’s news detection filter, allowing it to adapt or pause trading during high-impact economic events.

The ability to integrate real-time news awareness is crucial for AI-driven systems, as it prevents impulsive trades during unpredictable volatility spikes — improving drawdown control and profit consistency.

Strategic Interpretation

Based on the configuration, Argos Rage EA MT5 operates under a hybrid model:

- Low-risk exposure (0.1%) for consistent long-term performance.

- AI-enhanced entries (DeepSeek system) for intelligent decision-making.

- Aggressive volatility mode (Rage Mode) for capturing large market moves with precision.

- Fixed SL/TP structure ensuring clear, testable, and stable strategy behavior.

- News awareness to prevent unnecessary risk during fundamental events.

This combination demonstrates a professional-grade system that leverages both machine learning and structured risk control — a hallmark of modern institutional algorithmic trading.

Strengths

✅ AI-Powered Intelligence (DeepSeek Integration) – Enables adaptive and contextual market decisions.

✅ Ultra-Low Risk Exposure – Only 0.1% per trade, suitable for funded accounts and conservative traders.

✅ Smart News Filter – Avoids trades during economic spikes, reducing drawdown.

✅ Rage Mode Scalability – Enhances profitability during volatile sessions while maintaining discipline.

✅ Transparent Design – Unique magic number and comments support verifiable performance tracking.

Weaknesses or Limitations

⚠️ Fixed Risk/Reward Ratio (36:90) – May require fine-tuning to improve long-term expectancy.

⚠️ Trailing Stop Disabled – Limits profit protection unless manually enabled.

⚠️ Manual Lot Setting – Lacks dynamic scaling based on account growth (unless adjusted by user).

Professional Conclusion

The Argos Rage EA MT5 settings reveal a powerful fusion of AI sophistication and risk-controlled execution.

Its integration of DeepSeek neural intelligence and Rage Mode volatility adaptation positions it as an innovative, next-generation Expert Advisor capable of thriving in dynamic markets.

Despite its name, Argos Rage EA does not rely on reckless aggression — instead, it channels algorithmic precision, contextual analysis, and data-driven adaptability to deliver calculated, stable performance.

When combined with a reliable low-spread broker and proper VPS environment, Argos Rage EA MT5 can serve as a strategic AI trading tool for traders seeking a balance between technological advancement, safety, and profitability.