🧩 What is Loss Recovery 1 MT4?

Loss Recovery 1 MT4 is a specialized drawdown recovery Expert Advisor (EA) designed to recover losing positions using controlled position spacing, volume scaling, and ATR-based logic. Unlike traditional scalping or grid EAs, this system activates only after predefined loss conditions are met, making it a reactive recovery tool rather than a continuous trader.

➡️ Vender Website: View here

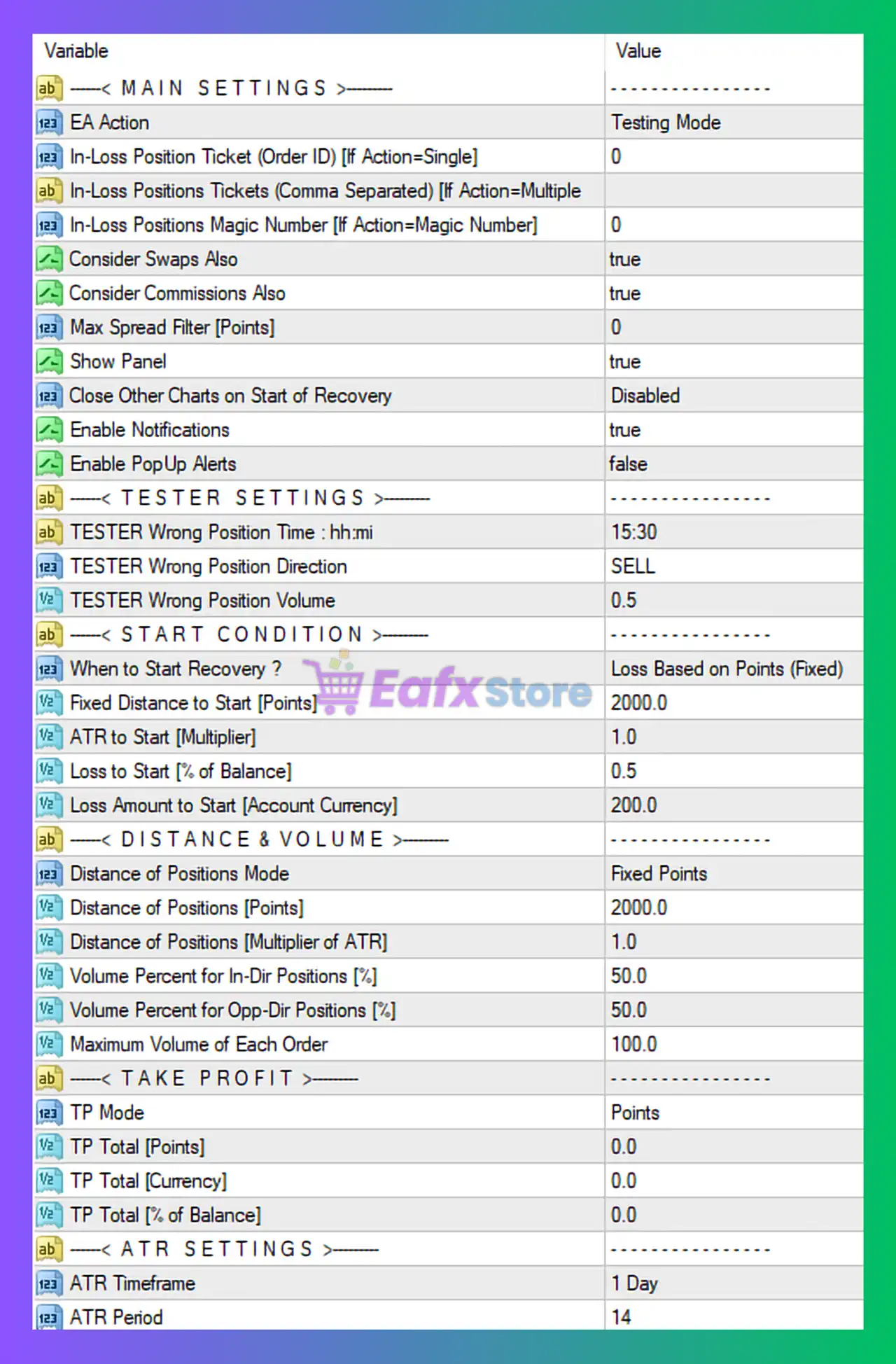

🧩 Main Settings Analysis

| Parameter | Value | Analysis |

|---|---|---|

| EA Action | Testing Mode | EA is running in simulation/safe mode |

| In-Loss Position Ticket | 0 | Uses automatic detection instead of manual ticket |

