🧩 What is Quantum Trade MT4?

The Quantum Trade EA is a time-based London session breakout system designed to capture intraday volatility between key price levels. This Expert Advisor (EA) relies on range breakout logic, recovery mechanisms, and session-specific filters to optimize entries and manage drawdowns efficiently.

📌📌📌 Buy this unlimited Quantum Trade EA MT4 product here 📌📌📌

🧩 General Overview

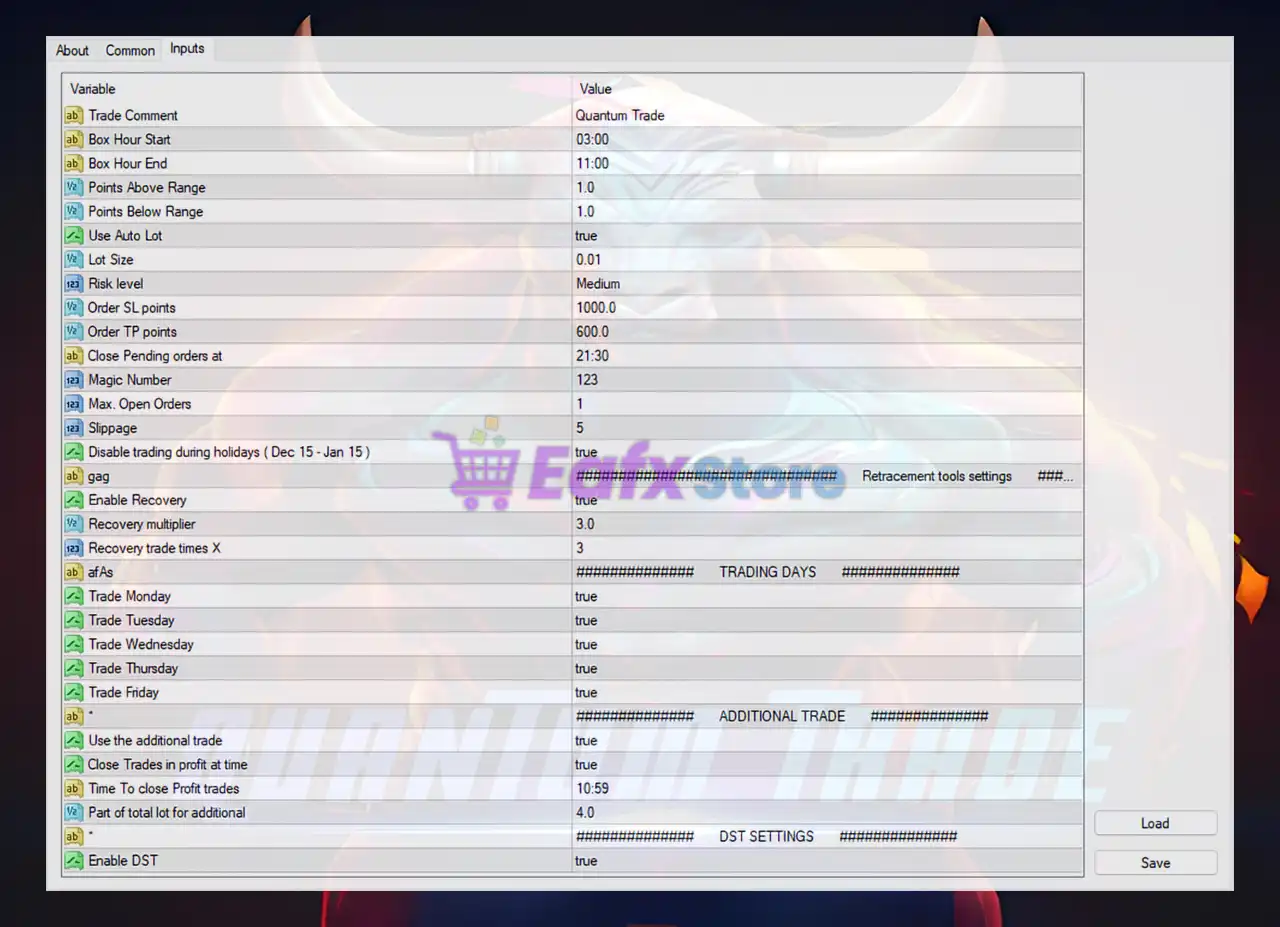

- Trade Comment:

Quantum Trade

→ Identifies this EA as a breakout trading system focused on volatility expansion during major sessions (typically London and New York). - Box Hour Start:

03:00 - Box Hour End:

11:00

→ Defines the breakout box period—the EA measures the high and low price range between these hours.

