🧩 Overview of Fx Kenji EA MT4

Fx Kenji EA is a semi-automated to fully automated Expert Advisor (EA) that focuses on breakout-based entries combined with volatility filtering, averaging logic, hedging, and news protection. The EA is designed to adapt dynamically to market conditions while maintaining controlled exposure through percentage-based risk management.

This setup indicates a strategy aimed at stable growth with strong protection against high-risk events, especially news volatility.

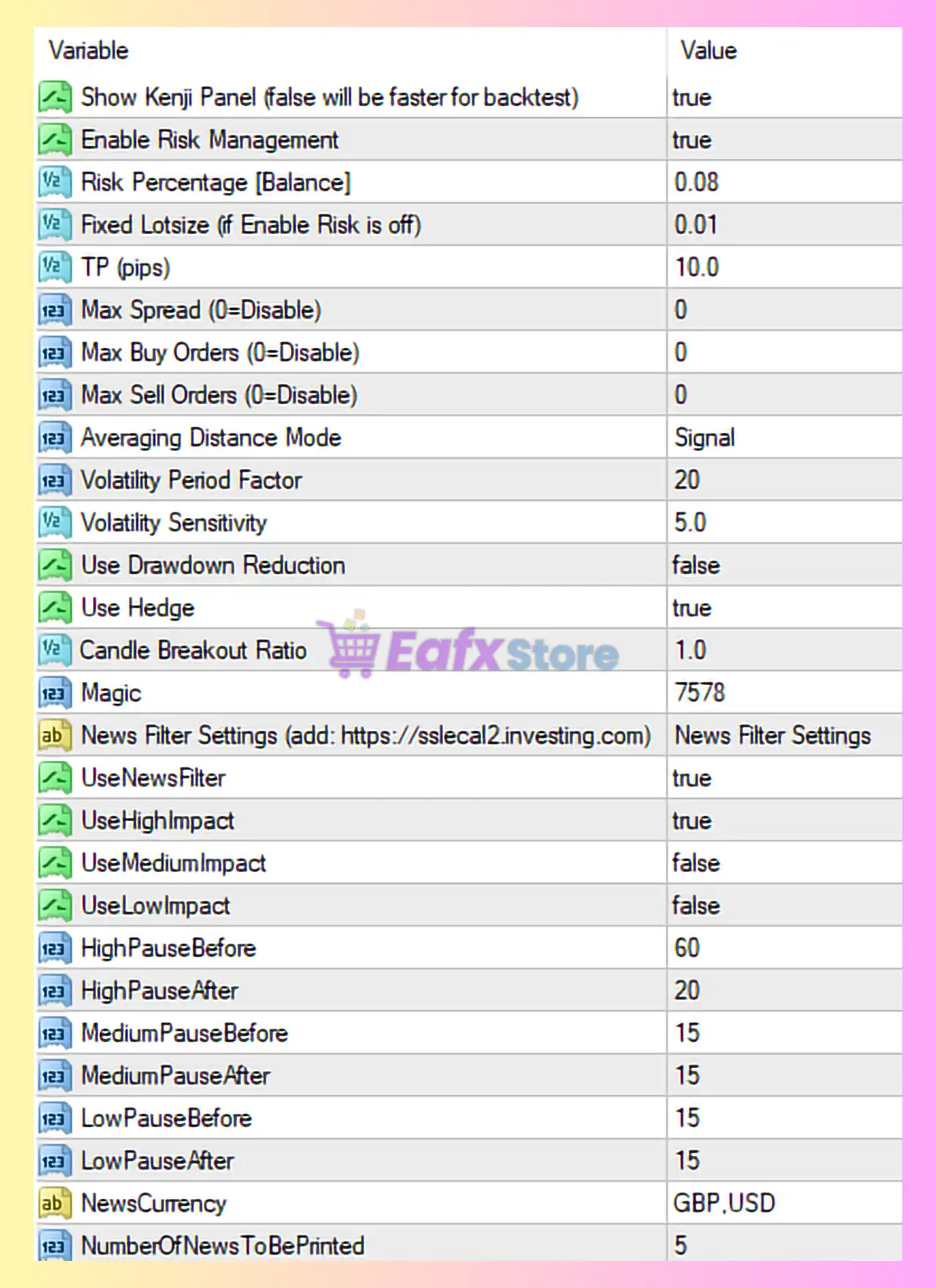

🧠 Interface & Risk Management Settings

- Show Kenji Panel: true

→ Enables on-chart control panel for live monitoring (disabled mode is recommended only for faster backtests). - Enable Risk Management: true

→ EA calculates lot size automatically based on account balance. - Risk Percentage (Balance): 0.08

→ Extremely conservative risk (0.08% per trade), suitable for long-term and funded accounts. - Fixed Lot Size: 0.01

→ Only applies if risk management is disabled.

📌 Assessment:

Fx Kenji EA prioritizes capital preservation over aggressive growth.

🎯 Trade Execution & Market Filters

- Take Profit (TP): 10 pips

→ Short-term profit objective, indicating scalping or fast breakout exits. - Max Spread / Max Buy Orders / Max Sell Orders: 0 (disabled)

→ No hard limits; relies on volatility and signal filters instead. - Averaging Distance Mode: Signal

→ Additional trades are placed based on signal logic, not fixed grid spacing.

📌 Assessment:

This is not a blind grid EA. Averaging is conditional and signal-based.

🌪️ Volatility & Market Sensitivity Settings

- Volatility Period Factor: 20

- Volatility Sensitivity: 5.0

- Candle Breakout Ratio: 1.0

These parameters define how aggressively the EA reacts to price expansion and breakout strength.

📌 Assessment:

Balanced volatility configuration helps the EA avoid trading during low-quality or choppy market phases.

🔁 Hedging & Drawdown Behavior

- Use Hedge: true

- Use Drawdown Reduction: false

📌 Assessment:

Hedging is enabled as a protective mechanism, but aggressive drawdown recovery is disabled, reducing account stress.

🧾 Identification & Order Control

- Magic Number: 7578

→ Ensures trade isolation from other EAs or manual trades.

📰 News Filter Settings (Major Strength)

- UseNewsFilter: true

- Use High Impact News: true

- Use Medium Impact News: false

- Use Low Impact News: false

News Pause Windows

- High Impact:

- Pause Before: 60 minutes

- Pause After: 20 minutes

- Medium & Low Impact: 15 minutes before & after

- News Currency: GBP, USD

- Number of News Events Printed: 5

📌 Assessment:

Strong protection against major economic events (NFP, CPI, FOMC, BOE). Ideal for GBP and USD pairs.

⚖️ Risk Profile Summary

| Feature | Evaluation |

|---|---|

| Risk per trade | Very Low |

| Strategy type | Breakout + volatility |

| Averaging | Conditional (signal-based) |

| Hedging | Enabled |

| News protection | High |

| Drawdown behavior | Conservative |

✅ Final Verdict: Is Fx Kenji EA MT4 Worth Using?

✅ Pros

- Extremely low-risk configuration

- Advanced news filter integration

- No martingale or fixed grid

- Hedging adds portfolio stability

- Suitable for prop firm & small accounts

⚠️ Cons

- Low TP limits profit potential

- Slower account growth

- Requires patience in sideways markets

🏆 Overall Rating

⭐ 8.5 / 10 – A Conservative & News-Safe Trading EA

Fx Kenji EA MT4 is best suited for traders who prioritize account safety, drawdown control, and consistency over aggressive returns. With proper broker conditions and disciplined expectations, it can perform well in volatile breakout environments, especially on GBP and USD pairs.