| In-Loss Positions Tickets | 0 | No manual multi-ticket binding |

| In-Loss Positions Magic Number | 0 | Can attach to any losing trade |

| Consider Swaps Also | true | Swap costs included in loss calculation |

| Consider Commissions Also | true | Commission included for accurate recovery |

| Max Spread Filter | 0 | No spread restriction applied |

| Show Panel | true | On-chart control panel enabled |

| Close Other Charts on Start of Recovery | Disabled | Does not force chart cleanup |

| Enable Notifications | true | Alerts enabled for recovery activity |

| Enable PopUp Alerts | false | Silent background execution |

Assessment:

This setup is highly flexible, allowing the EA to recover losses from any trade, regardless of magic number, while maintaining accurate cost calculations.

🧩 Tester Settings (Backtesting Logic)

| Parameter | Value | Analysis |

|---|---|---|

| Wrong Position Time | 15:30 | Simulated entry time |

| Wrong Position Direction | SELL | Test scenario assumes incorrect SELL |

| Wrong Position Volume | 0.5 | Medium-sized losing trade |

Assessment:

These parameters are only for strategy testing and do not affect live trading. They help validate recovery logic under controlled loss scenarios.

🧩 Start Condition – When Recovery Begins

| Parameter | Value | Analysis |

|---|---|---|

| When to Start Recovery | Loss Based on Points (Fixed) | Recovery triggers after fixed drawdown |

| Fixed Distance to Start | 2000 points | Large loss threshold (~200 pips) |

| ATR to Start Multiplier | 1.0 | ATR logic available but neutral |

| Loss to Start (% of Balance) | 0.5 | Recovery starts at 0.5% drawdown |

| Loss Amount to Start | 200.0 | Or $200 loss threshold |

Assessment:

This is a very conservative activation model. The EA does not intervene early, reducing unnecessary recovery trades and protecting capital.

🧩 Distance & Volume Control

| Parameter | Value | Analysis |

|---|---|---|

| Distance of Positions Mode | Fixed Points | Static spacing logic |

| Distance of Positions | 2000 points | Wide spacing reduces over-trading |

| Distance of Positions (ATR Multiplier) | 1.0 | ATR optional but unused |

| Volume % for In-Dir Positions | 50% | Same-direction recovery trades |

| Volume % for Opp-Dir Positions | 50% | Hedging-style recovery |

| Maximum Volume of Each Order | 100.0 | Hard cap for safety |

Assessment:

This configuration creates a balanced recovery structure, mixing directional continuation and hedge-style trades while enforcing a strict volume ceiling.

🧩 Take Profit Settings

| Parameter | Value | Analysis |

|---|---|---|

| TP Mode | Points | Profit measured in points |

| TP Total (Points) | 0 | Disabled |

| TP Total (Currency) | 0 | Disabled |

| TP Total (% of Balance) | 0 | Disabled |

Assessment:

The EA likely closes recovery baskets dynamically rather than relying on fixed TP values, offering greater adaptability to market conditions.

🧩 ATR Settings

| Parameter | Value | Analysis |

|---|---|---|

| ATR Timeframe | 1 Day | Higher-timeframe volatility filter |

| ATR Period | 14 | Standard ATR calculation |

Assessment:

Using Daily ATR ensures that recovery logic respects broader market volatility rather than short-term noise.