→ Commonly aligns with Asian–London session overlap, when price consolidations often lead to strong directional breakouts.

📈 Breakout Parameters

- Points Above Range:

1.0 - Points Below Range:

1.0

→ Entry triggers are set 1 point beyond the defined range, ensuring confirmation before entering a trade. - Close Pending Orders At:

21:30

→ Any untriggered pending orders are cancelled before the market slows down (typically post-London session), preventing overnight exposure.

💼 Trade Management Settings

- Use Auto Lot:

true

→ Enables automatic lot size calculation based on account equity and risk level, providing proportional risk management. - Lot Size:

0.01

→ Base lot size for low-risk accounts, ideal for micro or testing setups. - Risk Level:

Medium

→ Suggests a balanced profile—moderate exposure with sustainable drawdown. - Order SL Points:

1000 - Order TP Points:

600

→ Each trade has a Stop Loss of 1000 points and Take Profit of 600 points, giving a reward-to-risk ratio of 0.6:1.

→ While conservative, the EA compensates with high accuracy breakout entries and possible trade stacking through recovery mode. - Slippage:

5 points

→ Ensures stable execution and minimal deviation during volatile breakout conditions.

📊 Position and Order Management

- Max Open Orders:

1

→ Restricts the system to a single open trade at a time, minimizing overexposure and improving clarity of trade tracking. - Magic Number:

123

→ Unique identifier to separate this EA’s trades from others in the same account. - Disable Trading During Holidays (Dec 15 – Jan 15):

true

→ A smart risk-avoidance feature that prevents trading during low-liquidity periods, such as Christmas and New Year. This reduces false breakouts and unpredictable volatility.

🔄 Recovery & Retracement Tools

- Enable Recovery:

true

→ Activates a built-in loss recovery mechanism that opens compensatory trades after a losing position to regain lost equity safely. - Recovery Multiplier:

3.0

→ When enabled, each recovery trade has a volume 3x larger than the previous one.

→ While effective for capital recovery, it must be used with strong risk management or high balance accounts. - Recovery Trade Times X:

3

→ Limits recovery attempts to 3 cycles, preventing over-leveraging during extended drawdowns.

→ This adds a controlled martingale element, optimized for disciplined execution.

🗓️ Trading Days Configuration

- Trade Monday to Friday:

true

→ Active every weekday, trading during high-volatility sessions only.

→ No weekend trading, ensuring no gaps or liquidity issues at weekly openings.

➕ Additional Trade Features

- Use the Additional Trade:

true

→ Allows the EA to place secondary or stacked positions for averaging or increasing exposure when market conditions align. - Close Trades in Profit at Time:

true

→ Forces profitable trades to close automatically at a specific hour, securing gains before daily volatility declines. - Time to Close Profit Trades:

10:59

→ Ensures closure of all profitable positions before London-to-New York transition, minimizing reversal risk. - Part of Total Lot for Additional:

4.0

→ Specifies the portion of the total trade volume for additional positions. This structure aids in partial scaling or hedged management.

🌍 Time and Daylight Saving Settings

- Enable DST:

true

→ Adjusts EA operation automatically for Daylight Saving Time changes.

→ Guarantees synchronization with broker server time, preventing scheduling errors during transitions.

🧠 Strategic Interpretation

From this configuration, the Quantum Trade EA operates primarily as a breakout strategy bot designed to:

- Identify price ranges during the early session (03:00–11:00).

- Place pending orders slightly beyond those ranges.

- Execute high-probability breakouts with tight spread control and limited order count.

- Employ optional recovery and additional trades to maximize profitability while managing drawdown.

This type of system typically performs best on major Forex pairs (EURUSD, GBPUSD, XAUUSD) during M15–H1 timeframes.

✅ Advantages

✔️ Time-based breakout entry ensures precision during high liquidity hours.

✔️ Auto-lot and medium risk level offer balanced capital exposure.

✔️ Built-in recovery function for drawdown control.

✔️ Trading limited to weekdays with holiday filter.

✔️ Smart close timing prevents late-session reversals.

✔️ DST adjustment maintains consistent time accuracy.

⚠️ Potential Drawbacks

❌ Recovery multiplier (3.0) can become risky in volatile or extended ranging markets.

❌ TP/SL ratio favors safety but limits upside potential per trade.

❌ Performance heavily dependent on market volatility during the London session.

🏁 Conclusion – Is Quantum Trade EA Reliable?

Quantum Trade EA MT4 demonstrates a disciplined and well-structured breakout trading design that blends time-based logic, automated risk control, and selective trade recovery.

It is ideal for traders who prefer systematic, session-driven trading with defined trading hours, no martingale dependency, and stable capital protection mechanisms.