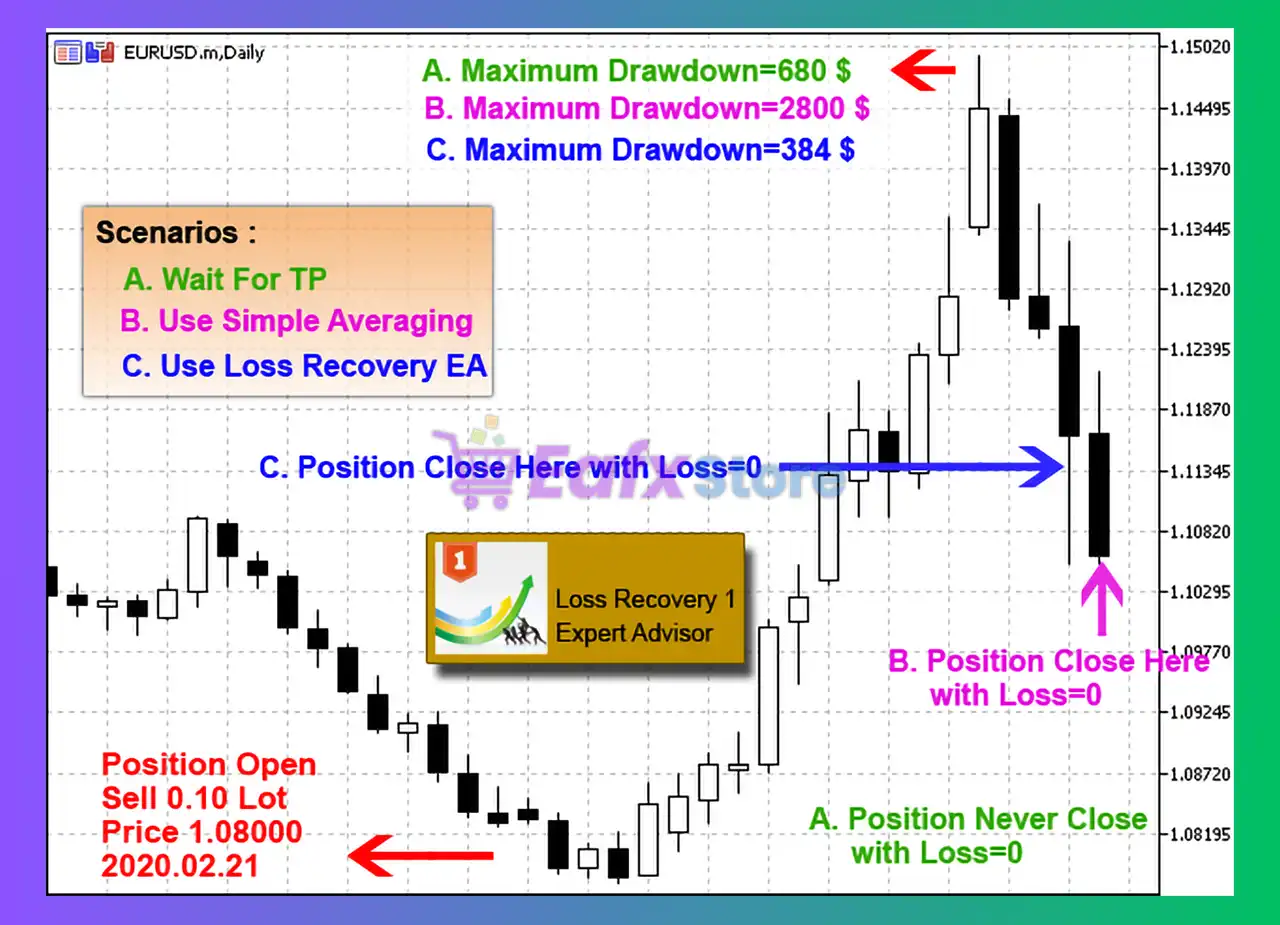

🧩 Final Conclusion

Based on the image, Loss Recovery 1 MT4 is configured as a:

✅ Conservative, loss-triggered recovery EA

✅ Not a scalping or martingale system

✅ Highly suitable as a companion EA

✅ Designed to recover deep drawdowns, not small losses

➡️ Key Strengths:

- Activates only after meaningful loss

- Accurate cost calculation (swap + commission)

- Wide position spacing reduces risk

- Supports both directional and hedge recovery

- Strong volume protection limits

➡️ Potential Limitations:

- Not suitable for fast recovery of small losses

- Requires sufficient margin for recovery cycles

- Best used with disciplined risk management

➡️ Best Use Case:

- Recovery of manual trades or other EA losses

- Accounts with moderate to large balance

- Traders seeking capital preservation over speed

➡️ Overall Rating: ⭐⭐⭐⭐☆ (4.2 / 5)

Loss Recovery 1 MT4 is a professional-grade recovery tool, ideal for traders who understand drawdown mechanics and prefer controlled, data-driven recovery instead of aggressive martingale systems.